Have decided to upload my weekly PnL status.

Reason: Currently, the single biggest fear/threat I pose is to drift away from my consistent #trading behavior which I am can see in me from mid November. In this 2.5 months, I have gone into "gamble" for a couple of time. (1/n)

Reason: Currently, the single biggest fear/threat I pose is to drift away from my consistent #trading behavior which I am can see in me from mid November. In this 2.5 months, I have gone into "gamble" for a couple of time. (1/n)

I didn& #39;t lose much. But, as #traders, we can agree to this that what destroys is not that you went to G-mode, but the feeling of coming back to square one! I am not sure how posting weekly PnL will help, actually. Well, I will just go with the flow for now.

#tradingpsychology

#tradingpsychology

Few negative or area of improvements I need:

1) To sustain the urge of trading until all the check box are not ticked.

2) Charges are ~22% of my #profits which is not good. (sign of #overtrading or trading before ALL conditions are met)

#TRADINGTIPS

1) To sustain the urge of trading until all the check box are not ticked.

2) Charges are ~22% of my #profits which is not good. (sign of #overtrading or trading before ALL conditions are met)

#TRADINGTIPS

P.s I mostly do #OptionsTrading (1 lot). Only select cash segment for FnO stocks when lot size is more than 3000 qty. Cash segment has a #profit of 400Rs for this week.

Will update weekly status in this tweet only.

Will update weekly status in this tweet only.

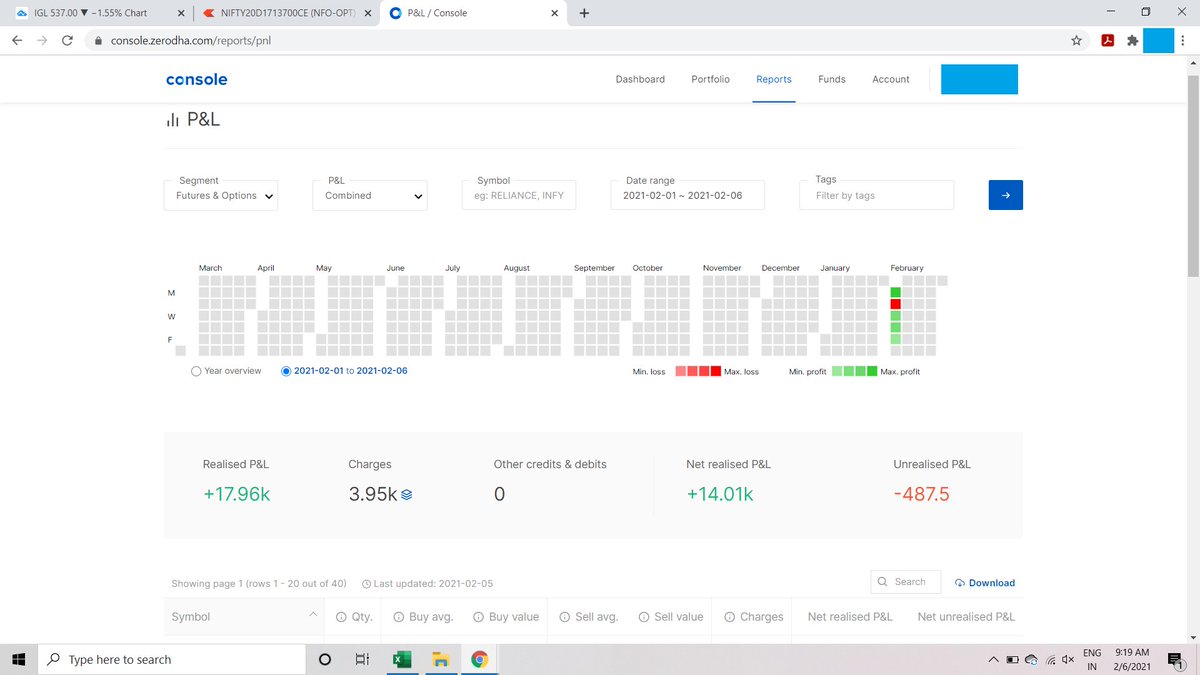

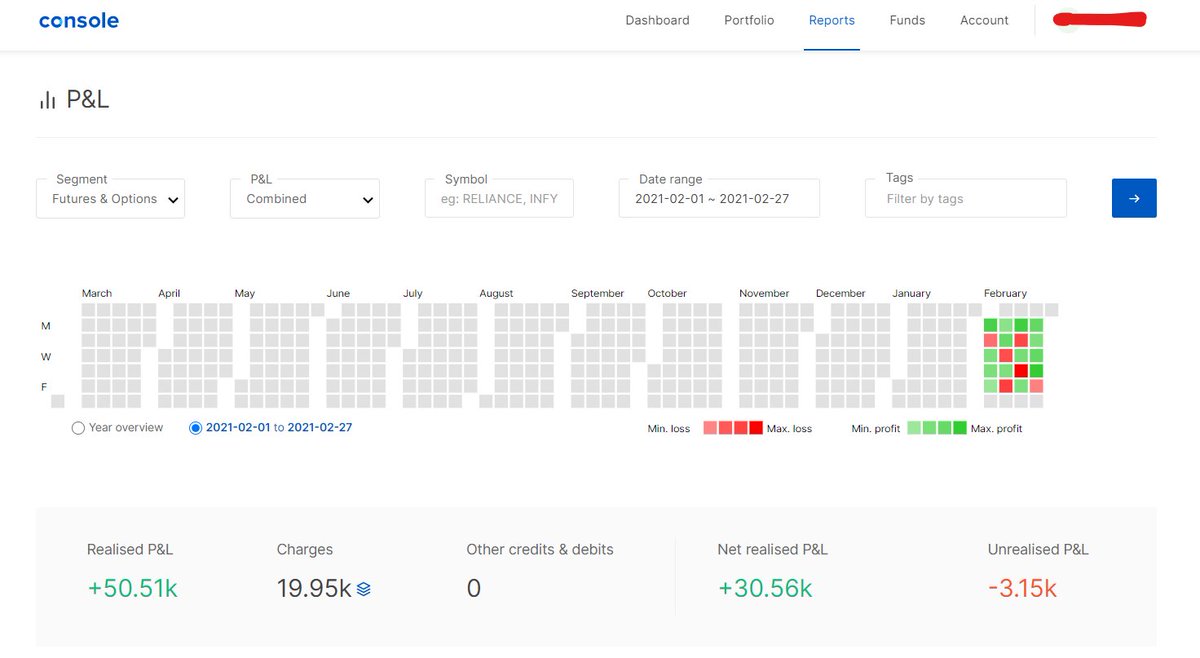

February 2021, 2nd week.

Ended the week on negative profile.

Observations: My enemy is not loss making trades now. It is overtrading. And that is clearly reflecting on charges and the main reason of loss!

The things, I trust my setup immensely. So I tend to take every trade 1/n

Ended the week on negative profile.

Observations: My enemy is not loss making trades now. It is overtrading. And that is clearly reflecting on charges and the main reason of loss!

The things, I trust my setup immensely. So I tend to take every trade 1/n

which gets triggered. I have added a 2 more filters to it.

Also, have kept a threshold of 5 trades per day. Lets see if I can follow it.

The third thing I have done is to cut down on my watchlist whose lot size in option is more than 3500

All the best to myself for next week! https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">

Also, have kept a threshold of 5 trades per day. Lets see if I can follow it.

The third thing I have done is to cut down on my watchlist whose lot size in option is more than 3500

All the best to myself for next week!

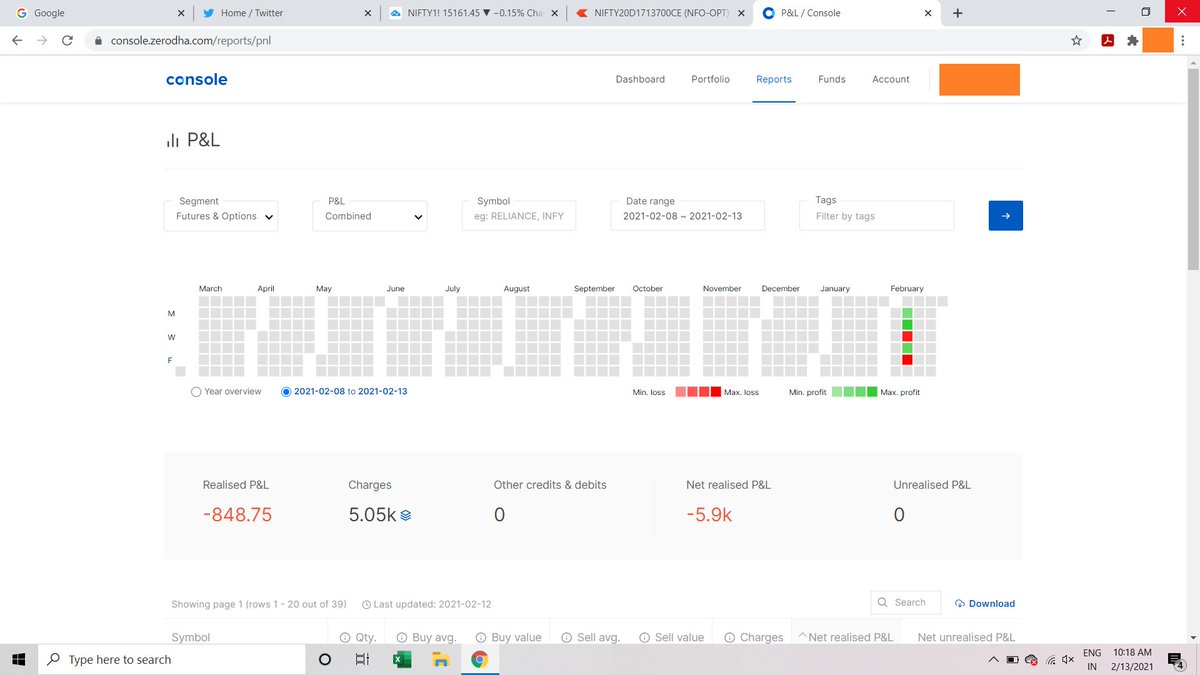

February 3rd week, 2021

Ended again loss :(

I was in good profit in greens and good loss in reds.

Reasons for profits: Good markets (of course!), followed my process, booked out when i got my targeted profits. Did not broke any rule.

Reasons for losses: Choppy markets, 1/n

Ended again loss :(

I was in good profit in greens and good loss in reds.

Reasons for profits: Good markets (of course!), followed my process, booked out when i got my targeted profits. Did not broke any rule.

Reasons for losses: Choppy markets, 1/n

DID NOT FOLLOWED MY PROCESS! Did not booked out profits once they met my targets! AND BROKE ALL THE DAMN RULES I HAD EVER! Took some random trades. Well, all in all, Feb month is turning out to be a not so good month for me. Lets hope, I end in green in the end.

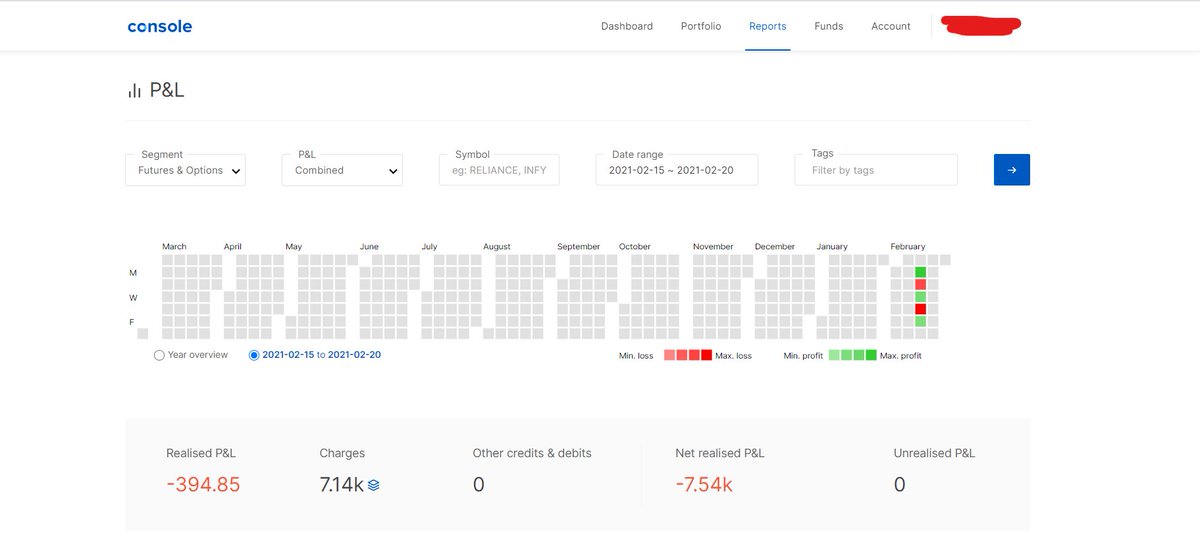

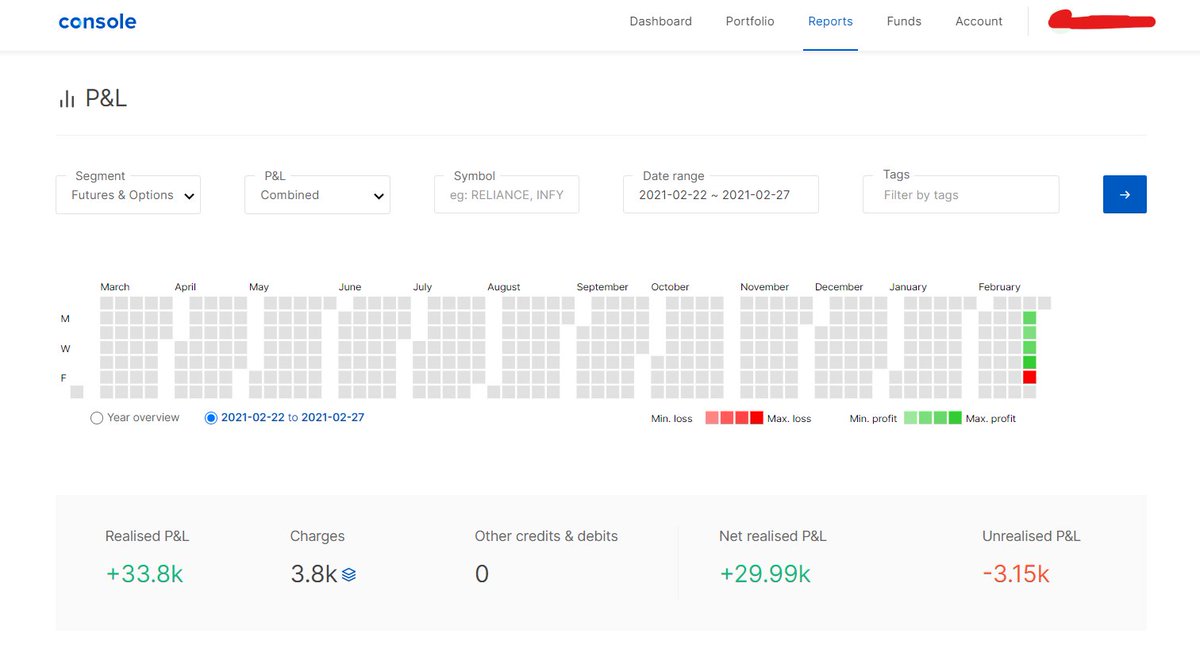

#February 4th week and Feb @2021.

Finally the week and the month ended! And I am in green. Third month to be in #green! Cheers to me! https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">

The charges in the last week has been the lowest so far. Yet its too much! Statistically speaking, then per day roughly there have been 1/n

Finally the week and the month ended! And I am in green. Third month to be in #green! Cheers to me!

The charges in the last week has been the lowest so far. Yet its too much! Statistically speaking, then per day roughly there have been 1/n

orders. Lets round it of to 20. So per day, I trade 10 times. Now I wouldn& #39;t have complained if this 10 trades would have been as per my setup and style. But ~4 trades from this would have been & #39;random& #39; or I knew that they have not met ALL the conditions but i still traded it 2/n

Eventually my goal is to have less than 3 #trades (6 punches) in a day! I am still very far from that zen stage. I can probably do it for a day or two but & #39; #consistency& #39; ka hi toh sab khel hai bhaiyo aur behno! Feb month was bad for me psychologically since i took many random 3/n

trades because of which i gave my profits back. Good #profit back! Out of 5 red, 3 red days are due to my rule breaking

Few learnings or plus/negative points:

-When market was 4% down tomorrow or once or twice when market was super up, i didn& #39;t trade much. Because hardly any 4/n

Few learnings or plus/negative points:

-When market was 4% down tomorrow or once or twice when market was super up, i didn& #39;t trade much. Because hardly any 4/n

trades got triggered. So its good, right. Idc about market as a whole. I will trade only when my trades will be triggered

-Although I took random trades other days so bleh. +point and -point are netted off

-I am conscious of my trade numbers and i actively try to lessen them 5/n

-Although I took random trades other days so bleh. +point and -point are netted off

-I am conscious of my trade numbers and i actively try to lessen them 5/n

-Even when i took random trade, i did not let the loss exceed my limits. I would immediately exit. Only once, it exceed my limit and i booked 4.8k loss (it was cummins long trade above 800. It reversed with a god speed!) (normally i get out at 2k to 2.5k no matter what)

-I am consciously letting my profit run. Now, I dont let it run till the end. lol i still am not that #psychologically equipped. But I am not exiting like i used to (If i get 3-4k profit per trade, i would exit previously) I am slightlyyyyyyyyy becoming more flexible. So good 6/n

-Although i decided to not trade #index henceforth, i entered a couple of times and i am breaking rules thereby. Sad :(

-Overall i am avoiding index completely. I just dont look at index #charts. I only guage the #bullishness and #bearishness as per #market breadth.

-Overall i am avoiding index completely. I just dont look at index #charts. I only guage the #bullishness and #bearishness as per #market breadth.

Well. All the best for March 2021 to me!

p.s. Unrealized loss of 3.15k is of Coal india debit spread. I have carried forward it. lets see.

#Trading #tradingpsychology #Traders

p.s. Unrealized loss of 3.15k is of Coal india debit spread. I have carried forward it. lets see.

#Trading #tradingpsychology #Traders

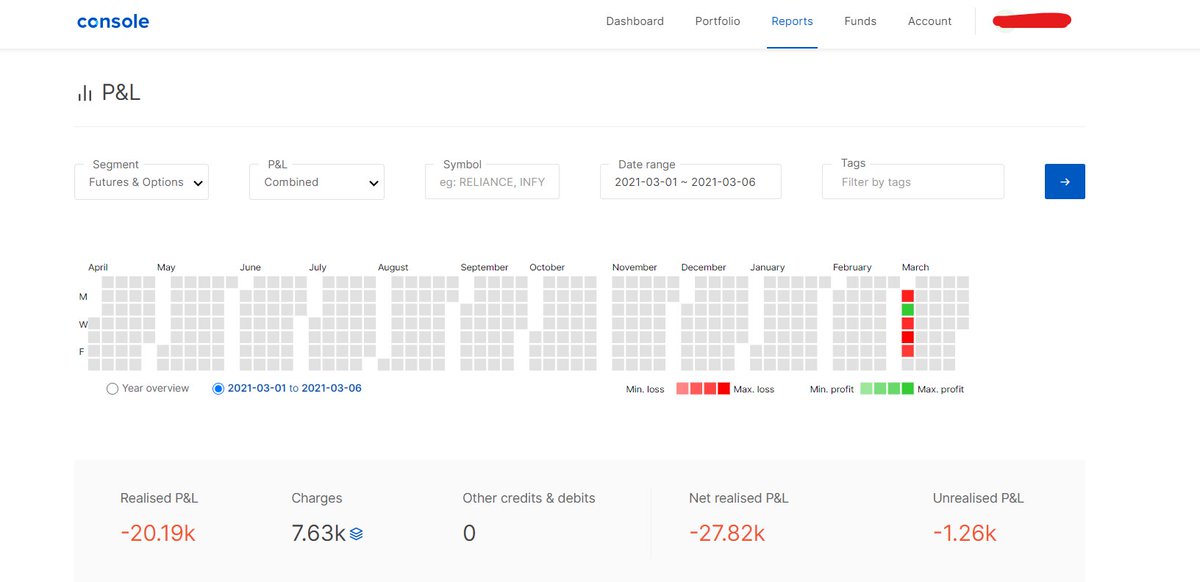

March 2021, 1st week.

Very very bad week for me.

I took trades in DLF and MGL. But the mistake i did, was i traded in odd strikes. Unluckily, after I entered, these 2 reversed very very fast in 2 minutes, and the I had to exit with heavy loss in bcz of wide bid-ask spread. 1/n

Very very bad week for me.

I took trades in DLF and MGL. But the mistake i did, was i traded in odd strikes. Unluckily, after I entered, these 2 reversed very very fast in 2 minutes, and the I had to exit with heavy loss in bcz of wide bid-ask spread. 1/n

The trades which followed after this, were slightly compromised. Couldn& #39;t book the profits timely. Basically, I lost my cool. A little soothing effect was of Heranba allotment haha. Anyway, have slightly modified the rules of exit. Lets hope, next week would be profitable! Bye.

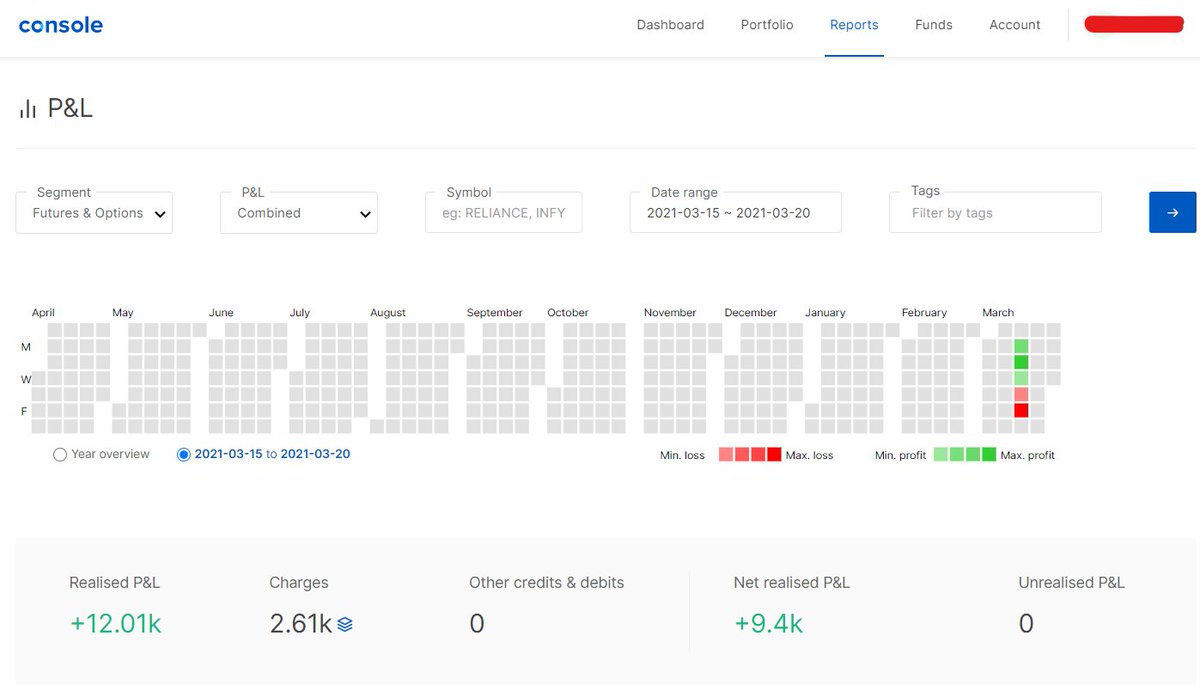

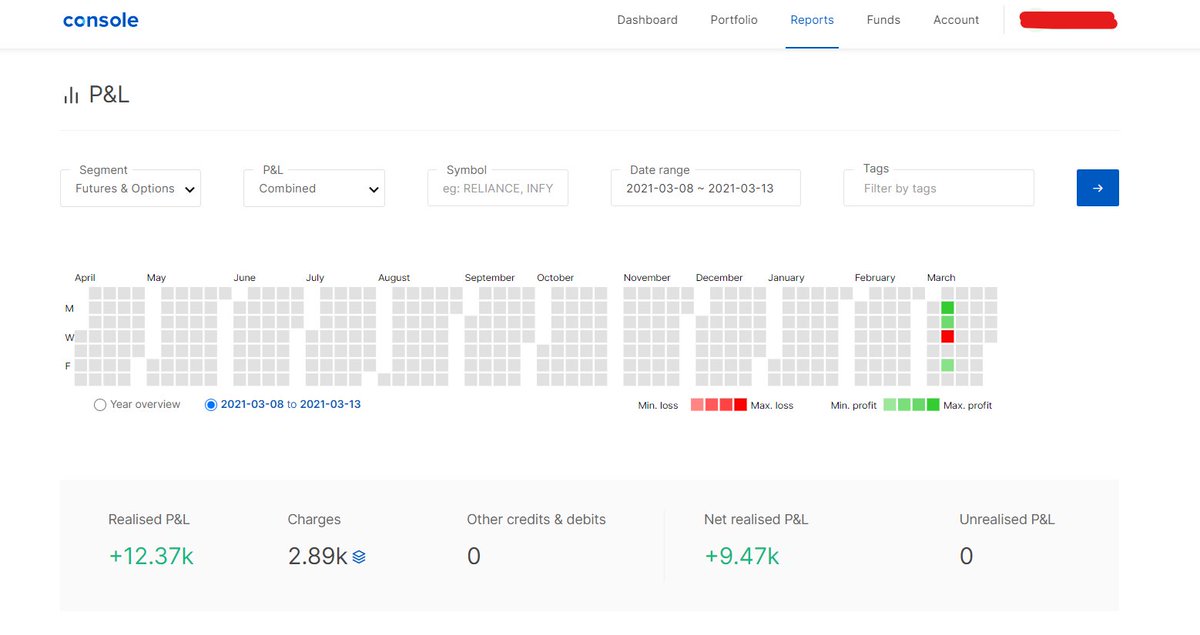

March 2nd week, 2021

Decent week.

March is turning out to be very difficult to trade. Although my setup works in range market also, but still the accuracy and strike falls considerably! Jaldi se trending move aa jaou! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥲" title="Smiling face with tear" aria-label="Emoji: Smiling face with tear">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥲" title="Smiling face with tear" aria-label="Emoji: Smiling face with tear"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Laut schreiendes Gesicht" aria-label="Emoji: Laut schreiendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Laut schreiendes Gesicht" aria-label="Emoji: Laut schreiendes Gesicht">

-Number of punches were below 15 average!

1/n

Decent week.

March is turning out to be very difficult to trade. Although my setup works in range market also, but still the accuracy and strike falls considerably! Jaldi se trending move aa jaou!

-Number of punches were below 15 average!

1/n

For me, its quite a good thing to come from 20 to 15. Now goal is to bring it to 10 till April end.

Please note, 15/20 includes trades which did not tick all checks and still I entered. I have no problem if punches are more than 100 IF all the conditions are met!

2/n

Please note, 15/20 includes trades which did not tick all checks and still I entered. I have no problem if punches are more than 100 IF all the conditions are met!

2/n

Lets hope to end March 2021 in green! Bye Bye! see you next week!

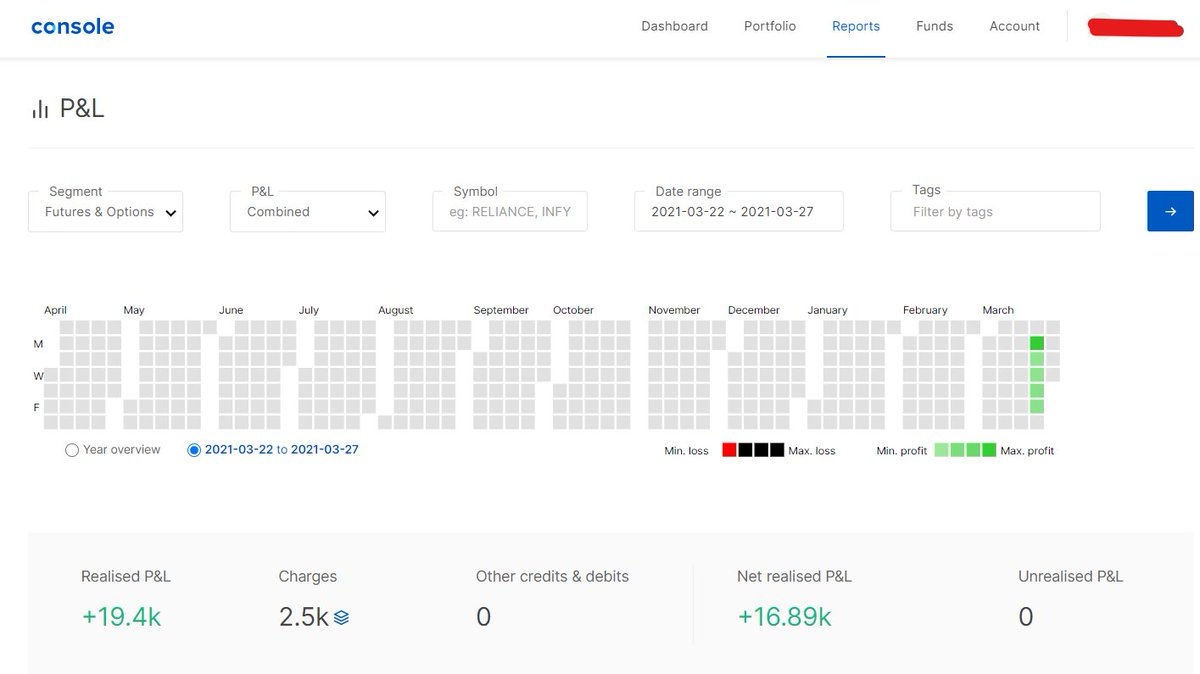

March 3rd week, 2021

Good points-Charges lesser than last week. Dropping consistently week by week.

-Ended in green. Even in such brutal market. hehe. Slightly proud feeling :)

Bad points-Decided not to trade on Wednesday due to some work. But couldn& #39;t control compulsive 1/n

Good points-Charges lesser than last week. Dropping consistently week by week.

-Ended in green. Even in such brutal market. hehe. Slightly proud feeling :)

Bad points-Decided not to trade on Wednesday due to some work. But couldn& #39;t control compulsive 1/n

trading element in me :(

-Took 2 trades which did not fulfil all the conditions. Gave me minor losses

Overall a decent week.

Its a tough war! I just might be able to end March in green! But no pressures! Hua toh thik or else, its business :) No issues! I survived March 2021!

-Took 2 trades which did not fulfil all the conditions. Gave me minor losses

Overall a decent week.

Its a tough war! I just might be able to end March in green! But no pressures! Hua toh thik or else, its business :) No issues! I survived March 2021!

Btw, Currently I am in loss of 7k for March 2021. And this is actually due to my charges in first week :( Overall I am in profit but due to overtrading in 1st week I am in loss!

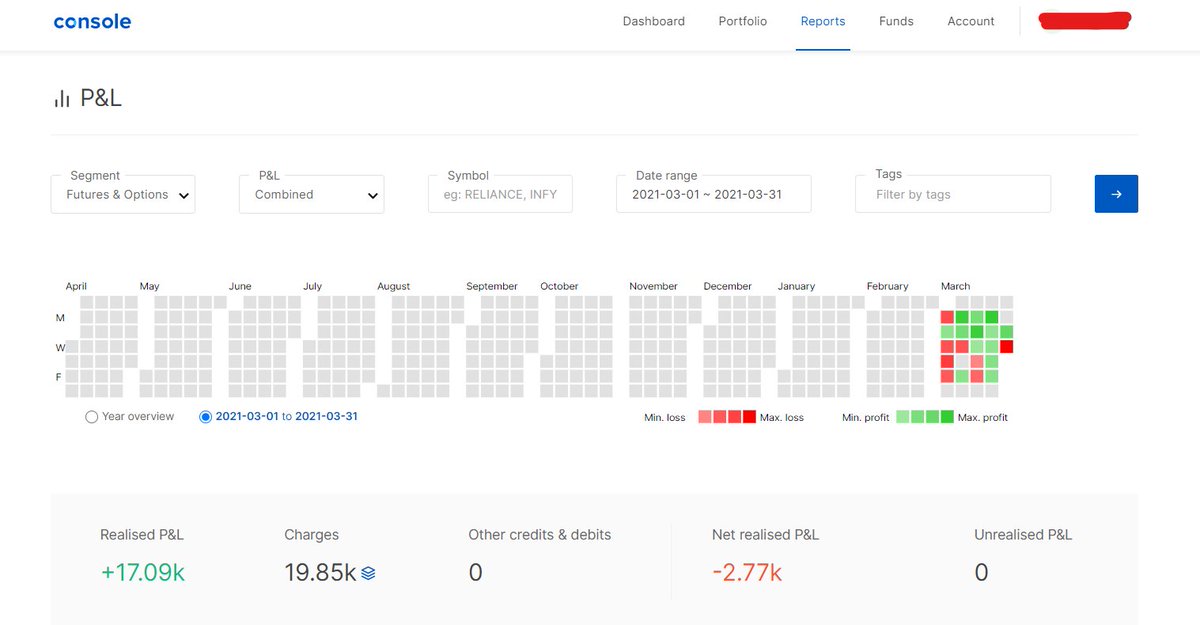

Week 4, March 2021.

Good points - Charges lower than previous month! although just Rs.100, but its coming down and thus my number of trades as well!

Came out profitable in probably one of the most volatile week in recent times! worth appreciating! No bad points as such 1/2

Good points - Charges lower than previous month! although just Rs.100, but its coming down and thus my number of trades as well!

Came out profitable in probably one of the most volatile week in recent times! worth appreciating! No bad points as such 1/2

except that I get really bored when my trades dont trigger! which makes me anxious (Yes I have a huge anxiety issues. in and out of the market as well!) But anyway, I am definitely doing good! March has still 3 days to go. Hopefully my streak continues and I end in green!

Bye

Bye

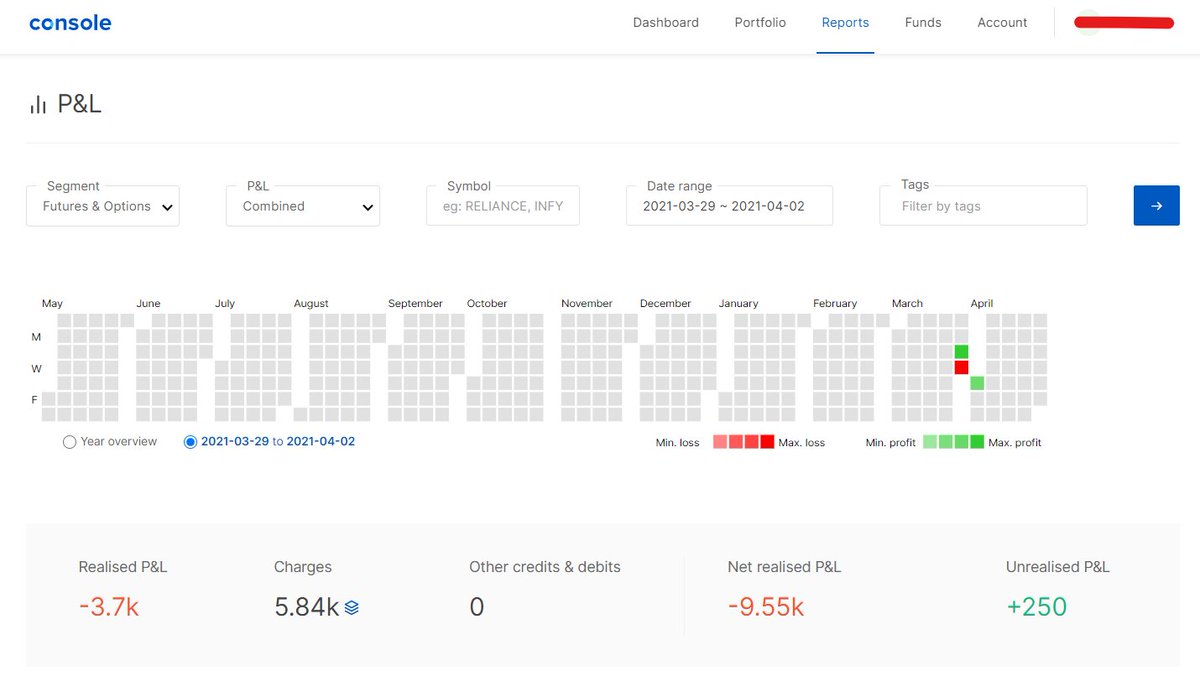

March 2021 and Week 1 of #April expiry

-Ended #March in red! Well technically I am in small green due to my Heberna #IPO allotment but I am not counting it. Last week I was very happy when I thought I would end in green when most #Traders would be in red. Well and here I m 1/n

-Ended #March in red! Well technically I am in small green due to my Heberna #IPO allotment but I am not counting it. Last week I was very happy when I thought I would end in green when most #Traders would be in red. Well and here I m 1/n

Bad points- Lost my cool, #overtraded like anything! (quite noticeable from the charges! Fuck!)

-Took tons and tons of random trading! (damn I hate it!)

-Was definitely getting vibes that I should not trade the week, but my #temptation was greater than my #discipline 2/n

-Took tons and tons of random trading! (damn I hate it!)

-Was definitely getting vibes that I should not trade the week, but my #temptation was greater than my #discipline 2/n

-Slightly getting self doubts again. Well thats obvious I guess!

Good points- Not once I was over leveraged! Although I took shitload of trades but subconsciously, never more than 2 at a single time. So even though I was lost, I was still aware of risk management! 3/n

Good points- Not once I was over leveraged! Although I took shitload of trades but subconsciously, never more than 2 at a single time. So even though I was lost, I was still aware of risk management! 3/n

Yes, it was crap management! I agree, but hey, it happens, alright!

-Other than that. No good points! Stupid week!

Reasons for mishap: I was in winning streak for 6 days. And eventually, the first trade on Wed turned out to be a loss! and the second too. 4/n

-Other than that. No good points! Stupid week!

Reasons for mishap: I was in winning streak for 6 days. And eventually, the first trade on Wed turned out to be a loss! and the second too. 4/n

I should have packed up and closed the day! But the "want" of maintaining the streak was so damn high and lucrative... that I ended up in a type of " #revenge trading" whereby my motive was not to recover my loss, but it was to be in green! Its similar but its different. 5/n

Moral: The #desire to be in #green was the reason that I ended up in #red Sad :(

Well, anyway, whats done is done. Lets hope April ends up well. I will stop caring about green or red. I will just follow my #process. THAT"S FUCKNG IT! I guess, in march, I lost my way!

See you!

Well, anyway, whats done is done. Lets hope April ends up well. I will stop caring about green or red. I will just follow my #process. THAT"S FUCKNG IT! I guess, in march, I lost my way!

See you!

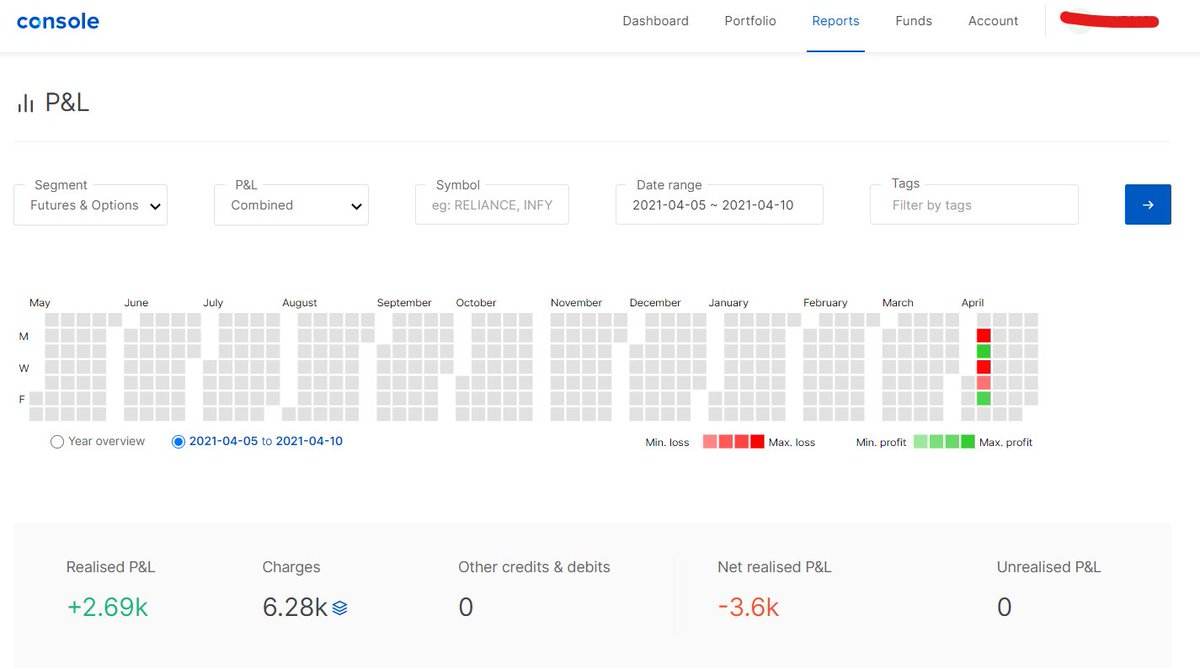

April 1st week, 2021

Wow! This week was the second worst week after March 1st week, last month! But the issue here was quite different.

Bad points: #Overtraded like fuck! Evident from charges! Last 8 #trading sessions has been horrible for me!

Last week charges was 5.5k 1/n

Wow! This week was the second worst week after March 1st week, last month! But the issue here was quite different.

Bad points: #Overtraded like fuck! Evident from charges! Last 8 #trading sessions has been horrible for me!

Last week charges was 5.5k 1/n

this week charges is 6.28k! Not at all good signs! So overtraded like hell. Monday let to spiral #recovery cycle, which continued till Thursday and thus a very tiresome cycle!

-Took random #trades which were not as per my setup

-Traded index (I do not trade it. Or i guess, 2/n

-Took random #trades which were not as per my setup

-Traded index (I do not trade it. Or i guess, 2/n

I just cant seem to master it so fuck it!) But still to recover, I traded it and made more #losses because it was so dangerously #volatile and gave weird moves and I fucked up big time!

- #Anxious throughout the week and still traded

- #Overleveraged to recover fast! 3/n

- #Anxious throughout the week and still traded

- #Overleveraged to recover fast! 3/n

Good points:

-Lol, as such there isn& #39;t any, bt finally on Friday, I managed to regain my previous composure. I only took 3 trades ( #Siemens, #Havells, #SunPharma ) n followed my #process to the teeth!

Although its too soon to say if it was just #luck or actually I overcame. 4/n

-Lol, as such there isn& #39;t any, bt finally on Friday, I managed to regain my previous composure. I only took 3 trades ( #Siemens, #Havells, #SunPharma ) n followed my #process to the teeth!

Although its too soon to say if it was just #luck or actually I overcame. 4/n

Anyway, after digging deep throughout the week, I understood the main #problem. It was overconfidence (OC). Now, not the typical OC you get when you are in profit. This OC was about me being able to follow my #process. So, since last 4 odd months, I was able to follow my 5/n

rules and process with occasional mistakes and rule breaking here and there. And I would always get upset that I broke rule. But somewhere in mid March, I started to get OC that even if I break rules, I will be able to follow it again. Basically, I considered that I had 6/n

superior #control over my ability to go into rule-abiding #trader WHENEVER I wish to. And this actually, subconsciously made me tempt to break rules and not follow my process. This whole thing starts when one breaks even the most insignificant rule they have! 7/n

Why? Because, we take reference from our recent #past. Just like how recent price action matters more, your recent behavior and action is more significant. When I broke my rules after following it for 3 months, the recent image/past changes to "rule-breaking trader", and 8/n

then your recent action will make you repeat those actions again and again... thus changing your entire behavior cycle to someone who doesn& #39;t follow the rules. Basically, the rule of 21days to build a habit is, I think, derived from this "recent past emphasis" #phenomenon. 9/n

So the solution is to be conscious when you think of doing something against the system. And if you must, then tweak the system n incorporate that rule because now, you are not a rule breaker. You are just following the updated rules! (Not so easy lol) But just a small hack. 10/n

@madan_kumar If you can go through my last 10 or at least last 6 tweets on this thread and can give some insights on my reasoning, then it would be great. Haven& #39;t following you for long since our style differ a lot, but I know your knowledge of trading psychology is brilliant!

Read on Twitter

Read on Twitter

The charges in the last week has been the lowest so far. Yet its too much! Statistically speaking, then per day roughly there have been 1/n" title=" #February 4th week and Feb @2021.Finally the week and the month ended! And I am in green. Third month to be in #green! Cheers to me! https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps"> The charges in the last week has been the lowest so far. Yet its too much! Statistically speaking, then per day roughly there have been 1/n">

The charges in the last week has been the lowest so far. Yet its too much! Statistically speaking, then per day roughly there have been 1/n" title=" #February 4th week and Feb @2021.Finally the week and the month ended! And I am in green. Third month to be in #green! Cheers to me! https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps"> The charges in the last week has been the lowest so far. Yet its too much! Statistically speaking, then per day roughly there have been 1/n">

The charges in the last week has been the lowest so far. Yet its too much! Statistically speaking, then per day roughly there have been 1/n" title=" #February 4th week and Feb @2021.Finally the week and the month ended! And I am in green. Third month to be in #green! Cheers to me! https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps"> The charges in the last week has been the lowest so far. Yet its too much! Statistically speaking, then per day roughly there have been 1/n">

The charges in the last week has been the lowest so far. Yet its too much! Statistically speaking, then per day roughly there have been 1/n" title=" #February 4th week and Feb @2021.Finally the week and the month ended! And I am in green. Third month to be in #green! Cheers to me! https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps"> The charges in the last week has been the lowest so far. Yet its too much! Statistically speaking, then per day roughly there have been 1/n">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Laut schreiendes Gesicht" aria-label="Emoji: Laut schreiendes Gesicht">-Number of punches were below 15 average! 1/n" title="March 2nd week, 2021Decent week.March is turning out to be very difficult to trade. Although my setup works in range market also, but still the accuracy and strike falls considerably! Jaldi se trending move aa jaou! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥲" title="Smiling face with tear" aria-label="Emoji: Smiling face with tear">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Laut schreiendes Gesicht" aria-label="Emoji: Laut schreiendes Gesicht">-Number of punches were below 15 average! 1/n" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Laut schreiendes Gesicht" aria-label="Emoji: Laut schreiendes Gesicht">-Number of punches were below 15 average! 1/n" title="March 2nd week, 2021Decent week.March is turning out to be very difficult to trade. Although my setup works in range market also, but still the accuracy and strike falls considerably! Jaldi se trending move aa jaou! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥲" title="Smiling face with tear" aria-label="Emoji: Smiling face with tear">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Laut schreiendes Gesicht" aria-label="Emoji: Laut schreiendes Gesicht">-Number of punches were below 15 average! 1/n" class="img-responsive" style="max-width:100%;"/>