1• 53% of adults are financially anxious

Financial Illiteracy is the real pandemic

18-34 aged persons are mostly infected by this Contagion

It causes

-63% Financial Stress

-55% Anxiety

•"Discussion finds Solution"

But They don& #39;t even like to discuss about their problems

Financial Illiteracy is the real pandemic

18-34 aged persons are mostly infected by this Contagion

It causes

-63% Financial Stress

-55% Anxiety

•"Discussion finds Solution"

But They don& #39;t even like to discuss about their problems

2• Two in three families lack an emergency fund

•A perfect Emergency Fund=

6× Monthly Expenses

•JPMorgan Chase says- a majority of families in the U.S. don’t have it.

•Emergency Fund must be used only for Emergency cases

-Job loss

-Wages cut

-Critical illness

•A perfect Emergency Fund=

6× Monthly Expenses

•JPMorgan Chase says- a majority of families in the U.S. don’t have it.

•Emergency Fund must be used only for Emergency cases

-Job loss

-Wages cut

-Critical illness

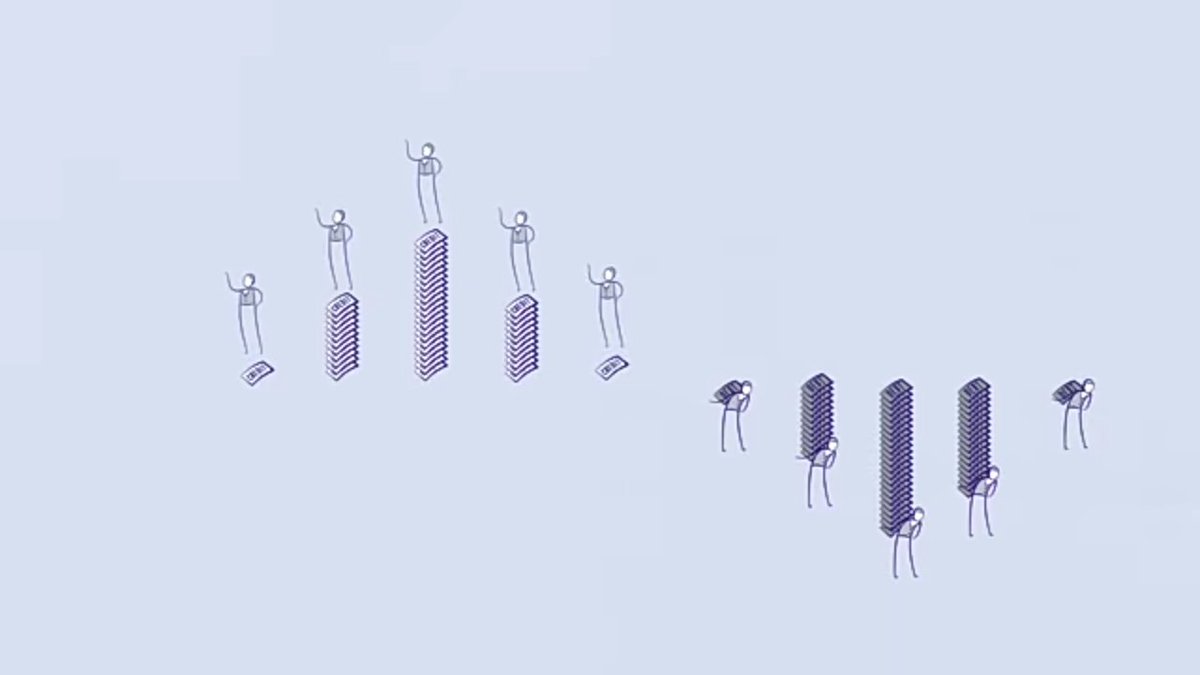

3• 78% of adults live paycheck to paycheck

•Money without financial intelligence,it will be soon gone

•$1000 Earning=$1000 spending

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">Result=0 (simple math)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">Result=0 (simple math)

~That& #39;s terrific

•A 2017 CareerBuilder survey

-Americans Stuck in a Hand to mouth cycle

-No leftover for savings

•Money without financial intelligence,it will be soon gone

•$1000 Earning=$1000 spending

~That& #39;s terrific

•A 2017 CareerBuilder survey

-Americans Stuck in a Hand to mouth cycle

-No leftover for savings

4• 3 in 5 adults don’t keep a budget

•A budget sets the foundation for-

-Incomes

-expenses

•You should track -

-Bills

-Debt

-Savings

~Calculate if you want to Control your expenses.

~This course may help you a lot if you have a Budget problem https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://gumroad.com/a/112989299 ">https://gumroad.com/a/1129892...

•A budget sets the foundation for-

-Incomes

-expenses

•You should track -

-Bills

-Debt

-Savings

~Calculate if you want to Control your expenses.

~This course may help you a lot if you have a Budget problem

https://gumroad.com/a/112989299 ">https://gumroad.com/a/1129892...

5• Four in five youths failed a financial literacy quiz

•FINRA says-

~18-34 aged Americans couldn’t answer a majority of financial literacy questions correctly.

~55 Years old performed better.

~A clear trend of declining financial literacy.

•FINRA says-

~18-34 aged Americans couldn’t answer a majority of financial literacy questions correctly.

~55 Years old performed better.

~A clear trend of declining financial literacy.

6• 27 states scored a C, D, or F for high school financial literacy

•Personal Finance course may increase~

-knowledge

-skills

For financial well-being.

•That’s why experts are fighting for these courses to be mandatory across the nation.

•Personal Finance course may increase~

-knowledge

-skills

For financial well-being.

•That’s why experts are fighting for these courses to be mandatory across the nation.

7• More than 54% of millennials are concerned about student loans

•In 2020,student loan debt reached a record high of $1.56 trillion.

•The Student loan borrowers should take advantage of the current federal student loan forbearance.

•In 2020,student loan debt reached a record high of $1.56 trillion.

•The Student loan borrowers should take advantage of the current federal student loan forbearance.

8• 60% of adults had credit card debt in the past year

•Federal Reserve Bank reports-

Credit card loan $1 Trillion

•Credit card=High Compounding interest+Random Extra Fees

•That means~

Credit Card= Compounding Debit card of your real life-peace & Happiness

#ThiefofLife

•Federal Reserve Bank reports-

Credit card loan $1 Trillion

•Credit card=High Compounding interest+Random Extra Fees

•That means~

Credit Card= Compounding Debit card of your real life-peace & Happiness

#ThiefofLife

9• Four in five adults experience barriers to homeownership

•Homeownership is financial milestone.

•50% of American 18 & older face some barriers-

-Poor credit Score

-Pre-existing Debt

-Rising Home prices

-Living in Expensive cities

-Lack of savings for Down payment

•Homeownership is financial milestone.

•50% of American 18 & older face some barriers-

-Poor credit Score

-Pre-existing Debt

-Rising Home prices

-Living in Expensive cities

-Lack of savings for Down payment

10• Fewer than one in five adults is confident in savings

•Americans are concerned about retirement, then why aren’t they saving more?

•NFCC 2019 says~

-Over one in four didn’t feel confident at all

~If the same case with you,this book may help you https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://gumroad.com/a/210506867/WiuYU">https://gumroad.com/a/2105068...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://gumroad.com/a/210506867/WiuYU">https://gumroad.com/a/2105068...

•Americans are concerned about retirement, then why aren’t they saving more?

•NFCC 2019 says~

-Over one in four didn’t feel confident at all

~If the same case with you,this book may help you

~Information,coined from-

http://www.ooploans.com"> http://www.ooploans.com

Thank you so much for reading this.

If you really like this thread click below and Retweet the First Tweet,and Follow me @MindsetPi for stay updated. https://twitter.com/MindsetPi/status/1378760340553428993?s=19">https://twitter.com/MindsetPi...

http://www.ooploans.com"> http://www.ooploans.com

Thank you so much for reading this.

If you really like this thread click below and Retweet the First Tweet,and Follow me @MindsetPi for stay updated. https://twitter.com/MindsetPi/status/1378760340553428993?s=19">https://twitter.com/MindsetPi...

Read on Twitter

Read on Twitter

Result=0 (simple math)~That& #39;s terrific•A 2017 CareerBuilder survey-Americans Stuck in a Hand to mouth cycle-No leftover for savings" title="3• 78% of adults live paycheck to paycheck•Money without financial intelligence,it will be soon gone•$1000 Earning=$1000 spendinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">Result=0 (simple math)~That& #39;s terrific•A 2017 CareerBuilder survey-Americans Stuck in a Hand to mouth cycle-No leftover for savings" class="img-responsive" style="max-width:100%;"/>

Result=0 (simple math)~That& #39;s terrific•A 2017 CareerBuilder survey-Americans Stuck in a Hand to mouth cycle-No leftover for savings" title="3• 78% of adults live paycheck to paycheck•Money without financial intelligence,it will be soon gone•$1000 Earning=$1000 spendinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">Result=0 (simple math)~That& #39;s terrific•A 2017 CareerBuilder survey-Americans Stuck in a Hand to mouth cycle-No leftover for savings" class="img-responsive" style="max-width:100%;"/>

https://gumroad.com/a/1129892..." title="4• 3 in 5 adults don’t keep a budget•A budget sets the foundation for--Incomes-expenses•You should track --Bills-Debt-Savings~Calculate if you want to Control your expenses.~This course may help you a lot if you have a Budget problem https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://gumroad.com/a/1129892..." class="img-responsive" style="max-width:100%;"/>

https://gumroad.com/a/1129892..." title="4• 3 in 5 adults don’t keep a budget•A budget sets the foundation for--Incomes-expenses•You should track --Bills-Debt-Savings~Calculate if you want to Control your expenses.~This course may help you a lot if you have a Budget problem https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://gumroad.com/a/1129892..." class="img-responsive" style="max-width:100%;"/>

https://gumroad.com/a/2105068..." title="10• Fewer than one in five adults is confident in savings•Americans are concerned about retirement, then why aren’t they saving more?•NFCC 2019 says~-Over one in four didn’t feel confident at all~If the same case with you,this book may help youhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://gumroad.com/a/2105068..." class="img-responsive" style="max-width:100%;"/>

https://gumroad.com/a/2105068..." title="10• Fewer than one in five adults is confident in savings•Americans are concerned about retirement, then why aren’t they saving more?•NFCC 2019 says~-Over one in four didn’t feel confident at all~If the same case with you,this book may help youhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://gumroad.com/a/2105068..." class="img-responsive" style="max-width:100%;"/>