One of the biggest verticals yet to be explored properly in #DeFi is Undercollaterlised loans.

Enter @maplefinance ... a decentralised corporate credit market.

Let& #39;s jump into what it is, what it does and what problems it solves...

1/12

Enter @maplefinance ... a decentralised corporate credit market.

Let& #39;s jump into what it is, what it does and what problems it solves...

1/12

LPs deposit USDC to a liquidity pool. Pool delegates carry out due diligence and agree on terms w/borrowers via smart contracts. MPL holders can stake 50/50 w/USDC in a balancer pool, participate in governance and get a passive fee share (no staking required).

2/12

2/12

Borrowers:

> Can borrow fixed-rate, fixed-term w/ a fixed collateralisation level w/out risk of liquidation or margin call, efficiently + transparently on-chain.

> Could be hedge funds, prop-traders, miners, market makers, exchanges etc.

> 1st pool will fund $15m of loans

3/12

> Can borrow fixed-rate, fixed-term w/ a fixed collateralisation level w/out risk of liquidation or margin call, efficiently + transparently on-chain.

> Could be hedge funds, prop-traders, miners, market makers, exchanges etc.

> 1st pool will fund $15m of loans

3/12

LPs deposit USDC to liquidity pools:

> Earn auto-compounding yield.

> All due diligence is outsourced to pool delegates.

> Liquidity pools can fund a variety of borrowers, to diversify risk.

4/12

> Earn auto-compounding yield.

> All due diligence is outsourced to pool delegates.

> Liquidity pools can fund a variety of borrowers, to diversify risk.

4/12

Pool Delegates:

> Required to stake tokens as first lost capital to cover any defaults (reduces moral hazard)

> Responsibilities include: credit assessing borrowers, agreeing terms, managing balance in liquidity pools to allow withdrawals, assist in special liquidations.

5/12

> Required to stake tokens as first lost capital to cover any defaults (reduces moral hazard)

> Responsibilities include: credit assessing borrowers, agreeing terms, managing balance in liquidity pools to allow withdrawals, assist in special liquidations.

5/12

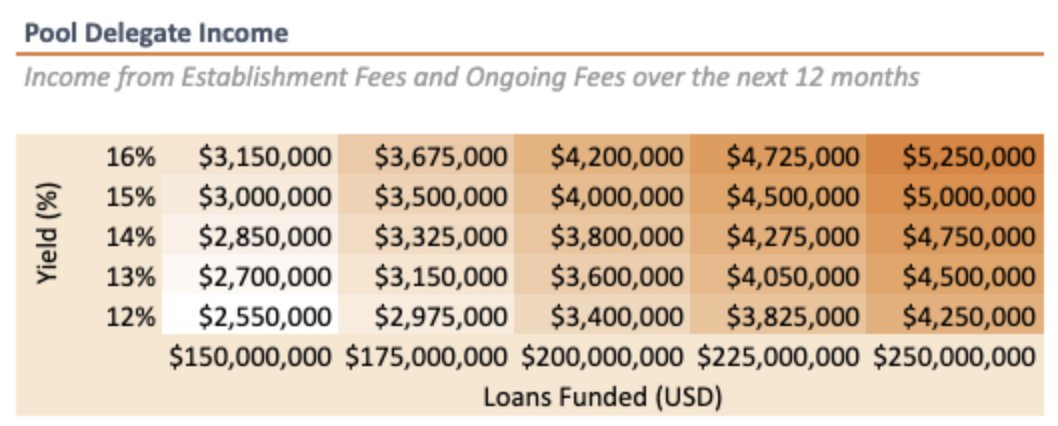

> Earn performance fees (see image for model)

> Orthogonal trading, a multi-strat digital asset fund, are the first pool delegate (see maple finance blog for more info on them)

6/12

> Orthogonal trading, a multi-strat digital asset fund, are the first pool delegate (see maple finance blog for more info on them)

6/12

MPL holders:

> Can add liquidity to an MPL/BPT pool and stake LP tokens in an insurance pool, in return for yield

> Participate in governance - eventually should be able to vote holders a share of treasury funds.

> Get a fee share (just from holding, entirely passive).

7/12

> Can add liquidity to an MPL/BPT pool and stake LP tokens in an insurance pool, in return for yield

> Participate in governance - eventually should be able to vote holders a share of treasury funds.

> Get a fee share (just from holding, entirely passive).

7/12

Other notes:

>Raised 1.3m in seed round. Backers include cluster capital, Framework ventures, Alameda Research, FBG, One Block, The LAO, Bitscale, Kain Warwick, Stani Kulechov.

> Brings with it a systemic risk to the crypto-ecosystem if adopted as a primitive.

8/12

>Raised 1.3m in seed round. Backers include cluster capital, Framework ventures, Alameda Research, FBG, One Block, The LAO, Bitscale, Kain Warwick, Stani Kulechov.

> Brings with it a systemic risk to the crypto-ecosystem if adopted as a primitive.

8/12

> TAM is enormous: basically all corporate credit and asset management markets.

> I do not know of many competitors. Cream had some/plans some form of under collateralization for other trusted DeFi protocols I believe. Dhedge is a different take on asset management.

9/12

> I do not know of many competitors. Cream had some/plans some form of under collateralization for other trusted DeFi protocols I believe. Dhedge is a different take on asset management.

9/12

> What exactly is the sequence of events in the event of a collateral shortfall? Are incentives properly aligned? Is there scope for risk tranching?

> Heavily contingent on how good the pool delegates are.

> Need further info on team: no published info on them.

10/12

> Heavily contingent on how good the pool delegates are.

> Need further info on team: no published info on them.

10/12

In summary, Maple targets a virtually unexplored vertical decentralised finance. The success hinges on whether the incentive structure is properly aligned between all participants ...

11/12

11/12

... do delegates sufficient skin in the game? Are MPL staking yields high enough to encourage sufficient insurance? Is risk & profit distributed correctly?

Imo Maple has a good shot at being a leader in this vertical. Expect copycats. This is the next frontier.

/end

Imo Maple has a good shot at being a leader in this vertical. Expect copycats. This is the next frontier.

/end

Read on Twitter

Read on Twitter