1/n

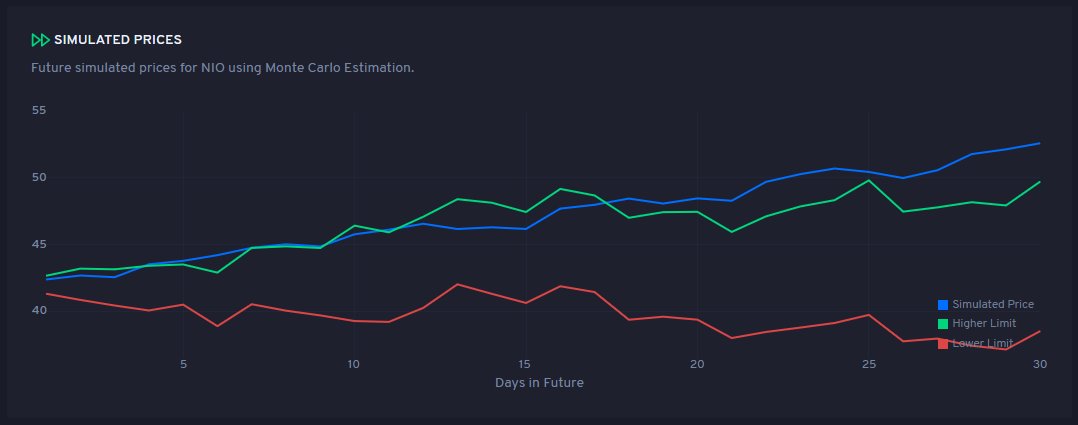

Interesting strategy that just came to mind - explaining with $TSLA, $NIO - we have an AI tool that allows you to look at future price ranges i.e the max and min price the stock might go to.

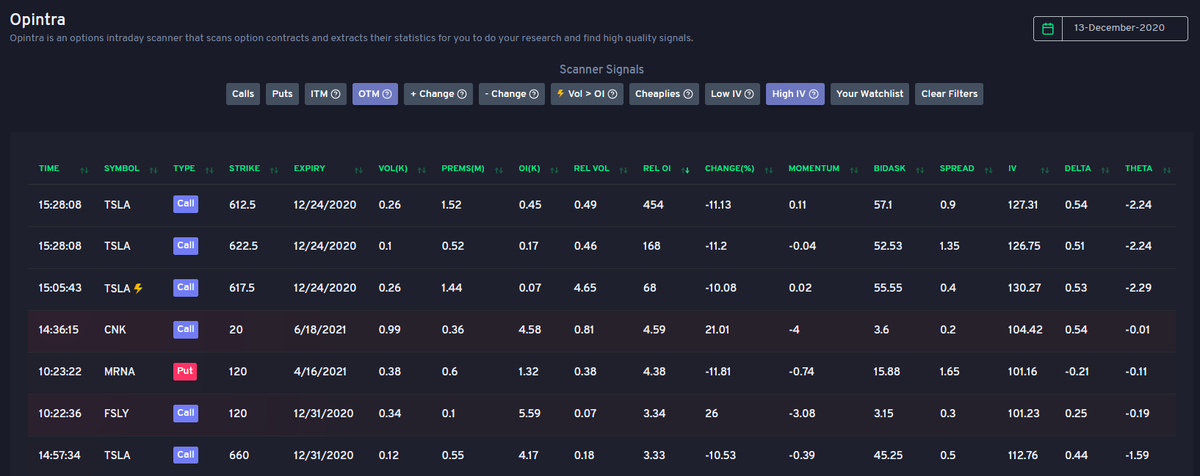

We also have options scanner that gives you high IV contracts for potential selling.

Interesting strategy that just came to mind - explaining with $TSLA, $NIO - we have an AI tool that allows you to look at future price ranges i.e the max and min price the stock might go to.

We also have options scanner that gives you high IV contracts for potential selling.

2/n

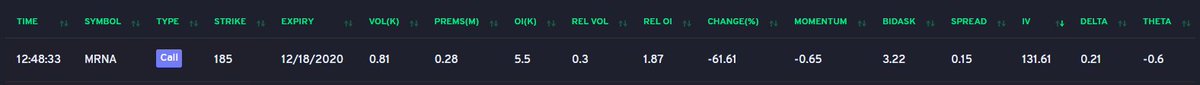

Now, once you know the potential future price ranges, you can simply go to our options scanner and find some OTM WEEKLY high IV contracts that are outside the max and min range of the predicted price.

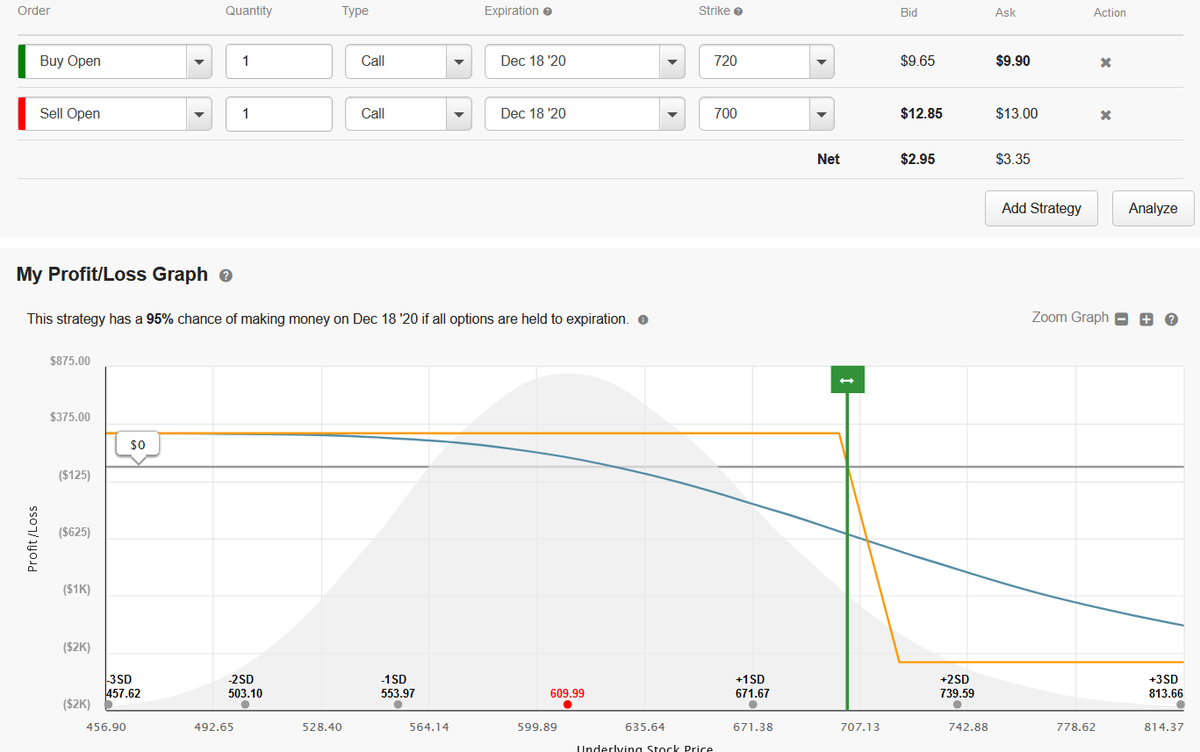

Those are the contracts that you can sell or do spreads to earn profits.

Now, once you know the potential future price ranges, you can simply go to our options scanner and find some OTM WEEKLY high IV contracts that are outside the max and min range of the predicted price.

Those are the contracts that you can sell or do spreads to earn profits.

3/n

Just to be safe, you can slightly go more OTM from the price ranges + do spreads instead of selling naked calls.

I am going to backtest this strategy but I have a feeling this will yield a high accuracy rate + returns. I would love for our premium members to try this.

Just to be safe, you can slightly go more OTM from the price ranges + do spreads instead of selling naked calls.

I am going to backtest this strategy but I have a feeling this will yield a high accuracy rate + returns. I would love for our premium members to try this.

4/n

We need high IV because that& #39;s were all the premiums are that we want to squeeze out of other people by selling contracts.

OTM because we don& #39;t want the contract to go ITM and get exercised.

We need high IV because that& #39;s were all the premiums are that we want to squeeze out of other people by selling contracts.

OTM because we don& #39;t want the contract to go ITM and get exercised.

5/n

Hope this makes sense. We want to tell the world about the potential uses of our premium AI tools so that people can begin to understand that we& #39;re not just an alert service - we are an AI based trading toolkit to help you build strategies and improve your trading.

Hope this makes sense. We want to tell the world about the potential uses of our premium AI tools so that people can begin to understand that we& #39;re not just an alert service - we are an AI based trading toolkit to help you build strategies and improve your trading.

6/n

Finally, here are the links to our scanner and to our premium AI dashboard.

Scanner: http://tradytics.com/opintra

AI">https://tradytics.com/opintra&q... Dashboard http://tradytics.com/tradytics-dashboard?ticker=NIO">https://tradytics.com/tradytics... (It also includes hedging suggestions, sector predictions, important news, maximum daily risk reward etc).

Finally, here are the links to our scanner and to our premium AI dashboard.

Scanner: http://tradytics.com/opintra

AI">https://tradytics.com/opintra&q... Dashboard http://tradytics.com/tradytics-dashboard?ticker=NIO">https://tradytics.com/tradytics... (It also includes hedging suggestions, sector predictions, important news, maximum daily risk reward etc).

Happy to take any questions. Thoughts?

Read on Twitter

Read on Twitter