ELMS ON HOMEBUYING:

FUNDING A DOWN PAYMENT

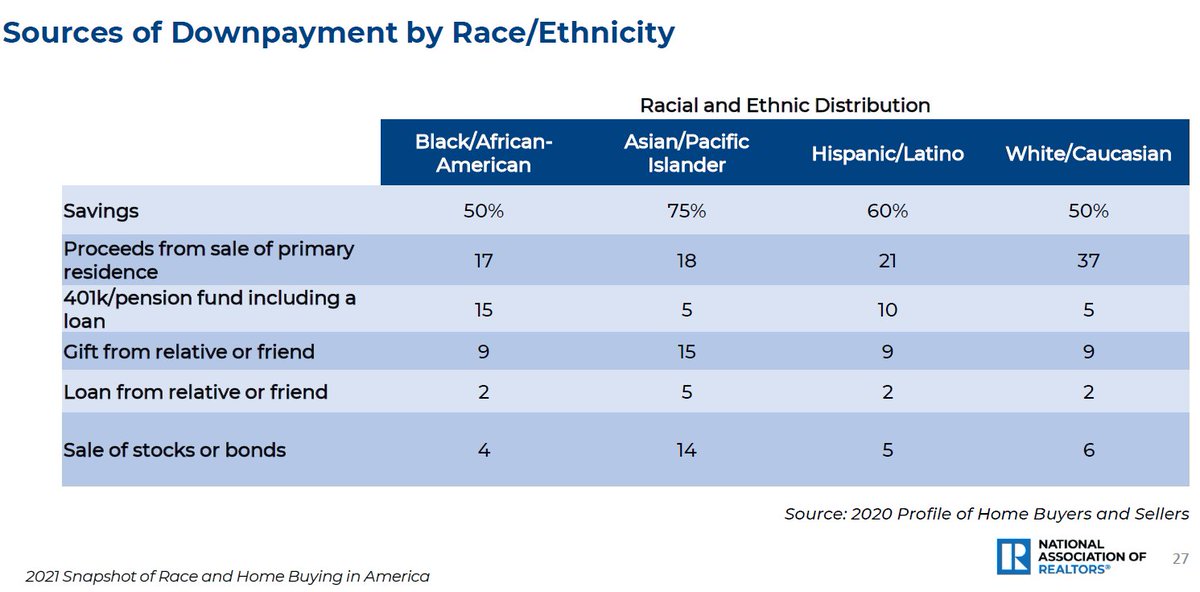

NAR lists the most common sources of down payment by race, & it& #39;s interesting.

(1) Saving is the most common source for everybody. Make more money if you want to own (lol), then save what you make. Not easy on a median CA income. 1/n

FUNDING A DOWN PAYMENT

NAR lists the most common sources of down payment by race, & it& #39;s interesting.

(1) Saving is the most common source for everybody. Make more money if you want to own (lol), then save what you make. Not easy on a median CA income. 1/n

(2) Proceeds from sale of a prior home is the 2nd most common source of down payment for everybody. It& #39;s a Catch-22; to buy a home, you must 1st already own a home! But tactically, people often buy a cheap condo, turn mortgage payments into equity, then use that on next home. 2/

(3) Gift or loan from family or friends is very common for Asian buyers, half as common but still #3 for white & Hispanic buyers. Black homebuyers use this source just as often as Hispanic & white buyers, but rank differs. Choose your parents well or be an extrovert. 3/

(3) For Black homebuyers, the 3rd most common source of down payment funds is cashing out a retirement plan. For Hispanic buyers, cash from a retirement plan nearly ties with #3 gifts/loans, but retirement funds rank #4. 4/

(3) For Asian/Pacific homebuyers, the sale of stocks & bonds is the #3 source of down payments. No other group comes close in frequency of use. White homebuyers use this source not quite half as often, but it beats out retirement funds (barely) to make the #3 slot for them. 5/

Not listed as a common source of down payment funds are: (a) co-purchase by 2 families, possibly related, for shared living; (b) insurance settlement proceeds; (c) lawsuit settlement proceeds; (d) inheritance; (e) lottery winnings. 6/

Not having chosen the best parents for this, the method I used was to wait for a housing bubble to burst & home prices to come down enough to COST LESS THAN RENT. Then I bought a cheap but comfy condo & turned a portion of my mortgage payments from then on into equity. 7/

I also cashed out my retirement fund, since I wanted to put down 20% & avoid costly mortgage insurance. As it turned out, I pulled out my money just before the 2008 stock market crash, so it worked out. LUCK happens. 8/

Once I owned a home, inflation plus automated bill pay took over & bootstrapped me into the bulk of the down payment I used on the next home, a standalone house. Once you get into ownership one way or another, it gets a lot easier to stay there. 9/end

Would you like to see more thread on buying a home? Check out this thread of threads: https://twitter.com/jteelms/status/1380689250018942978">https://twitter.com/jteelms/s...

Read on Twitter

Read on Twitter