My @voxeu column with @YasinMimir on

Quantitative easing in emerging market economies is now up! THREAD 1/n https://voxeu.org/article/quantitative-easing-emerging-market-economies#.YGsN6RbxCcI.twitter">https://voxeu.org/article/q...

Quantitative easing in emerging market economies is now up! THREAD 1/n https://voxeu.org/article/quantitative-easing-emerging-market-economies#.YGsN6RbxCcI.twitter">https://voxeu.org/article/q...

Before I start; views are mine and @YasinMimir& #39;s and do not represent the official views of the Norges Bank and

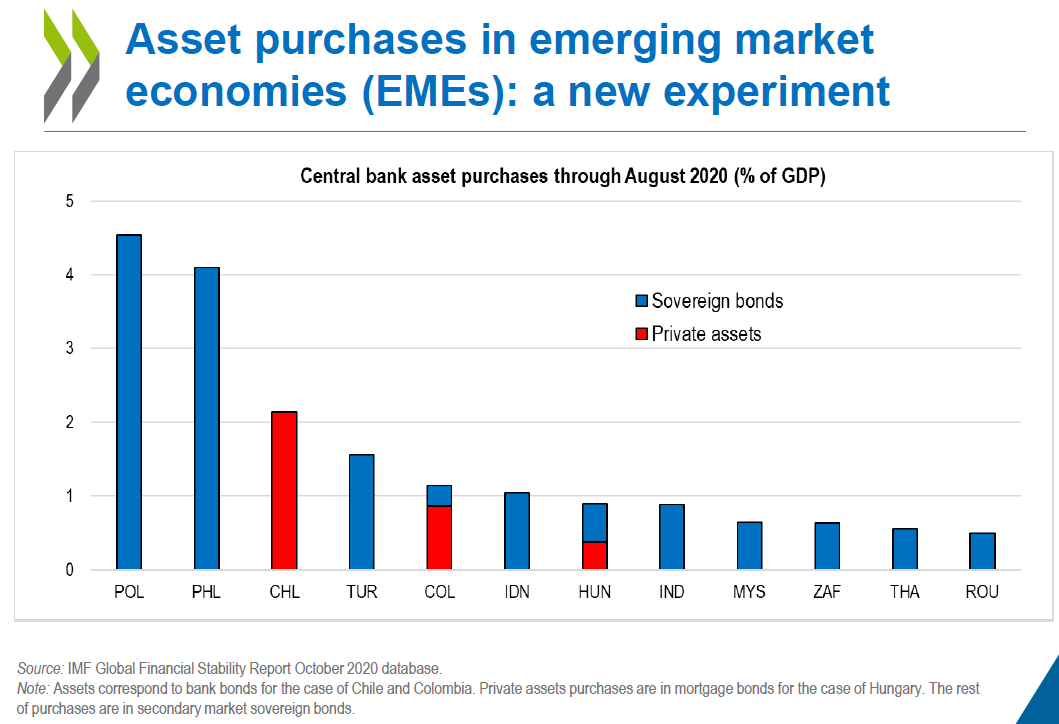

the OECD or of its member countries. Central banks in emerging market economies (EMEs) deployed asset purchases for the first time to respond to the #COVID19 shock. 2/n

the OECD or of its member countries. Central banks in emerging market economies (EMEs) deployed asset purchases for the first time to respond to the #COVID19 shock. 2/n

Initial studies by @Jon_Hartley_ and @arebucci1, @Can_Severr et al. of @IMF, @yavuz__arslan et al. of @BIS_org and Ha and @genekindberg of @WorldBank have found the announcement of QE reduced long-term bond yields in EMEs without creating bouts of currency depreciation. 3/n

The recent @voxeu posting by @BenignoGianluca, @jonhartley, @Aligarciaherrer and @elinaribakova envisioned that QE might be endorsed by credible EME central banks to combat the repercussions of the #COVID19 crisis. See

https://voxeu.org/article/credible-emerging-market-central-banks-could-embrace-quantitative-easing-fight-covid-19">https://voxeu.org/article/c... 4/n

https://voxeu.org/article/credible-emerging-market-central-banks-could-embrace-quantitative-easing-fight-covid-19">https://voxeu.org/article/c... 4/n

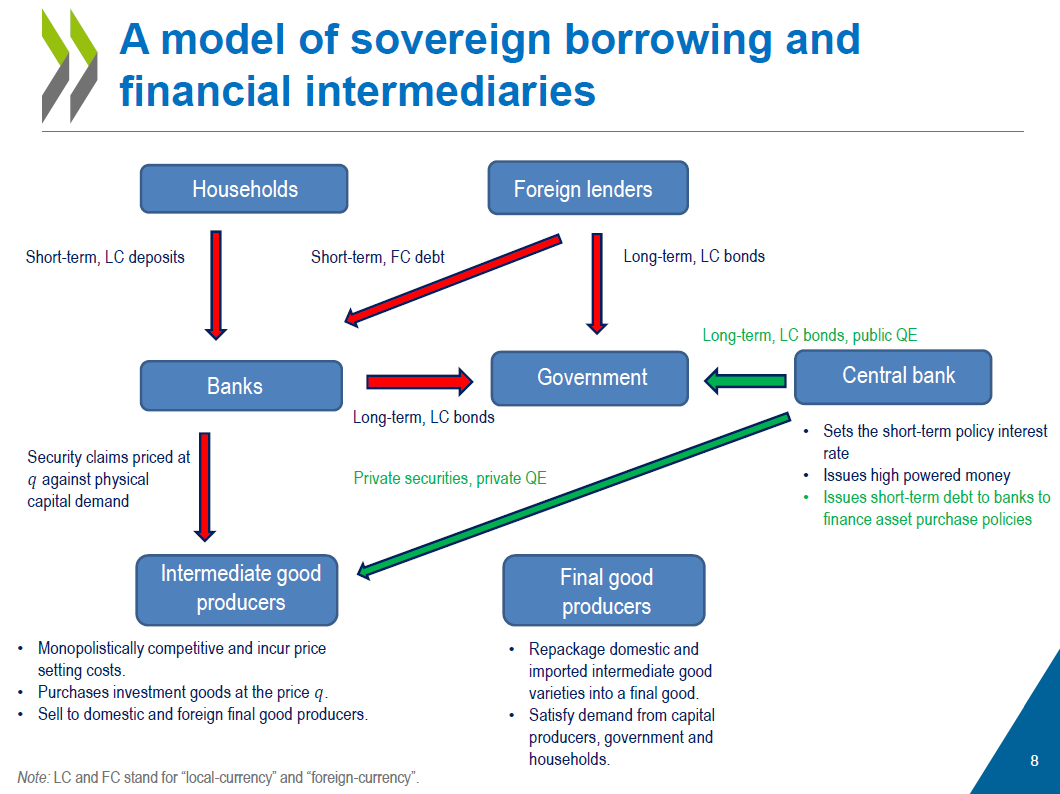

In our work, we are exploring this prospect by estimating a medium-scale, New Keynesian small open economy model in which domestic banks play a pivotal role as they purchase long-term, local currency (LC) government debt together with foreign investors. 5/n

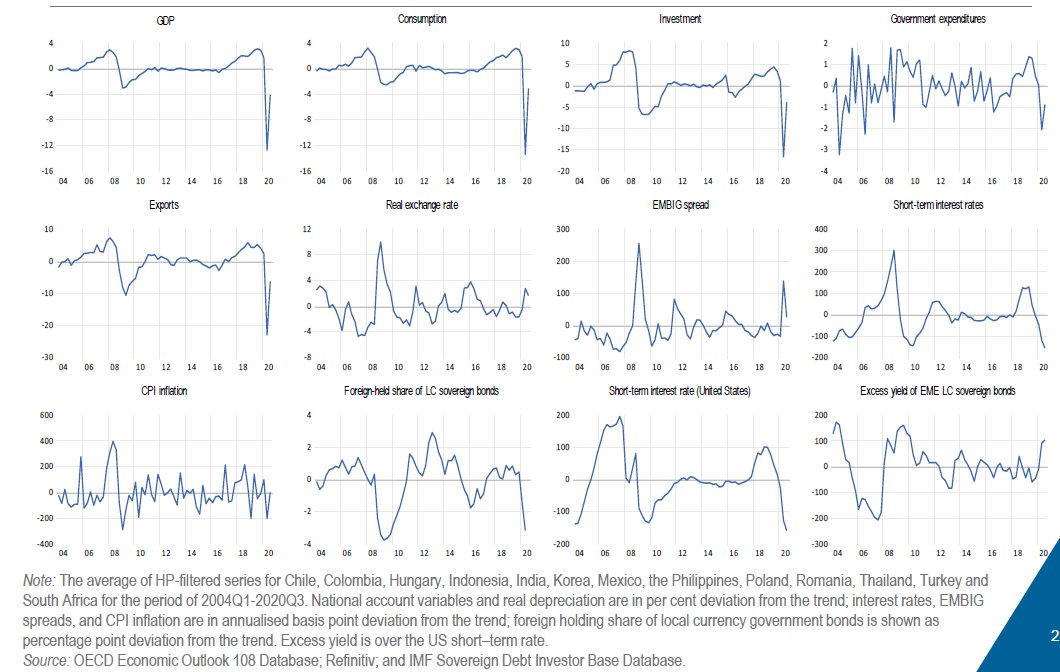

We take the average of 13 EMEs that are identified to have been applied QE during the pandemic as our calibration and estimation reference. One observation is that financial repercussions of #COVID19 on

EMEs have been weaker than the GFC. 6/n

EMEs have been weaker than the GFC. 6/n

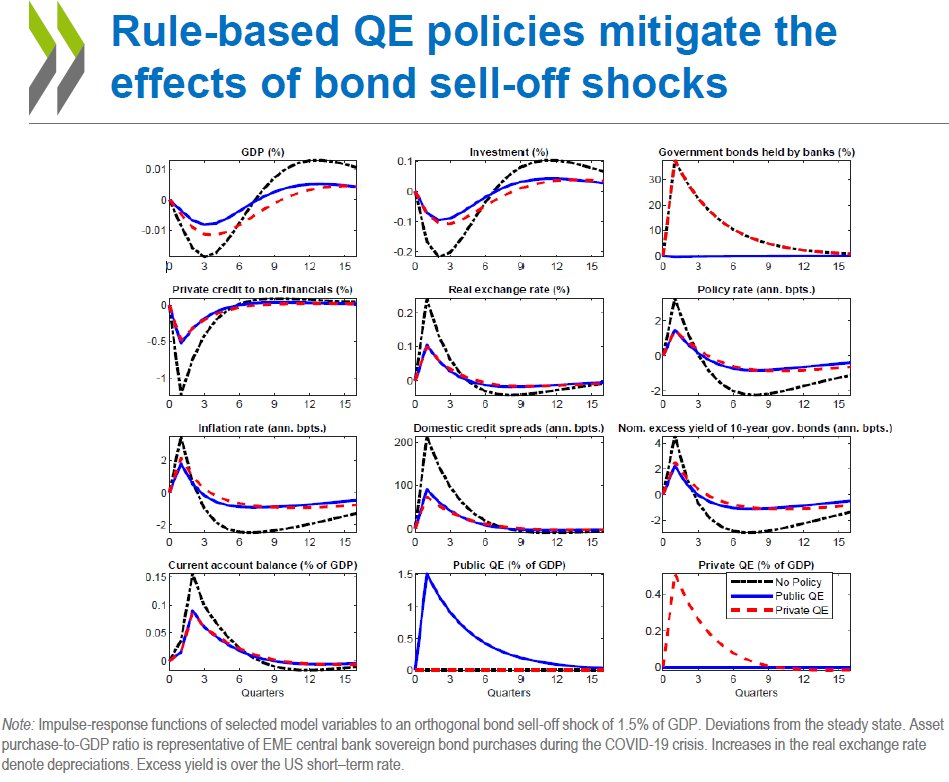

By purchasing LC sovereign bonds, central bank (CB) aims to repair the market dislocation created by the bond sell-off of foreign investors. We also analyse private QE policies in which CB can also purchase private securities as in Gertler and @peterkaradi 2011, and 2013. 7/n

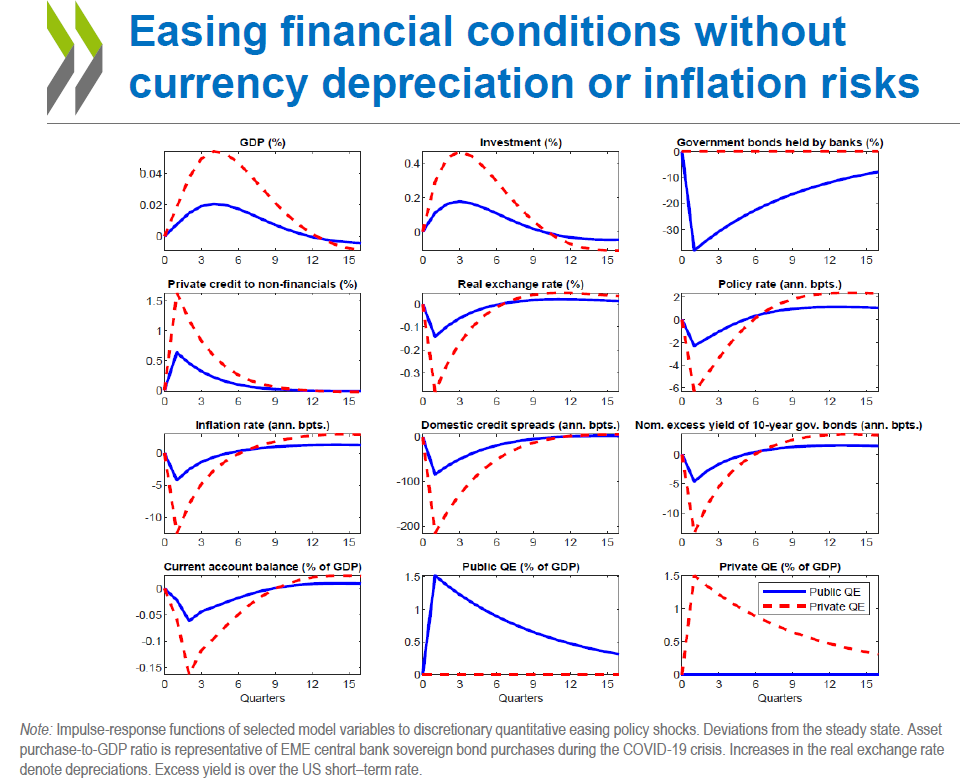

This column argues that asset purchases ease financial conditions in emerging economies by curbing capital outflows enabled by stronger bank balance sheets upon the asset intermediation by the CB. 8/n

Since asset intermediation by the CB is not subject to financial frictions, the QE policies act as a financial multiplier. The resulting boosts in asset prices, make bank balance sheets stronger and allow them to borrow more from both depositors and the rest of the world. 9/n

Thus, QE policies even facilitate an *appreciation* of domestic currencies! This mechanism that we uncover by the help of discretionary QE shocks explains how bond purchases can mitigate a bond sell-off shock similar to one we have observed during the #COVID19 crisis. 10/n

We also find that private asset purchases are about three times as more effective as bond purchases. This is because while bond purchases help bank balance sheets only via the boost in asset prices, private QE directly multiplies the stock of private loans made by banks. 11/n

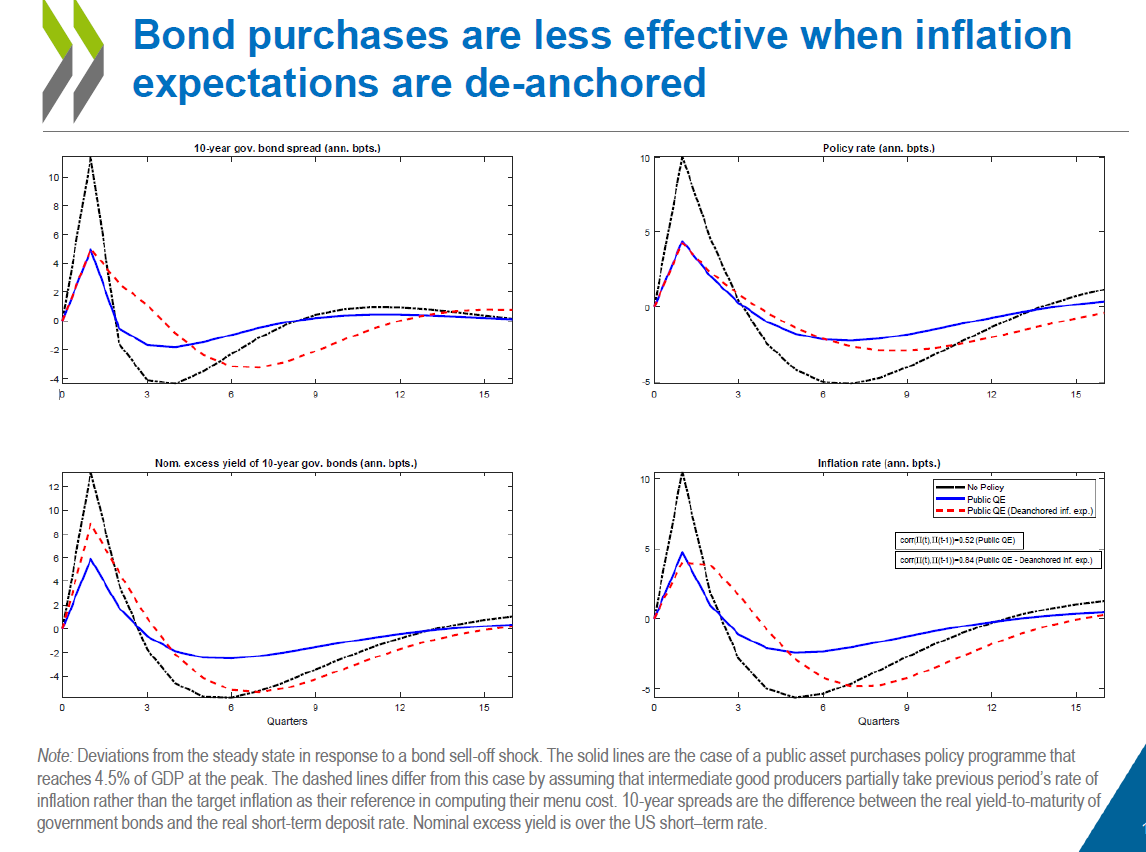

In an extension, we show that the efficacy of bond purchases by the CB declines when CB credibility is lower; i.e. when prices setting behaviour is partly backward looking. 12/n

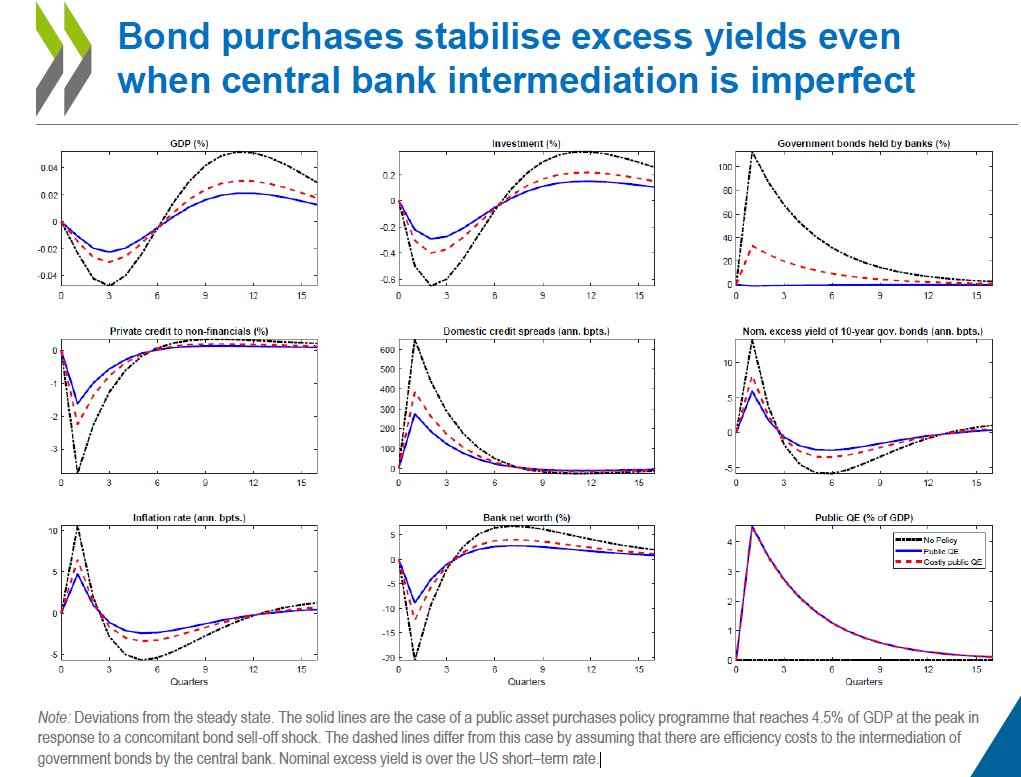

In another extension, we consider costly QE; CBs are not experts of asset intermediation after all, so there may be efficiency leakages in QE! We find that this also reduces the efficacy of QE. Nonetheless, it still helps ease financial conditions in response to a shock. 13/n

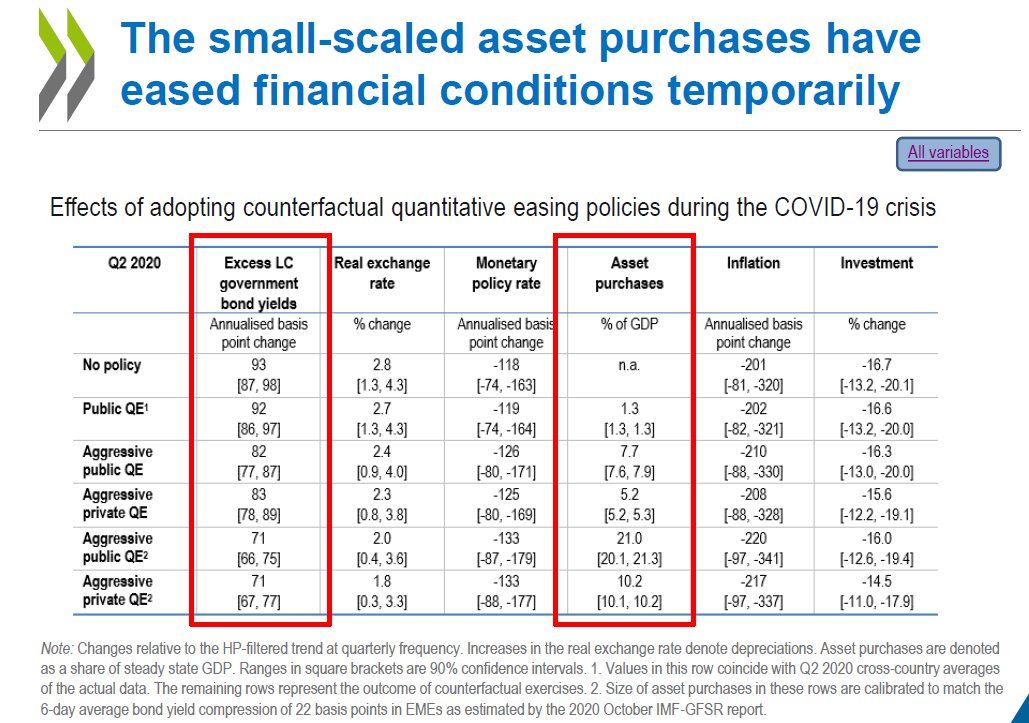

Finally, comes the fun part! We run counterfactual analyses around the #COVID19 crisis. By running Monte Carlo simulations, we conclude that the estimated bond yield reductions upon the announcement of QE in EMEs are only short-lived. 14/n

Indeed, we find that bond yield reductions from QE during the pandemic could have persisted only under large-sized programmes like those in the advanced economies. This is notwithstanding that no matter how large the CB goes, if it is credible, inflation would be in check. 15/n

We are grateful to internal seminar participants at the @OECDeconomy for constructive comments and suggestions! Looking forward to present our work at the @NorgesBank in two-weeks time other venues! Stay tuned for the finished draft soon. 16/16

Read on Twitter

Read on Twitter