1) #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> Beta Measurement to Determine the Volatility.

https://abs.twimg.com/hashflags... draggable="false" alt=""> Beta Measurement to Determine the Volatility.

You need to understand the volatility of the particular asset you invest/trade.

This volatility is also called the beta.

Beta is a quantitative measure of the volatility of a given asset relative to the overall market.

You need to understand the volatility of the particular asset you invest/trade.

This volatility is also called the beta.

Beta is a quantitative measure of the volatility of a given asset relative to the overall market.

2) Beta specifically measures the performance movement of asset as Index moves 1 percent up or down. A beta measurement above 1 is more volatile than the overall market, whereas a beta below 1 is less volatile.

3) Because beta measures how volatile or unstable the asset’s price is, it tends to be uttered in the same breath as “risk” — more volatility indicates more risk. Similarly, less volatility tends to mean less risk.

4) The beta is useful to know when it comes to stop-loss orders because it gives you a general idea of the asset’s trading range. If your asset is a volatile growth asset that may swing up and down by 10%, you can set your stop-loss at 15 percent below that day’s price.

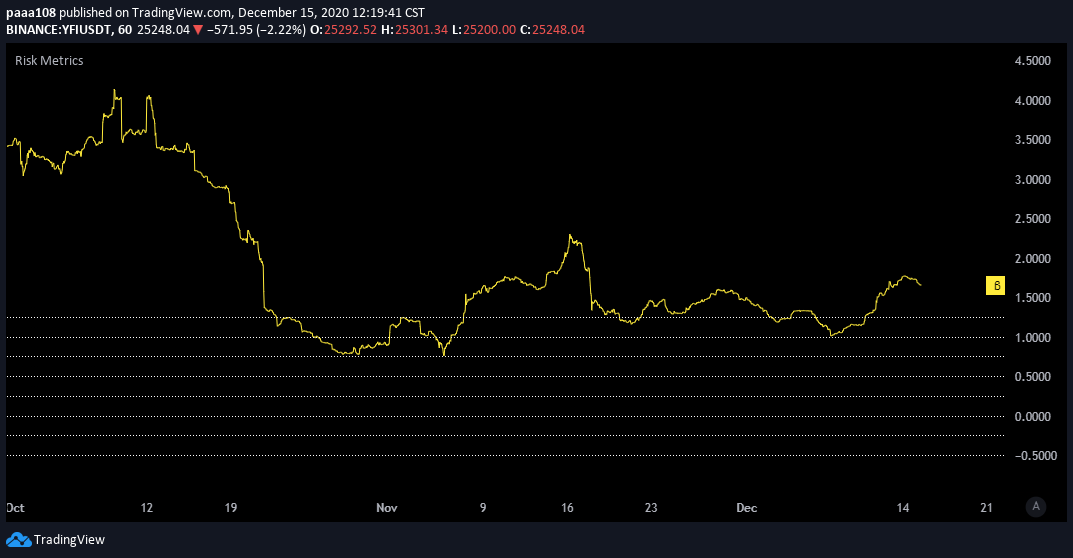

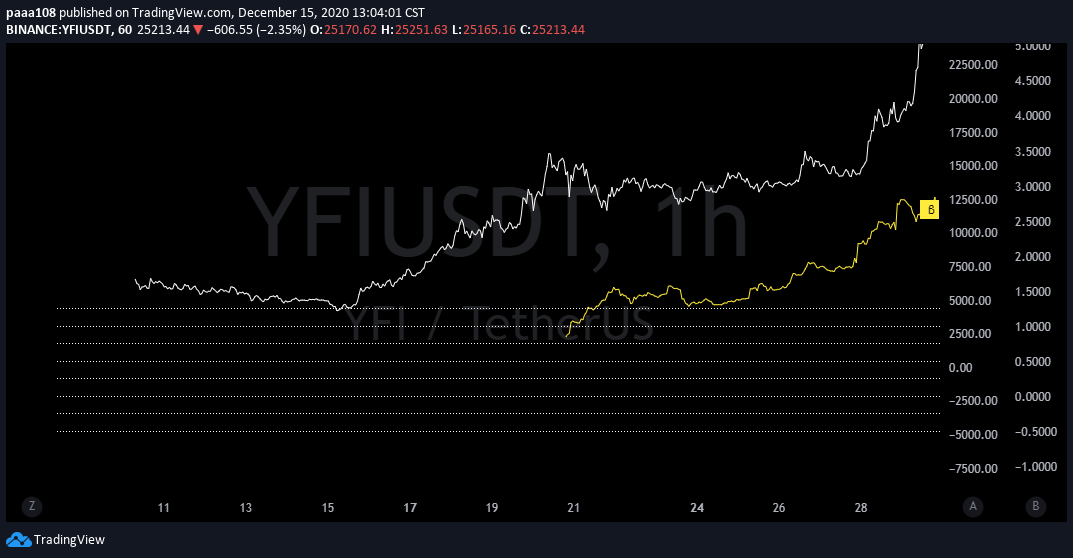

5) Let& #39;s setup Risk Metrics Indicator. I copied the code and added few more crypto indexes.

"CME:BTC1!"

"BITSTAMP:BTCUSD"

"FTX:DEFIPERP"

"BINANCE:YFIUSDT"

So we can compare any alt to BTC or any "defi" tokens to YFI or Defi index. https://www.tradingview.com/script/PCntVJj7-Risk-Metrics-beta-%CE%B2-correl-%CF%81xy-stdev-%CF%83-variance-%CF%83%C2%B2/">https://www.tradingview.com/script/PC...

"CME:BTC1!"

"BITSTAMP:BTCUSD"

"FTX:DEFIPERP"

"BINANCE:YFIUSDT"

So we can compare any alt to BTC or any "defi" tokens to YFI or Defi index. https://www.tradingview.com/script/PCntVJj7-Risk-Metrics-beta-%CE%B2-correl-%CF%81xy-stdev-%CF%83-variance-%CF%83%C2%B2/">https://www.tradingview.com/script/PC...

6) - We can consider 3 types of tokens:

- Token 1 with a Beta value of 1

- Token 2 with a Beta value of 0.5

- Token 3 with a Beta value of 1.5

- Token 1 with a Beta value of 1

- Token 2 with a Beta value of 0.5

- Token 3 with a Beta value of 1.5

7) - Token 1, which has a Beta value of 1, will show the exact same movement paired to that of the market. It reflects 100% of the market& #39;s movement

- Token 2, on the other hand, reflects only half of the market& #39;s movement, with a Beta value of 0.5 Thus, it moves up by 5%

- Token 2, on the other hand, reflects only half of the market& #39;s movement, with a Beta value of 0.5 Thus, it moves up by 5%

8) - Token 3, moves up by 15% as it has a beta value of 1.5, moves up more drastically than the market value, indicating that the token is more volatile.

9) Beta Value Equal to 1

Token shows a strongly correlated movement with the market movement.

Beta Value More Than 1

A beta that is greater than 1.0 indicates that the token& #39;s price is theoretically more volatile than the market.

Token shows a strongly correlated movement with the market movement.

Beta Value More Than 1

A beta that is greater than 1.0 indicates that the token& #39;s price is theoretically more volatile than the market.

10) Negative Beta Value

A token with a negative Beta value means that the token is inversely correlated to the market benchmark.

A token with a negative Beta value means that the token is inversely correlated to the market benchmark.

11) Limitations of Beta

- A token with a very low beta could have smaller price swings, yet it could still be in a long-term downtrend. So from a practical perspective, a low beta token that& #39;s experiencing a downtrend isn’t likely to improve a portfolio’s performance.

- A token with a very low beta could have smaller price swings, yet it could still be in a long-term downtrend. So from a practical perspective, a low beta token that& #39;s experiencing a downtrend isn’t likely to improve a portfolio’s performance.

Read on Twitter

Read on Twitter Beta Measurement to Determine the Volatility.You need to understand the volatility of the particular asset you invest/trade. This volatility is also called the beta. Beta is a quantitative measure of the volatility of a given asset relative to the overall market." title="1) #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Beta Measurement to Determine the Volatility.You need to understand the volatility of the particular asset you invest/trade. This volatility is also called the beta. Beta is a quantitative measure of the volatility of a given asset relative to the overall market." class="img-responsive" style="max-width:100%;"/>

Beta Measurement to Determine the Volatility.You need to understand the volatility of the particular asset you invest/trade. This volatility is also called the beta. Beta is a quantitative measure of the volatility of a given asset relative to the overall market." title="1) #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Beta Measurement to Determine the Volatility.You need to understand the volatility of the particular asset you invest/trade. This volatility is also called the beta. Beta is a quantitative measure of the volatility of a given asset relative to the overall market." class="img-responsive" style="max-width:100%;"/>