Want to save a few hundred grand on a property? Here& #39;s how to hustle your dream house for cheaper [Thread]

Thread covers:

1. Get a grip on price trend

2. Drive asset price lower

3. Access cheaper financing

4. Reduce the acquisition leverage

5. Use a subsidy

6. Weigh up off plan purchases

7. Use a buy-side agent

8. Scrape historic data

9. Check "true" affordability

10. Leverage time

1. Get a grip on price trend

2. Drive asset price lower

3. Access cheaper financing

4. Reduce the acquisition leverage

5. Use a subsidy

6. Weigh up off plan purchases

7. Use a buy-side agent

8. Scrape historic data

9. Check "true" affordability

10. Leverage time

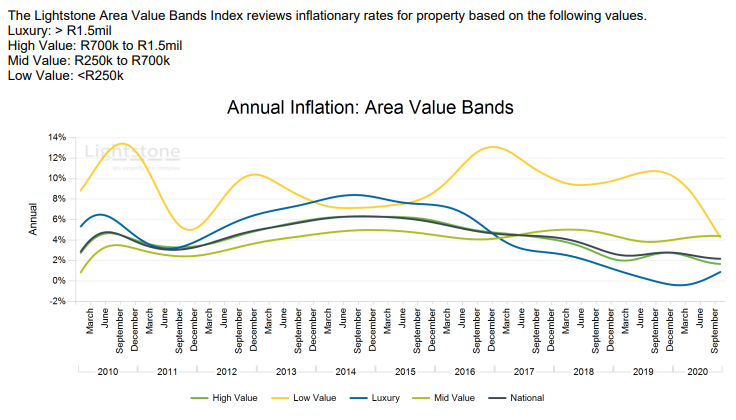

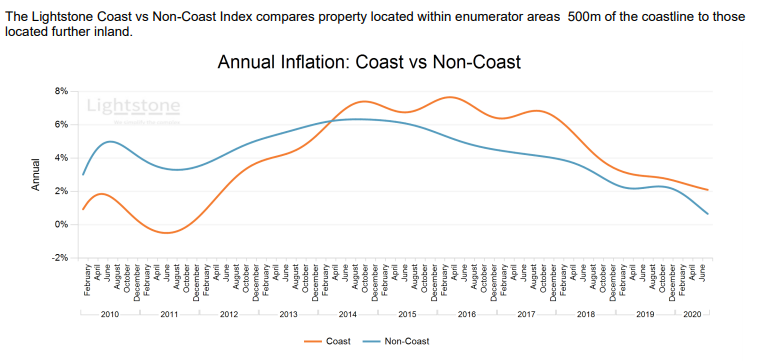

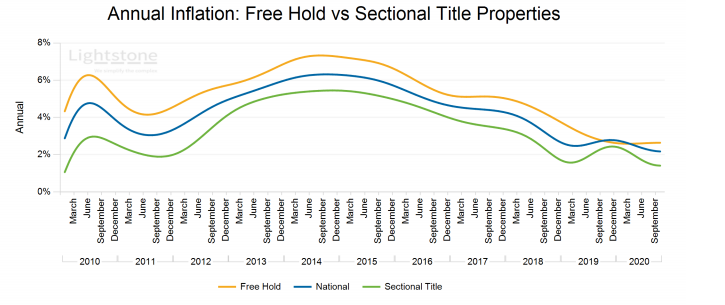

1. Price Trends

Luxury houses (>R1.5m) briefly lost value over the pandemic. Low value houses (<R250k) show the sharpest decline in inflation. Coastal properties hold up slightly better. Both free holds & sectional titles have slower price growth.

Know what you& #39;re buying into.

Luxury houses (>R1.5m) briefly lost value over the pandemic. Low value houses (<R250k) show the sharpest decline in inflation. Coastal properties hold up slightly better. Both free holds & sectional titles have slower price growth.

Know what you& #39;re buying into.

2. Negotiate asset price

When you log onto Property24 don& #39;t panic! That& #39;s not the final house price. At one point only 2% of sellers received their property asking price

Average discount to selling price is 12%. When you lock in an offer to purchase, start at least 20% lower

When you log onto Property24 don& #39;t panic! That& #39;s not the final house price. At one point only 2% of sellers received their property asking price

Average discount to selling price is 12%. When you lock in an offer to purchase, start at least 20% lower

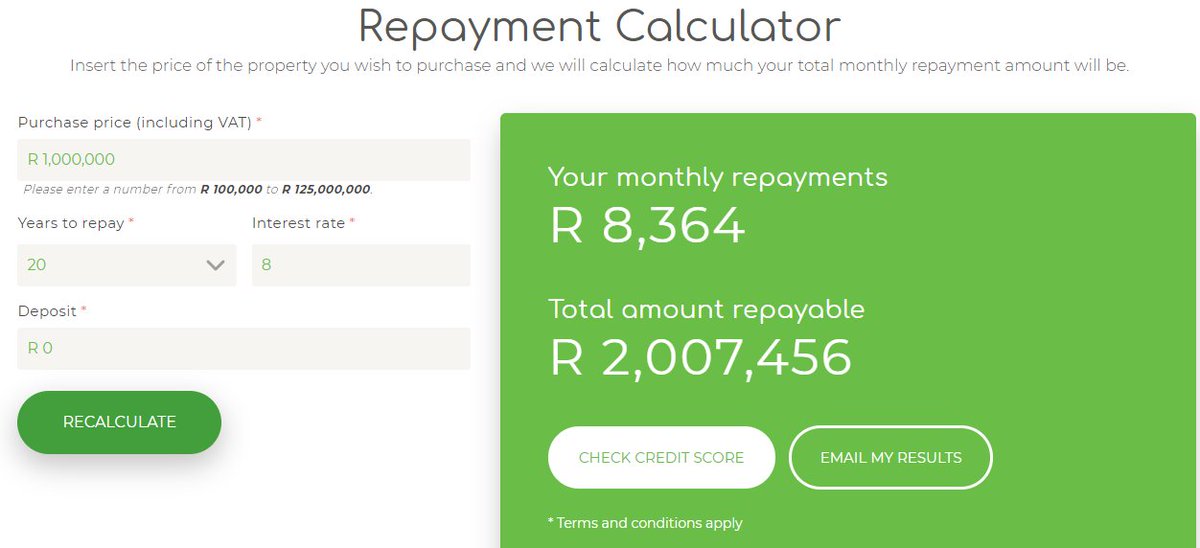

=> Impact of negotiating a lower asset price

On a R1m house, the 15% reduction is R150k at face value... except over the life of the home loan you& #39;re saving R300k.

That& #39;s over 27 years of daily cappuccinos you did not have to cut out through one decision.

On a R1m house, the 15% reduction is R150k at face value... except over the life of the home loan you& #39;re saving R300k.

That& #39;s over 27 years of daily cappuccinos you did not have to cut out through one decision.

3. Access cheaper financing

Banks will try to persuade you not to log multiple applications & tell you it hurts your credit score - the impact is very marginal.

Don& #39;t take the first bank home loan rate you receive. Play banks each other & push for EVERY tiny reduction.

Banks will try to persuade you not to log multiple applications & tell you it hurts your credit score - the impact is very marginal.

Don& #39;t take the first bank home loan rate you receive. Play banks each other & push for EVERY tiny reduction.

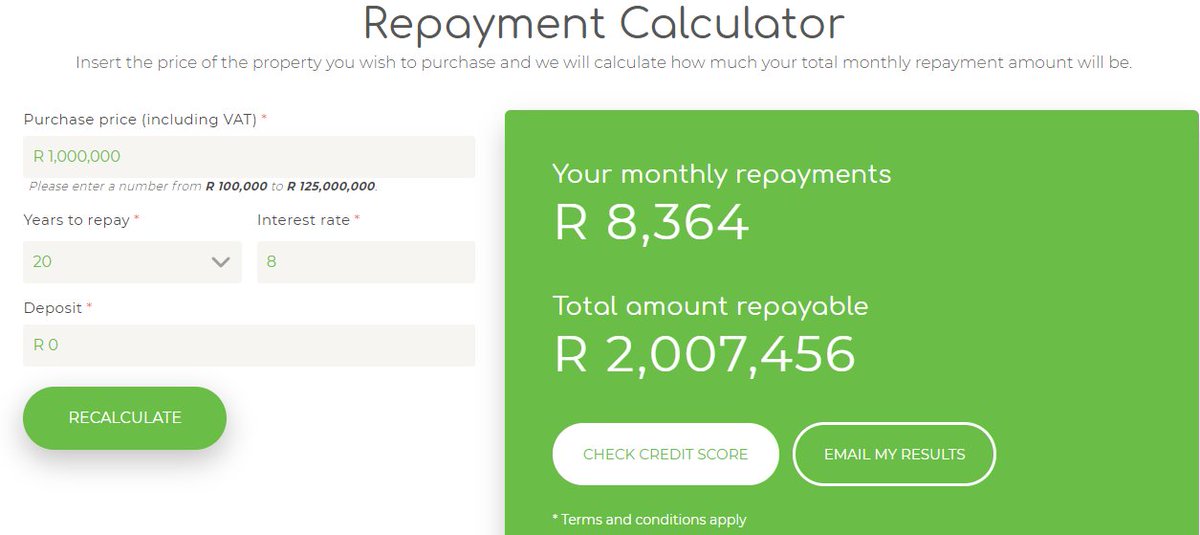

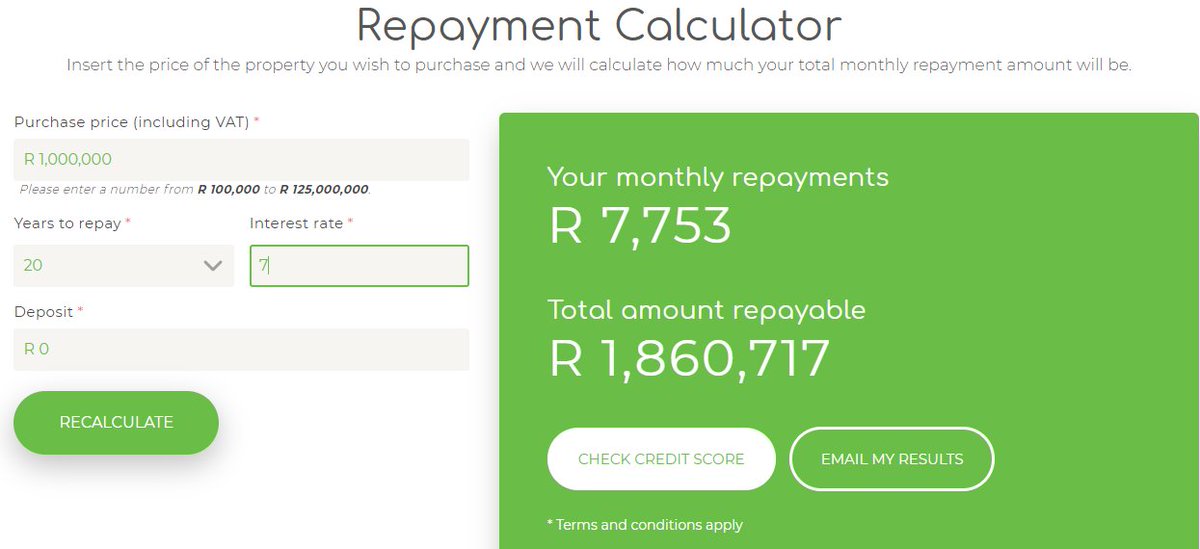

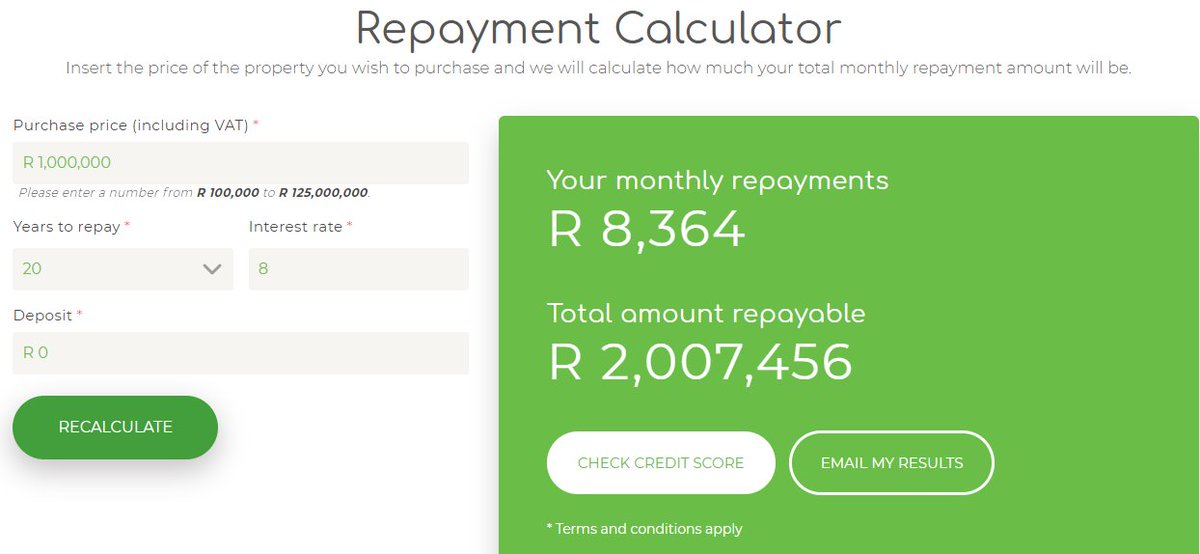

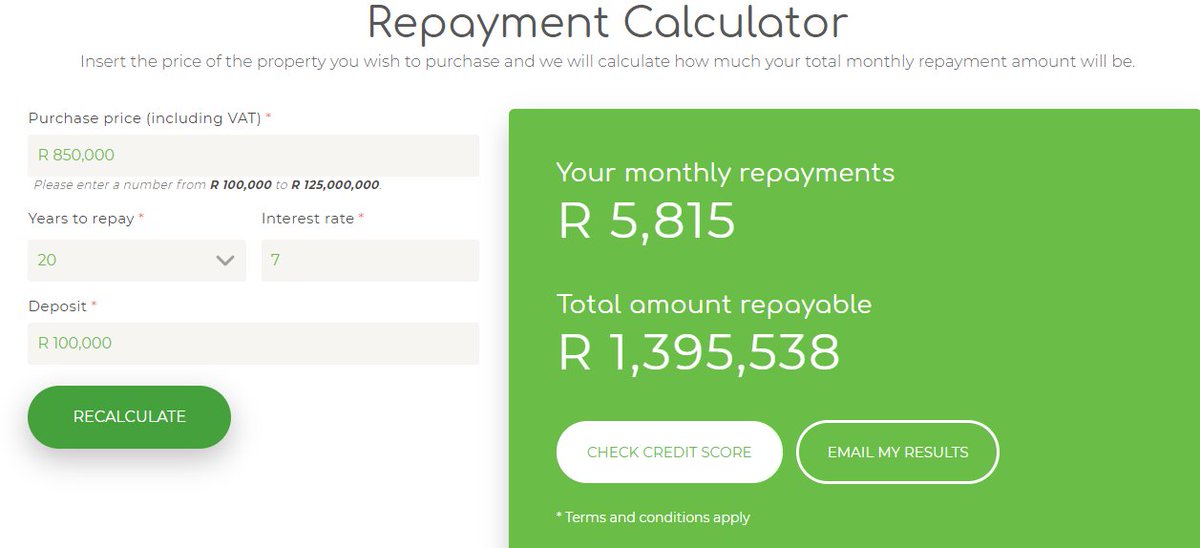

=> Impact of negotiating a lower interest rate

On a R1m house, a 1% interest rate reduction ends in a R140k saving (assuming you did not negotiate the asset price)

That& #39;s over 12 years of daily cappuccinos you did not have to cut out through one decision

On a R1m house, a 1% interest rate reduction ends in a R140k saving (assuming you did not negotiate the asset price)

That& #39;s over 12 years of daily cappuccinos you did not have to cut out through one decision

4. Reduce acquisition leverage

Paying a larger deposit will save you plenty of racks. How much do people pay as deposits?

- R500k- R1m, average deposit is 6.5%

- R1m- R1.5m, average deposit is 2.6%

Banks will offer up 100% financing (no deposit) but that isn& #39;t a good thing

Paying a larger deposit will save you plenty of racks. How much do people pay as deposits?

- R500k- R1m, average deposit is 6.5%

- R1m- R1.5m, average deposit is 2.6%

Banks will offer up 100% financing (no deposit) but that isn& #39;t a good thing

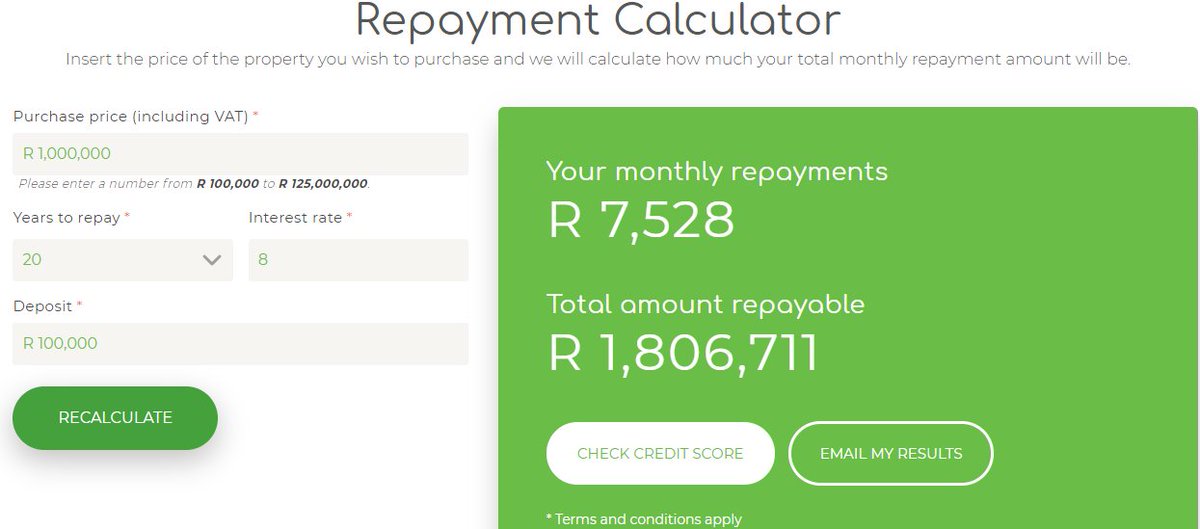

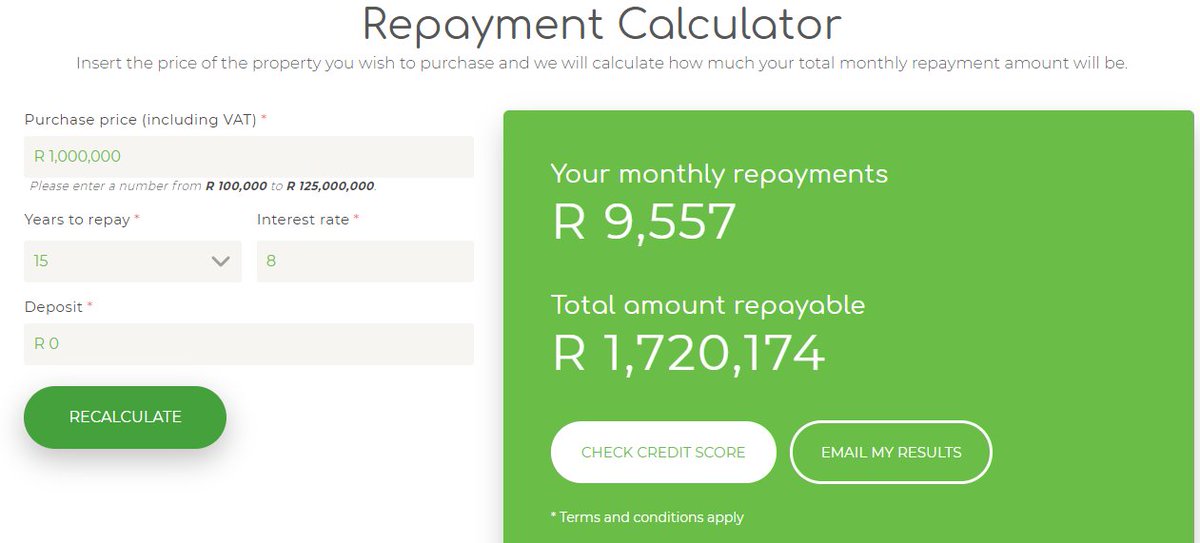

=> Impact of paying a deposit

On a R1m house, a 10% deposit ends in nearly R195k in savings (assuming you did not negotiate anything else)

That& #39;s close to 18 years of daily cappuccinos with one upfront tweak

On a R1m house, a 10% deposit ends in nearly R195k in savings (assuming you did not negotiate anything else)

That& #39;s close to 18 years of daily cappuccinos with one upfront tweak

=> putting it all together on a R1m house

- Negotiate house price down by 15%

- Reduce interest rate by 1%

- Pay a 10% deposit

BOOM! R600k

55 years of cappuccinos right there

That& #39;s R600k that can go towards a second property. Every decision here was made upfront

- Negotiate house price down by 15%

- Reduce interest rate by 1%

- Pay a 10% deposit

BOOM! R600k

55 years of cappuccinos right there

That& #39;s R600k that can go towards a second property. Every decision here was made upfront

5. Use a subsidy

There& #39;s a chance you qualify for a housing subsidy. In South Africa, FLISP is a great one to check out. Here& #39;s a useful @Banker__X thread: https://twitter.com/Banker__X/status/1325375154512334848?s=20">https://twitter.com/Banker__X...

There& #39;s a chance you qualify for a housing subsidy. In South Africa, FLISP is a great one to check out. Here& #39;s a useful @Banker__X thread: https://twitter.com/Banker__X/status/1325375154512334848?s=20">https://twitter.com/Banker__X...

6. Weigh up off-plan purchases

Typically by buying into a new development VAT is included in the purchase price and you save on transfer duties.

Be very careful of charlatan developers, research their history, ask questions about occupational rent & really inspect the finishes!

Typically by buying into a new development VAT is included in the purchase price and you save on transfer duties.

Be very careful of charlatan developers, research their history, ask questions about occupational rent & really inspect the finishes!

7. Use a buy-side agent

Agents are paid fees by the seller and they& #39;re incentivized to push a sale & not necessarily what& #39;s best for you as a buyer.

You can hire out an experienced agent to consult for you as a buyer. It may end up being the best couple of grand you spend.

Agents are paid fees by the seller and they& #39;re incentivized to push a sale & not necessarily what& #39;s best for you as a buyer.

You can hire out an experienced agent to consult for you as a buyer. It may end up being the best couple of grand you spend.

8. Scrape historic data

You can pull a registry of past property sales, how many people have moved out of the complex and compare prices in the same suburb.

This will give you the ammo for strong negotiating.

A great resource is Lightstone:

https://lightstoneproperty.co.za/OnlinePropertyReports.aspx">https://lightstoneproperty.co.za/OnlinePro...

You can pull a registry of past property sales, how many people have moved out of the complex and compare prices in the same suburb.

This will give you the ammo for strong negotiating.

A great resource is Lightstone:

https://lightstoneproperty.co.za/OnlinePropertyReports.aspx">https://lightstoneproperty.co.za/OnlinePro...

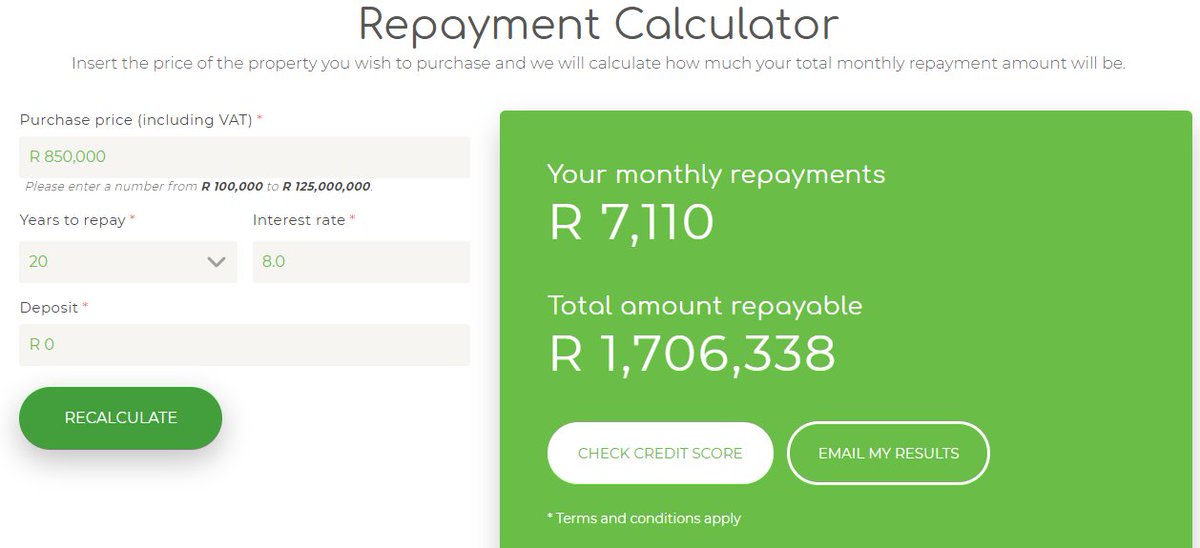

9. Check "true" affordability

Qualifying doesn& #39;t mean affordability

Being eligible for a home loan is a great but once you overlay rates, levies, maintenance, insurance, utilities and security, costs rack up quickly!

Add 40% onto your bond and see if you& #39;re still comfortable

Qualifying doesn& #39;t mean affordability

Being eligible for a home loan is a great but once you overlay rates, levies, maintenance, insurance, utilities and security, costs rack up quickly!

Add 40% onto your bond and see if you& #39;re still comfortable

10. Take your time

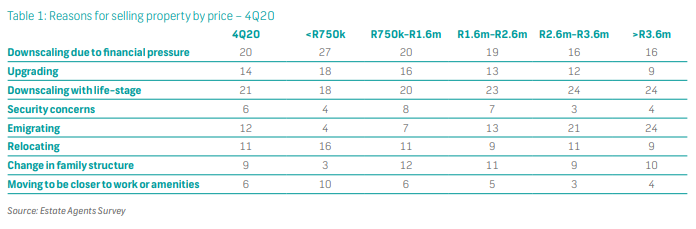

Average house in SA spends 9.4 weeks on the market, some houses spend FAR longer listed. The longer the listing period, the better you bargaining strength.

Find out why people are selling. Check if it& #39;s a high crime area vs. the owner downsizing.

Average house in SA spends 9.4 weeks on the market, some houses spend FAR longer listed. The longer the listing period, the better you bargaining strength.

Find out why people are selling. Check if it& #39;s a high crime area vs. the owner downsizing.

=> This is exciting. Does it really work? Yes https://twitter.com/Sithembile00/status/1346735642471002112?s=20">https://twitter.com/Sithembil...

=> Links to more useful property resources (threadception) https://twitter.com/iamkoshiek/status/1286328317042462724?s=20">https://twitter.com/iamkoshie...

Additional note:

You can pay off a home loan in less than 20 years & this will also save you massively in interest payments. Check with the bank what the "prepayment penalty" is. Banks will charge you for paying off a bond earlier than the pre-agreed time frame.

Bastards.

You can pay off a home loan in less than 20 years & this will also save you massively in interest payments. Check with the bank what the "prepayment penalty" is. Banks will charge you for paying off a bond earlier than the pre-agreed time frame.

Bastards.

=> Useful resources ++ source links

Sector data: https://www.fnb.co.za/economics-commentary/

Residential">https://www.fnb.co.za/economics... property data: https://lightstoneproperty.co.za/propertyinfo.aspx

Pricing">https://lightstoneproperty.co.za/propertyi... calculator:

https://www.ooba.co.za/home-loan/bond-repayment-calculator/

Additional">https://www.ooba.co.za/home-loan... sector insights: https://www.myproperty.co.za/tools/property-index">https://www.myproperty.co.za/tools/pro...

Sector data: https://www.fnb.co.za/economics-commentary/

Residential">https://www.fnb.co.za/economics... property data: https://lightstoneproperty.co.za/propertyinfo.aspx

Pricing">https://lightstoneproperty.co.za/propertyi... calculator:

https://www.ooba.co.za/home-loan/bond-repayment-calculator/

Additional">https://www.ooba.co.za/home-loan... sector insights: https://www.myproperty.co.za/tools/property-index">https://www.myproperty.co.za/tools/pro...

For daily stock market updates, useful finance threads & terrible jokes. Feel free to join our Telegram channel.

Link: https://t.me/BankerX ">https://t.me/BankerX&q...

Link: https://t.me/BankerX ">https://t.me/BankerX&q...

If you& #39;re planning on renting a property:

- Check if there& #39;s a discount for upfront payment

- Make sure the owner is putting your deposit in an interest bearing deposit account

- Check what the escalation is each year, might be cheap now but really expensive next year

- Check if there& #39;s a discount for upfront payment

- Make sure the owner is putting your deposit in an interest bearing deposit account

- Check what the escalation is each year, might be cheap now but really expensive next year

Shout-out for making it to the end. I appreciate you!

Read on Twitter

Read on Twitter