wanna explore another way the Brits secretly run the world? here& #39;s another chapter from Treasure Islands, about the Eurodollar

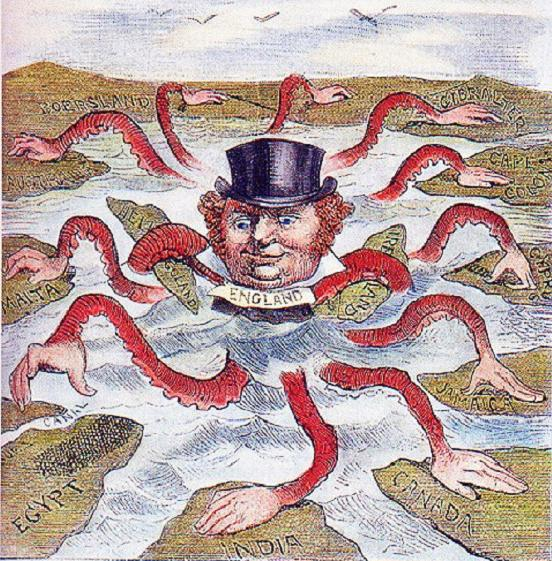

from the last 1940s to the late 1950s, the UK went from a formal empire of some 700 million people down to a formal empire of 5 million people, between the US and USSR& #39;s ascendancy and general decolonization everywhere

the UK had to grapple with this hemorrhaging, and they decided to maintain a hold on the systems they still had, e.g. the financial system

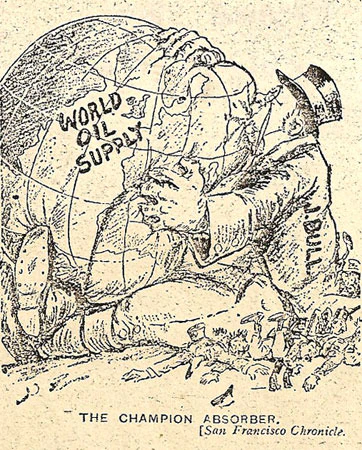

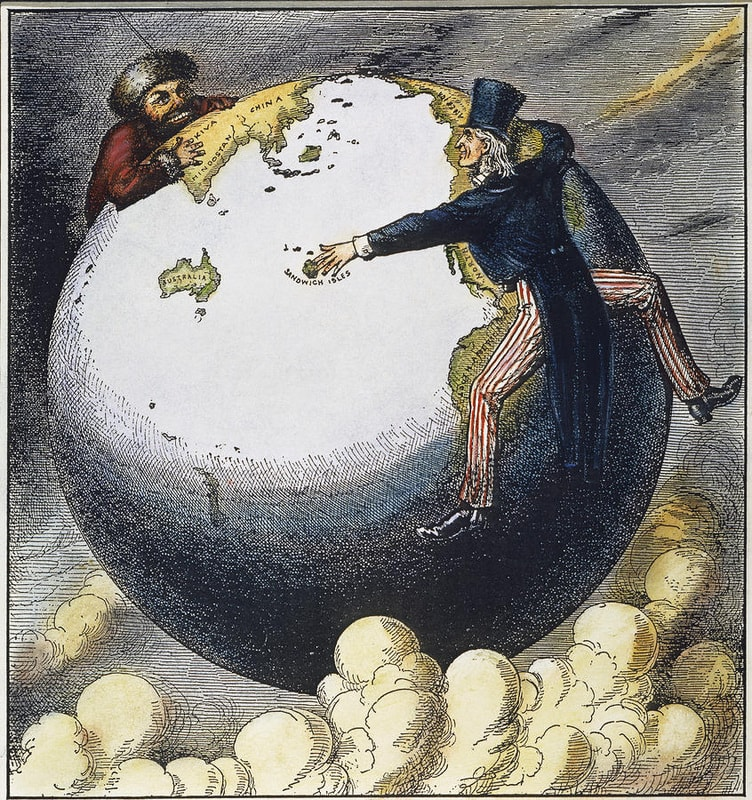

at the same time, the world financial system overall shifted to the US, who had the lion& #39;s share of gold reserves and intact infrastructure at the end of WWII. the US got to use their weight to start running things, and US currency became the & #39;gold standard& #39;

Henry Morgenthau, the U.S. treasury secretary, declared his intention to “move the financial center of the world from London and Wall Street to the U.S. Treasury,” and it was almost too much for the whiskery old gentlemen capitalists in London to bear

the UK& #39;s Midland Bank began contravening UK exchange controls by taking US dollar deposits that were not related to its commercial transactions, and offering interest rates on these dollar deposits that were substantially higher than those permitted by U.S. regulations

"Banks in London began keeping two sets of books - one for their onshore operations, where at least one party to the transaction was British, which was regulated, and one for their offshore operations, where neither party was British"

"A new offshore market had been born, which would become known as the Eurodollar market or the Euromarket. It was no more than a bookkeeping device, but it would change the world."

“As the good ship Sterling sank, the City was able to scramble aboard a much more seaworthy young vessel, the Eurodollar,” wrote PJ Cain and AG Hopkins, the leading historians of British imperialism.

they said, “As the imperial basis of its strength disappeared, the City survived by transforming itself into an ‘offshore island’ servicing the business created by the industrial and commercial growth of much more dynamic partners.”

the financial world loves to talk about the Big Bang of 1986, when Thatcher& #39;s administration deregulated their financial markets. but Treasure Islands argues that the creation and decision not to regulate the Eurodollar market was an even Bigger Bang, if less famous

The scholar Gary Burn put it in a different light. The market’s emergence, he said, was “the first shot in the neoliberal counterrevolution against the social market and the Keynesian welfare state.”

but to understand the Eurodollar& #39;s function, you gotta understand how the City of London is itself a sort of tax haven that allows the world to engage in what some call "casino banking"

the Glass-Steagall Act of 1933 specifically prohibited these behaviors, but it& #39;s been partially repealed right?

"The unit that blew up the insurance company American International Group (AIG), putting the U.S. taxpayer on the hook for $182.5 billion, was its four hundred–strong AIG Financial Products unit, based in London."

"Lehman Brothers had used a trick called Repo 105 to shift $50 billion in assets off its balance sheet, and that while no U.S. law firm would sign off on the transactions, a major law firm in London was delighted to oblige, without breaking the rules."

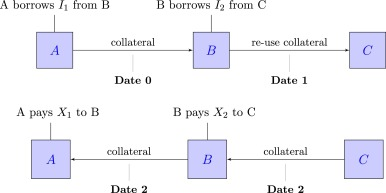

London also allows a seemingly arcane practice known as “rehypothecation,”a way of shifting assets off banks’ balance sheets. if that sounds like imaginary financial bullshit, yes, it is.

"Rehypothecation occurs when the creditor (a bank or broker-dealer) reuses the collateral posted by the debtor (a client such as a hedge fund) to back the broker& #39;s own trades and borrowing. This mechanism also enables leverage in the securities market."

"A little-noticed IMF paper in July 2010 estimated that by 2007 the seven largest players in the market—Lehman Brothers, Bear Stearns, Morgan Stanley, Goldman Sachs, Merrill/BoA, Citigroup, and JPMorgan—had shifted $4.5 trillion off their balance sheets in this way"

for those of you without a strong financial background it& #39;s usually not good when companies try to shift debts off their balance sheets, for various reasons. pic unrelated.

also, keep in mind that when these things inevitably bust-out, the taxpayer gets stuck with the bill. it& #39;s literally equivalent to gambling at a casino with someone else& #39;s money, except also they stole the money in the first place AND get bailed out afterwards

another problem is UK law. one expert on financial secrecy was quoted: “Have you ever examined UK trust law? All our bankers and financial lawyers say that if you really, really want to hide money, go to London and set up a trust.”

Another issue is the “domicile” rule, whereby wealthy foreigners can come to live in England and escape tax on all their non-UK income. In pursuit of this tax break, the world’s super-rich—from Greek shipping magnates to Saudi princesses—have descended on London in hordes

“There are no consequences in London"

“The City of London, that state within a state which has never transmitted even the smallest piece of usable evidence to a foreign magistrate.”

- international tax experts lmao

“The City of London, that state within a state which has never transmitted even the smallest piece of usable evidence to a foreign magistrate.”

- international tax experts lmao

the true financial district, the Square Mile, or the City of London proper, is actually this incredibly old, arcane entity, with all these weird powers and privileges

"businesses in the City vote too, as if they were human, with thirty-two thousand corporate votes. In effect, Goldman Sachs, the Bank of China, Moscow Narodny Bank, and KPMG can vote in a hugely important British election"

the most public display is the Lord Mayor& #39;s Show, a weird parade they do every year, which sort of refers to its true nature, as it& #39;s known as "The Corporation" and its history dates back to 1067

"When William the Conqueror invaded England in 1066, the rest of England disarmed and gave up its rights—but the City kept its freehold property, ancient liberties, and its own self-organizing militias: Even the King had to disarm in the City"

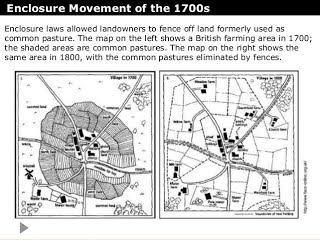

"the British crown had asked the Corporation to extend its ancient legal protections and privileges to new areas of London, outside the City, that were receiving tens of thousands of refugees from brutal land reforms known as the Enclosures."

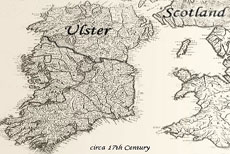

"But the Corporation refused, instead shipping excess populations off to the Ulster Plantation and the Corporation of Londonderry in what is now Northern Ireland, helping build a large Protestant community there and contributing to bitter future conflict."

the Queen actually has to ask to enter the City of London, since their power predates the Norman Conquests, lol

anyway, that& #39;s why the City of London& #39;s so well-equipped to be financial criminals, and that& #39;s the context you need to understand the Eurodollar market there

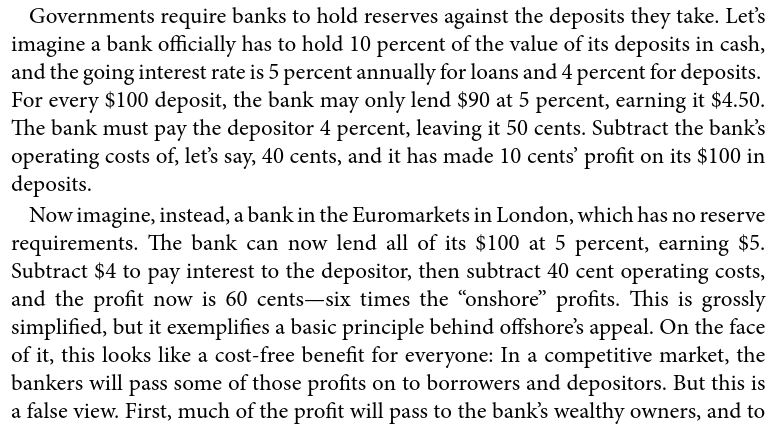

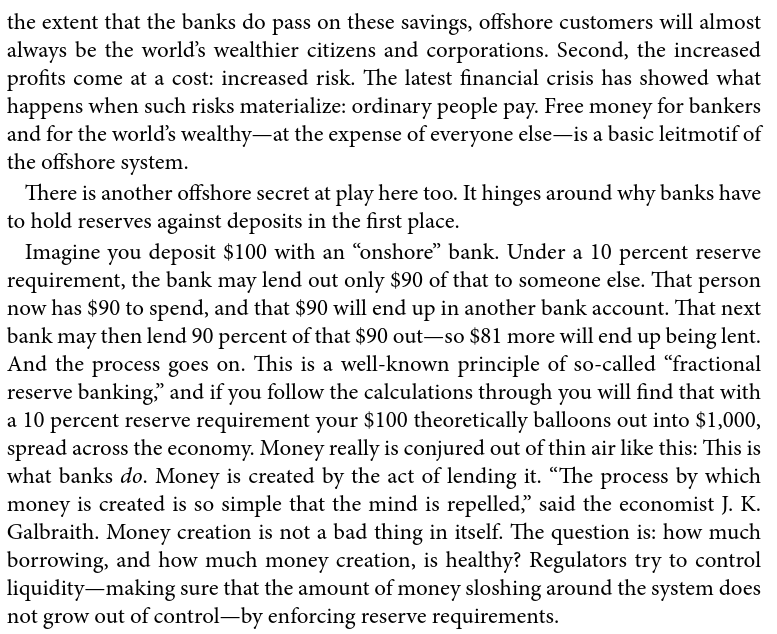

"The process by which money is created is so simple that the mind is repelled,” said the famous economist J. K. Galbraith.

but let& #39;s go through it anyway

but let& #39;s go through it anyway

this isn& #39;t very sexy, but this is how they get you, maaan

"The Euromarkets just kept snowballing: $500 billion in 1980, then a net $2.6 trillion eight years later; and by 1997, nearly 90 percent of all international loans were made through this market. It is now so all-enveloping that people hardly notice it anymore."

"“Euro-dollars, indeed!” one U.S. banker told Time magazine. “It’s hot money—and I prefer to call it by that name.” And it was hot money."

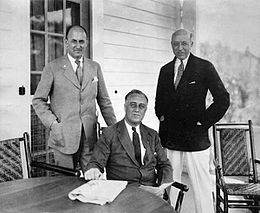

"By the time Margaret Thatcher and Ronald Reagan came to power in 1979 and 1981, the political classes in Britain and the United States were losing faith in manufacturing and genuflecting toward finance"

< they& #39;re laughing at us here, lol

< they& #39;re laughing at us here, lol

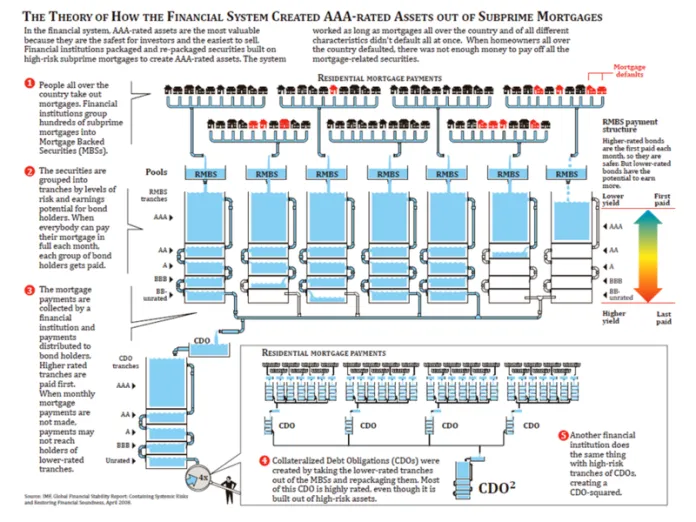

"Wall Street and the City of London were at the forefront of financialization: the reengineering of manufacturing firms as highly leveraged investment vehicles and, soon, the packaging of mortgages into risky asset backed securities for offloading into global markets"

"the deregulation race has an unforgiving internal logic: you deregulate—then when someone else catches up with you, you must deregulate some more, to stop the money from running away"

"And it was here in the City, just as Britain’s imperial dreams collapsed in the ignominy of the Suez retreat, that the financial establishment in London began piecing together the means by which London would restore its position as the capital of a world..."

"ruled in the interests of an elite of financial investors. At the moment of its apparent destruction, the British empire had begun to reinvent itself, back from the dead"

that& #39;s how the Eurodollar is sapping the US economy, and ofc the rest of the world, too.

I& #39;m thinking of becoming, like, a manufacturing and "real economy" type of guy.

(all this info from Treasure Islands, check it out)

anyway, thanks god bless

(all this info from Treasure Islands, check it out)

anyway, thanks god bless

Read on Twitter

Read on Twitter