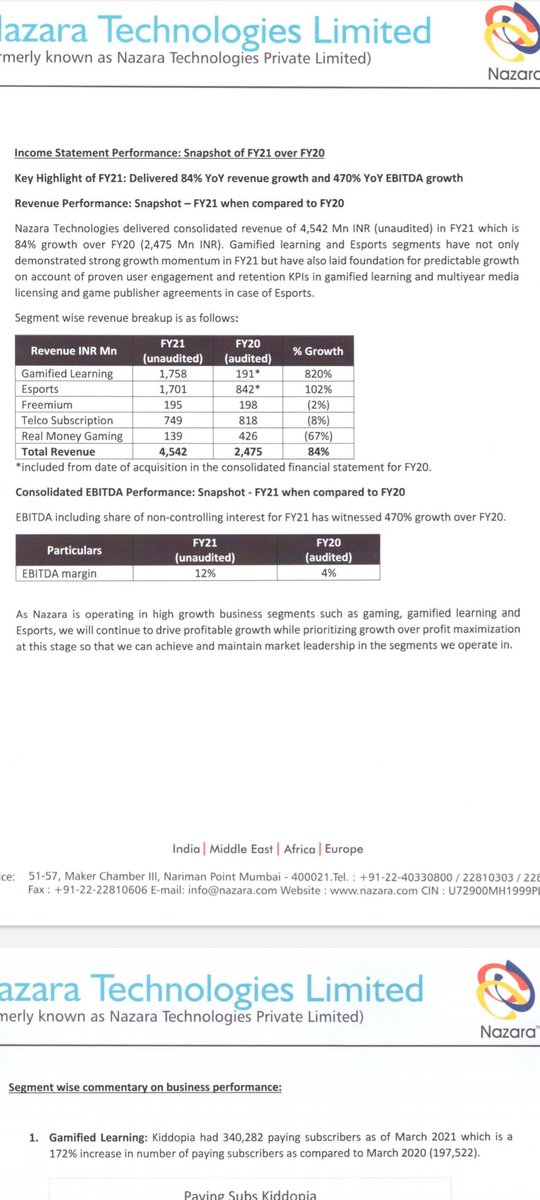

#Nazara& #39;s gamified early learning app, Kiddopia, subscriber base grew from 115,220 paying subscribers in January 2020 at the time of acquisition to 290,508 as of Oct 2020.

Stunning growth!

Another #Nazara subsidiary has 80% market share of Indian industry in esports segment.

Stunning growth!

Another #Nazara subsidiary has 80% market share of Indian industry in esports segment.

#Nazara& #39;s annualised Advertisement & Promotion spends has gone from 27 cr in Fy19 to 238 crores this year. They can easily show significantly higher profits by cutting this marginally but its more about land grab at this point. Market should recognise that and value accordingly.

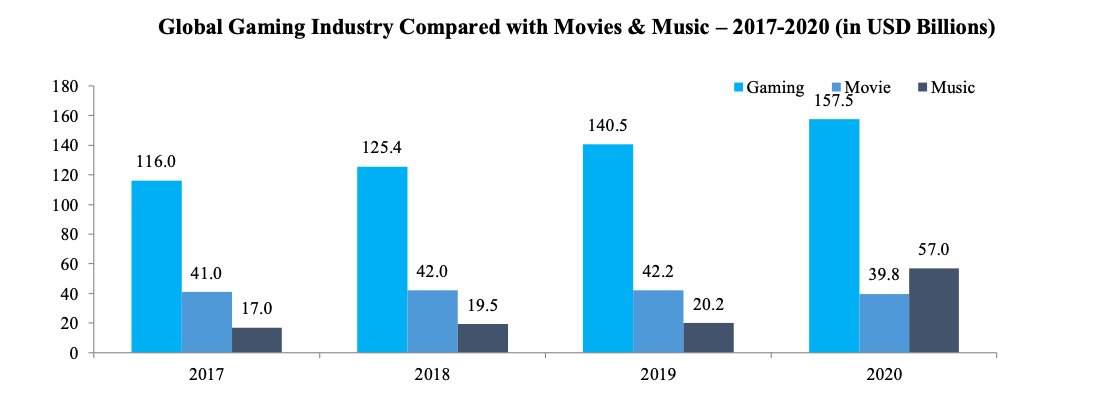

Gaming Vs Movies vs Music, although Movies get most attention due to glamour. But Gaming is bigger than movies and Music combined.

Here& #39;s the size of the glamorous Bollywood Industry vs Gaming Industry, in the race towards audience attention capture, gaming is plummeting Bollywood hands down, with Gaming expected to surpass Bollywood sales by 2023 , no catching up from there for Bollywood.

China& #39;s Gaming revenue in 2020 is $42.6 billion.

USA& #39;s Gaming Revenue at $39 Billion.

India& #39;s Gaming Revenue at $1.5 Billion growing at 32% cagr.

India& #39;s gaming penetration is at 30% vs 50% for China and 66% for US..

Represents a huge opportunity size for all participants.

USA& #39;s Gaming Revenue at $39 Billion.

India& #39;s Gaming Revenue at $1.5 Billion growing at 32% cagr.

India& #39;s gaming penetration is at 30% vs 50% for China and 66% for US..

Represents a huge opportunity size for all participants.

Some great categorical statements made by the management of #Nazara. Tremendous Growth possibilities in the next decade with the high immersion quotient of Gaming. https://economictimes.indiatimes.com/industry/media/entertainment/gaming-is-a-very-exciting-space-at-present-nazara-technologies-nitish-mittersain/articleshow/81362872.cms?from=mdr">https://economictimes.indiatimes.com/industry/...

Of the 40-50 million people engaged on Nazara, the top 10% spend close to 5-6 hours per day on gaming, and the top tier gamers are diversified across age groups.

Thats a massive capture of attention which can be monetized in the future with increasing affordability.

Thats a massive capture of attention which can be monetized in the future with increasing affordability.

More than half of the kids in US play roblox . Its a gaming platform where you can play a host of games, hang out and chat with friends . The company& #39;s valuation have massively surged from from $4bn in Feb 2020 to $20bn in early 2021.

Developer of the huge success story #PUBGmobile South Korean giant Krafton to invest in #Nazara& #39;s esports subsidiary #Nodwin.

Nazara has a more than 50% holding. It has already generated a more than 6x return for Nazara since the acquisition in 2018 https://techcrunch.com/2021/03/08/krafton-pubg-mobile-developer-invests-22-4-million-in-india-nodwin/">https://techcrunch.com/2021/03/0...

Nazara has a more than 50% holding. It has already generated a more than 6x return for Nazara since the acquisition in 2018 https://techcrunch.com/2021/03/08/krafton-pubg-mobile-developer-invests-22-4-million-in-india-nodwin/">https://techcrunch.com/2021/03/0...

“From a business point of view, lifetime gestation cycle in esports is: In Year 1, you’ll lose money, Year 2 you’ll kind of break even,Year 3 you will go get media rights, which will bring is an semblance of profitability, while going ahead & activating footfall, merchandising.

Try and name industries that are growing more than even 10% yoy, very few.

Gaming in India at an industry level is growing at a CAGR of 32% per annum, the best participants in the gaming ecosystem are growing at even faster rates.

Massive opportunity Size!

Gaming in India at an industry level is growing at a CAGR of 32% per annum, the best participants in the gaming ecosystem are growing at even faster rates.

Massive opportunity Size!

Eye Opening Facts:

There are over 200 Million Gamers in India, Gaming is the second most watched sport in India after cricket.

There are over 200 Million Gamers in India, Gaming is the second most watched sport in India after cricket.

The US gaming juggernaut #Roblox to list at a valuation of 30 billion dollars.

Created a unique unparalleled proposition for its developers leading to creation of great content. https://www.cnbc.com/2021/03/09/roblox-ipo-how-game-developers-built-a-30-billion-platform.html">https://www.cnbc.com/2021/03/0...

Created a unique unparalleled proposition for its developers leading to creation of great content. https://www.cnbc.com/2021/03/09/roblox-ipo-how-game-developers-built-a-30-billion-platform.html">https://www.cnbc.com/2021/03/0...

Large Gaming conglomerates have almost 300 to 400 companies under their umbrella, Nazara is also on that path which has just begun with just 12.

It doesnot matter whether growth is organic or inorganic all that matters is to build up the platform with strong network effect.

It doesnot matter whether growth is organic or inorganic all that matters is to build up the platform with strong network effect.

Its better to look at #Nazara similar to a Tencent of pure play Gaming in India, which uses its deep Knowledge of the sector and understanding of Indian Markets due to its long experience of 20 years and the capital allocation that feeds on that and acquires hypergrowth startups.

A simple question would be if you are a young Game developer in India with a promising product & need both capital as well as eyeballs , who will be the best partner for you in India, Nazara would be the best value for them with both a base of 100 million users and cash on books.

If one analyses these companies on traditional metrics ,they will never be able to build conviction to participate, that why we keep talking about Ecosystem analysis

With convergence of

1. Handset penetration

2. Fibre to home

3. online micro payments

opportunity has opened up.

With convergence of

1. Handset penetration

2. Fibre to home

3. online micro payments

opportunity has opened up.

The aim is to create Developer Side Networking effects, Create a platform with such attractiveness that every Game developer would choose to launch through your platform.

Everything else follows from that including scaling monetisation through IAP as well as Ad revenue.

Everything else follows from that including scaling monetisation through IAP as well as Ad revenue.

It takes the large game publishers a $100 million to develop, promote & market a top blockbuster game.

Much cheaper to develop one in India.

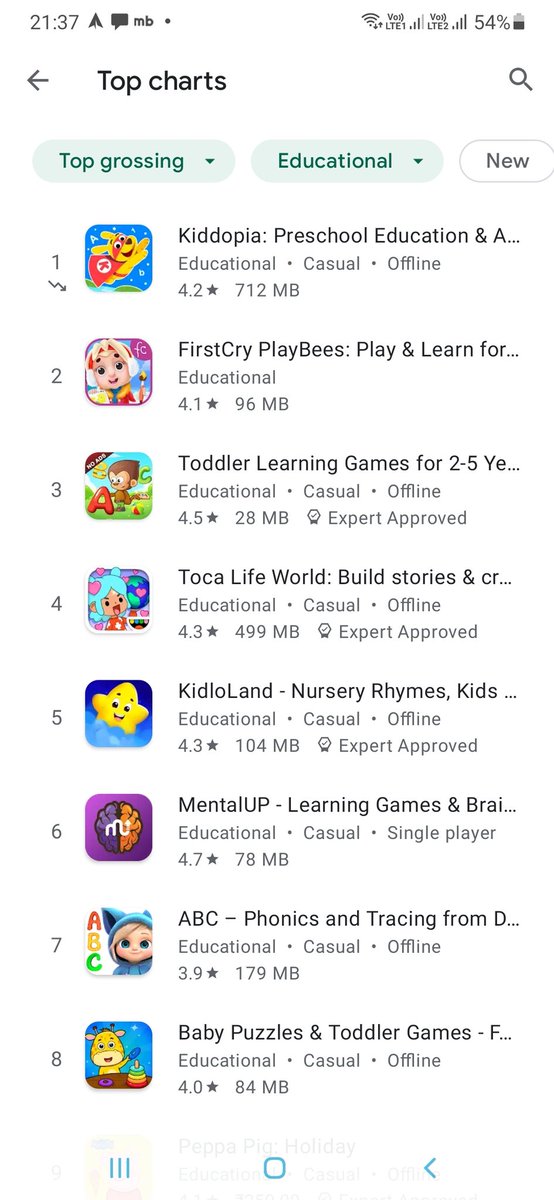

One can value the worth of kiddopia given that its the top grossing app on Google playstore in the educational category with 3x growth yoy.

Much cheaper to develop one in India.

One can value the worth of kiddopia given that its the top grossing app on Google playstore in the educational category with 3x growth yoy.

A company by the name of iHuman inc. which is the closest something comes to kiddopia, recently got listed on NYSE and currently trades at a market cap of close to a Billion Dollars. Kiddopia& #39;s biggest competitor in the US ,ABC is 8x the size of Kiddopia in the US.

Huge Opp Size.

Huge Opp Size.

The management has mentioned that all large companies around the world are choosing the acquisition route. Tencent itself buys successful IP& #39;s abroad takes them to China, localizes it and sells it in China.

Esports as a category over the course of the next decade is slated to be in the top2 sports with cricket in terms of both number of viewers as well as athletes participation.

A context to keep in mind while determining the potential.

A context to keep in mind while determining the potential.

Gaming as a category is habit forming, scalable, lends itself to brand building and can generate huge network effects. To talk about valuations at such early stages of its evolution is why public investors will never get the potential and very few of them will be able to invest.

A wonderful interview with @mittersain of #Nazara throwing light on the tough journey of past 20 years and what lays ahead in terms of creating value for all stakeholders of the company by scaling growth. https://anchor.fm/sinha/episodes/From-Idea-to-IPO-Nazara-Founder--Nitish-Mittersain-on-Staying-Focused-and-Building-a-Great-Business-et4qsg">https://anchor.fm/sinha/epi...

Japan opens its first esports gym at a monthly membership of $50 supported by the very popular League of legends, where players are provided coaching etc. https://www.insider.com/japan-opens-esports-gym-gaming-tokyo-2021-4">https://www.insider.com/japan-ope...

Pubg being relaunched in india in a new avatar, big positive for Nazara esports Subsidiary Nodwin gaming. https://www.google.com/amp/s/m.economictimes.com/tech/technology/pubg-to-relaunch-in-india-as-battleground-mobile-india/amp_articleshow/82425915.cms">https://www.google.com/amp/s/m.e...

Read on Twitter

Read on Twitter