It’s been a super tough week for me and I’m sure a super tough week for some of you as well. Here is how I’m doing after Friday and what I’ve learned...

1. The first thing I tried to do yesterday was take a step back and try to see the bigger picture:

i) I looked at March-2020 as a guide and saw that by the end of March-2020, the markets were down 20% but still found a way to fight back. What’s the same? Different?

i) I looked at March-2020 as a guide and saw that by the end of March-2020, the markets were down 20% but still found a way to fight back. What’s the same? Different?

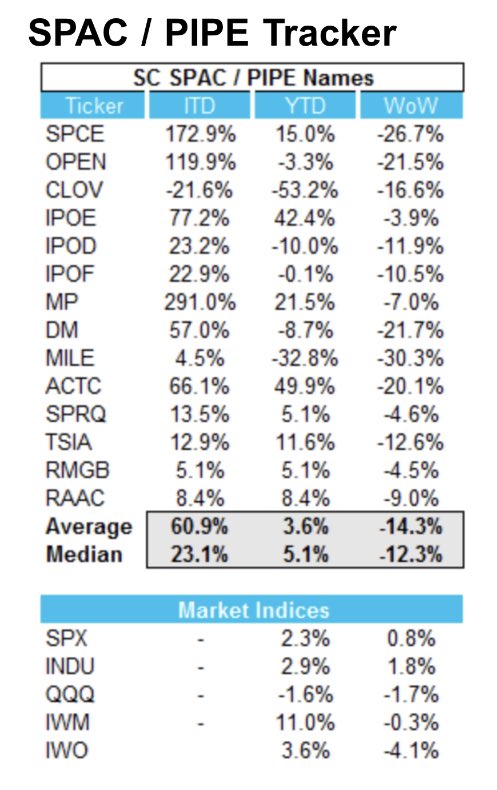

ii) I looked at my relative performance vs the S&P500 - 3.6% vs 2.3% = 56% above the benchmark. I’m no huge fan of being up 3.6% but right now I need to find confidence in this.

iii) I looked at my portfolio and remodeled everything I’m invested in. I’m still proud of it all.

iii) I looked at my portfolio and remodeled everything I’m invested in. I’m still proud of it all.

2) I re-questioned my goals and concluded my strategic view is still right: that inequality and climate change investments are a once in a lifetime opportunity to make hundreds of billions of dollars AND do the right thing.

3) I freed up some capital by selling some shares in $SPCE so I can keep investing at scale without impacting my pace and strategic view. I hated to do it but my balance sheet shrank by almost $2B this week.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥺" title="Pleading face" aria-label="Emoji: Pleading face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥺" title="Pleading face" aria-label="Emoji: Pleading face">

NB: I have not sold any shares of any other SPAC I’ve launched.

NB: I have not sold any shares of any other SPAC I’ve launched.

Anyways, the point is that this stuff is hard and I, like you, am not perfect and trying to learn, be resilient and keep fighting.

Markets, in the near term, are volatile and unforgiving but they ultimately always direct gains to valuable companies doing valuable things.

Markets, in the near term, are volatile and unforgiving but they ultimately always direct gains to valuable companies doing valuable things.

Find a way to make sure you are comfortable with what you own and if not, don’t be afraid to make changes. Prices are temporary but your peace of mind should not be.

If all else fails, remember the Persian adage: “This too shall pass.”

Good luck to everyone. https://abs.twimg.com/emoji/v2/... draggable="false" alt="❤️" title="Rotes Herz" aria-label="Emoji: Rotes Herz">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❤️" title="Rotes Herz" aria-label="Emoji: Rotes Herz"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="❤️" title="Rotes Herz" aria-label="Emoji: Rotes Herz">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❤️" title="Rotes Herz" aria-label="Emoji: Rotes Herz">

If all else fails, remember the Persian adage: “This too shall pass.”

Good luck to everyone.

Read on Twitter

Read on Twitter