I recently closed on a ~$1,000,000 fourplex in Jersey City, NJ and financed an additional ~$470,000 of renovation costs into the loan, while only putting ~$60,000 down.

A thread on supercharging your net worth by buying a house with only 3.5% down via the FHA / 203k loan

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

A thread on supercharging your net worth by buying a house with only 3.5% down via the FHA / 203k loan

Jersey City is a rapidly-appreciating city directly across the river from Manhattan. It is 20 minutes from the Financial District and 45 minutes from Midtown.

My property is in Downtown JC, a hip but family-oriented neighborhood similar to parts of Brooklyn or Queens.

My property is in Downtown JC, a hip but family-oriented neighborhood similar to parts of Brooklyn or Queens.

The property requires a full gut: plumbing, electrical, heating, cooling, kitchens, bathrooms. You name it -- it& #39;s getting redone.

Walls will also be moved around because the current layout of each unit is a disaster and only two of the four units are currently livable.

Walls will also be moved around because the current layout of each unit is a disaster and only two of the four units are currently livable.

While doing some exploratory demo, I found a newspaper from 1949 tucked away in the ceiling and the remnants of what appears to be a metal-melting operation in the basement.

The house itself was built in the 1880’s.

The house itself was built in the 1880’s.

By financing the purchase using the FHA 203k loan I am able to finance over $450,000 in renovation costs at record-low interest rates while still putting down just 3.5% up front.

Here’s a quick overview on the FHA 203k loan: https://www.nerdwallet.com/article/mortgages/203k-and-homestyle-mortgage-loans-for-home-renovation">https://www.nerdwallet.com/article/m...

Here’s a quick overview on the FHA 203k loan: https://www.nerdwallet.com/article/mortgages/203k-and-homestyle-mortgage-loans-for-home-renovation">https://www.nerdwallet.com/article/m...

You may be wondering how I was able to secure such a large loan. In my case, I was able to finance ~$1,450,000 because I included the projected income from three of the units while qualifying for the mortgage and because the home passes the FHA self-sufficiency test.

To pass the self-sufficiency test, 75% of the projected income if fully-rented must exceed the home’s PITI -- principal, interest, taxes and insurance.

The projected rental income of my fourplex appraised at $11,400/month, leaving a max PITI of $8,550. https://www.anmtg.com/mortgage-resources/fha-loans/fha-sustainability-test-3-4-units/">https://www.anmtg.com/mortgage-...

The projected rental income of my fourplex appraised at $11,400/month, leaving a max PITI of $8,550. https://www.anmtg.com/mortgage-resources/fha-loans/fha-sustainability-test-3-4-units/">https://www.anmtg.com/mortgage-...

My mortgage pushes within $100 of the max amount, as well as within $30,000 of the maximum allowable FHA loan amount. The max loan amounts vary by unit count / region, ranging from ~$500k to $1,472,550 for high COL areas (NYC, SF, etc.) https://www.fha.com/lending_limits ">https://www.fha.com/lending_l...

A lot of sharp real estate investors believe using an FHA / 203k loan to buy a triplex or fourplex is the fastest way to build wealth. I obviously agree, because I just did exactly that.

Example A, from a well-respected investor in LA: https://twitter.com/moseskagan/status/1279803980164370432">https://twitter.com/moseskaga...

Example A, from a well-respected investor in LA: https://twitter.com/moseskagan/status/1279803980164370432">https://twitter.com/moseskaga...

Example B, from a successful investor/operator managing hundreds of millions of multifamily property throughout the Western United States: https://twitter.com/Keith_Wasserman/status/1313331812374986752">https://twitter.com/Keith_Was...

Example C, from a real estate investor in the tech community: https://twitter.com/theSamParr/status/1307697480310624257">https://twitter.com/theSamPar...

Now, on to the important stuff... the numbers  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

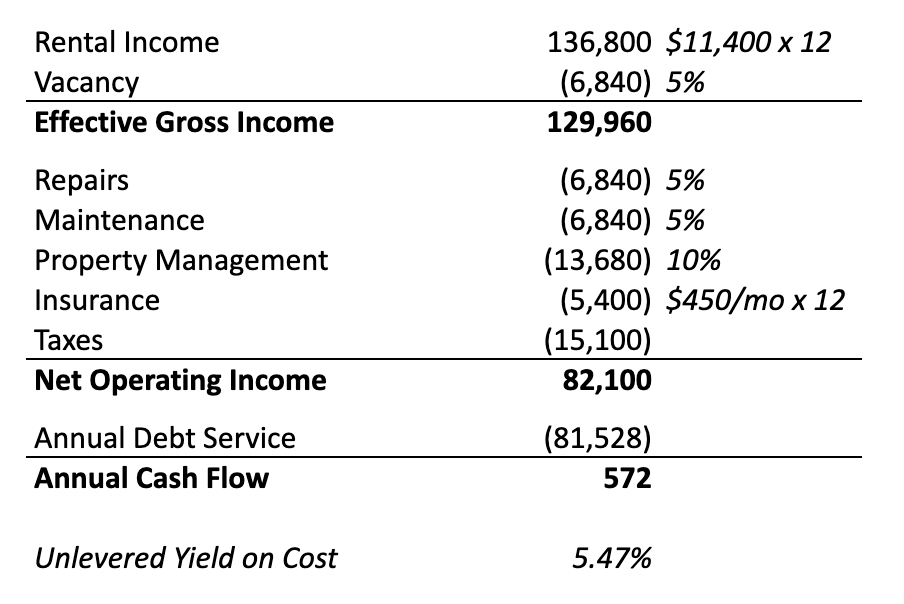

Here’s what the projected income and expenses would look like if fully-rented at $11,400 -- the price at which it was appraised in July

Unit 1: $2,700

Units 2 - 4: $2,900

Unlevered yield on cost: 5.47%

Here’s what the projected income and expenses would look like if fully-rented at $11,400 -- the price at which it was appraised in July

Unit 1: $2,700

Units 2 - 4: $2,900

Unlevered yield on cost: 5.47%

Unfortunately, NYC / Jersey City rents have dropped significantly because of Covid-19, as tracked by @GoodGuyGuaranty

I estimate the post-rehab, fully-rented income will land around $10,000. Here’s what the numbers are likely to look like:

https://twitter.com/GoodGuyGuaranty/status/1326529413773668354">https://twitter.com/GoodGuyGu...

I estimate the post-rehab, fully-rented income will land around $10,000. Here’s what the numbers are likely to look like:

https://twitter.com/GoodGuyGuaranty/status/1326529413773668354">https://twitter.com/GoodGuyGu...

Frankly, these numbers are much thinner than I’d like them to be, though I should be able to take advantage of a five-year tax abatement (100% year one, 20% less each year thereafter) because of the substantial rehab.

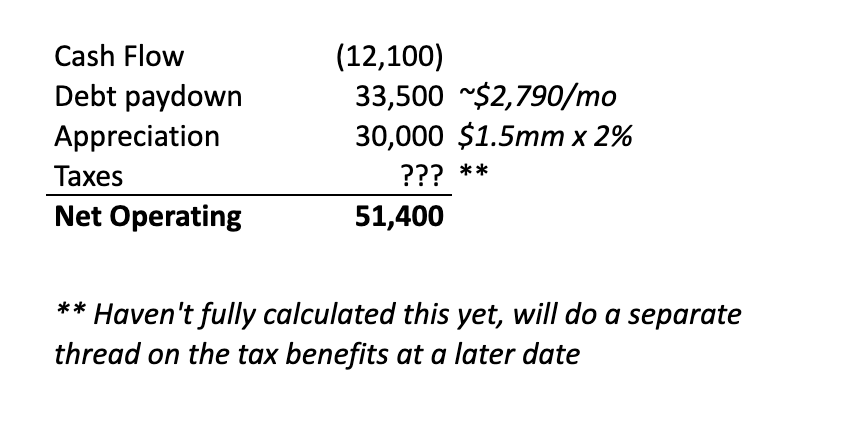

Long term, I will generate wealth from this property four ways: cash flow, appreciation, debt paydown and tax benefits.

In year one “wealth generation” could look something like this, though of course the appreciation is only on paper until I sell.

In year one “wealth generation” could look something like this, though of course the appreciation is only on paper until I sell.

This may seem like a ton of work to end up losing $12k/yr in cash -- and it is a ton of work. But the real power comes from buying, holding and waiting.

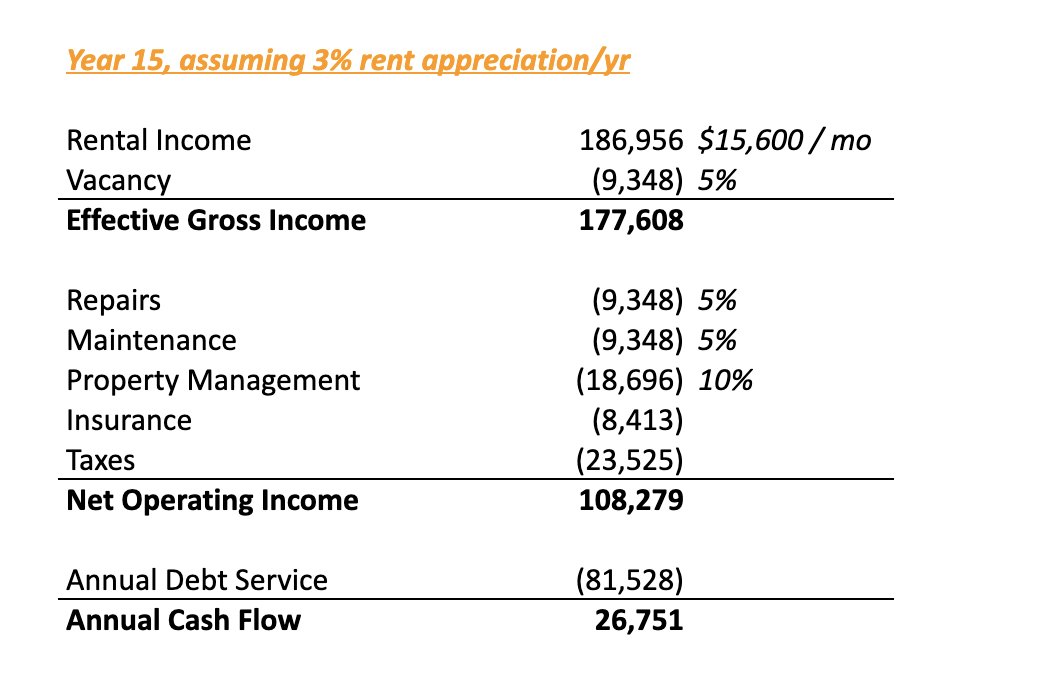

Here’s the projected NOI / cash flow in Year 15 if the property, rental income and expenses all increase at a rate of 3%/yr:

Here’s the projected NOI / cash flow in Year 15 if the property, rental income and expenses all increase at a rate of 3%/yr:

Further, if the property appreciates at 3% / year, after 15 years I will have a property worth ~$2.3mm and have a mortgage balance of ~$900k, leaving me with $1.4mm in equity.

Even if the property doesn’t appreciate **at all**, I’ll have $600k in equity because of debt paydown.

Even if the property doesn’t appreciate **at all**, I’ll have $600k in equity because of debt paydown.

If there is major rent appreciation, I win.

If there is major property value appreciation, I win.

And related, if there is 3%+ inflation, thereby driving up rent and property values, while my mortgage stays fixed, I win.

If there is major property value appreciation, I win.

And related, if there is 3%+ inflation, thereby driving up rent and property values, while my mortgage stays fixed, I win.

I’m diving straight into the deep end of the pool with this purchase. It’s a gnarly deal with thin margins and little room for error.

However, all across the country, there are triplexes and fourplexes ready to produce positive cash flow from day one.

However, all across the country, there are triplexes and fourplexes ready to produce positive cash flow from day one.

While it’s a ton of work, buying a triplex or fourplex with 3.5% down is the *most* powerful way to generate wealth in this country.

If you have a better way, I’m listening.

If you have a better way, I’m listening.

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="I recently closed on a ~$1,000,000 fourplex in Jersey City, NJ and financed an additional ~$470,000 of renovation costs into the loan, while only putting ~$60,000 down.A thread on supercharging your net worth by buying a house with only 3.5% down via the FHA / 203k loanhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="I recently closed on a ~$1,000,000 fourplex in Jersey City, NJ and financed an additional ~$470,000 of renovation costs into the loan, while only putting ~$60,000 down.A thread on supercharging your net worth by buying a house with only 3.5% down via the FHA / 203k loanhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Here’s what the projected income and expenses would look like if fully-rented at $11,400 -- the price at which it was appraised in JulyUnit 1: $2,700Units 2 - 4: $2,900Unlevered yield on cost: 5.47%" title="Now, on to the important stuff... the numbers https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Here’s what the projected income and expenses would look like if fully-rented at $11,400 -- the price at which it was appraised in JulyUnit 1: $2,700Units 2 - 4: $2,900Unlevered yield on cost: 5.47%" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Here’s what the projected income and expenses would look like if fully-rented at $11,400 -- the price at which it was appraised in JulyUnit 1: $2,700Units 2 - 4: $2,900Unlevered yield on cost: 5.47%" title="Now, on to the important stuff... the numbers https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Here’s what the projected income and expenses would look like if fully-rented at $11,400 -- the price at which it was appraised in JulyUnit 1: $2,700Units 2 - 4: $2,900Unlevered yield on cost: 5.47%" class="img-responsive" style="max-width:100%;"/>