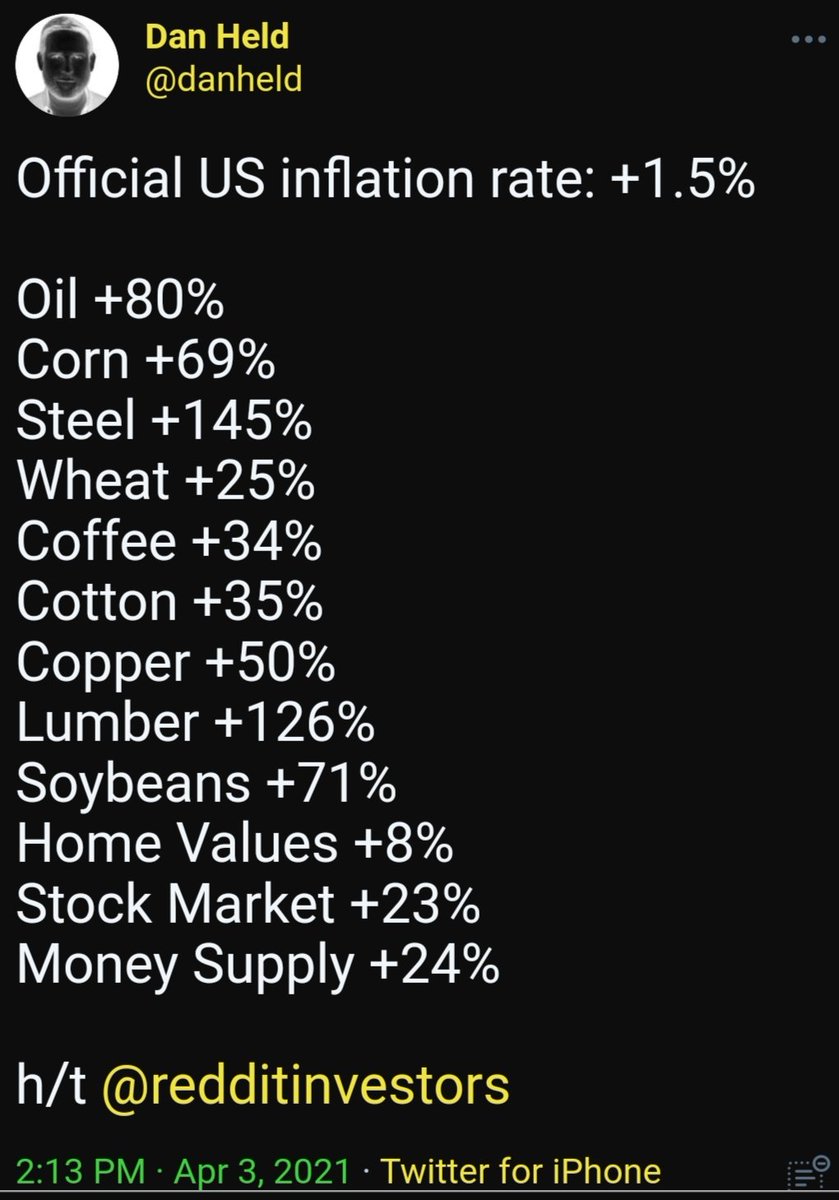

Officially, inflation is 1.5%, below the Fed& #39;s 2% target.

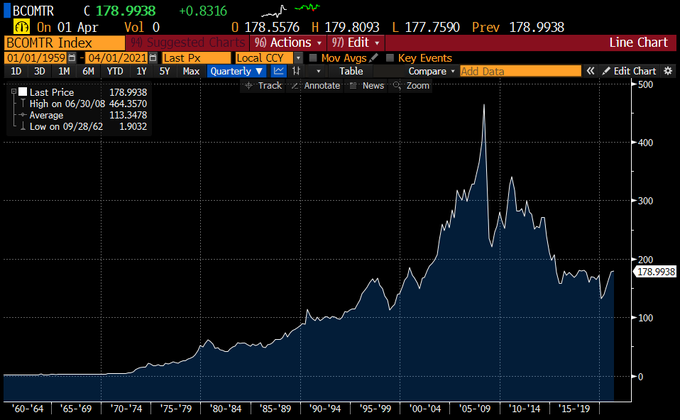

In reality, some assets, esp financial ones & homes, are ballooning, as are some cherry-picked commodities, but not the overall commodities index.

What& #39;s going on...?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

In reality, some assets, esp financial ones & homes, are ballooning, as are some cherry-picked commodities, but not the overall commodities index.

What& #39;s going on...?

There are several ways govt measures CPI (Consumer Price Index), which is the price of a "basket" of goods tracked across time.

https://www.bls.gov/cpi/overview.htm

The">https://www.bls.gov/cpi/overv... official calculation is controversial because it excludes energy & food. There& #39;s also lots of issues w/housing calculation.

https://www.bls.gov/cpi/overview.htm

The">https://www.bls.gov/cpi/overv... official calculation is controversial because it excludes energy & food. There& #39;s also lots of issues w/housing calculation.

Also, there was a secret bipartisan effort in the 80& #39;s to underreport inflation & lower official CPI as a stealth cut to entitlements (social security, medicare, medicaid), which are tied to inflation.

You can hear @EricRWeinstein discuss this on his latest @joerogan appearance.

You can hear @EricRWeinstein discuss this on his latest @joerogan appearance.

Bottom line is, the data is out there. BLS reports all versions of CPI but only uses one officially.

https://www.bls.gov/cpi/overview.htm

I">https://www.bls.gov/cpi/overv... think https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> inflation is likely from the vast printing of $& #39;s to fund stimulus, infrastructure & health bills. The real tell will be in treasury yields...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> inflation is likely from the vast printing of $& #39;s to fund stimulus, infrastructure & health bills. The real tell will be in treasury yields...

https://www.bls.gov/cpi/overview.htm

I">https://www.bls.gov/cpi/overv... think

So far, we& #39;ve been able to keep interest rates & payments low. But as total debt & currency creation rise, so does our risk as a borrower.

If interest on our debt go up by as little as 1-2%, at current levels, interest payments can devour a huge chunk of federal spending.

If interest on our debt go up by as little as 1-2%, at current levels, interest payments can devour a huge chunk of federal spending.

To cover rising debt payments, we& #39;ll likely print more $& #39;s rather than default. Either way, we end up in some sort of inflation spiral and a substantially weaker dollar.

This will hurt savers, help borrowers (more cheap $s to repay debts) & help what exports we have.

This will hurt savers, help borrowers (more cheap $s to repay debts) & help what exports we have.

This would also empower China as an alternate currency provider, if they can maintain greater stability & convince investors, oil producing nations to replace $s w/RNB.

Crypto may also play a role of it is viewed as a stable alternative states can& #39;t manipulate.

Crypto may also play a role of it is viewed as a stable alternative states can& #39;t manipulate.

If inflation is likely, this is a good time to borrow & buy investment property or a home. You& #39;ll repay w/abundant, cheap future $s.

Also a good time to own appreciating physical assets (land, collectibles), gold, stocks and (gulp) maybe Bitcoin.

Also a good time to own appreciating physical assets (land, collectibles), gold, stocks and (gulp) maybe Bitcoin.

If you enjoyed this thread, share & follow @ideafaktory for more futurism+innovation+economics+culture+wisecracks.

And get The McFuture newsletter/podcast at https://stevefaktor.com/newsletter ">https://stevefaktor.com/newslette...

And get The McFuture newsletter/podcast at https://stevefaktor.com/newsletter ">https://stevefaktor.com/newslette...

The Bitcoin-as-Chinese-financial-weapon conversation is inseparable from the dollar-devaluation one.

As w/Covid, an outside enemy may be targeting us, but what steps can we take to make its job easier or harder? It& #39;s vaccine+lockdowns vs treadmill+salad. https://www.bloomberg.com/news/articles/2021-04-07/peter-thiel-calls-bitcoin-a-chinese-financial-weapon-at-virtual-roundtable">https://www.bloomberg.com/news/arti...

As w/Covid, an outside enemy may be targeting us, but what steps can we take to make its job easier or harder? It& #39;s vaccine+lockdowns vs treadmill+salad. https://www.bloomberg.com/news/articles/2021-04-07/peter-thiel-calls-bitcoin-a-chinese-financial-weapon-at-virtual-roundtable">https://www.bloomberg.com/news/arti...

Hopefully, this is how it plays out. https://twitter.com/Claudia_Sahm/status/1380843169043132417">https://twitter.com/Claudia_S...

Read on Twitter

Read on Twitter " title="Officially, inflation is 1.5%, below the Fed& #39;s 2% target.In reality, some assets, esp financial ones & homes, are ballooning, as are some cherry-picked commodities, but not the overall commodities index.What& #39;s going on...?https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">">

" title="Officially, inflation is 1.5%, below the Fed& #39;s 2% target.In reality, some assets, esp financial ones & homes, are ballooning, as are some cherry-picked commodities, but not the overall commodities index.What& #39;s going on...?https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">">

" title="Officially, inflation is 1.5%, below the Fed& #39;s 2% target.In reality, some assets, esp financial ones & homes, are ballooning, as are some cherry-picked commodities, but not the overall commodities index.What& #39;s going on...?https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">">

" title="Officially, inflation is 1.5%, below the Fed& #39;s 2% target.In reality, some assets, esp financial ones & homes, are ballooning, as are some cherry-picked commodities, but not the overall commodities index.What& #39;s going on...?https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">">