1/ Impermanent Loss doesn& #39;t have to be this mythical phenomenon, such that it may only be explained clearly in a universe where Unicorns might live. No, today we pull back the curtain and present a tool to visualize and analyze impermanent loss by asset & investment time horizon.

2/ First, a quick primer on Impermanent Loss - it occurs when the price of either asset changes after you& #39;ve initially supplied liquidity (as you hope it does, since price changes are how a liquidity provider actually earns fees). Or, to take it straight from the Unicorn& #39;s mouth:

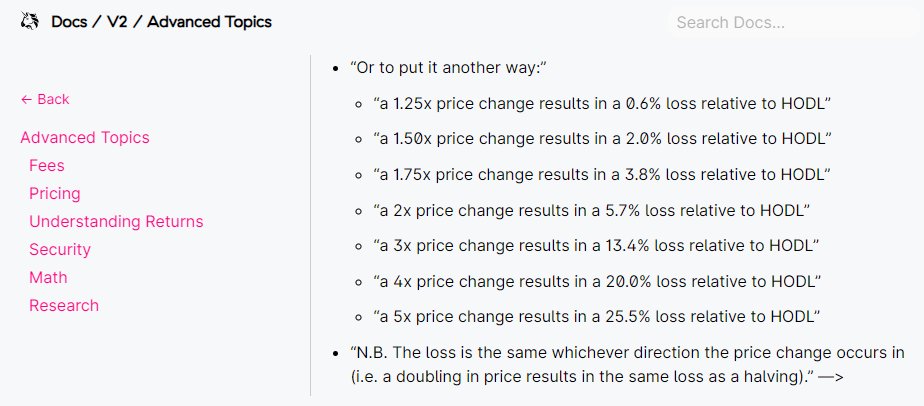

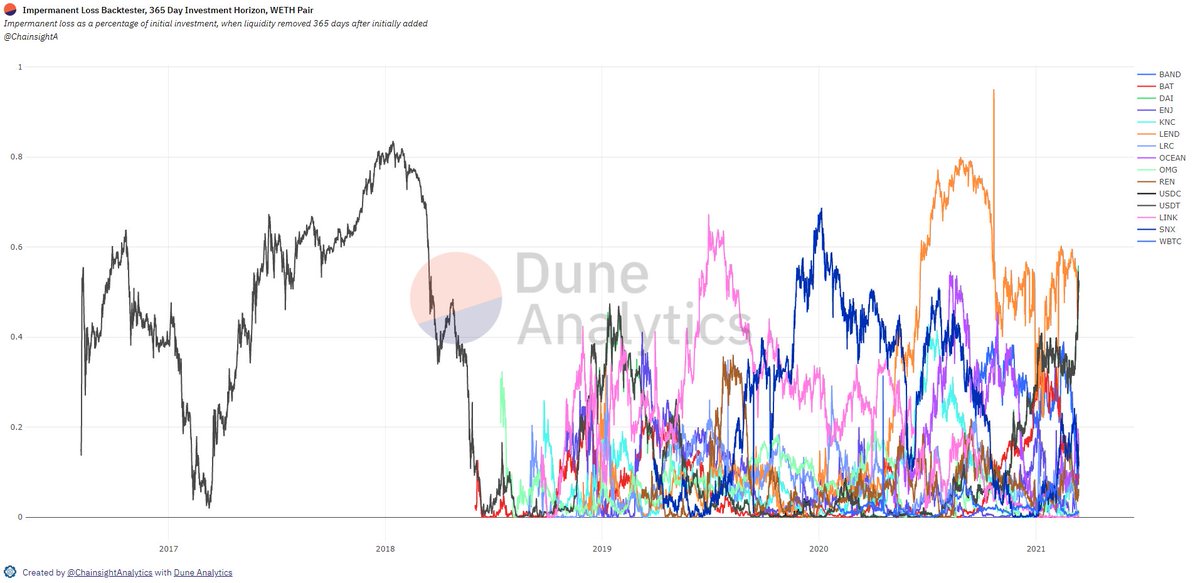

3/ As seen from the above Uniswap documentation, a 5x price change results in a 25.5% loss on your initial investment. But you aren& #39;t holding your favorite alt-coin for a mere 5x price appreciation, right, anon? Let& #39;s consider if you were supplying LINK/ETH liquidity last year:

4/ If you were to have withdrawn your LINK during the heat of DeFi Summer, you would have been signing yourself up for a loss of approximately 34%, if you had been supplying that liquidity for exactly 1 year. 34% of your initial investment, gone, all due to a Unicorn& #39;s friend.

5/ Let& #39;s consider another DeFi Blue-Chip, SNX. If you were to have withdrawn your SNX during DeFi Summer, you would have lost 50% of your initial investment. Ouch!

https://duneanalytics.com/embeds/22827/47249/ChVhNyDUgII22AhE3pGKN4q0bnfMPK1BdTJhb7Jx">https://duneanalytics.com/embeds/22...

https://duneanalytics.com/embeds/22827/47249/ChVhNyDUgII22AhE3pGKN4q0bnfMPK1BdTJhb7Jx">https://duneanalytics.com/embeds/22...

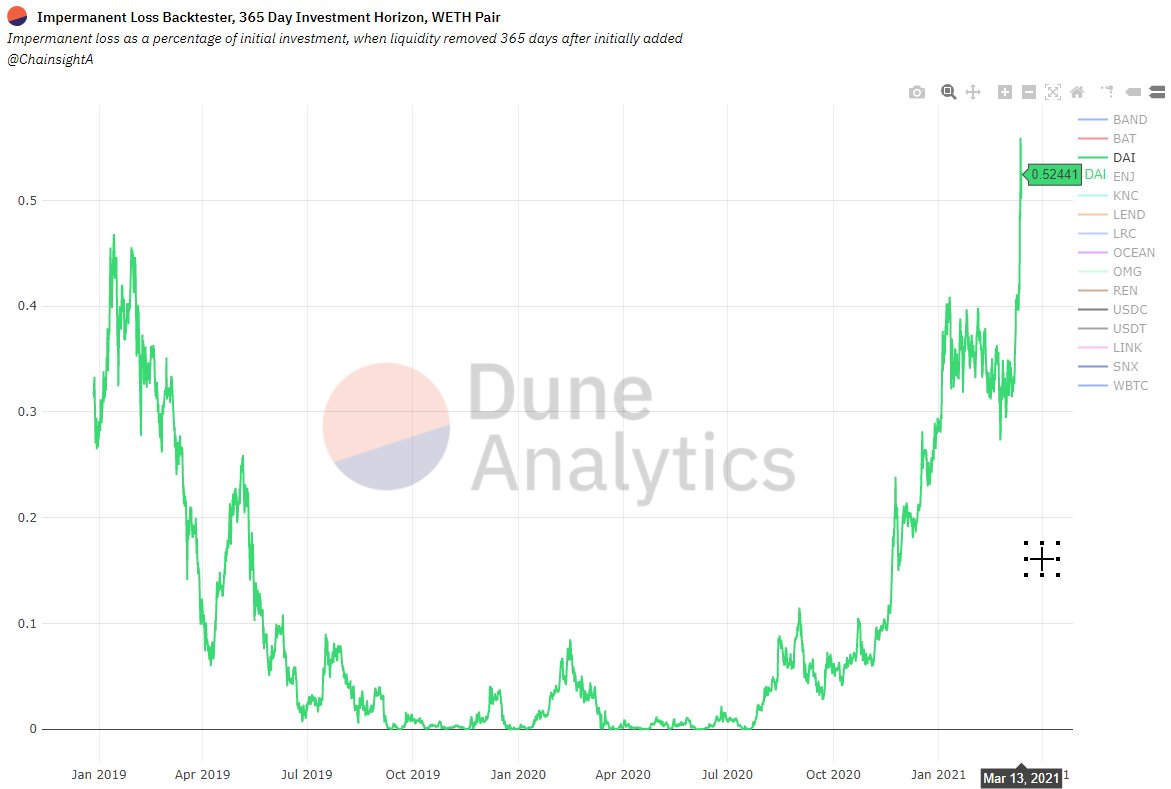

6/ Stablecoins should be safe, right? Sorry, but it actually gets worse. Consider if you supplied DAI/ETH (a & #39;stable& #39; and a & #39;safe& #39; asset) for 1 year, and withdrew TODAY. A nice 52% loss on your initial investment.

https://duneanalytics.com/embeds/22827/47249/ChVhNyDUgII22AhE3pGKN4q0bnfMPK1BdTJhb7Jx">https://duneanalytics.com/embeds/22...

https://duneanalytics.com/embeds/22827/47249/ChVhNyDUgII22AhE3pGKN4q0bnfMPK1BdTJhb7Jx">https://duneanalytics.com/embeds/22...

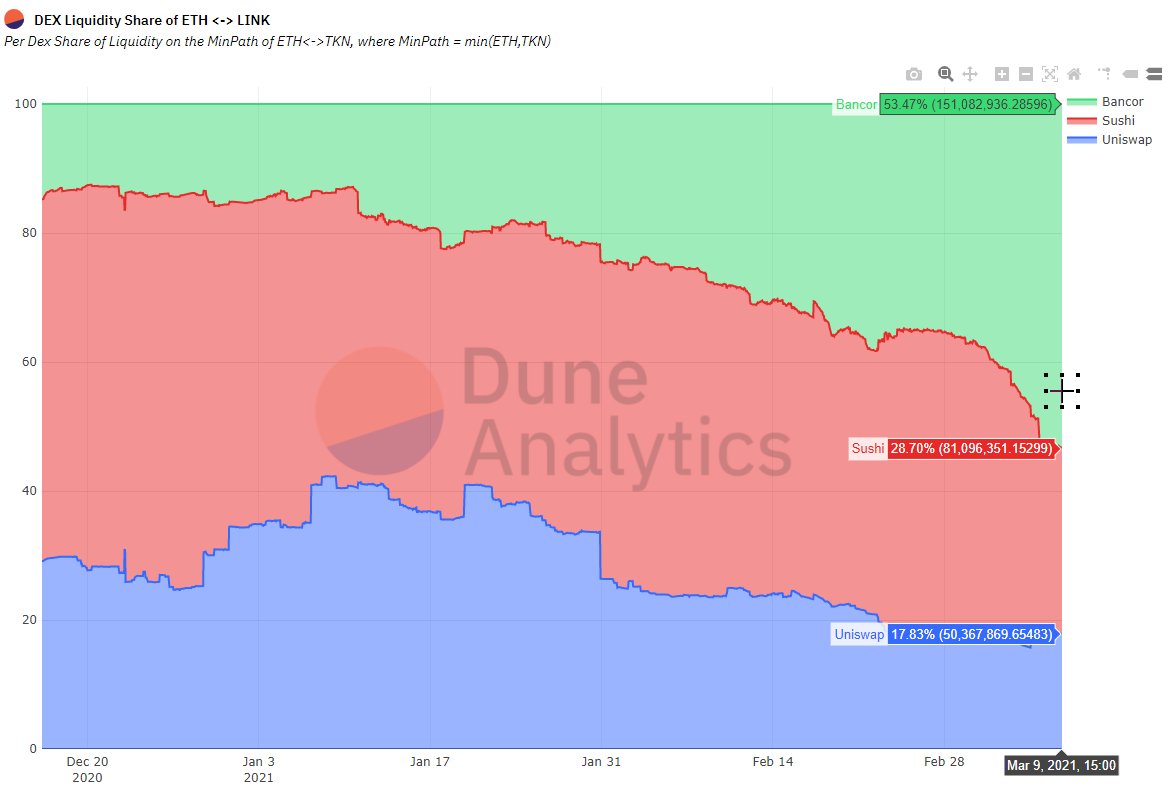

7/ It makes sense that the massive impermanent losses shown above are a big reason why many Liquidity Providers are leaving Uniswap and Sushiswap and moving to other platforms with IL protection. Namely, Bancor now has 53% of all LINK DEX liquidity, mostly gained very recently:

8/ Impermanent loss is now well known in the DEX space, but it is rarely assigned a & #39;penalty& #39; metric on UX& #39;s where users provide liquidity. Rather than assuming malicious intent by these popular DEX applications, we acknowledge that IL is difficult to convey.

9/ By using this Dune Analytics Dashboard, you can adjust your & #39;investment horizon& #39; variable (how long you& #39;ve been supplying liquidity), and refresh the query in order to plot the asset& #39;s impermanent loss by withdrawal date:

https://duneanalytics.com/ChainsightAnalytics/impermanent-loss-backtester">https://duneanalytics.com/Chainsigh...

https://duneanalytics.com/ChainsightAnalytics/impermanent-loss-backtester">https://duneanalytics.com/Chainsigh...

10/ To conclude, we suspect that in 2021 a mass migration of LPs from platforms without IL protection is imminent. Bancor will be a likely landing spot for them, given that Bancor provides full IL protection to LPs after providing liquidity for 100 days.

Remember to check out our latest creations on Bancor& #39;s Official Dune Dashboard at https://duneanalytics.com/ashachaf/bancor_1!">https://duneanalytics.com/ashachaf/...

Read on Twitter

Read on Twitter