1/ $JRT Thread:

Started in 2017, @Jarvis_Network is a set of Ethereum-based protocols & tools that allow users to gain exposure to any financial instrument through margin trading and synthetic assets.

Sights are set on “block-chainifying” traditional financial markets

Started in 2017, @Jarvis_Network is a set of Ethereum-based protocols & tools that allow users to gain exposure to any financial instrument through margin trading and synthetic assets.

Sights are set on “block-chainifying” traditional financial markets

2/ $JRT

The end goal of Jarvis is to remove intermediaries from financial markets https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> making them:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> making them:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">more open

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">more open

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">more transparent

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">more transparent

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">interoperable

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">interoperable

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">and programmable

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">and programmable

The end goal of Jarvis is to remove intermediaries from financial markets

3/ $JRT

"The Synthereum Manifesto": A research paper on Jarvis& #39; Synthetic protocol discusses their high-level overview of the technical aspects of Synthereum. It also highlights the business use-case of Synthereum.

See link: https://drive.google.com/file/d/1WGK2yHG9C_IPXeZkH94jnSliYyQY0xVi/view">https://drive.google.com/file/d/1W...

"The Synthereum Manifesto": A research paper on Jarvis& #39; Synthetic protocol discusses their high-level overview of the technical aspects of Synthereum. It also highlights the business use-case of Synthereum.

See link: https://drive.google.com/file/d/1WGK2yHG9C_IPXeZkH94jnSliYyQY0xVi/view">https://drive.google.com/file/d/1W...

4/ $JRT Synthetic Assets track the price of another asset on the blockchain

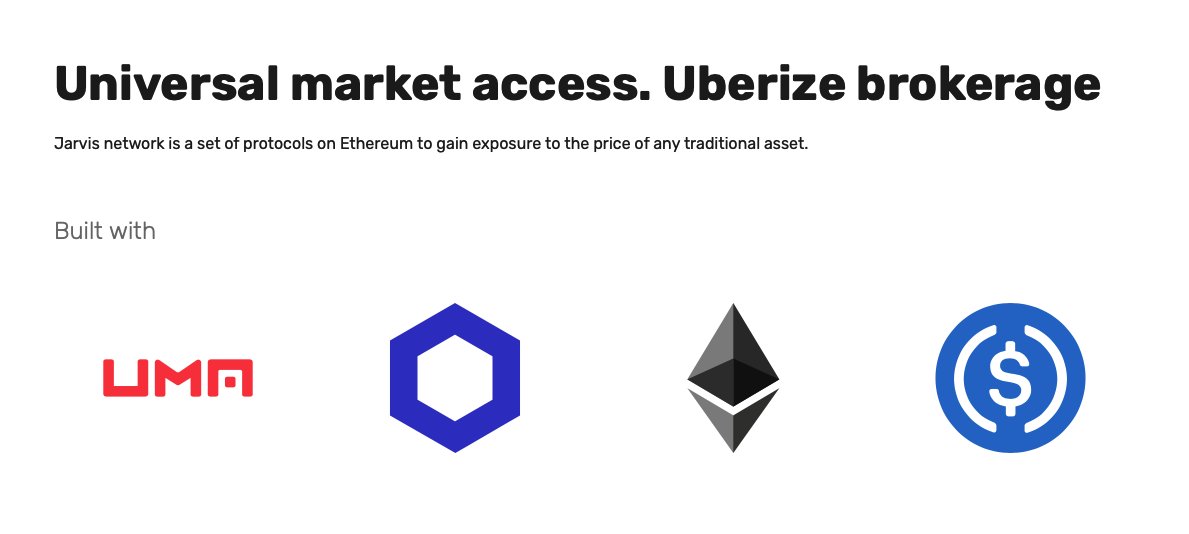

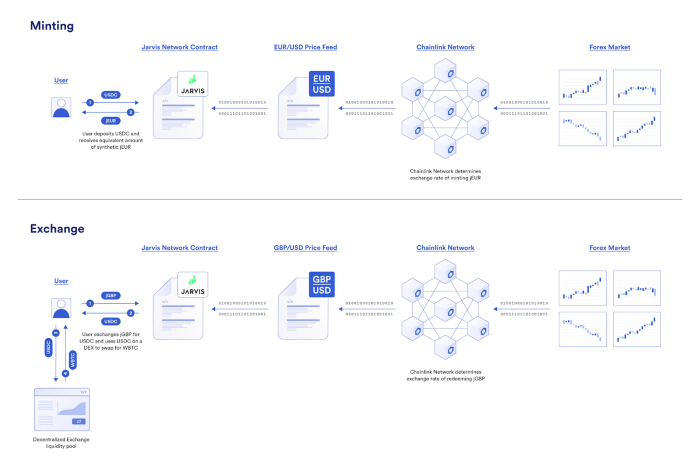

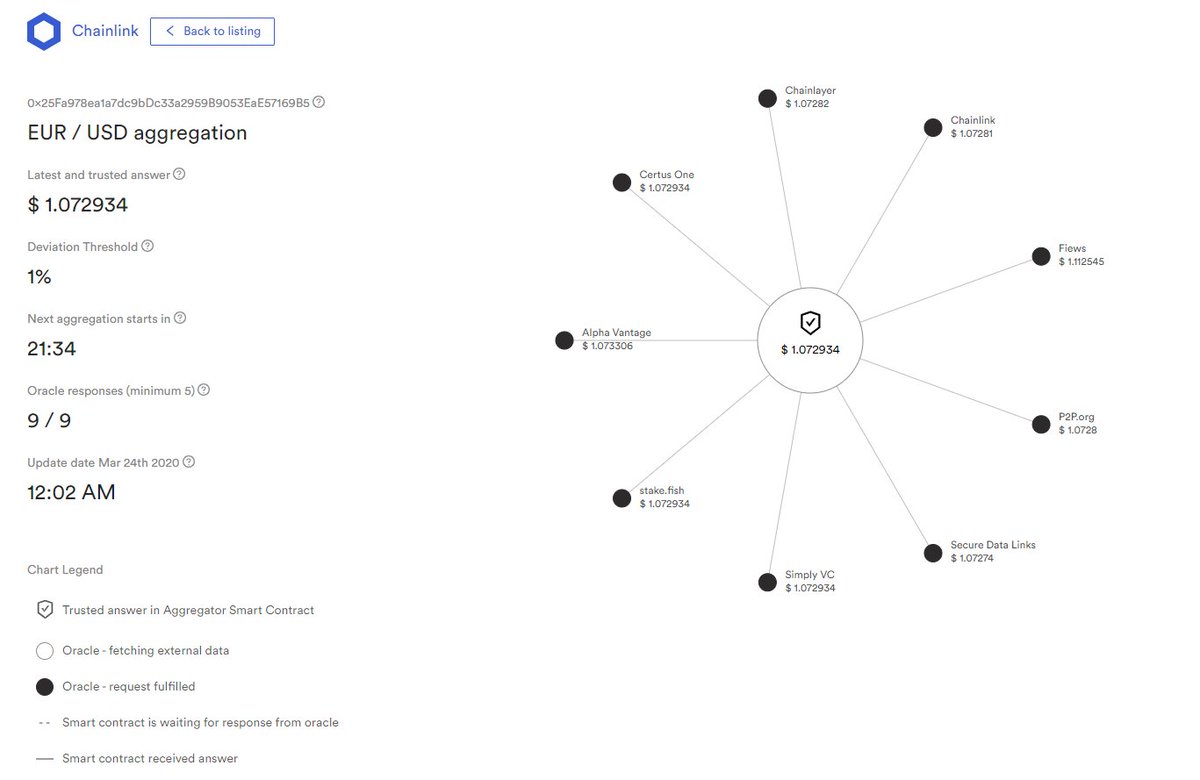

Synthereum, Jarvis& #39; synthetic protocol, has been designed on V1 of @UMAprotocol $UMA and uses @chainlink $LINK price feeds

In Feb 2020 $UMA requested to port Synthereum on their V2 protocol

Synthereum, Jarvis& #39; synthetic protocol, has been designed on V1 of @UMAprotocol $UMA and uses @chainlink $LINK price feeds

In Feb 2020 $UMA requested to port Synthereum on their V2 protocol

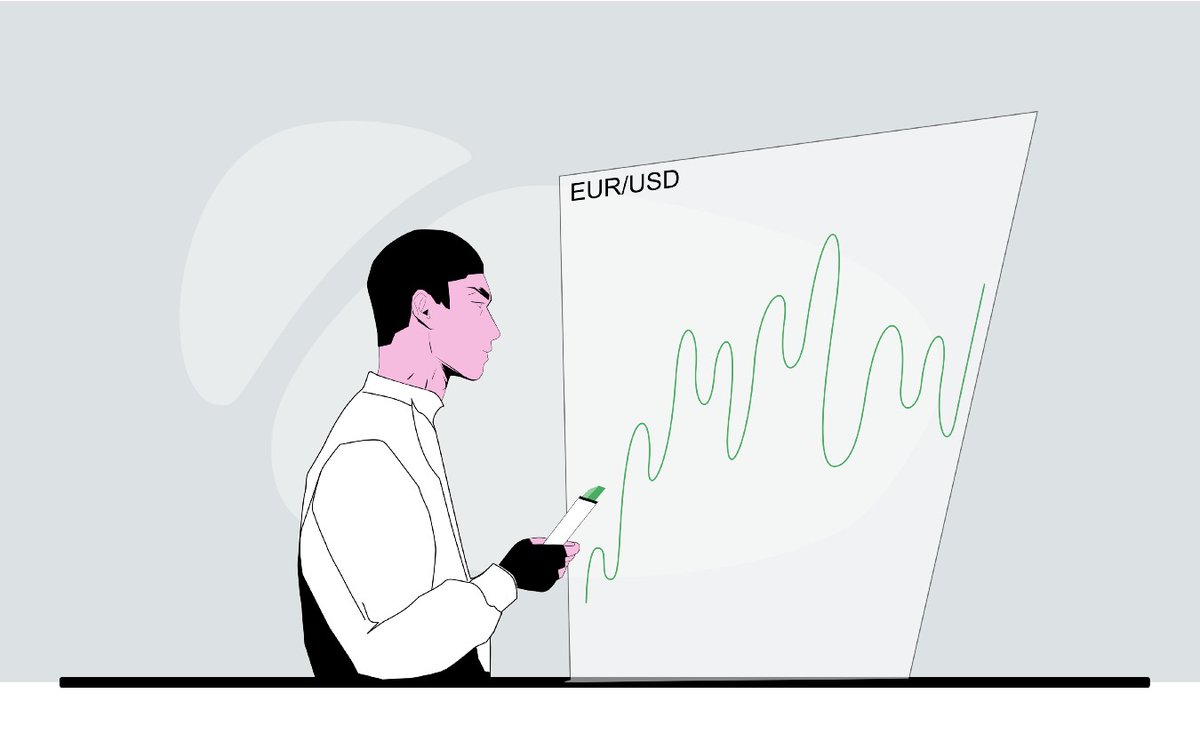

5/ $JRT According to CEO @pscltllrd

"The focus [of JRT] is on Forex, which is for me the next big thing (60bn USD of stablecoins, 99% is USD... this has to change). We issue Fx synths + have an autonomous broker with chainlink price feed + they can be exchanged on Sushiswap"

"The focus [of JRT] is on Forex, which is for me the next big thing (60bn USD of stablecoins, 99% is USD... this has to change). We issue Fx synths + have an autonomous broker with chainlink price feed + they can be exchanged on Sushiswap"

6/ $JRT

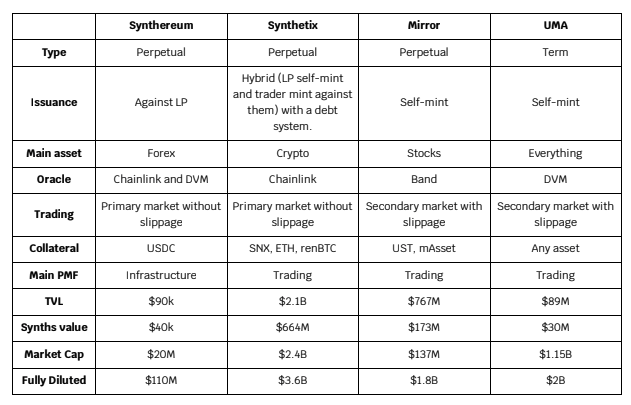

Synthereum is in one of the hottest niches of DeFi, "Synthetics". Below is a table to compare and contrast other synthetic protocols currently existing in DeFi.

Synthereum is in one of the hottest niches of DeFi, "Synthetics". Below is a table to compare and contrast other synthetic protocols currently existing in DeFi.

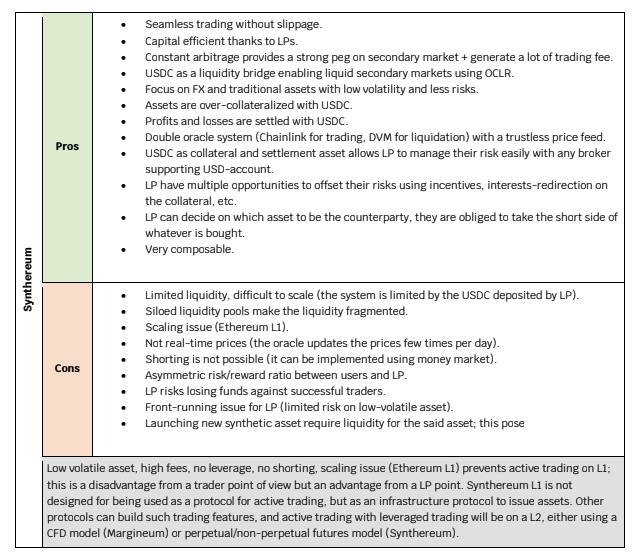

7/ $JRT as mentioned, primarily focuses on Forex in terms of their synthetic assets

Forex will enable use cases such as creating more value in the DeFi sector and onboard new users

Consider the size of FX market...."~6.6trillion traded per day in 2019" -www.tokenist.com

Forex will enable use cases such as creating more value in the DeFi sector and onboard new users

Consider the size of FX market...."~6.6trillion traded per day in 2019" -www.tokenist.com

8/ $JRT Once Synthereum has a significant amount of fiat currencies  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> with a robust infrastructure and deep liquidity they will add more assets such as commodities, metal, stocks, indexes, ETFs etc.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> with a robust infrastructure and deep liquidity they will add more assets such as commodities, metal, stocks, indexes, ETFs etc.

In terms of expansion...this can be exponential https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

In terms of expansion...this can be exponential

9/ $JRT On-Chain Liquidity Routing (OCLR) allows swapping any ERC20 seamlessly & atomically for synthetic assets using USDC to bridge

The router leverages from an AMM (Uniswap, Balancer, Curve) liquidity or an on-chain Liq aggregator to atomically swap any ERC20 for any jSynths

The router leverages from an AMM (Uniswap, Balancer, Curve) liquidity or an on-chain Liq aggregator to atomically swap any ERC20 for any jSynths

10/ $JRT USDC is at the base asset of the Jarvis Network. USDC an ultra-liquid asset with a total of 5.5

billion outstanding tokens. It is a fully audited tokenized dollar, with a strong-peg and the issuer works hard pushing the boundaries (Visa integration, banking

license, etc)

billion outstanding tokens. It is a fully audited tokenized dollar, with a strong-peg and the issuer works hard pushing the boundaries (Visa integration, banking

license, etc)

11/ $JRT jSynths happen at the oracle price without slippage. OCLR leverages from the USDC deep liquidity to perform atomic swap: if a user wants to sell wBTC for jEUR, the wBTC would be sold for USDC on an AMM, & USDC will be used to mint jEUR at the oracle price within 1 txn.

12/ $JRT This means that the liquidity of any ERC20 <> jSynths = the liquidity of any ERC20 <> USDC. This makes Jarvis assets more liquid and capital-efficient than others. Any synthetic fiat currency live on Synthereum will have the same liquidity and

integration as USDC.

integration as USDC.

13/ $JRT This feature will enable to scale DeFi and to provide trading of pairs and liquidity depth that were not possible before

14/ $JRT This is especially important in some countries like Nigeria and Cameroun, where they need to buy BTC at a premium due to lack of liquidity or the possibility for market makers and arbitrageurs to exchange their local currencies into USD.

15/ $JRT for this reason, it is primordial to create a fiat on and off-ramp for synthetic assets.

A route could be:

1. Fiat https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> jFiat using a fiat on-ramp partner

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> jFiat using a fiat on-ramp partner

2. jFiat https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> USDC by burning the jFiat on Synthereum

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> USDC by burning the jFiat on Synthereum

3. USDC https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> any ERC20 tokens by using an AMM or aggregator

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> any ERC20 tokens by using an AMM or aggregator

A route could be:

1. Fiat

2. jFiat

3. USDC

16/ $JRT this means that Fiat <> ERC20 tokens would have the same liquidity and slippage as USDC <> ERC20 token;

This can ultimately position Synthereum as the best on and off-ramping tool for individuals and professionals.

This can ultimately position Synthereum as the best on and off-ramping tool for individuals and professionals.

17/ $JRT DeFi is becoming a blackhole for liquidity, the OCLR possibilities (AMM x Synthereum + Curve x Synthereum + Paraswap x Synthereum + Fiat x jFiat bridges) can enable the creation of the MOST POWERFUL tool to buy/sell crypto assets & onboard millions of new users into DeFi

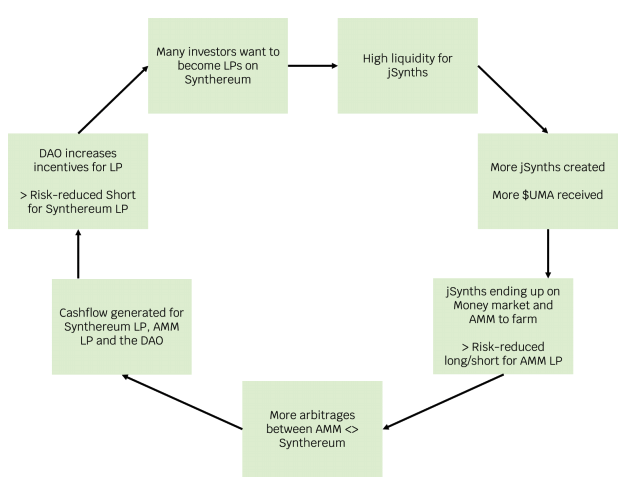

18/ $JRT The self minting upcoming update will allow synthetic as collateral to mint synthetic  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen"> ....a synthetic in a synthetic....in a synthetic

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen"> ....a synthetic in a synthetic....in a synthetic  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

Synthereum is summarized in their manifesto as a virtuous circle:

Synthereum is summarized in their manifesto as a virtuous circle:

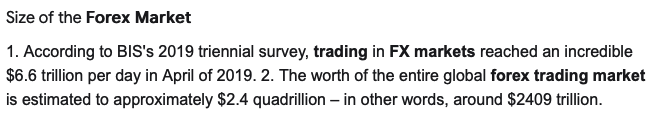

19/ $JRT One audit has been completed by Halborn and a second is coming with Ubik.

Check out their completed audit here: https://gitlab.com/jarvis-network/apps/exchange/mono-repo/-/blob/dev/docs/security-audits/halborn/02-response-to-jarvis-v3-smart-contracts-report-v1.md">https://gitlab.com/jarvis-ne...

Check out their completed audit here: https://gitlab.com/jarvis-network/apps/exchange/mono-repo/-/blob/dev/docs/security-audits/halborn/02-response-to-jarvis-v3-smart-contracts-report-v1.md">https://gitlab.com/jarvis-ne...

20/ $JRT @pscltllrd is the CEO and founder of Jarvis who has a large following of eager FX traders and is also very admired in the French DeFi space

https://www.youtube.com/channel/UCvWCz_oY_Hu6RiDNEMR_0rw">https://www.youtube.com/channel/U... https://www.linkedin.com/in/pascal-tallarida/en-us/?originalSubdomain=bg">https://www.linkedin.com/in/pascal...

https://www.youtube.com/channel/UCvWCz_oY_Hu6RiDNEMR_0rw">https://www.youtube.com/channel/U... https://www.linkedin.com/in/pascal-tallarida/en-us/?originalSubdomain=bg">https://www.linkedin.com/in/pascal...

21/ $JRT To anyone looking to learn more about @Jarvis_Network and the team, I highly suggest checking out the resources below:

https://www.coingecko.com/en/coins/jarvis-reward-token

https://www.coingecko.com/en/coins/... href=" https://jarvis.network/

https://jarvis.network/">... href=" https://t.me/jarvistrading

https://t.me/jarvistra... href=" https://medium.com/jarvis-network ">https://medium.com/jarvis-ne... https://drive.google.com/file/d/1WGK2yHG9C_IPXeZkH94jnSliYyQY0xVi/view">https://drive.google.com/file/d/1W...

https://www.coingecko.com/en/coins/jarvis-reward-token

Read on Twitter

Read on Twitter

making them:https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">more openhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">more transparent https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">interoperable https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">and programmable" title="2/ $JRT The end goal of Jarvis is to remove intermediaries from financial markets https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> making them:https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">more openhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">more transparent https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">interoperable https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">and programmable" class="img-responsive" style="max-width:100%;"/>

making them:https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">more openhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">more transparent https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">interoperable https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">and programmable" title="2/ $JRT The end goal of Jarvis is to remove intermediaries from financial markets https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> making them:https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">more openhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">more transparent https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">interoperable https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">and programmable" class="img-responsive" style="max-width:100%;"/>

![5/ $JRT According to CEO @pscltllrd "The focus [of JRT] is on Forex, which is for me the next big thing (60bn USD of stablecoins, 99% is USD... this has to change). We issue Fx synths + have an autonomous broker with chainlink price feed + they can be exchanged on Sushiswap" 5/ $JRT According to CEO @pscltllrd "The focus [of JRT] is on Forex, which is for me the next big thing (60bn USD of stablecoins, 99% is USD... this has to change). We issue Fx synths + have an autonomous broker with chainlink price feed + they can be exchanged on Sushiswap"](https://pbs.twimg.com/media/Ex_32DWXAAQZbU7.jpg)

with a robust infrastructure and deep liquidity they will add more assets such as commodities, metal, stocks, indexes, ETFs etc. In terms of expansion...this can be exponential https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">" title="8/ $JRT Once Synthereum has a significant amount of fiat currencies https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> with a robust infrastructure and deep liquidity they will add more assets such as commodities, metal, stocks, indexes, ETFs etc. In terms of expansion...this can be exponential https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">" class="img-responsive" style="max-width:100%;"/>

with a robust infrastructure and deep liquidity they will add more assets such as commodities, metal, stocks, indexes, ETFs etc. In terms of expansion...this can be exponential https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">" title="8/ $JRT Once Synthereum has a significant amount of fiat currencies https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> with a robust infrastructure and deep liquidity they will add more assets such as commodities, metal, stocks, indexes, ETFs etc. In terms of expansion...this can be exponential https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">" class="img-responsive" style="max-width:100%;"/>

....a synthetic in a synthetic....in a synthetic https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Synthereum is summarized in their manifesto as a virtuous circle:" title="18/ $JRT The self minting upcoming update will allow synthetic as collateral to mint synthetic https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen"> ....a synthetic in a synthetic....in a synthetic https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Synthereum is summarized in their manifesto as a virtuous circle:">

....a synthetic in a synthetic....in a synthetic https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Synthereum is summarized in their manifesto as a virtuous circle:" title="18/ $JRT The self minting upcoming update will allow synthetic as collateral to mint synthetic https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen"> ....a synthetic in a synthetic....in a synthetic https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Synthereum is summarized in their manifesto as a virtuous circle:">

....a synthetic in a synthetic....in a synthetic https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Synthereum is summarized in their manifesto as a virtuous circle:" title="18/ $JRT The self minting upcoming update will allow synthetic as collateral to mint synthetic https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen"> ....a synthetic in a synthetic....in a synthetic https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Synthereum is summarized in their manifesto as a virtuous circle:">

....a synthetic in a synthetic....in a synthetic https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Synthereum is summarized in their manifesto as a virtuous circle:" title="18/ $JRT The self minting upcoming update will allow synthetic as collateral to mint synthetic https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen"> ....a synthetic in a synthetic....in a synthetic https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Synthereum is summarized in their manifesto as a virtuous circle:">