China Youzan Limited is an investment holding company principally engaged in the merchant service business.

The stock is listed in the @HKEXGroup with the number $8083

#ChinaStocks #HKEX #investors $JD $BABA #HongKongStocks

The stock is listed in the @HKEXGroup with the number $8083

#ChinaStocks #HKEX #investors $JD $BABA #HongKongStocks

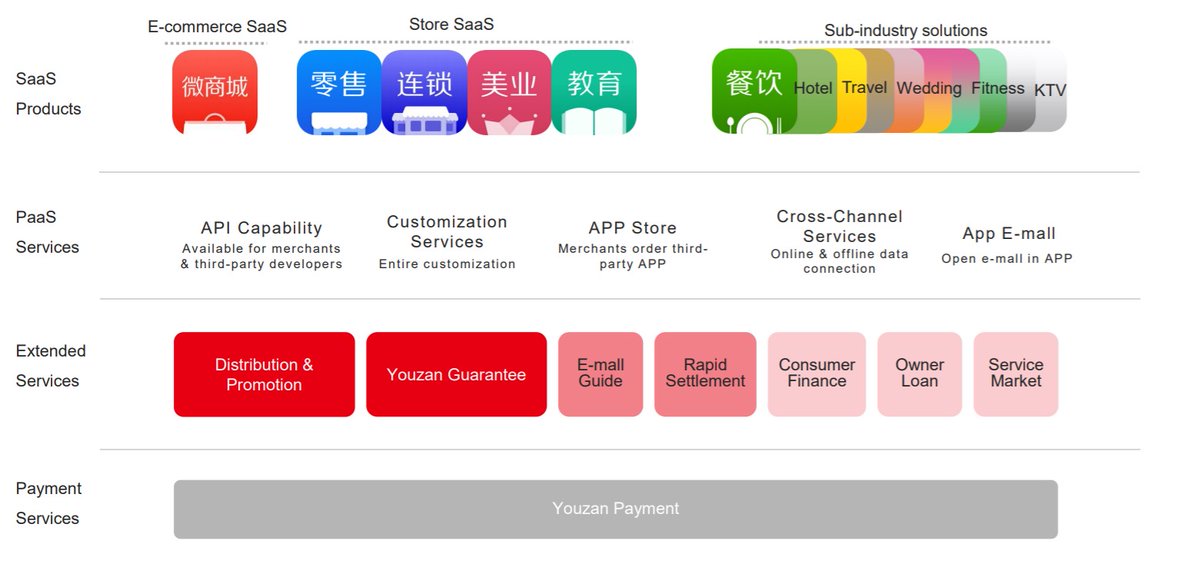

The Company operates through four business segments. The Merchant Service segment engages in the provision of e-commerce platform with SaaS (Software as a Service) products and comprehensive services through Youzan WeiMall, Youzan Retail, Youzan Beauty and other SaaS products.

The Third-party Payment Services segment is involved in the provision of third-party payment services and related consultancy services. The Onecomm segment is engaged in the provision of third-party payment management services and sales of integrated smart point of sales devices.

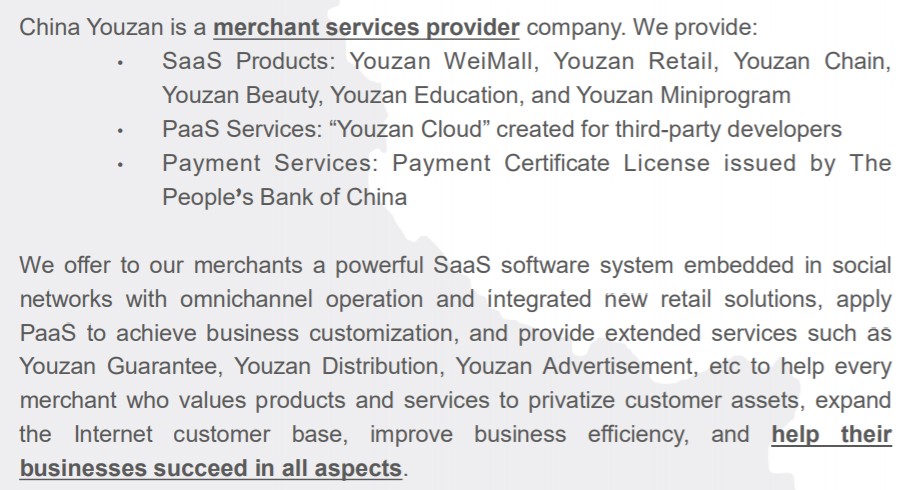

Help merchants run business in multi-channels… Buying China Youzan you will have exposure to a lot of businesses in China.

IN LINE WITH THE ANTI-MONOPOLY GOVERNMENT PLANS

One interest point in China Youzan is that the business model is not incompatible with the anti monopoly plans of the Chinese government. Youzan is in line with diversify the sources of sales...

One interest point in China Youzan is that the business model is not incompatible with the anti monopoly plans of the Chinese government. Youzan is in line with diversify the sources of sales...

creating the own e-ecommerce for each business, and change the concentration logic of the biggest portals like JD and Alibaba. https://www.wsj.com/articles/china-regulators-plan-to-tame-tech-giant-alibaba-jack-ma-11615475344">https://www.wsj.com/articles/...

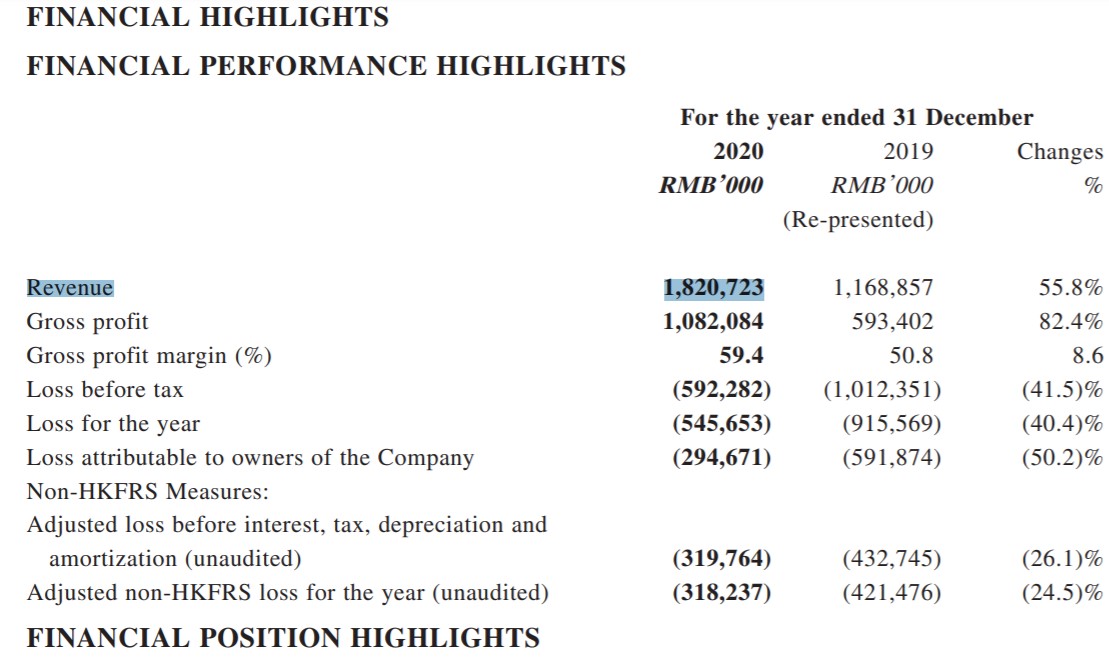

REVENUE

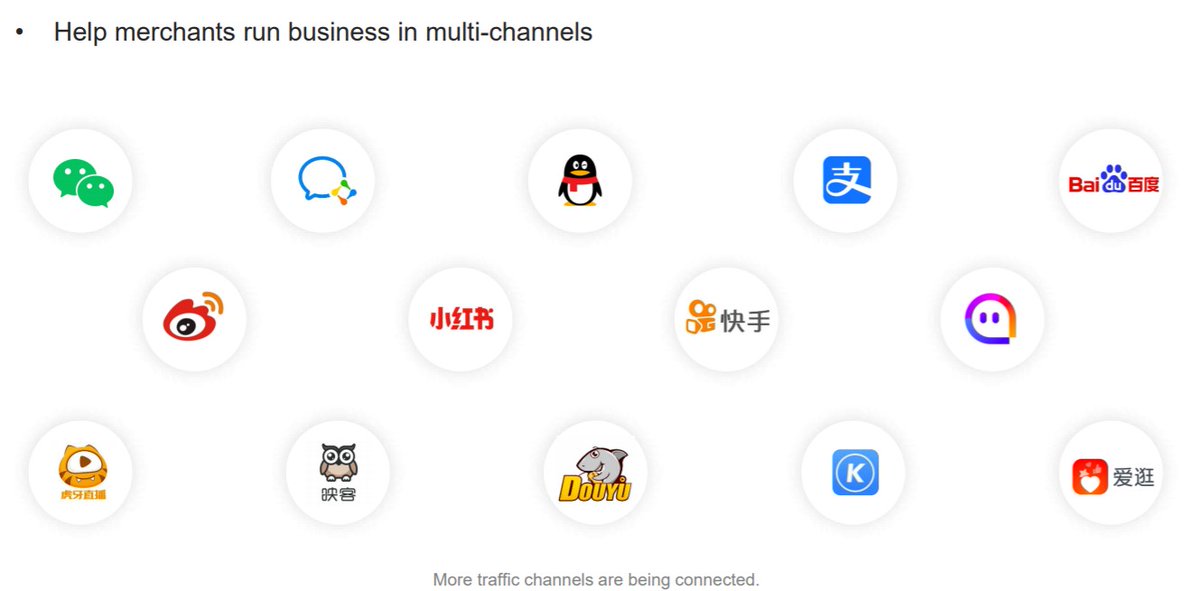

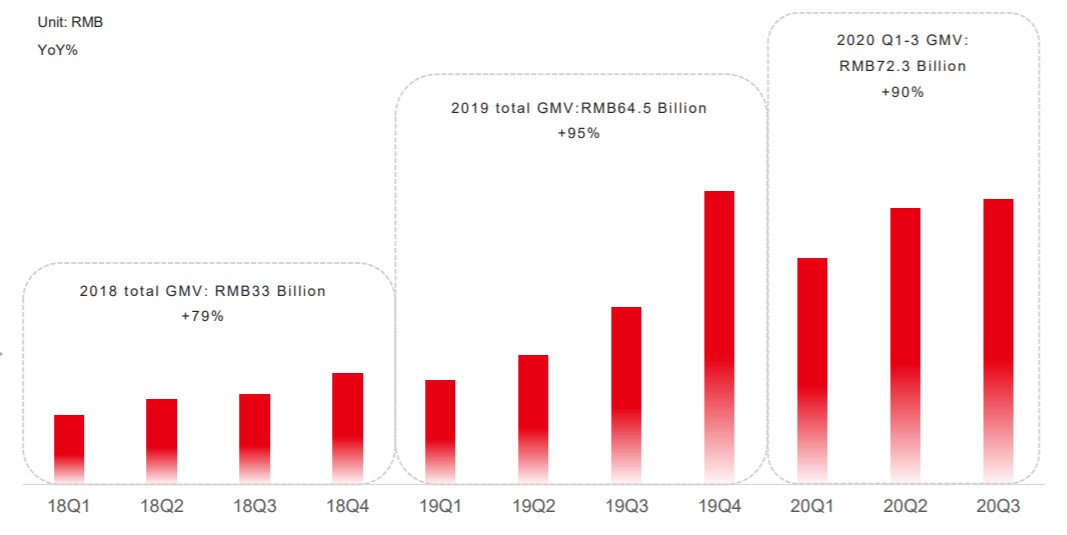

The real growth of Youzan can be observed in the number of paying merchants. For the first three quarters of 2020, China Youzan’s GMV reached RMB72.3 billion, representing an increase of 90% YoY. In 2019, Youzan total GMV reached RMB64.5 billion, an increase of 95% YoY

The real growth of Youzan can be observed in the number of paying merchants. For the first three quarters of 2020, China Youzan’s GMV reached RMB72.3 billion, representing an increase of 90% YoY. In 2019, Youzan total GMV reached RMB64.5 billion, an increase of 95% YoY

GMV: refers to the total value of all confirmed products and services transactions of Youzan Group, regardless of whether the goods have been delivered or returned or how the relevant orders are settled.

SOURCES OF REVENUE

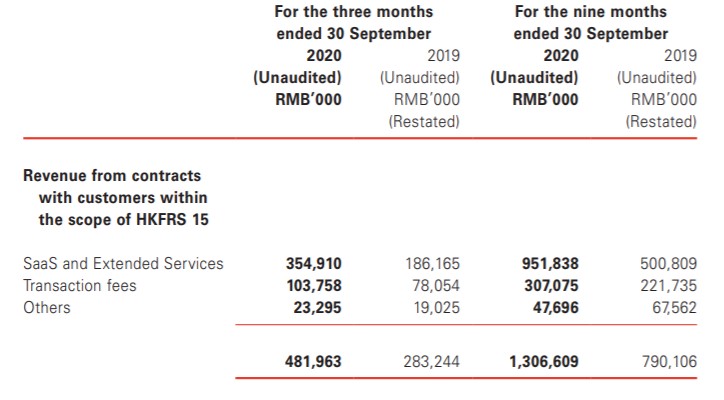

The revenue comes from two mains business: the sales of Software as a Service (creation of the provision of e-commerce platform) is 75% and the transaction fees at 25%. The growth in transaction fees is very interesting because it should be recurring revenue.

The revenue comes from two mains business: the sales of Software as a Service (creation of the provision of e-commerce platform) is 75% and the transaction fees at 25%. The growth in transaction fees is very interesting because it should be recurring revenue.

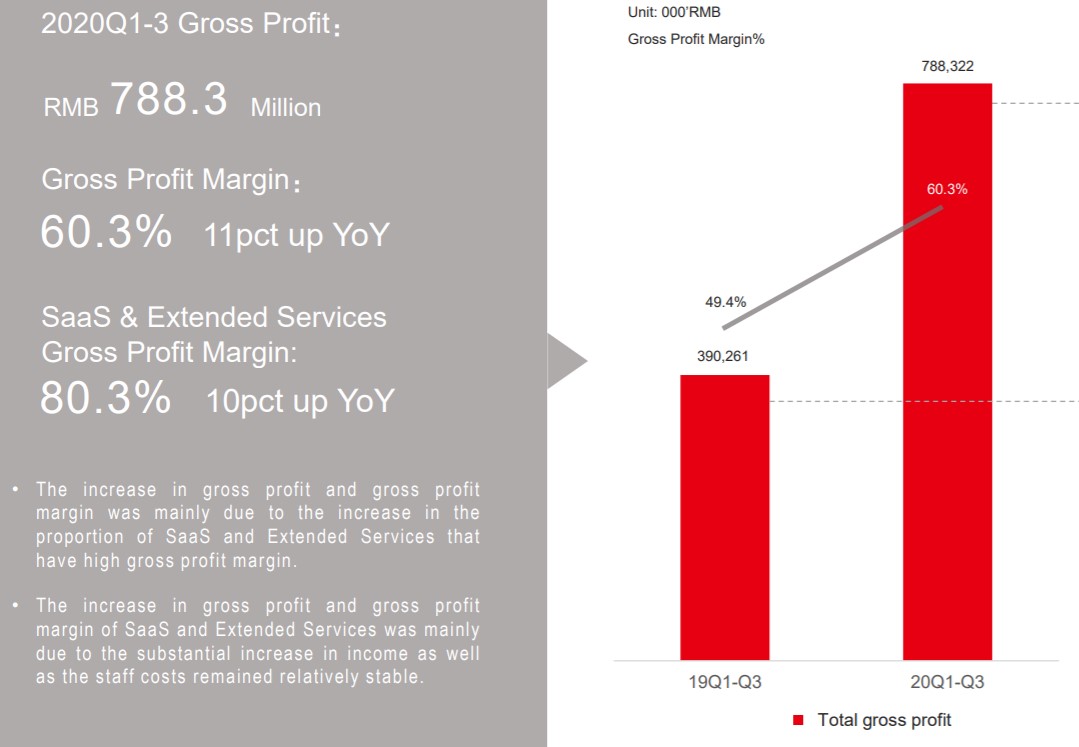

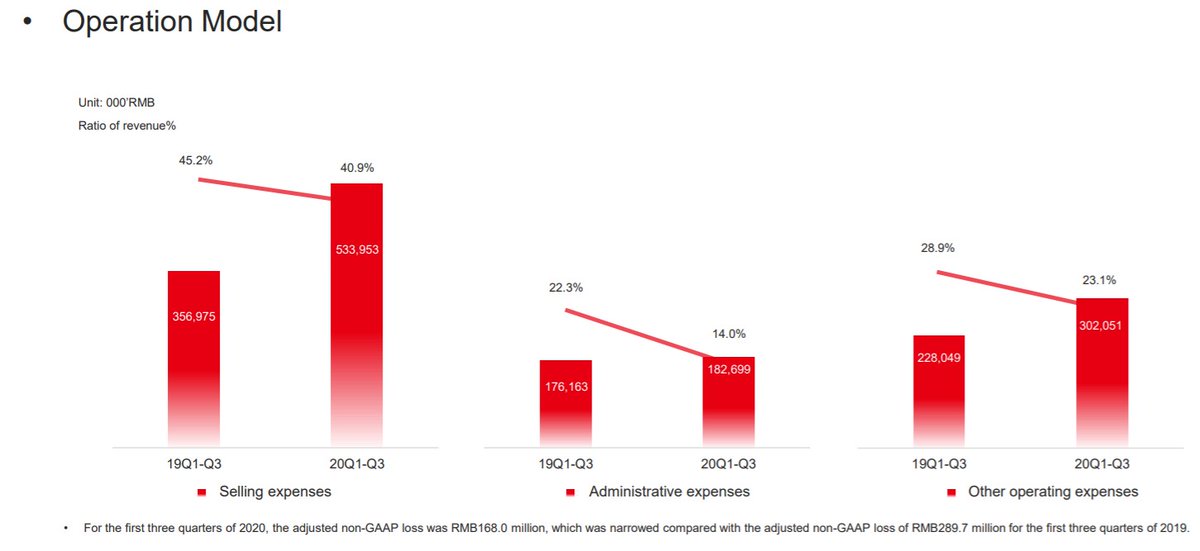

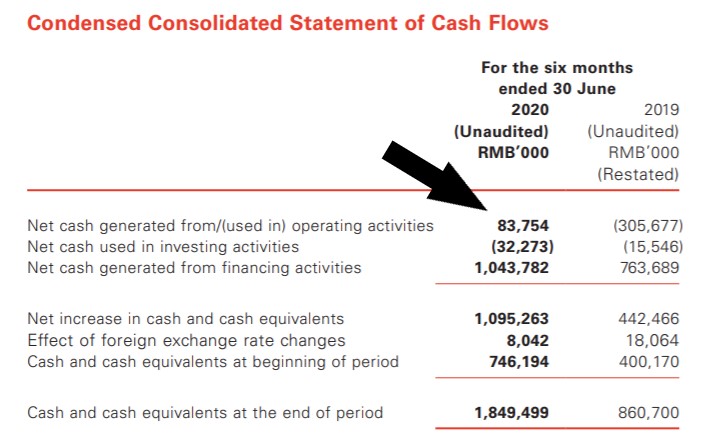

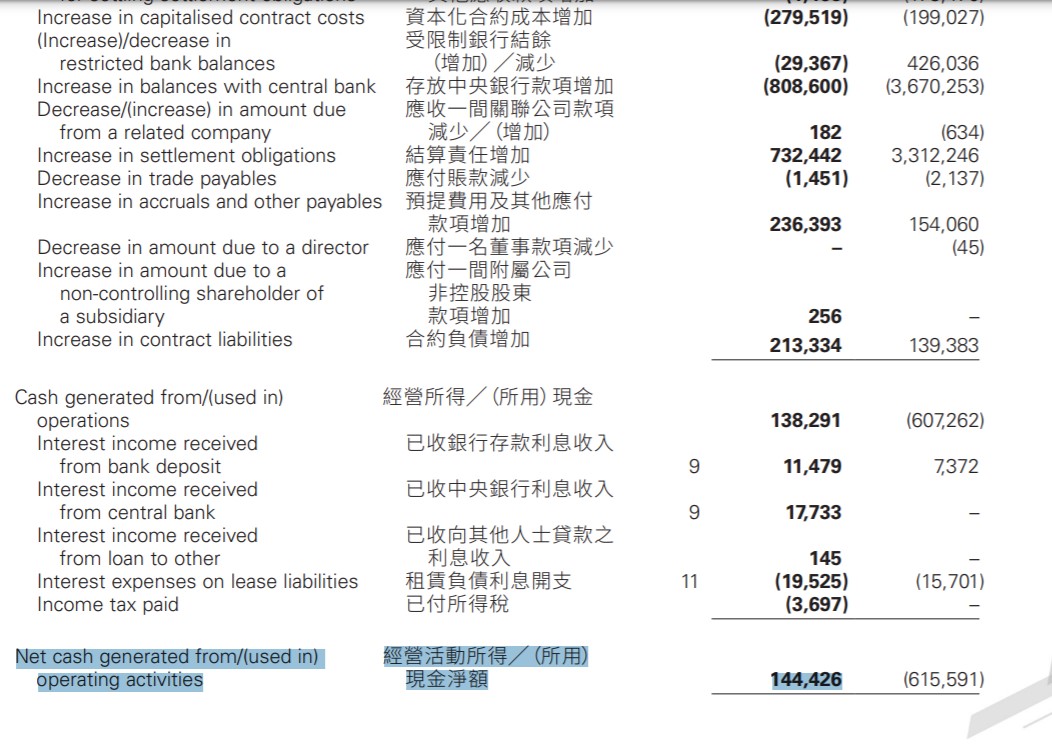

LOSS FROM OPERATION, MARGINS and CASH FLOW

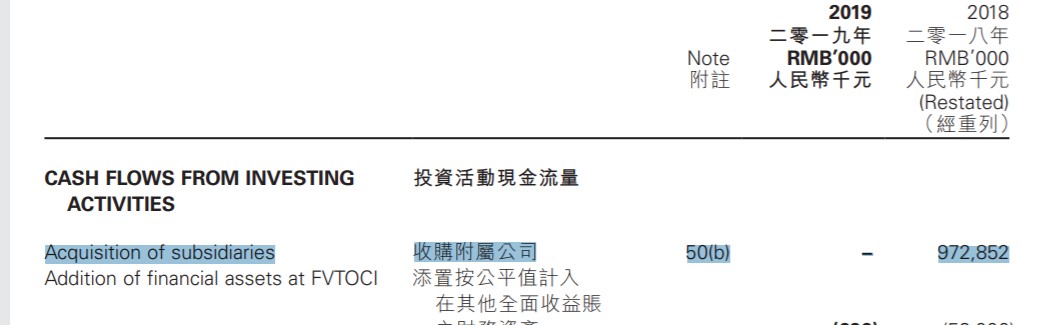

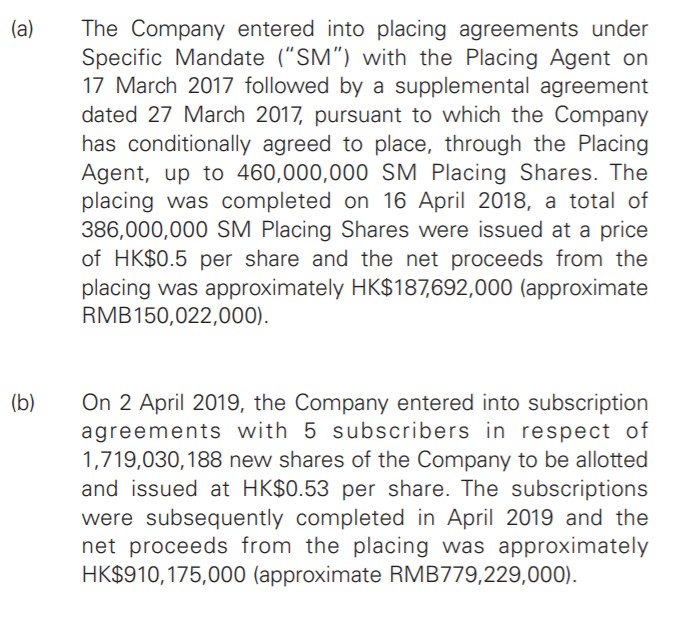

Both years 2018 and 2019 the Cash from operation activities was negative. How Youzan affront it? In the year 2018 it was offset by the cash in bank of the subsidiarie acquired and in the year 2019 issuing shares at HK$0,53.

Both years 2018 and 2019 the Cash from operation activities was negative. How Youzan affront it? In the year 2018 it was offset by the cash in bank of the subsidiarie acquired and in the year 2019 issuing shares at HK$0,53.

The Covid-19 year impulsed the creation of e-commerce and China Youzan has a amazing year with very high growth rates in Gross profit…

And improved very well the margin of the operation… The growth rate of the revenue was much better than the costs growth.

VALUATION

China Youzan has a current market capitalization of 50.500 mln CNY or 42.496 mln HKD. It has a very high valuation, and has a very high especulation of growht in the stock price. As it is still not profitable, so we take the price to sale ratio for valuate it.

China Youzan has a current market capitalization of 50.500 mln CNY or 42.496 mln HKD. It has a very high valuation, and has a very high especulation of growht in the stock price. As it is still not profitable, so we take the price to sale ratio for valuate it.

The Price to sale ratio of China Youzan is very high in comparasion to the biggest e-commmerce chineses stocks like JD and BABA.

CONCLUSION

China Youzan is a great business, with a great future, but the stock price needs a strong growth at very high rates for improve the margins and justify the current price.

At this price the margin of safety is very far. Stock to follow and look the growth rates.

China Youzan is a great business, with a great future, but the stock price needs a strong growth at very high rates for improve the margins and justify the current price.

At this price the margin of safety is very far. Stock to follow and look the growth rates.

Revenue and Cash from operating activities showed nice growth interannual and in relation to the 3th quarter 2020.

At current Market Capitalization of 39.087 mln RMB, China Youzan is quoting at 21 Price to sales ratio.

Still very above peers like http://JD.com"> http://JD.com or Alibaba, but if sustain this high rates of growing... it´s ratio could go down very fast.

Still very above peers like http://JD.com"> http://JD.com or Alibaba, but if sustain this high rates of growing... it´s ratio could go down very fast.

Read on Twitter

Read on Twitter