Some #FootballIndex traders were overexposed, but I feel the narrative of "problem gamblers" will be repeated despite FI have such external stamps of approval. Not only from gambling bodies but also its partnership with NASDAQ + appearing in The Sunday Times 2020 Tech Track 100. https://twitter.com/WelshIndex/status/1370315964940742658">https://twitter.com/WelshInde...

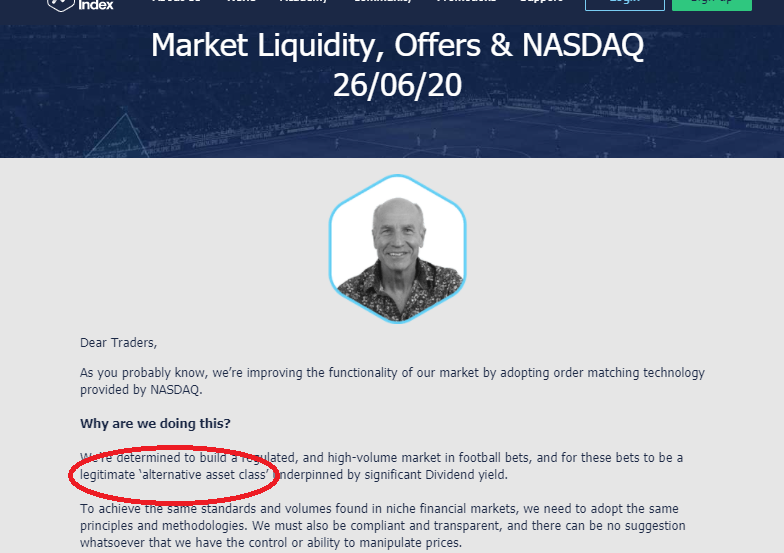

We saw statements from then-CEO of #FootballIndex, Adam Cole, in June 2020, stating his desire for FI to become "a legitimate alternative asset class" (this update also mentions NASDAQ partnership and their Tier 1 operator with the Gambling Commission)

https://trade.footballindex.co.uk/nasdaq-20200626/">https://trade.footballindex.co.uk/nasdaq-20...

https://trade.footballindex.co.uk/nasdaq-20200626/">https://trade.footballindex.co.uk/nasdaq-20...

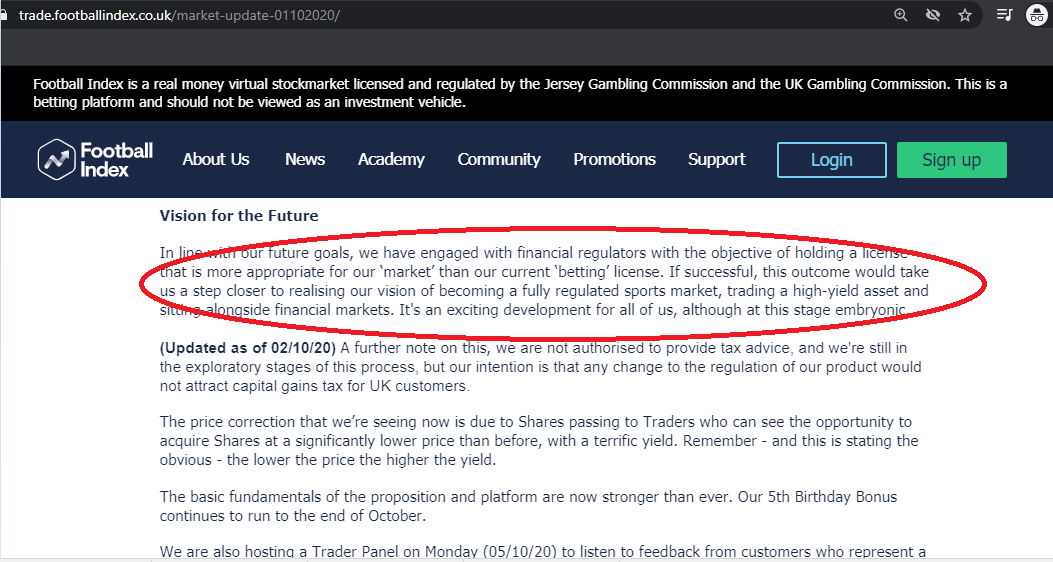

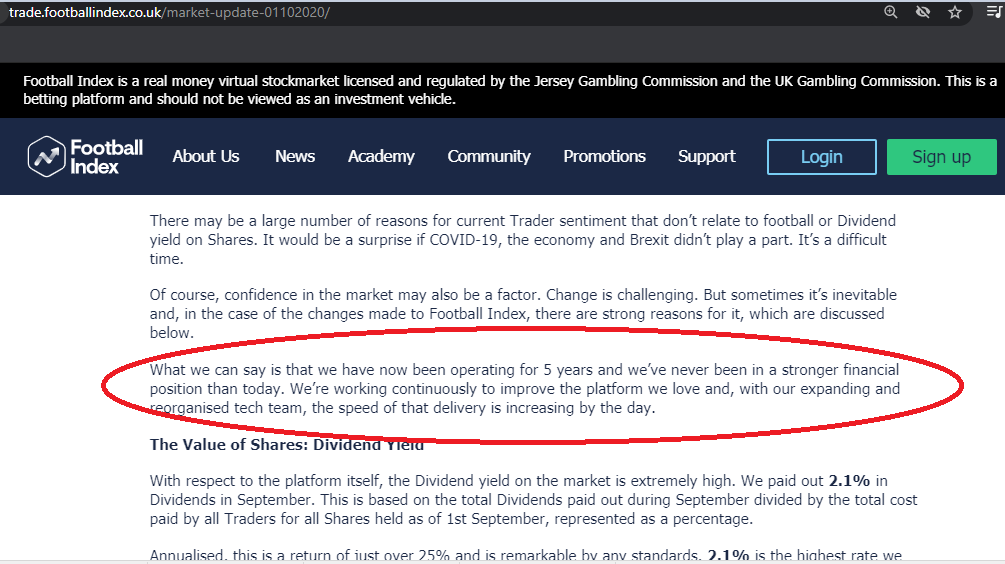

In the 1st October 2020 #FootballIndex public update, the company repeated this desire to move away from gambling and into a more financial regulated product, doubling down in a further update the following day in the paragraph below the highlighted one.

This 01/10/20 update is also the one where #FootballIndex stated that "we have now been operating for 5 years and we’ve never been in a stronger financial position than today". (Misreported in some places as being 15/11/20.)

https://trade.footballindex.co.uk/market-update-01102020/">https://trade.footballindex.co.uk/market-up...

https://trade.footballindex.co.uk/market-update-01102020/">https://trade.footballindex.co.uk/market-up...

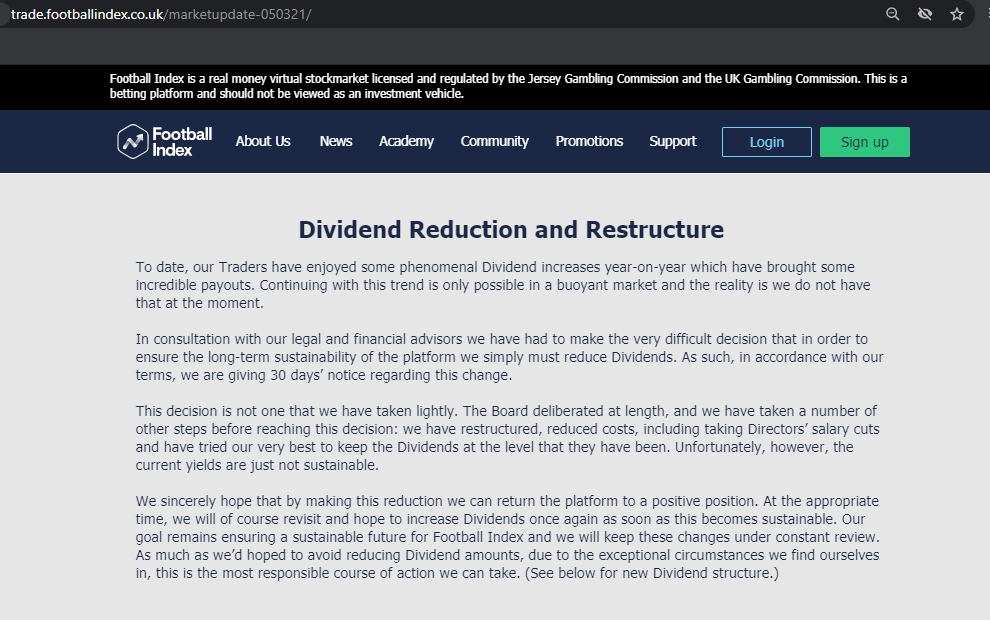

Just a few months after the statement of being in the strongest financial position in their history, #FootballIndex then declared on 5 March 2021, that they were facing serious financial difficulty and dividends had to be reduced

https://trade.footballindex.co.uk/marketupdate-050321/">https://trade.footballindex.co.uk/marketupd...

https://trade.footballindex.co.uk/marketupdate-050321/">https://trade.footballindex.co.uk/marketupd...

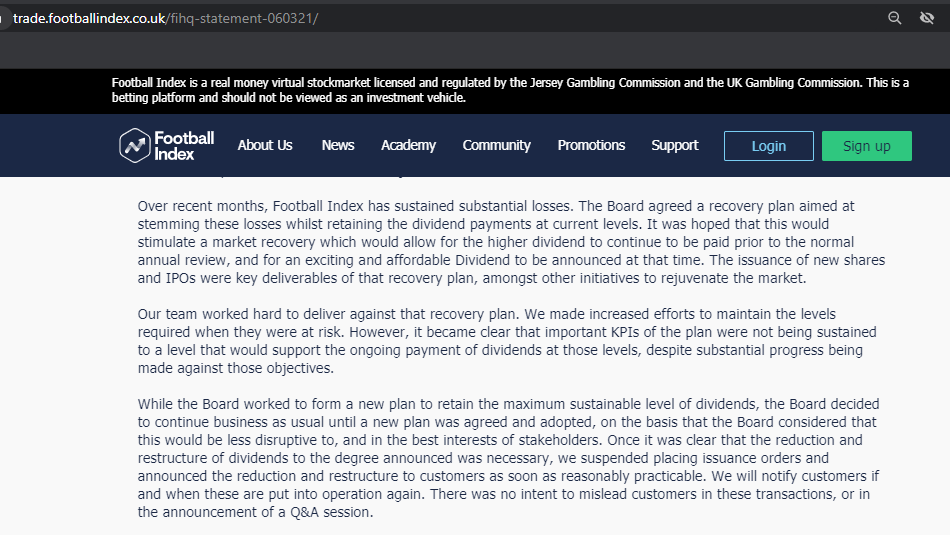

The financial difficulties (vs financial strength, as of 01/10/20) were re-iterated in a #FootballIndex statement on 6 March 2021: "Over recent months, Football Index has sustained substantial losses". https://trade.footballindex.co.uk/fihq-statement-060321/…">https://trade.footballindex.co.uk/fihq-stat...

Interestingly, #FootballIndex had removed another dividend (In-Play, aka IPD) in early 2021 also, and their announcement on 8 January 2021 did not state (or even hint at) financial difficulties https://trade.footballindex.co.uk/update-080121/ ">https://trade.footballindex.co.uk/update-08...

I may return with further examples, but the ones in this thread, show how #FootballIndex customers placed their bets in good faith and were repeatedly misled, and arguably mis-sold. The narrative should remain on the negligence of the people involved with the company.

Already found another hugely misleading #FootballIndex statement from the 26/08/20 update: "We& #39;ve successfully weathered the COVID-19 economic storm" (backtracked on in the 05/03/21 update)

https://trade.footballindex.co.uk/dividendreview20/

https://trade.footballindex.co.uk/dividendr... href=" https://trade.footballindex.co.uk/marketupdate-050321/">https://trade.footballindex.co.uk/marketupd...

https://trade.footballindex.co.uk/dividendreview20/

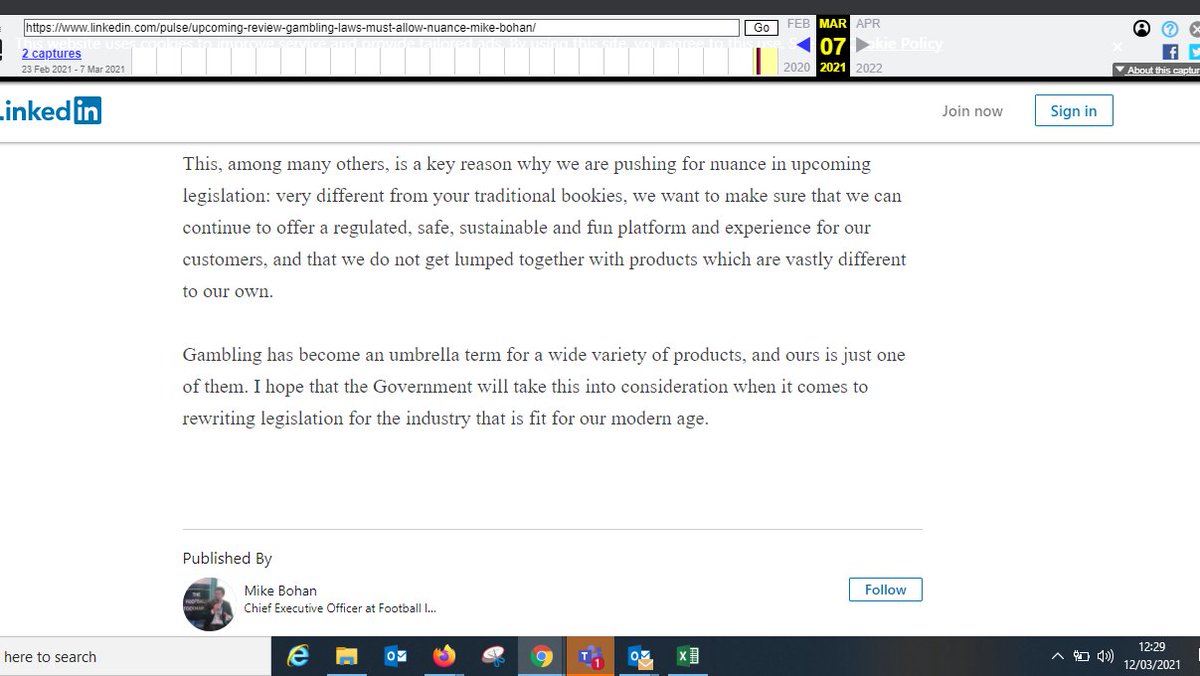

Mike Bohan wrote a piece (23 Feb 2021) on LinkedIn regarding the upcoming review into UK gambling. #FootballIndex has unravelled rapidly and the mentions of the platform as "safe" and "sustainable" may not have been true at the time of publication

http://web.archive.org/web/20210307114058/https://www.linkedin.com/pulse/upcoming-review-gambling-laws-must-allow-nuance-mike-bohan/">https://web.archive.org/web/20210...

http://web.archive.org/web/20210307114058/https://www.linkedin.com/pulse/upcoming-review-gambling-laws-must-allow-nuance-mike-bohan/">https://web.archive.org/web/20210...

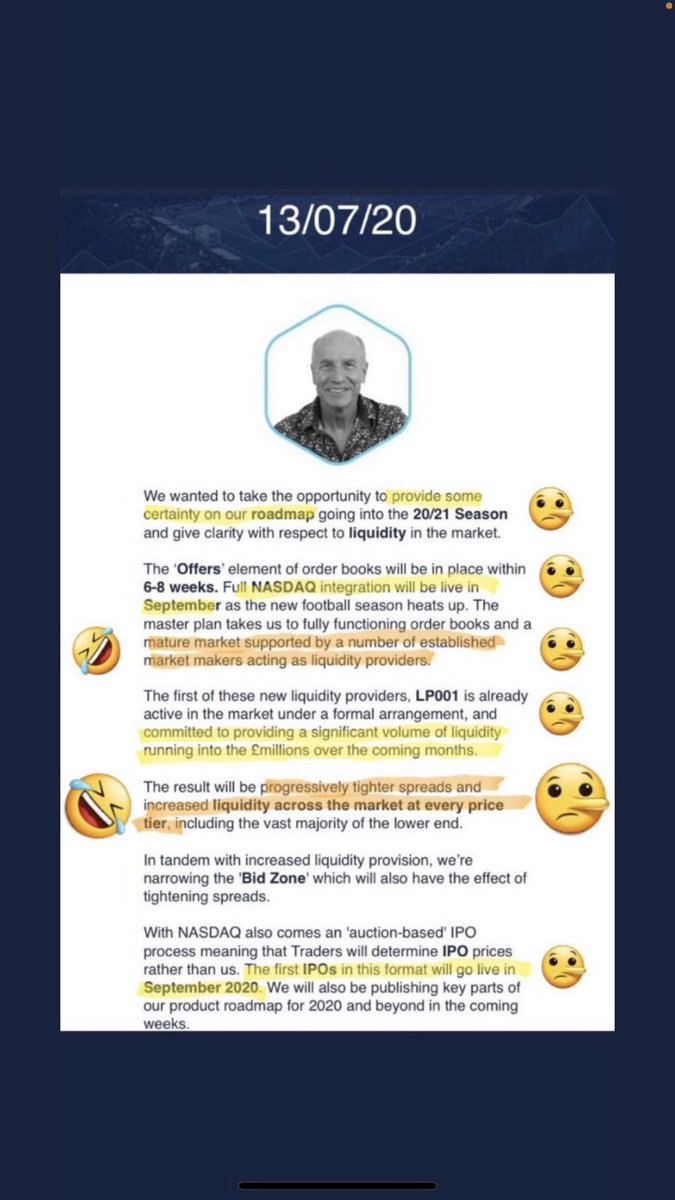

This 13/07/20 update is perhaps the best summation of the misleading nature of #FootballIndex communications, and promises not fulfilled. People deposited more money into the product due to the roadmap. For example, NASDAQ integration has not materialised https://trade.footballindex.co.uk/marketupdate-20200713/">https://trade.footballindex.co.uk/marketupd...

I am not 100% sure where this screenshot has come from but another possible example of the reassurance that #FootballIndex were in a strong financial position. This was in February 2021, and only weeks before the company entered administration.

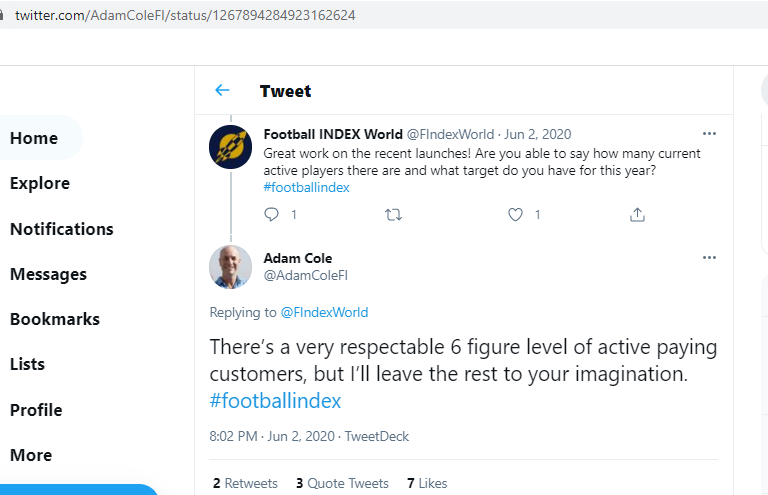

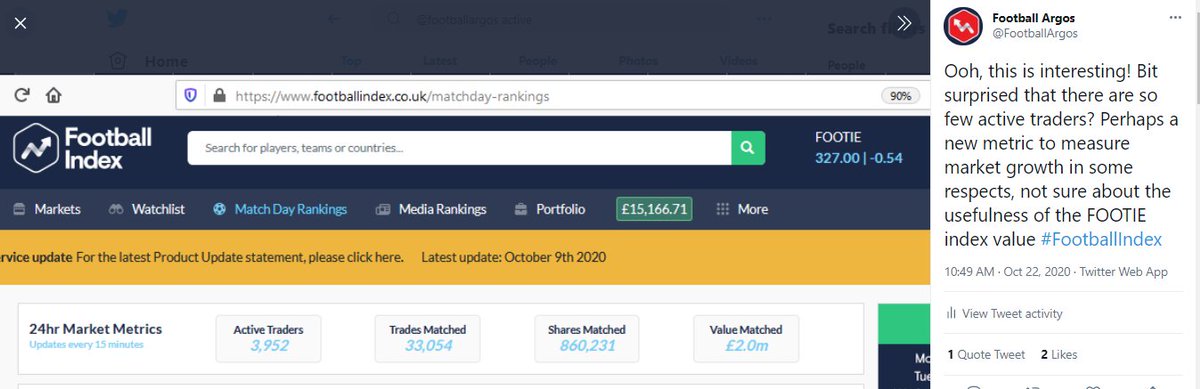

In June 2020, then-CEO of #FootballIndex Adam Cole confirmed that the company had a "6 figure level of active paying customers". In October 2020, FI launched the active trader metric, regularly showing less than 5k active customers https://twitter.com/AdamColeFI/status/1267894284923162624">https://twitter.com/AdamColeF...

In the 2nd half of 2019, #FootballIndex were in bidding war for Atlantic Sport Exchange, losing out to Sportex (not sure what happened to them?), who paid £19 million. Did FI then funnel customer funds into Project Hadron to develop similar fintech? https://www.prnewswire.co.uk/news-releases/sportex-outbids-football-index-in-a-ps19-million-takeover-of-atlantic-sport-exchange-841679770.html">https://www.prnewswire.co.uk/news-rele...

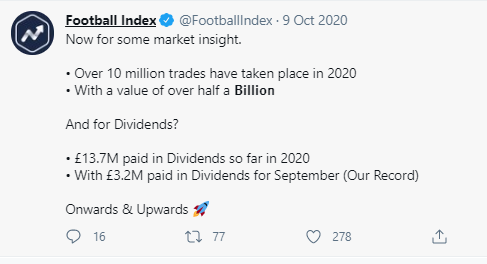

As #FootballIndex traders, we were often given the picture that & #39;business was booming& #39; until very recently. Note the rocket emoji and emphasis within this FI market insight tweet on October 9th 2020, as they mentioned paying a record amount of dividends.

https://twitter.com/footballindex/status/1314625096800235522">https://twitter.com/footballi...

https://twitter.com/footballindex/status/1314625096800235522">https://twitter.com/footballi...

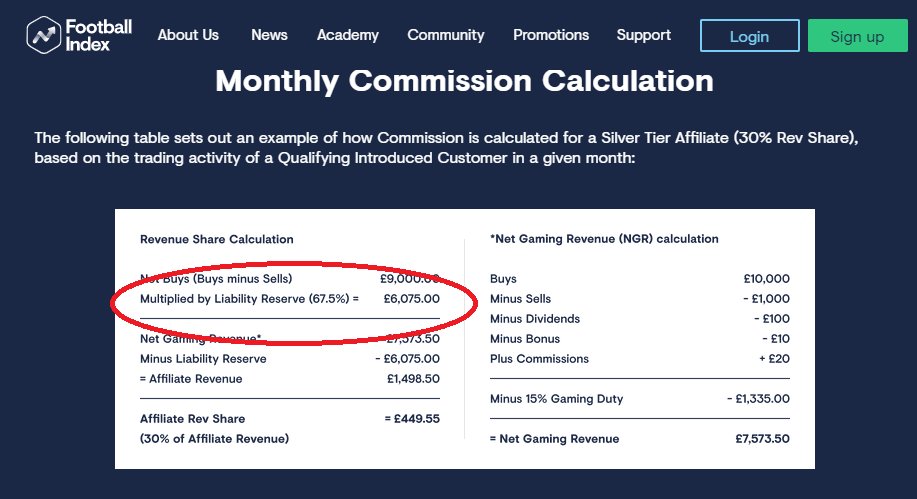

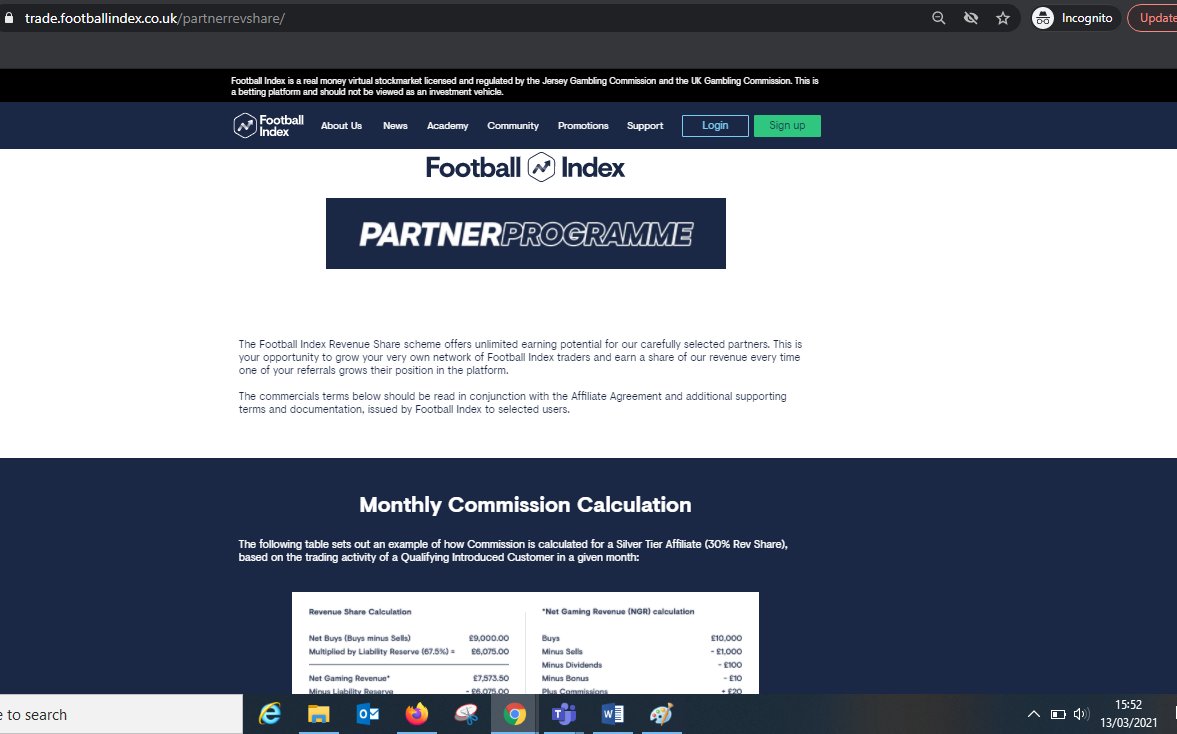

This may be old information but based on the #FootballIndex Partner Programme (affiliate scheme), there is a mention of a 67.5% liability reserve. If the FI money well does dry up, I think this aspect should be a particular focus of investigation.

https://trade.footballindex.co.uk/partnerrevshare/">https://trade.footballindex.co.uk/partnerre...

https://trade.footballindex.co.uk/partnerrevshare/">https://trade.footballindex.co.uk/partnerre...

Read on Twitter

Read on Twitter

https://trade.footballindex.co.uk/marketupd..." title="Already found another hugely misleading #FootballIndex statement from the 26/08/20 update: "We& #39;ve successfully weathered the COVID-19 economic storm" (backtracked on in the 05/03/21 update) https://trade.footballindex.co.uk/dividendr... href=" https://trade.footballindex.co.uk/marketupdate-050321/">https://trade.footballindex.co.uk/marketupd...">

https://trade.footballindex.co.uk/marketupd..." title="Already found another hugely misleading #FootballIndex statement from the 26/08/20 update: "We& #39;ve successfully weathered the COVID-19 economic storm" (backtracked on in the 05/03/21 update) https://trade.footballindex.co.uk/dividendr... href=" https://trade.footballindex.co.uk/marketupdate-050321/">https://trade.footballindex.co.uk/marketupd...">

https://trade.footballindex.co.uk/marketupd..." title="Already found another hugely misleading #FootballIndex statement from the 26/08/20 update: "We& #39;ve successfully weathered the COVID-19 economic storm" (backtracked on in the 05/03/21 update) https://trade.footballindex.co.uk/dividendr... href=" https://trade.footballindex.co.uk/marketupdate-050321/">https://trade.footballindex.co.uk/marketupd...">

https://trade.footballindex.co.uk/marketupd..." title="Already found another hugely misleading #FootballIndex statement from the 26/08/20 update: "We& #39;ve successfully weathered the COVID-19 economic storm" (backtracked on in the 05/03/21 update) https://trade.footballindex.co.uk/dividendr... href=" https://trade.footballindex.co.uk/marketupdate-050321/">https://trade.footballindex.co.uk/marketupd...">