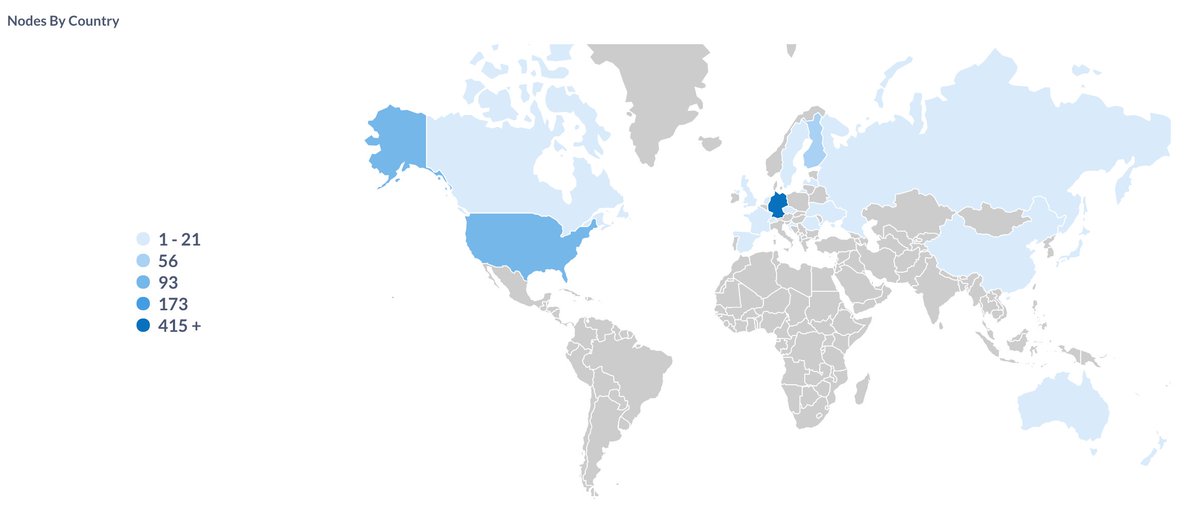

2/ Kadena is the only scalable layer-1 PoW blockchain available right now. The security & integrity found in Bitcoin is maintained while throughput and scalability are massively improved. Kadena has hundreds of node operators around the world securing the network at this moment.

3/ Why Proof of Work? Because it is the only “battle-tested” consensus protocol primitive. PoW creates an economic incentive for the majority of the hashpower to validate and honestly support the entire network. Other systems (like PoS) are still in the experimental phase. $KDA

4/ Many financial regulators don’t consider proof of work miners as money transmitters, making a probabilistic PoW mining system safer from a US regulatory perspective than other systems. Hence the statement of the SEC about Bitcoin not being a security. https://www.fincen.gov/resources/statutes-regulations/administrative-rulings/application-fincens-regulations-virtual-0">https://www.fincen.gov/resources...

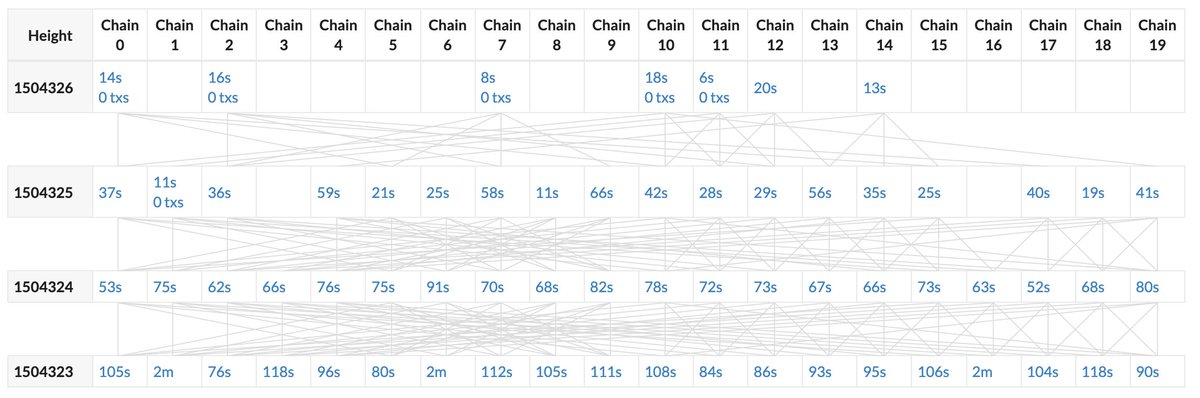

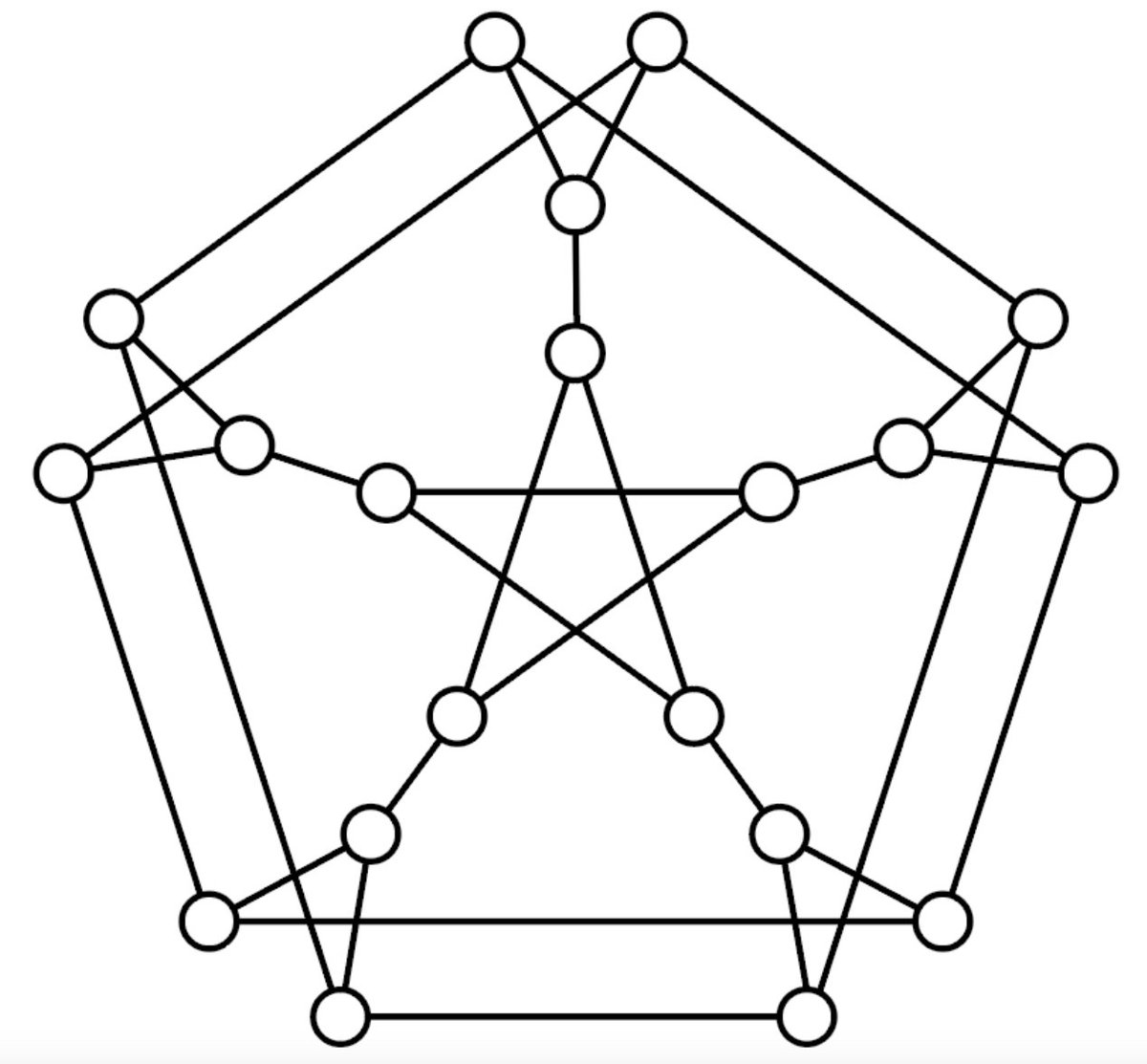

5/ Scalability is achieved by braiding multiple chains together. Many blocks are asynchronously produced on different peer chains (all at the same height). Each block requires only a fraction of the hash power of the total network. This increases the number of transactions..

6/ ..per second over the total network. Security is not compromised because when 2 (or more) chains are braided, in addition to making each block include the hash of the previous block on the same chain, you also have it include the hash of the previous block on the other chain.

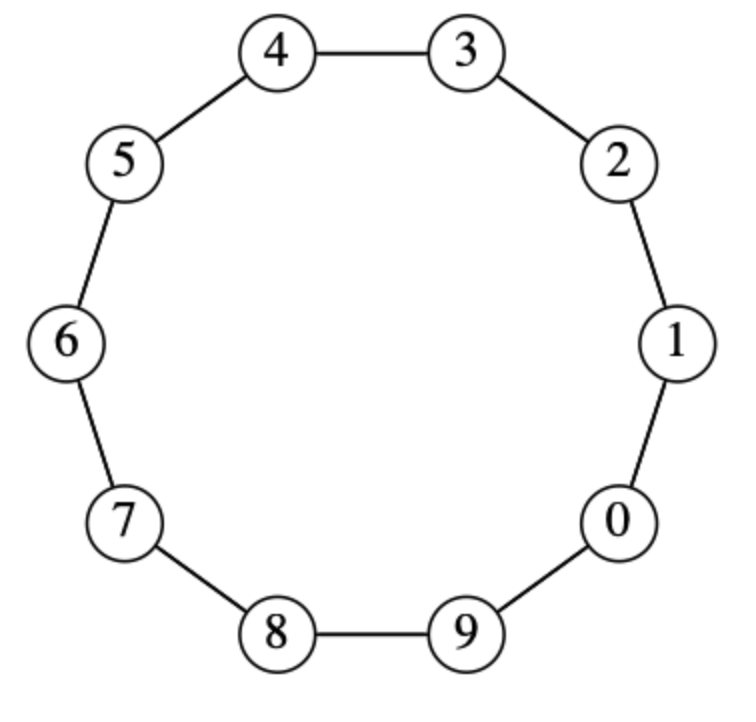

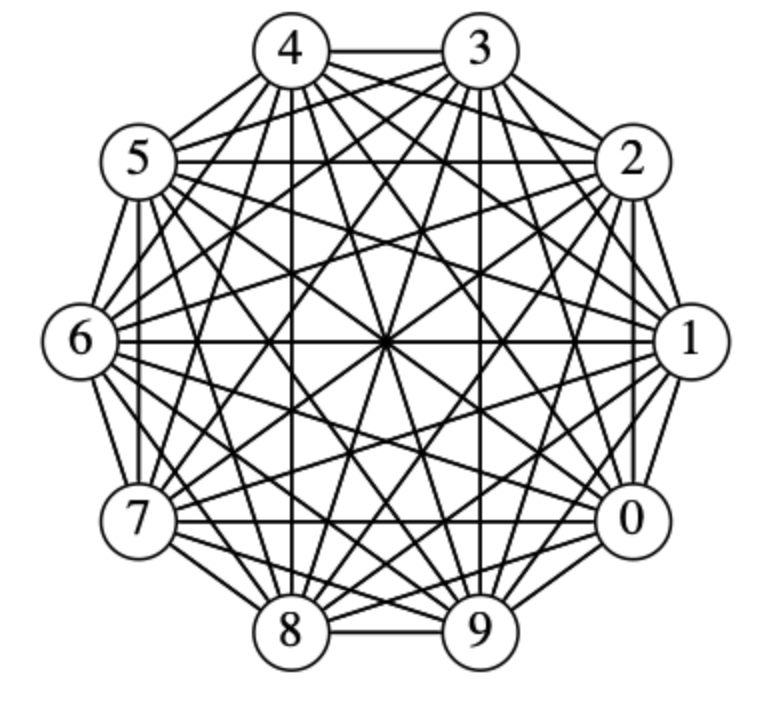

7/ Also graph theory research is leveraged to further scale. Let’s take 10 chains as an example. The problem with the first construction is, it takes 5 hops to get from any chain to the chain that is farthest away. Scaled to 20 chains, that would be 100 hops.

8/ Connecting every chain to every other chain won’t work either, because that takes up too much space. Using graph theory, Kadena has found ways to construct solutions that make its PoW blockchain scalable. $KDA

9/ This is a 20-chain graph that Kadena uses right now. Every node has 3 edges and it only takes at most 3 hops to get from any node to another node. Thus, we only have to wait 3 blocks (30s per block) after a transaction before the whole network’s hash power is protecting it.

10/ Using these types of constructions, Kadena’s blockchain can scale to hundreds of thousands of chains without compromising its security. With 20 chains, the Kadena blockchain achieves an industry-leading 480,000 transactions per second. $KDA

11/ The next major upgrade will be 50 braided chains working in parallel. The expected throughput will exceed 1 million transactions per second (!). Check this post out for a more detailed explanation: https://medium.com/kadena-io/how-to-scale-a-proof-of-work-blockchain-9233e5b4b62">https://medium.com/kadena-io...

12/ In addition to unmatched speed, Kadena’s PoW blockchain does not increase energy consumption as it scales due to its unique Chainweb protocol. Kadena is still using the same amount of energy after expanding from 10 to 20 chains. $KDA

13/ And tx fees? Even the fastest PoS platform has upper limits on throughput, but Kadena can scale the number of chains to meet any demand. This makes gas fees on Kadena microscopic. Thus, dApps on Kadena can simply scale out to the number of chains needed to service demand.

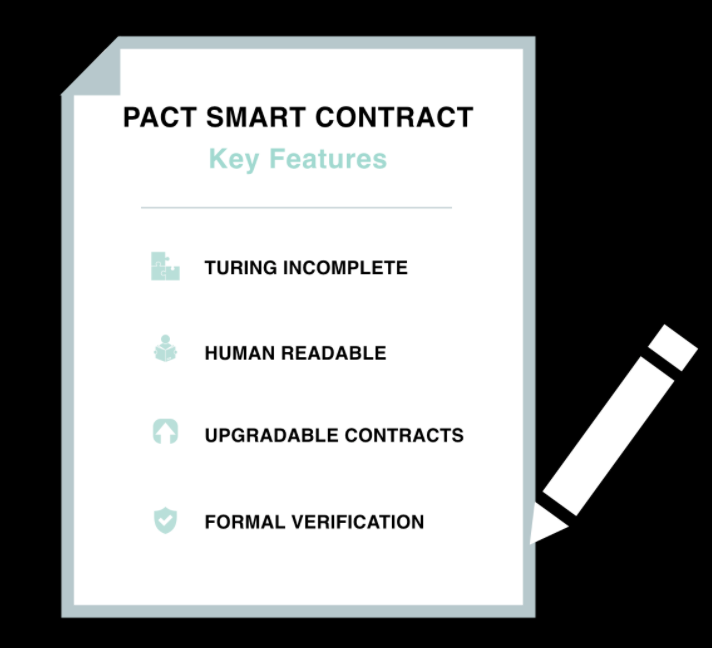

14/ Designed from the ground up, Kadena created their own smart contract language: PACT. Human-readable, while offering key features such as interchain communication, multi-signature, upgradable contracts and strong permission controls.

15/ Smart contracts are key to success. Ethereum (solidity), Tezos (lang) and Kadena (pact) are 2 of the few platforms that support real smart contracts. Check out this thread to see why this matters: https://twitter.com/SirLensALot/status/1374077976309075973">https://twitter.com/SirLensAL... ( @SirLensALot $KDA)

16/ A big barrier to the broad use of dApps is the requirement that users must first buy crypto to pay gas for tx fees. These steps create a huge hurdle to onboarding, one of the most critical steps to adoption.. $KDA

17/ ..for this reason Kadena introduced “gas stations”. By supporting multi-signature and capability-based security, gas stations will be used to pay on behalf of other users under specific conditions. This makes the customer experience pleasant and encouraging.

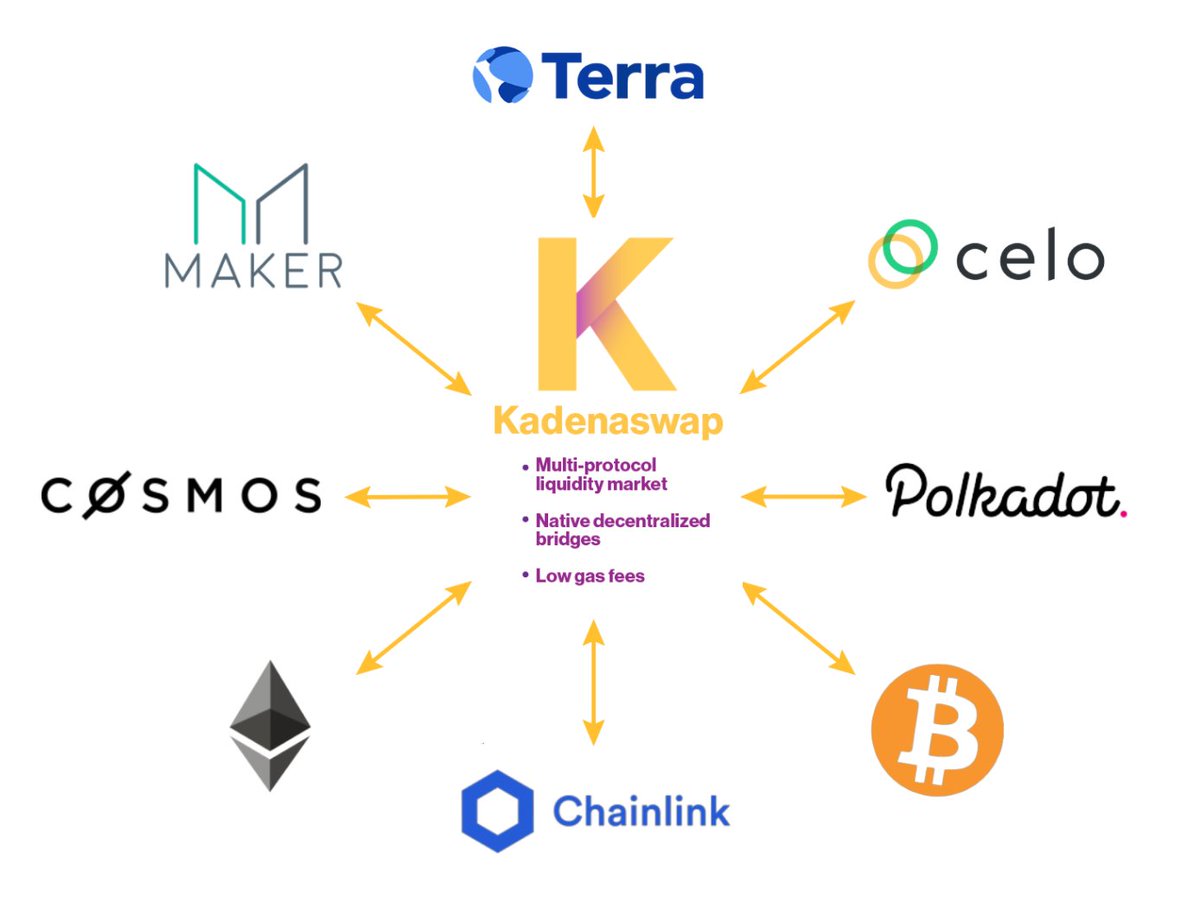

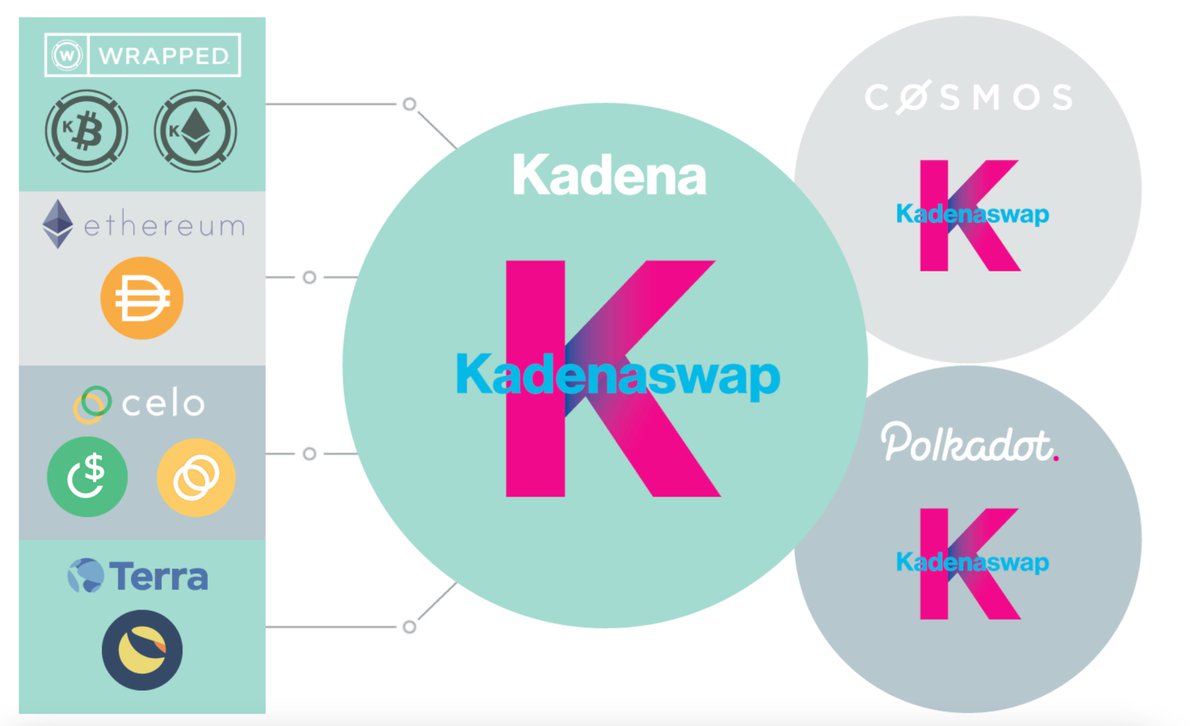

18/ Scaling liquidity across chains. Kadenaswap will be the only Multi-Chain, Multi-Protocol, Multi-Platform DEX. Their multi-chain design will act as a decentralized hub, providing bridges to major protocols like Bitcoin, Cosmos, Polkadot and other networks.

19/ Kadenaswap leverages the scalable PoW architecture of the Kadena blockchain to ensure the DEX can scale to handle any amount of trading volume. Also, @TokensoftInc is bringing wrapped tokens for BTC and ETH to Kadenaswap. The Kadena Chain Relay, a decentralized bridge..

20/ will connect Kadena with other platforms like Ethereum, Celo and Luna. This allows native tokens from these platforms to interoperate with the Kadena platform. Kadenaswap will become the clearing and settlement platform across multiple platforms. $KDA

21/ Kadenaswap is already live on the testnet: https://kadenaswap.chainweb.com/ .">https://kadenaswap.chainweb.com/">... A true demonstration of interoperable, scalable DeFi with low cost and high throughput. Kadenaswap is expected to officially launch in Q2 2021. $KDA

22/ Let’s take a look at the brains behind Kadena. Will Martino, one of the co-founders, was the lead engineer for Juno, JP Morgan’s blockchain prototype. Martino was also the tech lead for the SEC’s Cryptocurrency Steering Committee and the Quantitative Analytics Unit. $KDA

23/ The other co-founder, Stuart Popejoy, previously directed JP Morgan’s Emerging Tech Blockchain group and has 15 years experience building trading systems and exchange backbones for the financial industry. $KDA

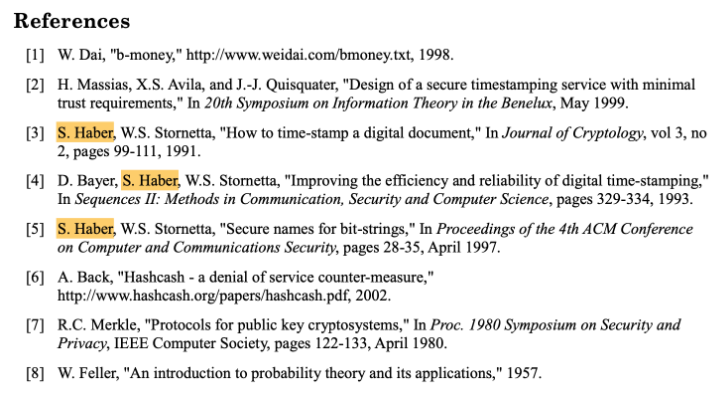

24/ The biggest case can be made for Dr. Stuart Haber (“Co-inventor of Blockchain"). Haber co-invented the blockchain technique for ensuring the integrity of digital records. He is the most cited author in Satoshi Nakamoto’s Bitcoin Whitepaper (!). $KDA $BTC

25/ The mechanism for KDA’s liquidity is PoW mining, which is entirely independent of Kadenaswap or other on-chain uses for KDA. With a PoS token, the value of the token and its liquidity directly impacts security. If an on-chain DEX provides higher rewards for the staking..

26/ ..token, this starts to compete with staking as a source of income. This will become a security problem and a liquidity problem for the DEX rolled into one. Kadena will never have these issues due to the independence of the KDA token from any application on the platform.

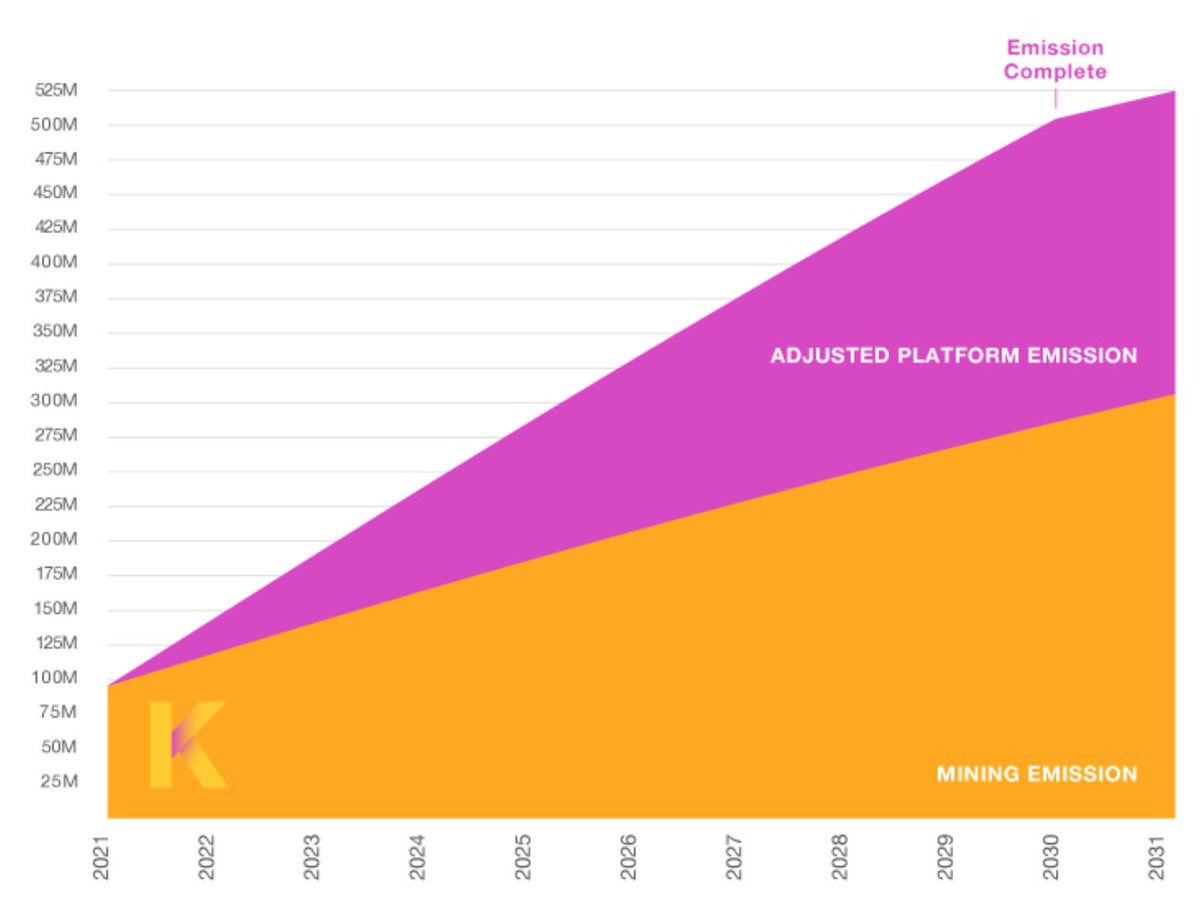

27/ Let’s talk economics now. The overall emission happens through 2 processes: mining and release of allocated tokens. The vast majority of the emission will be through mining. 1 billion tokens seems like a lot, but it’s more important to focus on the annual emission rate.. $KDA

28/ The annual emission rate is 22.08M tokens. The circulating supply is 110M. With the current price ($0.59) the calculated cap will be $65M. Even if the supply doubles (which takes 5 years), the cap is only $130M. Which is massively low for a project of this magnitude $KDA

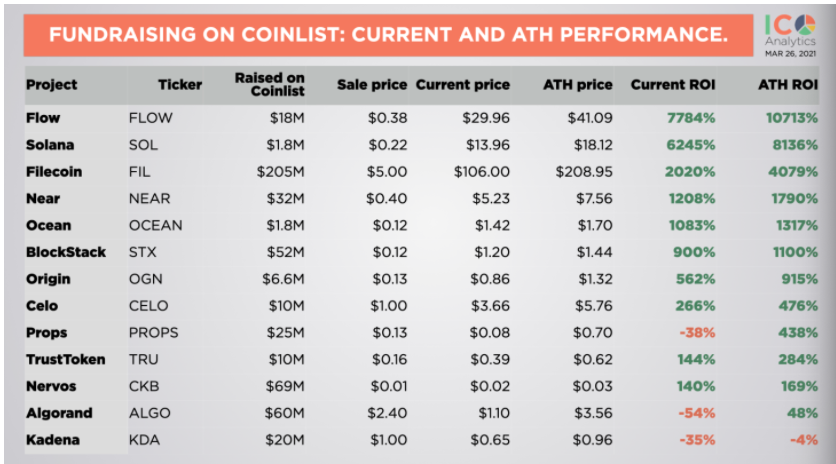

29/ Kadena is one of the few Coinlist projects that has remained rather unnoticed in this bull market. Looking at the projects in this list, it’s fair to say that there’s still a lot of room for growth. Their tokensale was conducted in the middle of the bear market in 2019. $KDA

30/ Kadena is still “under the radar” because it’s not listed on any big-volume exchanges yet. The order books are still very thin and big orders will cause too much slippage. The moment liquidity increases, whales will enter. It’s not a matter of if but when.. $KDA

31/ ..Kadena swap will pull in liquidity, Wrapped KDA tokens will be tradeable on Uniswap etc., Rosetta integration (by Coinbase) already in place, on the radar of Coinbase, additional exchanges in the pipeline according to their Q1 2021 roadmap: https://medium.com/kadena-io/kadena-roadmap-for-q1-2021-c511f8d95579">https://medium.com/kadena-io...

32/ Also..NFT’s are coming: https://github.com/kadena-io/KIPs/pull/14">https://github.com/kadena-io... $KDA $NFT

@kadena_io

@kadena_io

Read on Twitter

Read on Twitter