Bank financial results reporting season starting soon.

Uganda& #39;s largest bank by assets, @stanbicug is the first to release financial results for 2020. According to the CEO, Anne Juuko, 2020 "was a year riddled with challenges brought on by the pandemic...but the bank has shown resilience."

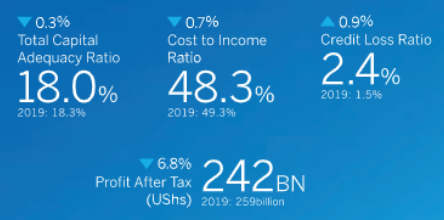

Profit-After-Tax https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">6% to UGX243bn ( @stanbicug after tax profit had been on a consistent upward growth trajectory since 2016).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">6% to UGX243bn ( @stanbicug after tax profit had been on a consistent upward growth trajectory since 2016).

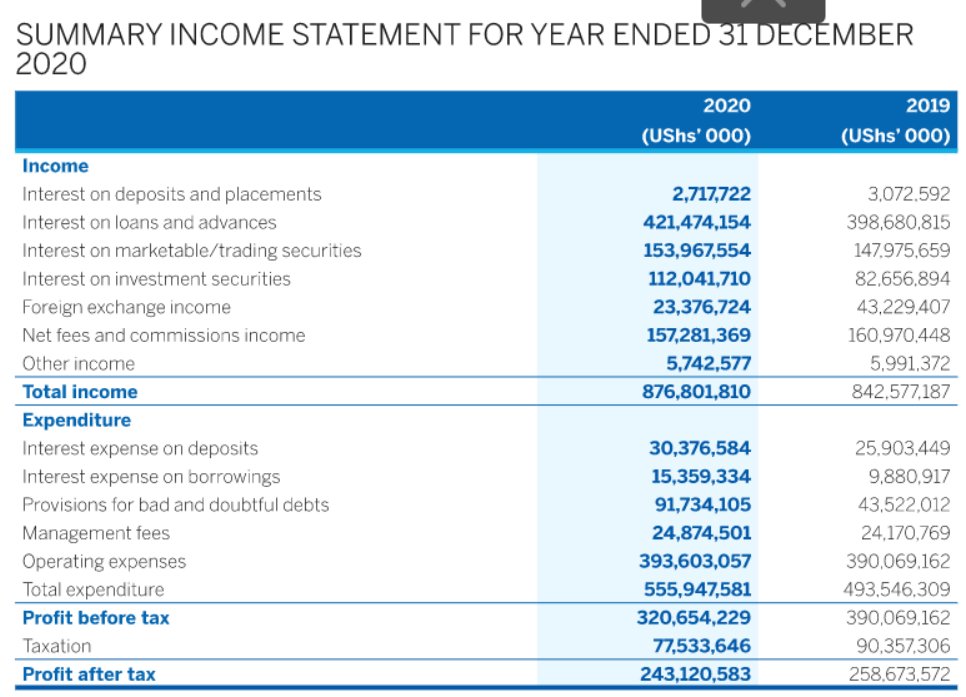

Reduced profitability was due to a 12.7% rise in expenses to UGX556bn. Largest contributor to rising expenses was provisions for bad debts ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">110%)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">110%)

Reduced profitability was due to a 12.7% rise in expenses to UGX556bn. Largest contributor to rising expenses was provisions for bad debts (

Provisions were expected to rise due to the difficult operating environment borrowers faced in 2020. This is also noticeable in the Non-Performing Loans (NPLs)

NPLs https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 19.4% to UGX219bn BUT represent 6% of the @stanbicug total loans, compared to 6.4% in 2019.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 19.4% to UGX219bn BUT represent 6% of the @stanbicug total loans, compared to 6.4% in 2019.

NPLs

Additionally @stanbicug debt write-off rose by 202% to UGX48bn.

Despite the rise in provisions and write-off, the bank is still well capitalized. Core capital position by 18% to UGX918bn.

Due to the reduced profitability, income tax paid reduced by 13.8% to UGX77.5bn

Despite the rise in provisions and write-off, the bank is still well capitalized. Core capital position by 18% to UGX918bn.

Due to the reduced profitability, income tax paid reduced by 13.8% to UGX77.5bn

How did @stanbicug make money?

Loans https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">26.8% to UGX3.6trillion leading to interest income on loans to

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">26.8% to UGX3.6trillion leading to interest income on loans to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">by 5.6% to UGX421.4bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">by 5.6% to UGX421.4bn

62.3% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in govt securities to UGX2.2trillion leading interest income

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in govt securities to UGX2.2trillion leading interest income  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> by 15.4% to UGX266bn.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> by 15.4% to UGX266bn.

However, non-interest related income declined.

Loans

62.3%

However, non-interest related income declined.

The growth in @stanbicug& #39;s interest income led to overall income growth of 8.6% to UGX876.8bn. Due to a 13.7% rise in total expenses to UGX556bn, this led to a drop in net income and gross profit.

Other positives for bank include the 30%  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> in total assets to UGX8.5trillion (meaning @stanbicug will retain the #1 spot) & 16.3%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> in total assets to UGX8.5trillion (meaning @stanbicug will retain the #1 spot) & 16.3% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in customer deposits to UGX5.5trillion. (Interest spent on deposits

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in customer deposits to UGX5.5trillion. (Interest spent on deposits https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">18% to UGX30.3bn)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">18% to UGX30.3bn)

Shareholders will receive a divided of UGX1.95 per share.

Shareholders will receive a divided of UGX1.95 per share.

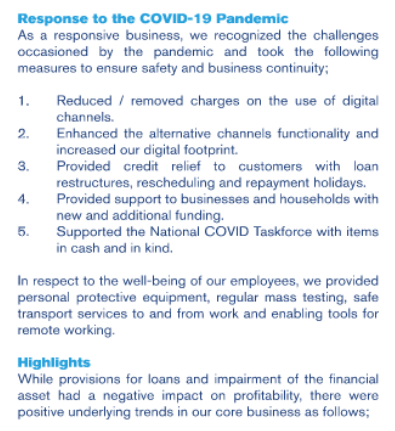

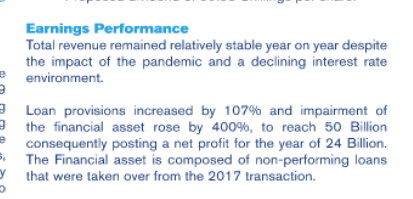

Next is @dfcugroup, the 5th largest bank by assets. The board, in a note to the published results said even though they had to make provisions on bad debts (due to the impact of Covid19 on businesses/people), which affected profitability, there were some positives for the bank.

Let& #39;s start with what people like to see. After-tax-profit for @dfcugroup https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">67.5% to UGX24.3bn. As highlighted in the profit warning issued by the bank a few weeks ago, profitability was expected to reduce due to

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">67.5% to UGX24.3bn. As highlighted in the profit warning issued by the bank a few weeks ago, profitability was expected to reduce due to  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> provisions on bad debts + assets from the Crane Bank acquisition.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> provisions on bad debts + assets from the Crane Bank acquisition.

Provisions for bad debts https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">108% to UGX30.6bn. The bank also highlighted a fair valuation loss of UGX50.4bn on assets (loans) acquired in 2017 from Crane Bank. This ploughed into the income of the bank contributing to the @dfcugroup reduction in profit.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">108% to UGX30.6bn. The bank also highlighted a fair valuation loss of UGX50.4bn on assets (loans) acquired in 2017 from Crane Bank. This ploughed into the income of the bank contributing to the @dfcugroup reduction in profit.

Other indicators of the operating environment being affected by Covid19 include the 5.6% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in NPLs to UGX94bn, representing 5.2% of total @dfcugroup loans.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in NPLs to UGX94bn, representing 5.2% of total @dfcugroup loans.

So, where did the money @dfcugroup make come from?

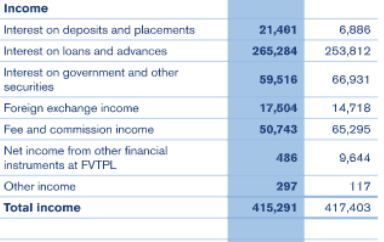

The bank total income https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">by just 0.35% to UGX415.2bn.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">by just 0.35% to UGX415.2bn.

Whereas interest income on loans https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">4.4% to UGX256bn (due to 15%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">4.4% to UGX256bn (due to 15% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in lending to UGX1.7trillion), other earnings like interest on govt securities + non-interest income dropped.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in lending to UGX1.7trillion), other earnings like interest on govt securities + non-interest income dropped.

The bank total income

Whereas interest income on loans

The drop in interest on govt securities came about despite the 13% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">to UGX573bn in govt and other securities.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">to UGX573bn in govt and other securities.

The non-interest income for @dfcugroup dropped to UGX68.8bn in 2020 from UGX190bn in 2019. This due to a reduction in fees and commissions income.

The non-interest income for @dfcugroup dropped to UGX68.8bn in 2020 from UGX190bn in 2019. This due to a reduction in fees and commissions income.

Noticeable from the @dfcugroup results is that the marginal less than 1% growth in total income was gobbled up by 21% growth in expenses to UGX382bn.

Importantly the bank remains profitable with core capital slightly by 2.2% to UGX482bn

Importantly the bank remains profitable with core capital slightly by 2.2% to UGX482bn

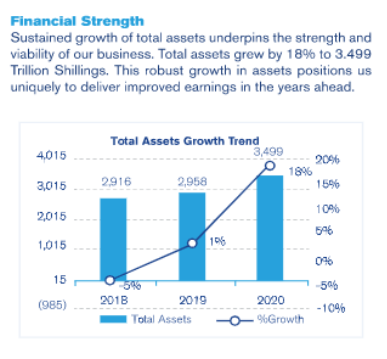

The core operations of @dfcugroup (lending and taking deposits) remained positive.

Assets https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">19% to UGX3.5trillion

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">19% to UGX3.5trillion

Customer deposits https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">27% to UGX2.6trillion

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">27% to UGX2.6trillion

For the govt, drop in profitability led to 69% https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">to UGX8.2bn in income tax from the bank.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">to UGX8.2bn in income tax from the bank.

Assets

Customer deposits

For the govt, drop in profitability led to 69%

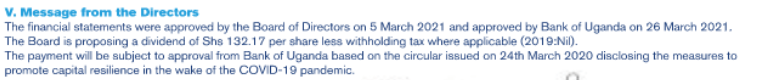

For the @dfcugroup shareholders, the hope was for better results on the profitability front. The faster dfcu consolidates & sheds off the effects of acquiring Crane Bank, the better the fortunes.

The shareholders will get a dividend of UGX132.17 per share

The shareholders will get a dividend of UGX132.17 per share

Story by @KHISAISAAC in the @UGIndependent on the banking results for @dfcugroup & @stanbicug

Dividends for banking investors down but better than expected https://www.independent.co.ug/dividends-for-banking-investors-down-but-better-than-expected/">https://www.independent.co.ug/dividends...

Dividends for banking investors down but better than expected https://www.independent.co.ug/dividends-for-banking-investors-down-but-better-than-expected/">https://www.independent.co.ug/dividends...

Today, @kcbbankug released its 2020 financial results. The bank recovered from a UGX13.5bn loss in 2019 to post an after tax profit of UGX13bn in 2020. The KCB profit was driven by a 29.4% reduction in expenses.

Below are some select highlights from @kcbbankug& #39;s results.

Net profit https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">197% (from a loss) to UGX13bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">197% (from a loss) to UGX13bn

Loans https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">9% to UGX253.3bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">9% to UGX253.3bn

Govt Securities https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 30% to UGX127.7bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 30% to UGX127.7bn

Deposits https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 32.7% to UGX445.5bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 32.7% to UGX445.5bn

Total Income https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">3.7% to UGX78.6bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">3.7% to UGX78.6bn

Total Expenses https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 29.4% to UGX59.6bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 29.4% to UGX59.6bn

Net profit

Loans

Govt Securities

Deposits

Total Income

Total Expenses

How @kcbbankug made money in 2020? Although total income was down in 2020, most income came from interest earnings on loans ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 2.2%), interest on govt securities (

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 2.2%), interest on govt securities ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">14.7%) and non-interest income - fees and commissions - (

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">14.7%) and non-interest income - fees and commissions - ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">24.7%).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">24.7%).

However, @kcbbankug 29.4% reduction in expenses offset the 3.7% reduction in income leading to operating profitability of UGX19bn.

All expenses in the bank reduced in 2020. Importantly was that in 2020, KCB did not have an net impairment charge on its income.

All expenses in the bank reduced in 2020. Importantly was that in 2020, KCB did not have an net impairment charge on its income.

@kcbbankug& #39;s Non-performing Loans (NPLs) https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">4% to UGX23bn (about 9% of the total loan book - 9.5% in 2019). Bad debts written off

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">4% to UGX23bn (about 9% of the total loan book - 9.5% in 2019). Bad debts written off https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">34.2% to UGX4.7bn. The core capital position of the bank 25%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">34.2% to UGX4.7bn. The core capital position of the bank 25% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">to UGX67bn.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">to UGX67bn.

The bank paid 30% (UGX5.9bn) of the operating profit income taxes.

The bank paid 30% (UGX5.9bn) of the operating profit income taxes.

Shortly, I& #39;ll provide some highlights on the impressive @UgEquityBank 2020 financial results.

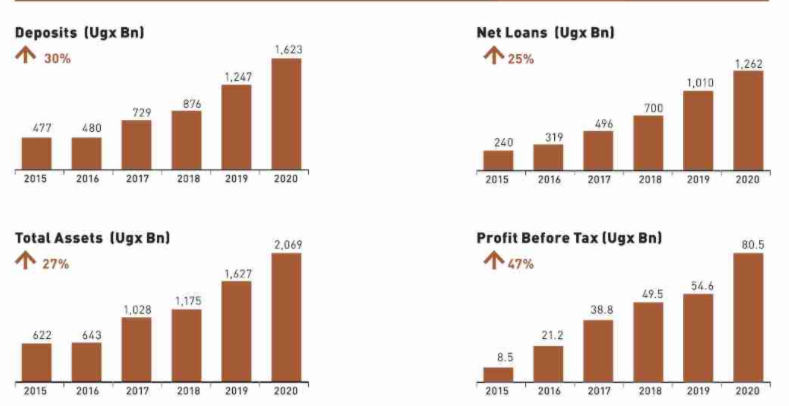

The @UgEquityBank 2020 results released on April 19, show a continued trend of improved growth for a bank that started operations in 2008 when it acquired Uganda Microfinance Limited. Equity has consolidated & is perhaps one of the fastest growing/improved banks.

In 2020, @UgEquityBank& #39;s after-tax profit grew by 53.2% to UGX57bn, indicating an impressive performance by the bank.

How did @UgEquityBank improve its profitability?

Loans https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">25% to UGX1.26trillion which led to interest earned on lending to

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">25% to UGX1.26trillion which led to interest earned on lending to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">34% to UGX200bn.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">34% to UGX200bn.

Interest earned on govt securities https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">68% to UGX28.5bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">68% to UGX28.5bn

Non-interest income https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">10% to UGX59bn.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">10% to UGX59bn.

Loans

Interest earned on govt securities

Non-interest income

In what was a tough operating environment due to Covid19 + the restrictions, @UgEquityBank was able to "milk" its assets better.

Total income https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">32% to UGX292bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">32% to UGX292bn

Total expenses https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 26.6% to UGX211bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 26.6% to UGX211bn

Total income

Total expenses

The rise in @UgEquityBank& #39;s expenses was due to:

71.3% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX24bn in provisions/impairment for bad debts

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX24bn in provisions/impairment for bad debts

31% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX37.8bn in interest expenses on deposits

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX37.8bn in interest expenses on deposits

27% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX132.8bn in operational expenses

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX132.8bn in operational expenses

52% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX7bn in management fees

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX7bn in management fees

71.3%

31%

27%

52%

The faster growth in income offset any pressure on expenses for @UgEquityBank, leading profit before tax to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 47% to UGX80.5bn.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 47% to UGX80.5bn.

The @URAuganda collected UGX26.2bn (30.6% growth from 2019) of this amount, representing 28% effective income tax.

The @URAuganda collected UGX26.2bn (30.6% growth from 2019) of this amount, representing 28% effective income tax.

Of @UgEquityBank& #39;s UGX1.26trillion loan book, 3.9% (UGX49.2bn) were Non-performing loans(NPLs). This is a rise from 2019, where 1.4% of total loans were classified as NPLs. Still, the 2020 NPL rate for Equity is below the banking sector average in Uganda, just like in 2019.

Due to the growth in lending to the private sector (24.8% rise to UGX1.26trillion) + lending to the govt (63.8% rise to UGX317.8), it was yet another milestone for @UgEquityBank as it crossed the UGX2trillion mark in terms of assets.

Assets rose by 27% to UGX2.06trillion.

Assets rose by 27% to UGX2.06trillion.

Customer deposits  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 30.2% to UGX1.62trillion (people decided to keep their money in the banks, it appears).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 30.2% to UGX1.62trillion (people decided to keep their money in the banks, it appears).

Bad debts written off https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 71.4% to UGX4.4bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 71.4% to UGX4.4bn

Core capital https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">46% to UGX296.6bn.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">46% to UGX296.6bn.

Overall, a good year for @UgEquityBank

Bad debts written off

Core capital

Overall, a good year for @UgEquityBank

Shortly, @AbsaUganda will be releasing its financial results for 2020. I& #39;ll tweet the highlights from the financial results and remarks from the #AbsaResults2020 event.

"Uganda and @AbsaUganda felt the impact of the pandemic in 2020. As the board, we are proud of the response by the Absa team during pandemic (operations, staff & customers)." Nadine Byaruhanga Board Chairperson Absa Uganda #AbsaResults2020

Read on Twitter

Read on Twitter

6% to UGX243bn ( @stanbicug after tax profit had been on a consistent upward growth trajectory since 2016). Reduced profitability was due to a 12.7% rise in expenses to UGX556bn. Largest contributor to rising expenses was provisions for bad debts (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">110%)" title="Profit-After-Taxhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">6% to UGX243bn ( @stanbicug after tax profit had been on a consistent upward growth trajectory since 2016). Reduced profitability was due to a 12.7% rise in expenses to UGX556bn. Largest contributor to rising expenses was provisions for bad debts (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">110%)" class="img-responsive" style="max-width:100%;"/>

6% to UGX243bn ( @stanbicug after tax profit had been on a consistent upward growth trajectory since 2016). Reduced profitability was due to a 12.7% rise in expenses to UGX556bn. Largest contributor to rising expenses was provisions for bad debts (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">110%)" title="Profit-After-Taxhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">6% to UGX243bn ( @stanbicug after tax profit had been on a consistent upward growth trajectory since 2016). Reduced profitability was due to a 12.7% rise in expenses to UGX556bn. Largest contributor to rising expenses was provisions for bad debts (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">110%)" class="img-responsive" style="max-width:100%;"/>

19.4% to UGX219bn BUT represent 6% of the @stanbicug total loans, compared to 6.4% in 2019." title="Provisions were expected to rise due to the difficult operating environment borrowers faced in 2020. This is also noticeable in the Non-Performing Loans (NPLs)NPLs https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 19.4% to UGX219bn BUT represent 6% of the @stanbicug total loans, compared to 6.4% in 2019." class="img-responsive" style="max-width:100%;"/>

19.4% to UGX219bn BUT represent 6% of the @stanbicug total loans, compared to 6.4% in 2019." title="Provisions were expected to rise due to the difficult operating environment borrowers faced in 2020. This is also noticeable in the Non-Performing Loans (NPLs)NPLs https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 19.4% to UGX219bn BUT represent 6% of the @stanbicug total loans, compared to 6.4% in 2019." class="img-responsive" style="max-width:100%;"/>

26.8% to UGX3.6trillion leading to interest income on loans tohttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">by 5.6% to UGX421.4bn62.3%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in govt securities to UGX2.2trillion leading interest income https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> by 15.4% to UGX266bn. However, non-interest related income declined." title="How did @stanbicug make money? Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">26.8% to UGX3.6trillion leading to interest income on loans tohttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">by 5.6% to UGX421.4bn62.3%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in govt securities to UGX2.2trillion leading interest income https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> by 15.4% to UGX266bn. However, non-interest related income declined." class="img-responsive" style="max-width:100%;"/>

26.8% to UGX3.6trillion leading to interest income on loans tohttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">by 5.6% to UGX421.4bn62.3%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in govt securities to UGX2.2trillion leading interest income https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> by 15.4% to UGX266bn. However, non-interest related income declined." title="How did @stanbicug make money? Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">26.8% to UGX3.6trillion leading to interest income on loans tohttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">by 5.6% to UGX421.4bn62.3%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in govt securities to UGX2.2trillion leading interest income https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> by 15.4% to UGX266bn. However, non-interest related income declined." class="img-responsive" style="max-width:100%;"/>

in total assets to UGX8.5trillion (meaning @stanbicug will retain the #1 spot) & 16.3%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in customer deposits to UGX5.5trillion. (Interest spent on depositshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">18% to UGX30.3bn)Shareholders will receive a divided of UGX1.95 per share." title="Other positives for bank include the 30% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> in total assets to UGX8.5trillion (meaning @stanbicug will retain the #1 spot) & 16.3%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in customer deposits to UGX5.5trillion. (Interest spent on depositshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">18% to UGX30.3bn)Shareholders will receive a divided of UGX1.95 per share." class="img-responsive" style="max-width:100%;"/>

in total assets to UGX8.5trillion (meaning @stanbicug will retain the #1 spot) & 16.3%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in customer deposits to UGX5.5trillion. (Interest spent on depositshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">18% to UGX30.3bn)Shareholders will receive a divided of UGX1.95 per share." title="Other positives for bank include the 30% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> in total assets to UGX8.5trillion (meaning @stanbicug will retain the #1 spot) & 16.3%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in customer deposits to UGX5.5trillion. (Interest spent on depositshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">18% to UGX30.3bn)Shareholders will receive a divided of UGX1.95 per share." class="img-responsive" style="max-width:100%;"/>

67.5% to UGX24.3bn. As highlighted in the profit warning issued by the bank a few weeks ago, profitability was expected to reduce due to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> provisions on bad debts + assets from the Crane Bank acquisition." title="Let& #39;s start with what people like to see. After-tax-profit for @dfcugrouphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">67.5% to UGX24.3bn. As highlighted in the profit warning issued by the bank a few weeks ago, profitability was expected to reduce due to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> provisions on bad debts + assets from the Crane Bank acquisition." class="img-responsive" style="max-width:100%;"/>

67.5% to UGX24.3bn. As highlighted in the profit warning issued by the bank a few weeks ago, profitability was expected to reduce due to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> provisions on bad debts + assets from the Crane Bank acquisition." title="Let& #39;s start with what people like to see. After-tax-profit for @dfcugrouphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">67.5% to UGX24.3bn. As highlighted in the profit warning issued by the bank a few weeks ago, profitability was expected to reduce due to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> provisions on bad debts + assets from the Crane Bank acquisition." class="img-responsive" style="max-width:100%;"/>

108% to UGX30.6bn. The bank also highlighted a fair valuation loss of UGX50.4bn on assets (loans) acquired in 2017 from Crane Bank. This ploughed into the income of the bank contributing to the @dfcugroup reduction in profit." title="Provisions for bad debtshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">108% to UGX30.6bn. The bank also highlighted a fair valuation loss of UGX50.4bn on assets (loans) acquired in 2017 from Crane Bank. This ploughed into the income of the bank contributing to the @dfcugroup reduction in profit." class="img-responsive" style="max-width:100%;"/>

108% to UGX30.6bn. The bank also highlighted a fair valuation loss of UGX50.4bn on assets (loans) acquired in 2017 from Crane Bank. This ploughed into the income of the bank contributing to the @dfcugroup reduction in profit." title="Provisions for bad debtshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">108% to UGX30.6bn. The bank also highlighted a fair valuation loss of UGX50.4bn on assets (loans) acquired in 2017 from Crane Bank. This ploughed into the income of the bank contributing to the @dfcugroup reduction in profit." class="img-responsive" style="max-width:100%;"/>

in NPLs to UGX94bn, representing 5.2% of total @dfcugroup loans." title="Other indicators of the operating environment being affected by Covid19 include the 5.6%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in NPLs to UGX94bn, representing 5.2% of total @dfcugroup loans." class="img-responsive" style="max-width:100%;"/>

in NPLs to UGX94bn, representing 5.2% of total @dfcugroup loans." title="Other indicators of the operating environment being affected by Covid19 include the 5.6%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in NPLs to UGX94bn, representing 5.2% of total @dfcugroup loans." class="img-responsive" style="max-width:100%;"/>

by just 0.35% to UGX415.2bn. Whereas interest income on loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">4.4% to UGX256bn (due to 15%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in lending to UGX1.7trillion), other earnings like interest on govt securities + non-interest income dropped." title="So, where did the money @dfcugroup make come from? The bank total incomehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">by just 0.35% to UGX415.2bn. Whereas interest income on loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">4.4% to UGX256bn (due to 15%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in lending to UGX1.7trillion), other earnings like interest on govt securities + non-interest income dropped." class="img-responsive" style="max-width:100%;"/>

by just 0.35% to UGX415.2bn. Whereas interest income on loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">4.4% to UGX256bn (due to 15%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in lending to UGX1.7trillion), other earnings like interest on govt securities + non-interest income dropped." title="So, where did the money @dfcugroup make come from? The bank total incomehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">by just 0.35% to UGX415.2bn. Whereas interest income on loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">4.4% to UGX256bn (due to 15%https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">in lending to UGX1.7trillion), other earnings like interest on govt securities + non-interest income dropped." class="img-responsive" style="max-width:100%;"/>

19% to UGX3.5trillionCustomer depositshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">27% to UGX2.6trillionFor the govt, drop in profitability led to 69%https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">to UGX8.2bn in income tax from the bank." title="The core operations of @dfcugroup (lending and taking deposits) remained positive. Assetshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">19% to UGX3.5trillionCustomer depositshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">27% to UGX2.6trillionFor the govt, drop in profitability led to 69%https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">to UGX8.2bn in income tax from the bank." class="img-responsive" style="max-width:100%;"/>

19% to UGX3.5trillionCustomer depositshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">27% to UGX2.6trillionFor the govt, drop in profitability led to 69%https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">to UGX8.2bn in income tax from the bank." title="The core operations of @dfcugroup (lending and taking deposits) remained positive. Assetshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">19% to UGX3.5trillionCustomer depositshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">27% to UGX2.6trillionFor the govt, drop in profitability led to 69%https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔽" title="Nach unten zeigendes Dreieck" aria-label="Emoji: Nach unten zeigendes Dreieck">to UGX8.2bn in income tax from the bank." class="img-responsive" style="max-width:100%;"/>

197% (from a loss) to UGX13bn Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">9% to UGX253.3bnGovt Securitieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 30% to UGX127.7bn Depositshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 32.7% to UGX445.5bn Total Incomehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">3.7% to UGX78.6bnTotal Expenseshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 29.4% to UGX59.6bn" title="Below are some select highlights from @kcbbankug& #39;s results. Net profithttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">197% (from a loss) to UGX13bn Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">9% to UGX253.3bnGovt Securitieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 30% to UGX127.7bn Depositshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 32.7% to UGX445.5bn Total Incomehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">3.7% to UGX78.6bnTotal Expenseshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 29.4% to UGX59.6bn" class="img-responsive" style="max-width:100%;"/>

197% (from a loss) to UGX13bn Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">9% to UGX253.3bnGovt Securitieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 30% to UGX127.7bn Depositshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 32.7% to UGX445.5bn Total Incomehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">3.7% to UGX78.6bnTotal Expenseshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 29.4% to UGX59.6bn" title="Below are some select highlights from @kcbbankug& #39;s results. Net profithttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">197% (from a loss) to UGX13bn Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">9% to UGX253.3bnGovt Securitieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 30% to UGX127.7bn Depositshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 32.7% to UGX445.5bn Total Incomehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">3.7% to UGX78.6bnTotal Expenseshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 29.4% to UGX59.6bn" class="img-responsive" style="max-width:100%;"/>

32% to UGX292bnTotal expenses https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 26.6% to UGX211bn" title="In what was a tough operating environment due to Covid19 + the restrictions, @UgEquityBank was able to "milk" its assets better. Total incomehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">32% to UGX292bnTotal expenses https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 26.6% to UGX211bn" class="img-responsive" style="max-width:100%;"/>

32% to UGX292bnTotal expenses https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 26.6% to UGX211bn" title="In what was a tough operating environment due to Covid19 + the restrictions, @UgEquityBank was able to "milk" its assets better. Total incomehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">32% to UGX292bnTotal expenses https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 26.6% to UGX211bn" class="img-responsive" style="max-width:100%;"/>

to UGX24bn in provisions/impairment for bad debts31% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX37.8bn in interest expenses on deposits27% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX132.8bn in operational expenses 52% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX7bn in management fees" title="The rise in @UgEquityBank& #39;s expenses was due to: 71.3% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX24bn in provisions/impairment for bad debts31% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX37.8bn in interest expenses on deposits27% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX132.8bn in operational expenses 52% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX7bn in management fees" class="img-responsive" style="max-width:100%;"/>

to UGX24bn in provisions/impairment for bad debts31% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX37.8bn in interest expenses on deposits27% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX132.8bn in operational expenses 52% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX7bn in management fees" title="The rise in @UgEquityBank& #39;s expenses was due to: 71.3% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX24bn in provisions/impairment for bad debts31% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX37.8bn in interest expenses on deposits27% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX132.8bn in operational expenses 52% https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> to UGX7bn in management fees" class="img-responsive" style="max-width:100%;"/>

30.2% to UGX1.62trillion (people decided to keep their money in the banks, it appears). Bad debts written off https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 71.4% to UGX4.4bn Core capitalhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">46% to UGX296.6bn. Overall, a good year for @UgEquityBank" title="Customer deposits https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 30.2% to UGX1.62trillion (people decided to keep their money in the banks, it appears). Bad debts written off https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 71.4% to UGX4.4bn Core capitalhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">46% to UGX296.6bn. Overall, a good year for @UgEquityBank" class="img-responsive" style="max-width:100%;"/>

30.2% to UGX1.62trillion (people decided to keep their money in the banks, it appears). Bad debts written off https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 71.4% to UGX4.4bn Core capitalhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">46% to UGX296.6bn. Overall, a good year for @UgEquityBank" title="Customer deposits https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> 30.2% to UGX1.62trillion (people decided to keep their money in the banks, it appears). Bad debts written off https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 71.4% to UGX4.4bn Core capitalhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">46% to UGX296.6bn. Overall, a good year for @UgEquityBank" class="img-responsive" style="max-width:100%;"/>