On March 11, the American Rescue Plan Act of 2021 (ARPA) was signed into law. The nearly $2 trillion stimulus package builds upon the CARES Act that was enacted nearly a year ago, as well as the CARES Act 2 which was enacted in December #GOPCThread https://www.greaterohio.org/blog/2021/3/16/american-rescue-plan-signed-into-law-what-it-means-for-ohio">https://www.greaterohio.org/blog/2021...

This week’s #GOPCThread is a breakdown of what is included in the historic relief program. Be sure to check back as GOPC will be providing more information about specific sectors of the relief bill as more details become available.

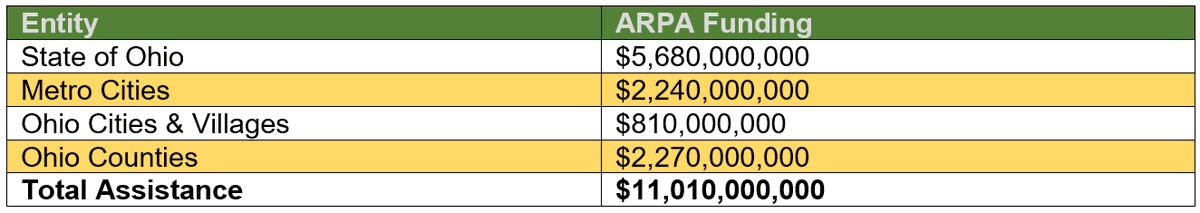

ARPA Provides $350B to help states, counties, cities & tribal governments cover increased expenditures, replenish lost revenue & mitigate economic harm from the COVID-19 pandemic. Ohio will receive $5.68B, while local governments will collectively receive $5.48B #GOPCThread

State & local government recipients can use the funds to cover costs incurred by 12/31/24. The funds would be distributed in 2 tranches - 50% delivered no later than 60 days from the date of enactment, the rest within one year after. #GOPCThread https://www.greaterohio.org/s/Ohio-ARPA-Allocations-State-Local.xlsx">https://www.greaterohio.org/s/Ohio-AR...

States will have to distribute funds to smaller towns within 30 days of receiving a payment from @USTreasury. States that miss the deadline would have to pay back any undistributed funds. A town cannot receive more than 75% of its budget as of Jan. 27, 2020 #GOPCThread

. @USTreasury could also withhold up to half of a state or territory’s allocation for as long as 12 months based on its unemployment rate and require an updated certification of its funding needs. #GOPCThread

Governments can use the funds to respond to the COVID-19 emergency & address its economic effects, including through aid to households, small businesses, nonprofits, & industries such as tourism and hospitality. #GOPCThread

Other uses of funds include: providing premium pay to essential workers, provide government services affected by a revenue reduction resulting from COVID-19, and make investments in water, sewer & broadband infrastructure #GOPCThread

State & local governments cannot use the funds towards pensions or to offset revenue resulting from a tax cut enacted since March 3, 2021. Funds can be transferred to private nonprofit groups, & special-purpose units of state or local governments #GOPCThread

ARPA provides another round of direct payments of $1,400 for individuals, $2,800 for joint filers, and $1,400 for each qualifying dependent child. Full payments will be provided to anyone with an income of $75,000 or less ($150,000 for married couples) #GOPCThread

The payments would begin to phase out for individuals with an adjusted gross income (AGI) of $75K ($150K for couples) & would be zero for AGIs of $80K ($160K for couples) or more. Dependents would include full-time students younger than 24 & adult dependents #GOPCThread

Payments would be based on 2019 or 2020 tax returns. @USTreasury could provide payments to individuals who have not filed based on return information available to the department. You can check the status of your direct payment via @IRSnews #GOPCThread https://sa.www4.irs.gov/irfof-wmsp/notice">https://sa.www4.irs.gov/irfof-wms...

ARPA provides $27.4 billion in emergency rental assistance, including $21.55B for emergency rental assistance, $5B for emergency housing vouchers, $750M for tribal housing needs & $100M for rural housing. Funds can be made available through 2030 #GOPCThread

The bill makes $5B available to assist people who are homeless with immediate & long-term assistance (emergency housing vouchers) with funds available until 9/30/30 #GOPCThread

The first 40% of funding for rental assistance will be provided within 60 days of enactment of ARPA #GOPCThread https://nlihc.org/sites/default/files/COVID-Relief-Budget_Reconciliation.pdf?utm_source=NLIHC+All+Subscribers&utm_campaign=c62cbba4d8-cta_022420&utm_medium=email&utm_term=0_e090383b5e-c62cbba4d8-292697541&ct=t(cta_022420)">https://nlihc.org/sites/def...

There is a further $9.96B for a homeowner’s assistance fund. This includes $100M for housing counseling via @neighborworks #GOPCThread https://www.neighborworks.org/Homes-Finances ">https://www.neighborworks.org/Homes-Fin...

ARPA will make $7.25B available for the Paycheck Protection Program (PPP) in the form of forgivable loans. This is on-top of the already existing $284B that remains from the December stimulus package. The deadline to apply is 3/31/21 so apply soon #GOPCThread

More not-for-profits are eligible for the PPP by under ARPA. This includes those not-for-profits listed in Sec. 501(c) of the RIC code other than 501(c)3, 501(c)4, 501(c)6, or 501(c)19 organizations #GOPCThread

These groups are eligible for loans if they don’t receive more than 15% of receipts from lobbying activities (and lobbying is not more than 15% of their activities), lobbying cost the group less than $1M through 2/15/20 & they don’t employ more than 300 people #GOPCThread

ARPA also provides funds to businesses located in low-income communities that have no more than 300 employees & have suffered an economic loss of more than 30% #GOPCThread

Businesses can show eligibility by showing the entity& #39;s gross receipts declined during an 8-week period, between 3/2/20 & 12/31/21 relative to a comparable eight-week period immediately preceding 3/2/20 #GOPCThread

$25B in ARPA will be provided for restaurants, bars & other eligible providers of food & drink. This will allow for grants equal to COVID-related revenue loss of the eligible entity, up to $10M per entity, or $5M per physical location, up to 20 locations #GOPCThread

$1.25B is available for shuttered venue operators such as theaters or concert halls & $175M is available to create a "community navigator" pilot program to increase awareness of & participation in COVID-19 relief programs for minority, women & veteran-owned businesses #GOPCThread

ARPA provides $30.5B for grants to transit agencies for use for operating expenses, including payroll & PPE costs. This includes $26.1B to aid transit services in urbanized areas & $2.21B for urban & rural systems that require additional assistance due to the pandemic #GOPCThread

$1.7B will be made available for Capital Investment Grants; $281M in operating assistance formula grants for states to support rural transit & $100 million will support intercity bus services to support essential connections in rural areas #GOPCThread https://www.transit.dot.gov/CIG ">https://www.transit.dot.gov/CIG"...

More information about ARPA can be found online courtesy of @NCSLorg as well as on our blog. As more details are available, we sure to check our website #GOPCThread https://www.ncsl.org/ncsl-in-dc/publications-and-resources/american-rescue-plan-act-of-2021.aspx">https://www.ncsl.org/ncsl-in-d...

Read on Twitter

Read on Twitter