Biggest launch in Defi history? @feiprotocol raised $1.2B from its Genesis event, and the $FEI - $TRIBE pool is #1 on Uniswap with $2.6 BILLION in liquidity.

Simultaneously, retail investors got predictably rekt.

Here& #39;s how the drama unfolded:

Simultaneously, retail investors got predictably rekt.

Here& #39;s how the drama unfolded:

Tl;dr $FEI is another algorithmic stablecoin, this time with an actual peg to USD. It maintains its peg via its protocol controlled value (PCV) design (think: central bank) selling and buying back supply as needed to maintain price.

However, unlike uncollateralized seignorage models like Basis and ESD, $FEI is actually collateralized to the tune of $1.2 billion dollars, ~$1 billion of which was raised in the last 24 hours.

Why is collateral important?

Uncollateralized stablecoins are like a Fed with no balance sheet. They can print money to inflate supply / depress value, but if demand falls they have no liquidity to buy currency back.

As people rush for the exits your currency& #39;s value --> 0.

Uncollateralized stablecoins are like a Fed with no balance sheet. They can print money to inflate supply / depress value, but if demand falls they have no liquidity to buy currency back.

As people rush for the exits your currency& #39;s value --> 0.

The protocol also builds on the insufficiency of PCV designs by adding "direct incentives."

Translation: "we punish the shit out of you if you trade against the protocol."

Translation: "we punish the shit out of you if you trade against the protocol."

Selling $FEI below its $1 peg triggers a burn mechanic that gets exponentially worse the further price is from the peg.

Penalty = (Distance from peg * 100)^2

Right now $FEI is 5.96% off its peg, so the penalty for selling it is a whopping **35%**.

Penalty = (Distance from peg * 100)^2

Right now $FEI is 5.96% off its peg, so the penalty for selling it is a whopping **35%**.

So, onto questions:

1) How did they raise so much fucking money?

2) Why rekt?

1) How did they raise so much fucking money?

2) Why rekt?

Two answers to #1: first, they sold the initial $FEI on an ETH bonding curve dependent on demand. $FEI would be issued between $0.50 and $1.01 depending on demand, with the $1.01 price being triggered at $250 million $FEI issued.

There was $1.2 billion of demand.

There was $1.2 billion of demand.

So here& #39;s what happened to $FEI in plain English:

You thought you were buying a dollar for 50 cents but instead you paid $1.01 only to get $0.95 and now if you try to sell it you& #39;ll end up with $0.60.

lol

You thought you were buying a dollar for 50 cents but instead you paid $1.01 only to get $0.95 and now if you try to sell it you& #39;ll end up with $0.60.

lol

The bigger reason the raise was so big was an air-drop of the $TRIBE governance token.

If you kept your Genesis purchase in $FEI, you got part of the $TRIBE air drop pro rata, though investors also had the opportunity to pre-swap $FEI for $TRIBE.

More pre-swap, higher price.

If you kept your Genesis purchase in $FEI, you got part of the $TRIBE air drop pro rata, though investors also had the opportunity to pre-swap $FEI for $TRIBE.

More pre-swap, higher price.

$383M of retail money decided to pre-swap.

This excellent doc from @korpi87 helps explain the underlying math: https://docs.google.com/spreadsheets/d/1aWbQLYiHF6XV8dl3Vkv24NqFZlk332qpQSGjZbFGDJ0">https://docs.google.com/spreadshe...

This excellent doc from @korpi87 helps explain the underlying math: https://docs.google.com/spreadsheets/d/1aWbQLYiHF6XV8dl3Vkv24NqFZlk332qpQSGjZbFGDJ0">https://docs.google.com/spreadshe...

The predictably unfortunate problem with handing out free shit is, well, people will want to dump it for something that actually has value -- $ETH.

As a result, whales took retail to the fucking woodshed.

Look at this post by @angelomint of a whale who made a cool 650 $ETH:

As a result, whales took retail to the fucking woodshed.

Look at this post by @angelomint of a whale who made a cool 650 $ETH:

$TRIBE went from an opening price of $3.18 to $2.04 (as of this writing). So:

If you pre-swapped $FEI for $TRIBE you got rekt.

If you held $FEI straight up you got rekt.

Basically if you aped in for the airdrop without a *programmatic* exit plan, you. got. rekt.

If you pre-swapped $FEI for $TRIBE you got rekt.

If you held $FEI straight up you got rekt.

Basically if you aped in for the airdrop without a *programmatic* exit plan, you. got. rekt.

It remains to be seen how $FEI will restore its peg given it continues to diverge--there seems to be limited interest from traders at buying it below $1, despite incentives.

The next few days will test the protocol& #39;s willingness to re-weight $FEI to $1--a throw-in-the-towel type event given re-weights are a) expensive and b) a signal market-based peg incentives can& #39;t be relied on.

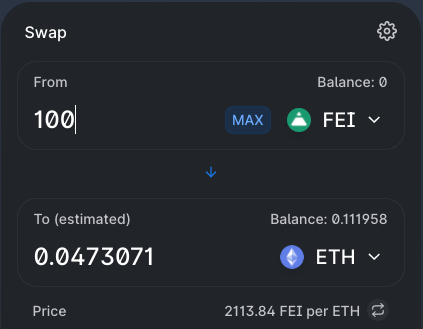

Finally, even w/ $2.6 BILLION in liquidity on Uniswap, there is ironically no good exit option for $FEI holders.

Uniswap doesn& #39;t show the burn mechanic, meaning you think you& #39;re swapping at market rate, but in the background the protocol is spanking you for 30%.

Uniswap doesn& #39;t show the burn mechanic, meaning you think you& #39;re swapping at market rate, but in the background the protocol is spanking you for 30%.

The biggest Defi launch ever seems like it& #39;ll be a multi-billion dollar teaching lesson for retail:

- DYOR

- Don& #39;t ape

- Whales eat pieces of shit like you for breakfast

$FEI $TRIBE @feiprotocol

- DYOR

- Don& #39;t ape

- Whales eat pieces of shit like you for breakfast

$FEI $TRIBE @feiprotocol

Read on Twitter

Read on Twitter