Let us understand Petrol taxes clearly to see that whether it is possible to bring them under GST.

A small #thread for you.

You should understand the tax regimes first to understand the nuances.

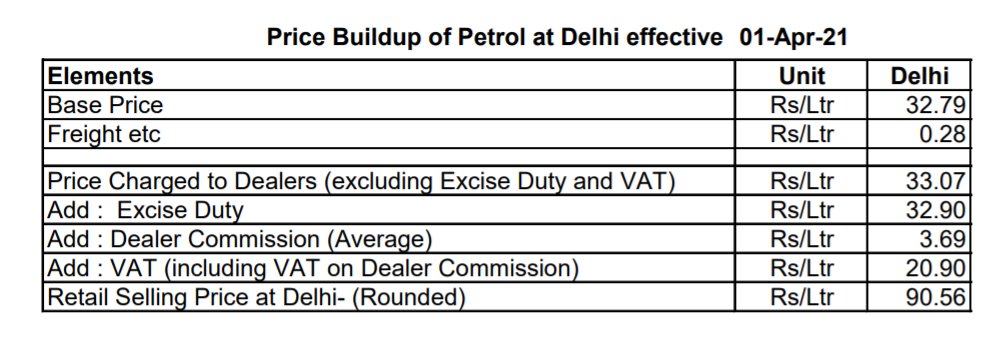

Price Build up of Petrol (Ex-Delhi)

A small #thread for you.

You should understand the tax regimes first to understand the nuances.

Price Build up of Petrol (Ex-Delhi)

There are two sets of taxes are levied on the Petrol, first is by Union Govt, which is collectively called Excise Duty and Second one is the taxes imposed by the State Government called Sales Tax.

First of all understand that both taxes are distinctively different tax regimes

First of all understand that both taxes are distinctively different tax regimes

Let us first understand how the Union Government tax works.

It is a specific tax or unit tax, that means it is a FIXED amount levied on per litre of the Petrol, ie, it is not affected by the price of the fuel in the market.

It is a specific tax or unit tax, that means it is a FIXED amount levied on per litre of the Petrol, ie, it is not affected by the price of the fuel in the market.

So the Union Government at present charges Rs. 32.90 per litre of Petrol.

That means the amount of excise duty alone comes 89.5% of the Base Price + Frieght Price + Dealer Commission (32.79+0.28+3.69).

So let us ask whether the Union will ready to take a pie of 14% here???

That means the amount of excise duty alone comes 89.5% of the Base Price + Frieght Price + Dealer Commission (32.79+0.28+3.69).

So let us ask whether the Union will ready to take a pie of 14% here???

Many still believe or argue that even though Union Government charges this much huge amount of specific tax on fuel, 41% of the same is shared with the States as per recommendation of 15th Financial Commission.

THIS IS NOT TRUE!

THIS IS NOT TRUE!

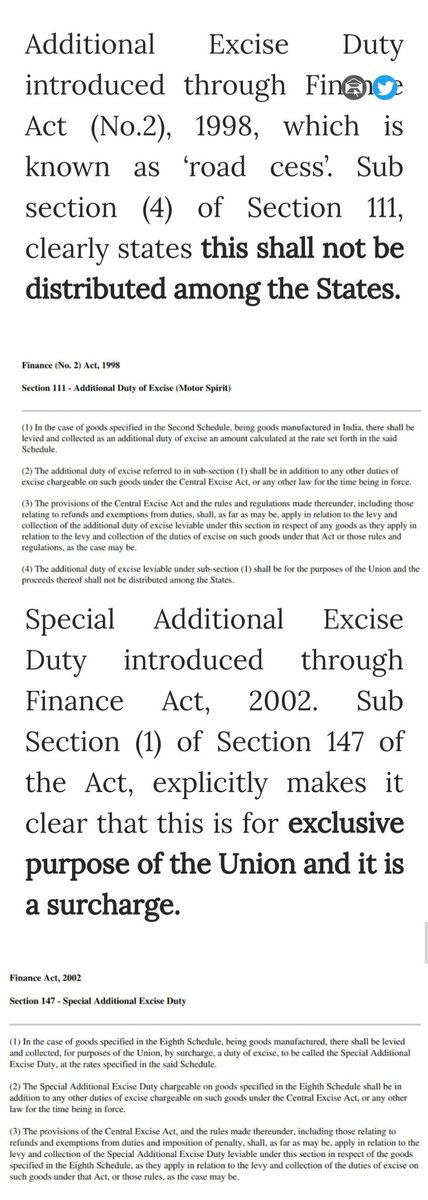

Union Excise now has 4 distinct components and out of that only BASIC EXCISE DUTY GOES TO DIVISIBLE POOL.

Basic Excise Duty - Rs. 1.40/ltr

Additional Excise Duty - Rs. 11.00/ltr

Agricultural Infrastructure Development Cess - Rs.2.50/ltr

Road & Infrastructure Cess - Rs.18.00/ltr

Basic Excise Duty - Rs. 1.40/ltr

Additional Excise Duty - Rs. 11.00/ltr

Agricultural Infrastructure Development Cess - Rs.2.50/ltr

Road & Infrastructure Cess - Rs.18.00/ltr

Here the Union Govt shares only just 57 paise, ie, 41% of the Rs. 1.40 with the States.

Remaining Rs.32.33 of excise duty goes to the Central Government!

Over the years NDA Govt reduced the component to the divisible pool systematically and now made it a token gesture!

Remaining Rs.32.33 of excise duty goes to the Central Government!

Over the years NDA Govt reduced the component to the divisible pool systematically and now made it a token gesture!

Now look at the taxes levied by the States.

They charge sales tax on Petrol, while charging the sales tax, they considers (Base Price + freight + dealer commission + central excise duty) and charges an ad valorem tax ie, a percentage tax on the above amount.

They charge sales tax on Petrol, while charging the sales tax, they considers (Base Price + freight + dealer commission + central excise duty) and charges an ad valorem tax ie, a percentage tax on the above amount.

So what is this means?

States benefit each time international oil prices goes up as well as Union Govt hikes excise duty, because they levy a percentage tax.

Vice versa, they suffer tax losses, when base price of petrol goes down or Union cuts excise duty.

States benefit each time international oil prices goes up as well as Union Govt hikes excise duty, because they levy a percentage tax.

Vice versa, they suffer tax losses, when base price of petrol goes down or Union cuts excise duty.

To know how each State is charging taxes, Please click the following link

https://www.ppac.gov.in/WriteReadData/userfiles/file/PP_3_SalesTax.xls">https://www.ppac.gov.in/WriteRead...

https://www.ppac.gov.in/WriteReadData/userfiles/file/PP_3_SalesTax.xls">https://www.ppac.gov.in/WriteRead...

Now understand that Delhi now charges you a tax on Petrol @ Rs.20.90 per litre, that is 56.9% of the Base Price + freight + Dealer Commission.

I have not considered here the Union Excise to find how much Delhi will suffer it is shifted to GST.

I have not considered here the Union Excise to find how much Delhi will suffer it is shifted to GST.

That means if GST& #39;s maximum slab of 28% is considered, GST on Petrol becomes Rs.10.30 at Delhi, which will be shared Rs. 5.15 each by both Delhi and Union.

GST regime means

Union will loss 32.90-5.15 = Rs. 27.75 per litre

Delhi will loss 20.90-5.15 = Rs. 15.75 per litre

GST regime means

Union will loss 32.90-5.15 = Rs. 27.75 per litre

Delhi will loss 20.90-5.15 = Rs. 15.75 per litre

Media to even political parties when discussing the Petrol taxes always says your 60% of the money you are paying for the price of oil is taxes.

Why we use this terminology?

Actually we should say that we are paying 146% of the tax of the price of Petrol!

Why we use this terminology?

Actually we should say that we are paying 146% of the tax of the price of Petrol!

Yep, when the Base Price + Freight + Dealer Commission together costs just Rs. 36.76 for a litre of Petrol in Delhi, each Delhite is paying Rs. 32.90 to Union & Rs. 20.90 to Delhi Government, ie, Rs. 53.80 as TAX for a product cost of Rs.36.76 ,ie, 146% tax!

Both Union and majority of States levy the tax at the origin, ie, at the refineries instead of collecting the same from the petrol pumps, so the collection efficiency is maximum in case of fuel taxes.

So no need to fear tax evasion here!

So no need to fear tax evasion here!

Now please comes back to the GST question.

Every one should ask:

Whether the Union is ready to forego 32.90-5.15 = Rs.27.75 per litre tax on Petrol?

States are ready to forego a major share of sales tax?

Example Delhi has to forego 20.90-5.15 = Rs.15.75 per ltire tax??

Every one should ask:

Whether the Union is ready to forego 32.90-5.15 = Rs.27.75 per litre tax on Petrol?

States are ready to forego a major share of sales tax?

Example Delhi has to forego 20.90-5.15 = Rs.15.75 per ltire tax??

Unless both Union & States found some innovate tax avenues to compensate for the above tax losses, they cant shift to GST regime as it means lakhs of crores of tax losses to Union and thousand of crores tax losses to States.

Who will compensate who?

Who will compensate who?

When they are offering you GST on fuel, you should ask them how they are going to do that?

Of course GST regime will bring down the cost of one litre of Petrol from Rs. 90.56 to Rs.47.05!

But is it possible when all Governments struggle with huge revenue gaps?

Leave that to U

Of course GST regime will bring down the cost of one litre of Petrol from Rs. 90.56 to Rs.47.05!

But is it possible when all Governments struggle with huge revenue gaps?

Leave that to U

PS:

There is some papers circulated in media by some "economists" that States will suffer huge losses if GST on fuel is implemented and they will be hesitant to do so. They say that GST will bring down Petrol price to Rs.75/-

It is a cheerleadering for Union Govt...

There is some papers circulated in media by some "economists" that States will suffer huge losses if GST on fuel is implemented and they will be hesitant to do so. They say that GST will bring down Petrol price to Rs.75/-

It is a cheerleadering for Union Govt...

Their calculations do some chicanery an brings only basic excise duty and Sales Tax component only as GST while keeping the exorbitant CESS charged by Union intact over and above GST and keep that in Union kitty!

Of course, then Union will benefit immensely...so CUNNING!

Of course, then Union will benefit immensely...so CUNNING!

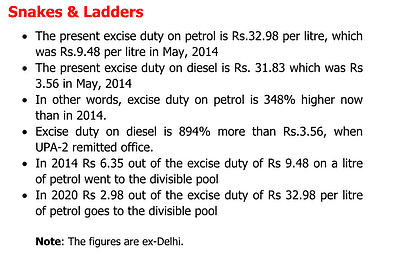

It is a systematic process where Union Govt stage by stage by reduced the basic excise duty and increased the CESS since 2014, so now 96% of taxes levied by Union comes under CESS and SURCHARGE.

So these sarkari "economists" keep that pie in Union kitty and ask States to suffer!

So these sarkari "economists" keep that pie in Union kitty and ask States to suffer!

If anyone wants to know under which notifications the additional excise duty and Special Additional Excise Duty (now known as Road & Infrastructure Cess) are not shared under divisible pool read this blog post https://www.jamewils.com/2017/09/decoding-petrol-tax_21.html">https://www.jamewils.com/2017/09/d...

How the Petrol Tax regime changed from taxation to day light robbery after 2014?

When economy was tanking due to Tuglakian reforms, petrol tax used as a single shot to reduce the Revenue gap

Here this article of mine discuss this great pick pocketing https://www.nationalheraldindia.com/india/high-fuel-prices-blame-it-on-high-central-excise-which-has-increased-manifold-since-2014">https://www.nationalheraldindia.com/india/hig...

When economy was tanking due to Tuglakian reforms, petrol tax used as a single shot to reduce the Revenue gap

Here this article of mine discuss this great pick pocketing https://www.nationalheraldindia.com/india/high-fuel-prices-blame-it-on-high-central-excise-which-has-increased-manifold-since-2014">https://www.nationalheraldindia.com/india/hig...

For the lazy ones in twitter, who don& #39;t have the patience to read the full article, here is the gist!

Please note that the above figures changed after this years budget..

I will soon write a comprehensive blog post, which will explain all nuances of fuel taxes.

Thank you all for overwhelming response to this #thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Gefaltete Hände" aria-label="Emoji: Gefaltete Hände">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Gefaltete Hände" aria-label="Emoji: Gefaltete Hände"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💐" title="Blumenstrauß" aria-label="Emoji: Blumenstrauß">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💐" title="Blumenstrauß" aria-label="Emoji: Blumenstrauß">

I will soon write a comprehensive blog post, which will explain all nuances of fuel taxes.

Thank you all for overwhelming response to this #thread

Read on Twitter

Read on Twitter