.

For more info, please review our guide: https://link.twitch.tv/taxinfo

Non-US">https://link.twitch.tv/taxinfo&q... 1042-S will be ready by March 15.

To make things easier, here& #39;s a thread of steps to take from start to finish

(1/8)

To start, it& #39;s worth noting that not everyone may receive a form - only Creators who were paid for the following in 2020 will receive a 1099 form:

Service (Cheering & some non-standard revenue): Exceeding $600 paid

Royalty (everything else): Exceeding $10 paid (2/8)

Service (Cheering & some non-standard revenue): Exceeding $600 paid

Royalty (everything else): Exceeding $10 paid (2/8)

If you do not receive a form from us, you may still need to file. Please consult a tax professional for clarity and assistance. (3/8)

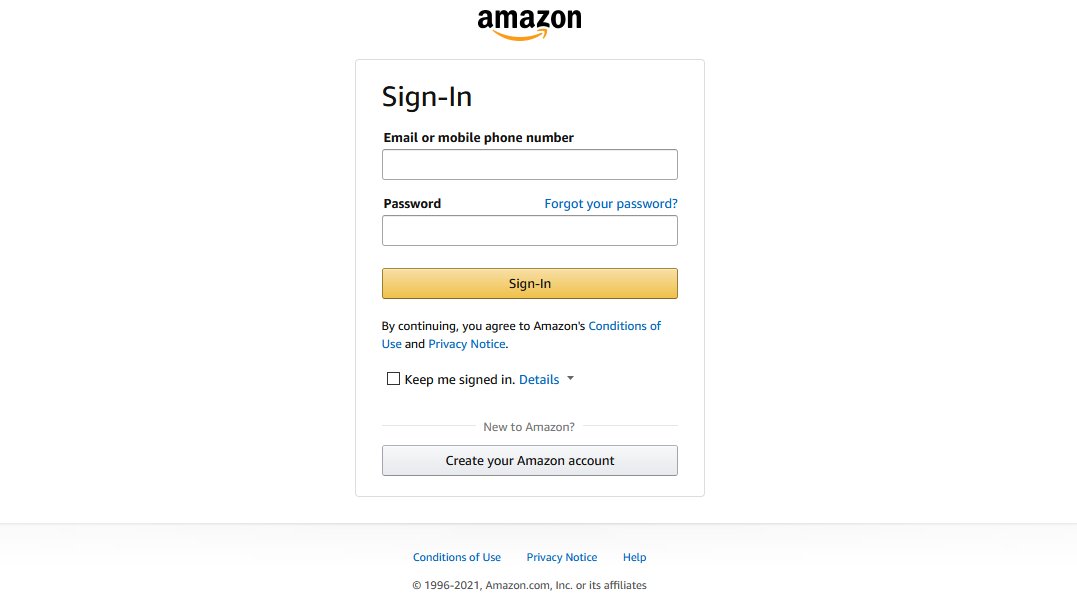

If you& #39;ve never created an Amazon account, click "Create your Amazon account". Here you can enter your email and create a new password. (4/8)

A one-time passcode will be emailed to you for security. You must enter this passcode to complete account registration!

Make sure you check your spam/junk folders and ensure it is the right email address, which again, could be different than your Twitch or Amazon account. (6/8)

Make sure you check your spam/junk folders and ensure it is the right email address, which again, could be different than your Twitch or Amazon account. (6/8)

Log in with your Amazon account and click View/Edit to navigate to the Find Forms (Forms 1099-NEC, 1099-MISC, 1042-S) button in both Royalty and Service for any applicable forms.

You can then select the form for the year you wish to view. (7/8)

You can then select the form for the year you wish to view. (7/8)

For more detailed information and a handy FAQ, please check out our guide:  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📚" title="Bücher" aria-label="Emoji: Bücher"> https://link.twitch.tv/taxinfo

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📚" title="Bücher" aria-label="Emoji: Bücher"> https://link.twitch.tv/taxinfo

We">https://link.twitch.tv/taxinfo&q... highly recommend you work with a tax professional to ensure you are getting the best care possible.

Happy filing! https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Violettes Herz" aria-label="Emoji: Violettes Herz"> (8/8)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Violettes Herz" aria-label="Emoji: Violettes Herz"> (8/8)

We">https://link.twitch.tv/taxinfo&q... highly recommend you work with a tax professional to ensure you are getting the best care possible.

Happy filing!

Read on Twitter

Read on Twitter