I really like @solana.

Here& #39;s why I think Solana will become a top 10 coin in market cap by the end of 2021. I will share my perspective as both a long term investor & short term speculator. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Not investment advice.

Here& #39;s why I think Solana will become a top 10 coin in market cap by the end of 2021. I will share my perspective as both a long term investor & short term speculator.

Not investment advice.

This is a story about Solana but as with many things in this space, it all started with Ethereum.

A couple of months ago, I started looking at NFTs on marketplaces like Foundation & Opensea.

A couple of months ago, I started looking at NFTs on marketplaces like Foundation & Opensea.

Buying & selling an NFT requires you to perform a total of 5 transactions, excluding the bidding process. You have to:

1. Pay the creator

2. Receive the NFT from the marketplace where you bought

3. Register proxy on the marketplace where you intend to sell

1. Pay the creator

2. Receive the NFT from the marketplace where you bought

3. Register proxy on the marketplace where you intend to sell

4. Set an approval on the selling marketplace

5. Receive the payment from the new buyer

At each step of the way, you have to pay a hefty gas fee even for 0 ETH transactions and waiting an average of 9 minutes for completion.

5. Receive the payment from the new buyer

At each step of the way, you have to pay a hefty gas fee even for 0 ETH transactions and waiting an average of 9 minutes for completion.

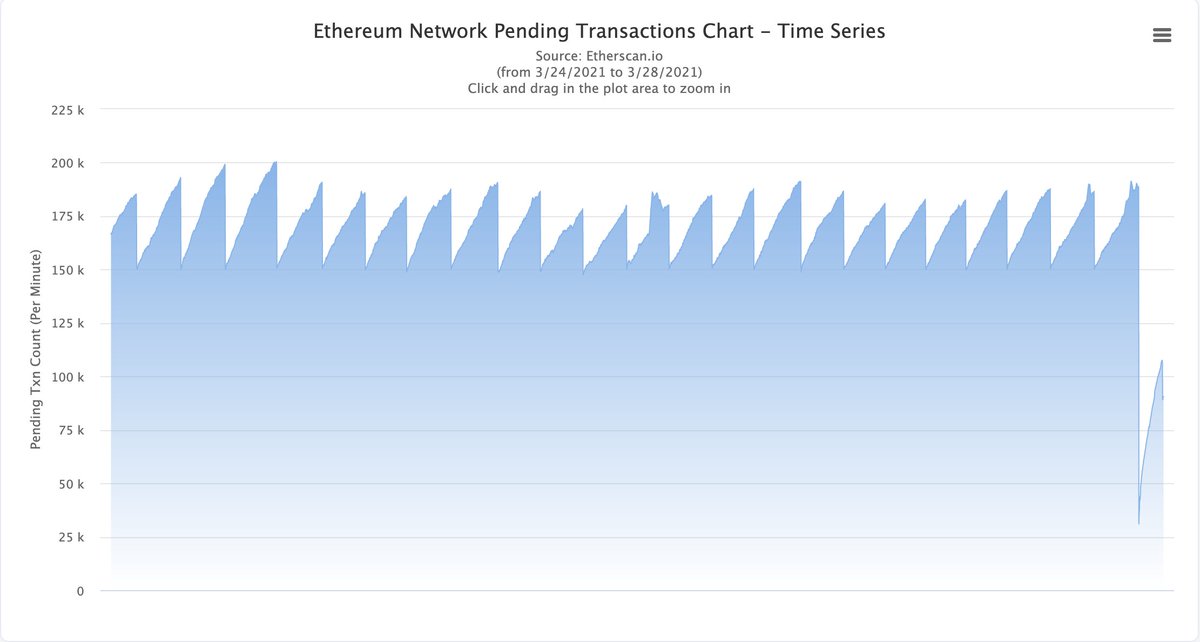

For anyone who& #39;s been in the Ethereum ecosystem for a while, this should come as no surprise. In fact, you can see it for yourself on the Ethereum mempool right now.

https://etherscan.io/chart/pendingtx ">https://etherscan.io/chart/pen...

https://etherscan.io/chart/pendingtx ">https://etherscan.io/chart/pen...

Obviously, any computer (because thats what the Ethereum network really is - a massive decentralized computer) that takes 9 minutes to confirm an action is not going to gain mainstream adoption.

So what& #39;s out there now? And how do they compare with each another when it comes to performance/scalability factors*:

*while maintaining decentralization & security

*while maintaining decentralization & security

- Throughput - number of transactions that a network is capable of processing each second, measured in transactions per second (TPS)

- Transaction finality time - how long one has to wait to be given a reasonable guarantee the transaction written in blockchain is irreversible

- Transaction finality time - how long one has to wait to be given a reasonable guarantee the transaction written in blockchain is irreversible

Here are the benchmarks in the top 10 coin by market cap, excluding Tether & Uniswap:

1. Bitcoin - 7 TPS, 60min transaction time

2. Ethereum - 25 TPS, 6min transaction time

3. Binance Smart Chain (BNB) - 300 TPS, 5s

4. Cardano - 250 TPS, 10min

5. Polkadot - 1000+ TPS, 12s

6. XRP - 1500 TPS, 5s

7. Theta - 1000+ TPS, 6s

8. Litecoin - 56 TPS, 30min

2. Ethereum - 25 TPS, 6min transaction time

3. Binance Smart Chain (BNB) - 300 TPS, 5s

4. Cardano - 250 TPS, 10min

5. Polkadot - 1000+ TPS, 12s

6. XRP - 1500 TPS, 5s

7. Theta - 1000+ TPS, 6s

8. Litecoin - 56 TPS, 30min

Here& #39;s how some of the most popular high-speed chains perform:

- Steem: 10,000 TPS, 3s

- Cosmos: 10,000 TPS, 2s

- Algorand: 1000+ TPS, 45s

- Hashgraph: 10,000+ TPS, 3s

- Cosmos: 10,000 TPS, 2s

- Algorand: 1000+ TPS, 45s

- Hashgraph: 10,000+ TPS, 3s

And here& #39;s how @solana performs:

50,000+ TPS, 400 milliseconds

From a performance standpoint, Solana knocks it completely out of the park. How were they able to achieve this?

50,000+ TPS, 400 milliseconds

From a performance standpoint, Solana knocks it completely out of the park. How were they able to achieve this?

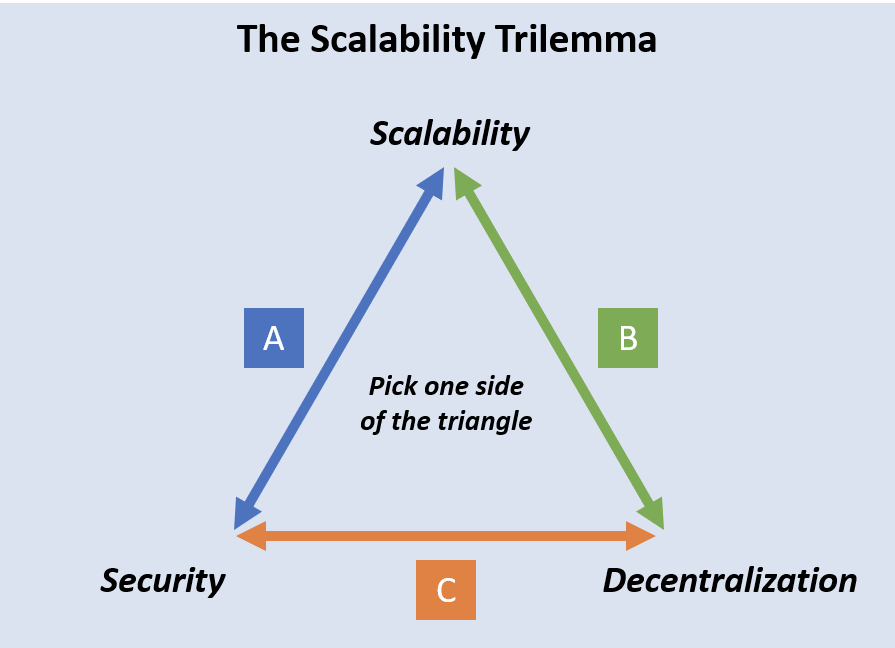

First off, there are significant issues with scalability solutions adopted by many of the existing Layer 1 & 2 blockchains, presented in the form of the Scalability Trilemma

a term coined by Ethereum founder Vitalik Buterin to describe the trade-off projects must make when deciding on how to optimise their architecture, by balancing between three properties.

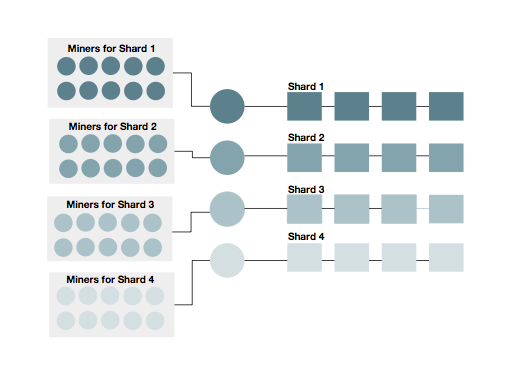

For many of the popular Layer 1s, they& #39;ve chosen Sharding as the main scalability solution. Instead of making a network sequentially work on each and every transaction, sharding will break these transaction sets into small data-sets called “shards.”

But according to Solana CEO @aeyakovenko, the risks associated with sharding far outweigh any possible scalability benefits.

“Once you split the network, you introduce an additional attack vector,” he explained. ”Sharding technology flips security.”

“Once you split the network, you introduce an additional attack vector,” he explained. ”Sharding technology flips security.”

"If one shard gets taken over by hackers it could trigger a domino effect that would impact token price and lead to a mass exodus of users and nodes." https://cryptobriefing.com/solana-ceo-sharding-risk/">https://cryptobriefing.com/solana-ce...

For Solana, they& #39;ve adopted a completely different approach with 8 key innovations to create a true time-synced distributed network that can achieve parallelised computing of smart contracts & transaction processing. All without a need for Sharding.

https://solana.com/developers ">https://solana.com/developer...

https://solana.com/developers ">https://solana.com/developer...

Of course, performance, speed & security alone are not enough for mass adoption. Any serious project will also need to solve for (1) composability, (2) interoperability with existing ecosystems (3) developer experience & productivity.

1. Composability

A platform is composable if its existing resources can be used as building blocks and programmed into higher order applications. Many Layer 1s are composable but scalability is often sacrificed in return for composability.

A platform is composable if its existing resources can be used as building blocks and programmed into higher order applications. Many Layer 1s are composable but scalability is often sacrificed in return for composability.

When a platform is segregated across many different shards, it limits its own ability to be used as a building block.

For Solana, scalable composability is not an issue since it never used sharding to solve its scalability issues to begin with.

For Solana, scalable composability is not an issue since it never used sharding to solve its scalability issues to begin with.

2. Interoperability with existing ecosystems

When talking about "existing ecosystems", I am mainly referring to Ethereum here where an overwhelming majority of DeFi projects are still built on.

When talking about "existing ecosystems", I am mainly referring to Ethereum here where an overwhelming majority of DeFi projects are still built on.

2. Interoperability with existing ecosystems

When talking about "existing ecosystems", I am mainly referring to Ethereum here where an overwhelming majority of DeFi projects are still built on.

When talking about "existing ecosystems", I am mainly referring to Ethereum here where an overwhelming majority of DeFi projects are still built on.

Out of the 83 DeFi projects that DeFi Pulse are tracking, 82 of them are based on the Ethereum platform (~98%).

https://defipulse.com/ ">https://defipulse.com/">...

https://defipulse.com/ ">https://defipulse.com/">...

By establishing a cross chain bridge, Solana is able to benefit from the strength & size of the Ethereum ecosystem. https://twitter.com/solana/status/1357539833980153859">https://twitter.com/solana/st...

Solana has also partnered up with @chainlink for DeFi Oracle data, providing high-speed Oracle feeds to DeFi applications.

Solana Dapps will get secure access to all the data inputs and outputs they need, while avoiding the major pitfalls of developing a self-made oracle, such as long time delays, additional expenses, and even fatal security flaws. https://medium.com/solana-labs/chainlink-and-solana-integration-high-quality-price-oracle-data-cd9fa41f6ecb">https://medium.com/solana-la...

3. Developer experience & productivity

Solana apps are built on Rust and according to GitHub, Rust is one of the fastest growing languages: https://octoverse.github.com/ .">https://octoverse.github.com/">...

Solana apps are built on Rust and according to GitHub, Rust is one of the fastest growing languages: https://octoverse.github.com/ .">https://octoverse.github.com/">...

Rust has a broad industry adoption beyond blockchain while Ethereum& #39;s Solidity is specifically for smart contract programming.

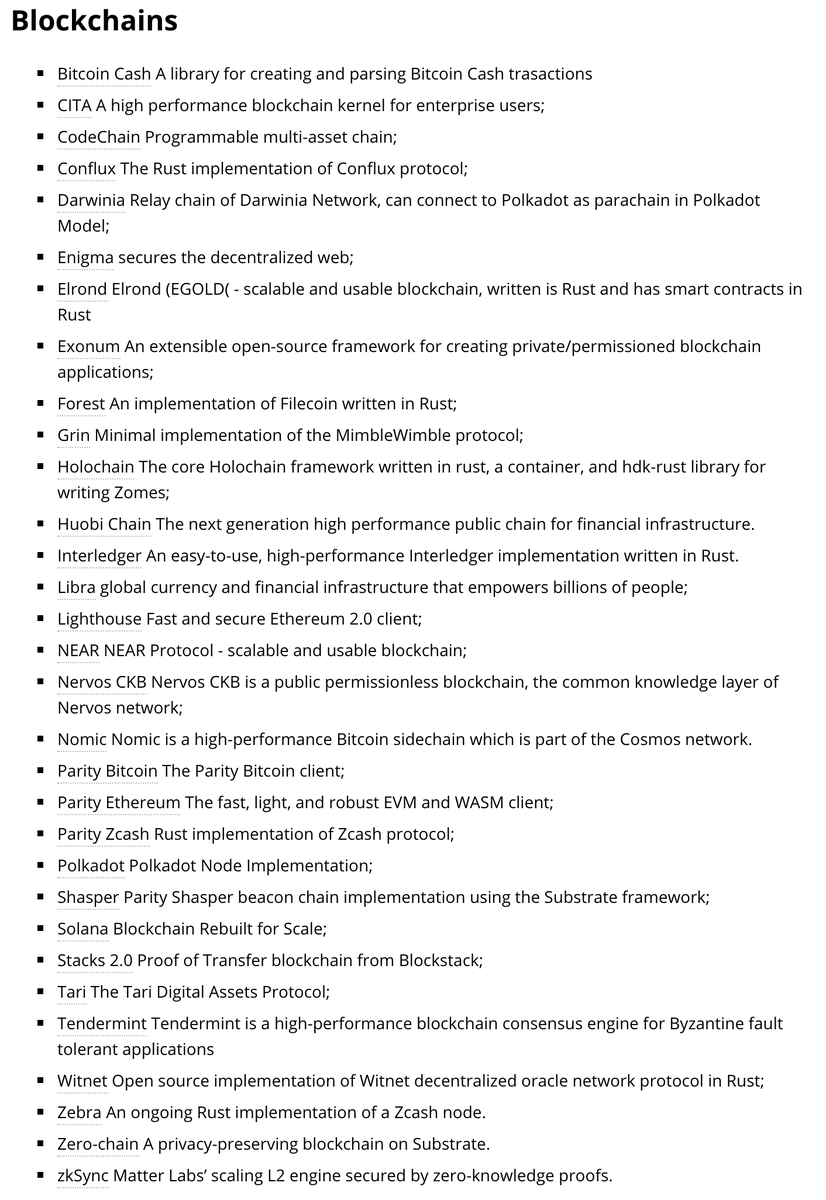

Many other projects seem to agree Rust is the way to go, including Polkadot & Huobi Chain: https://rustinblockchain.org/awesome-blockchain-rust/">https://rustinblockchain.org/awesome-b...

Many other projects seem to agree Rust is the way to go, including Polkadot & Huobi Chain: https://rustinblockchain.org/awesome-blockchain-rust/">https://rustinblockchain.org/awesome-b...

I believe Rust will become the blockchain programming language of choice, just like how JavaScript became the language of the web. Lowering developer friction by focusing on one unified language across the blockchain space is going to dramatically improve developer productivity.

Solana& #39;s high-performance also ties back into improved developer productivity.

When working with many existing blockchains, developers need to build unnecessary technical infrastructure to solve for the limited throughput, creating bloat & technical debt.

In my experience, technical debt creeps up on a project over time and more resources are spent maintaining the bloated infrastructure rather than building new features.

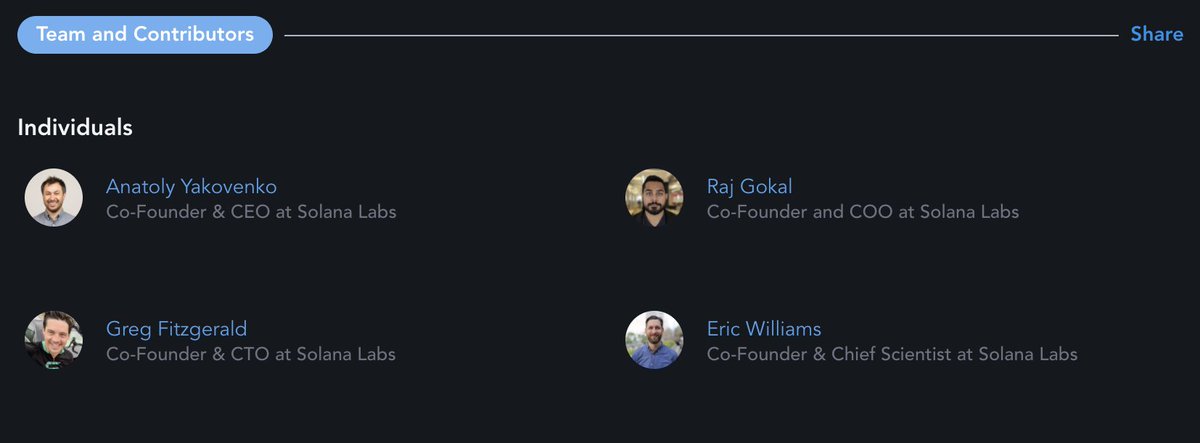

The founders & team come from diverse backgrounds, having previously contributed to the building of high-performance distributed systems at Qualcomm (Yakovenko & Fitzgerald) as well as products for HealthTech at Omada Health (Gokal & Williams).

The founding team has worked together for number of years, which reduces the risk of founder misalignment - the most common cause of failure in early stage projects.

https://messari.io/asset/solana/profile">https://messari.io/asset/sol...

https://messari.io/asset/solana/profile">https://messari.io/asset/sol...

Furthermore, Solana is backed by @SBF_Alameda, founder of @FTX_Official. The influence he has around his community will help accelerate formation of partnerships and further developer adoption.

Now that I& #39;ve covered the core benefits of Solana, allow me to put on my speculator hat.

I believe there are two trends that will allow Solana to break into the top 10 coins by market cap:

1. High quality Layer 2 projects

2. Displacement of incumbents from the top 10

I believe there are two trends that will allow Solana to break into the top 10 coins by market cap:

1. High quality Layer 2 projects

2. Displacement of incumbents from the top 10

1. High quality Layer 2 projects

At the time of this writing, there are 2462 Ethereum projects listed on the State of Dapps: https://www.stateofthedapps.com/rankings/platform/ethereum

And">https://www.stateofthedapps.com/rankings/... there are only 243 projects listed on Solana& #39;s site: https://solana.com/ecosystem ">https://solana.com/ecosystem...

At the time of this writing, there are 2462 Ethereum projects listed on the State of Dapps: https://www.stateofthedapps.com/rankings/platform/ethereum

And">https://www.stateofthedapps.com/rankings/... there are only 243 projects listed on Solana& #39;s site: https://solana.com/ecosystem ">https://solana.com/ecosystem...

While Solana& #39;s ecosystem is only about 1/10 of Ethereum& #39;s, its important to remember that Ethereum has been around for 6 years while Solana is less than 1 year old.

It& #39;s not the absolute number of projects that counts, but the quality of those projects. There are too many projects to name and there are others who& #39;ve done a better job of synthesising the information. https://medium.com/stakin/solana-emerging-ecosystem-87b8436305a2">https://medium.com/stakin/so...

I will focus on one area of DeFi that seem to affect prices of the underlying token more than anything else - Decentralized Exchanges (DEX).

Namely, Ethereum& #39;s Uniswap, Binance Smart Chain& #39;s PancakeSwap & Solana& #39;s Serum.

Namely, Ethereum& #39;s Uniswap, Binance Smart Chain& #39;s PancakeSwap & Solana& #39;s Serum.

For DEXes & their governance tokens, they seem to follow the same cycle. People buying the governance token causing token appreciation → incentives for liquidity provider increases → Total Value Locked (TVL) increases → People buy more token causing more appreciation

https://twitter.com/SBF_Alameda/status/1284966013444841472">https://twitter.com/SBF_Alame...

This cycle also drives the price of the Layer 1 token, as evident when BNB went up by 50% after PancakeSwap& #39;s TVL surpassed that of Uniswap on Feb 19th 2021.

Since then, PancakeSwap& #39;s TVL has been consistently above Uniswap& #39;s & BNB has held onto its number 3 position for over a month after overtaking USDT. https://www.coindesk.com/binance-bnb-45-pancakeswap">https://www.coindesk.com/binance-b...

So how is Serum looking?

The TVL on Raydium, an Automated Market Maker (AMM) & Serum& #39;s liquidity provider, is $220m, only about ~4% of both PancakeSwap & Uniswap& #39;s. https://coinmarketcap.com/currencies/raydium/

Obviously,">https://coinmarketcap.com/currencie... Solana& #39;s DEX & AMM has some room to grow.

The TVL on Raydium, an Automated Market Maker (AMM) & Serum& #39;s liquidity provider, is $220m, only about ~4% of both PancakeSwap & Uniswap& #39;s. https://coinmarketcap.com/currencies/raydium/

Obviously,">https://coinmarketcap.com/currencie... Solana& #39;s DEX & AMM has some room to grow.

But it& #39;s growing at an incredible pace.

Raydium launched on 21st Feb 2021 with $5m TVL. In slightly more than a month, it has grown 44x to $220m.

https://raydium.io/info/ ">https://raydium.io/info/&quo...

Raydium launched on 21st Feb 2021 with $5m TVL. In slightly more than a month, it has grown 44x to $220m.

https://raydium.io/info/ ">https://raydium.io/info/&quo...

2. Displacement of incumbents from the top 10

When I look at Coinmarketcap& #39;s top 10, I can& #39;t help but to wonder why 2 tokens are there: ADA & XRP.

For different reasons, I don& #39;t believe these two coins will occupy their current spots in the near future.

When I look at Coinmarketcap& #39;s top 10, I can& #39;t help but to wonder why 2 tokens are there: ADA & XRP.

For different reasons, I don& #39;t believe these two coins will occupy their current spots in the near future.

ADA

Cardano is set to release its smart contract capability called Goguen later this year. Based on this statement, you would think that Cardano is a fairly new project.

Cardano is set to release its smart contract capability called Goguen later this year. Based on this statement, you would think that Cardano is a fairly new project.

In actual fact, it was launched in 2015, the same year Ethereum was launched. Since then, other ecosystems have surged forward while Cardano& #39;s remain stagnant.

Do a simple Google search of "Cardano projects" and you& #39;ll be hard pressed to find any satisfying information on it.

Do a simple Google search of "Cardano projects" and you& #39;ll be hard pressed to find any satisfying information on it.

XRP

There& #39;s general consensus in the community that XRP is not decentralised. Out of the total 100bn XRPs that will be in circulation, Ripple will own at least 60bn with 20-30bn XRP already in their possession.

There& #39;s general consensus in the community that XRP is not decentralised. Out of the total 100bn XRPs that will be in circulation, Ripple will own at least 60bn with 20-30bn XRP already in their possession.

XRP& #39;s network is also limited to 150+ validators because Ripple maintains a Unique Node List (UNL) and controls 100% of all nodes that are added to their ledger.

Out of those 150+ nodes, 70 are fully owned by Ripple and few more by other partners. All five of the recommended validator nodes are also owned and operated by Ripple. https://en.cryptonomist.ch/2020/01/25/ripple-who-owns-the-most-xrp/">https://en.cryptonomist.ch/2020/01/2...

While being centralised is not a bad thing per se (BNB is owned by Binance afterall), Ripple is also being sued by the SEC for conducting a $1.3B unregistered securities offering.

https://www.sec.gov/news/press-release/2020-338">https://www.sec.gov/news/pres...

https://www.sec.gov/news/press-release/2020-338">https://www.sec.gov/news/pres...

Coupled with a history of making invalid claims that prey on retail investor psychology, I am confident the lawsuits will continue.

When they need to fund their legal defense team, they will be forced to stop the holdback of XRP supply.

When they need to fund their legal defense team, they will be forced to stop the holdback of XRP supply.

At the time of this writing, ADA& #39;s market cap stands at $38B while XRP is at $25B.

While Solana is at ~$5B.

As mentioned before, this is not investment advice.

While Solana is at ~$5B.

As mentioned before, this is not investment advice.

In conclusion, I will be hodling Solana for these reasons:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> High throughput and transaction speed

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> High throughput and transaction speed

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Low transaction fees

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Low transaction fees

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Scalable composability

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Scalable composability

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Interoperability with other Layer 1s

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Interoperability with other Layer 1s

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Great developer experience

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Great developer experience

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Rapidly growing ecosystem

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Rapidly growing ecosystem

Read on Twitter

Read on Twitter