Today we& #39;ve published the Rail Industry Finance report for the financial year 1 April 2019 to 31 March 2020.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/1889/rail-industry-finance-uk-statistical-release-2019-20.pdf

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/1889/rail-industry-finance-uk-statistical-release-2019-20.pdf

This">https://dataportal.orr.gov.uk/media/188... thread shows the key points of the income, expenditure, and government funding of the UK rail industry, and the impact of COVID-19.

This">https://dataportal.orr.gov.uk/media/188... thread shows the key points of the income, expenditure, and government funding of the UK rail industry, and the impact of COVID-19.

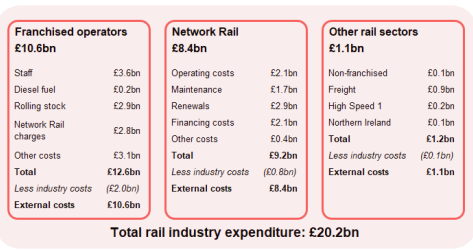

As a whole, the industry in 2019-20 cost £20.2bn, which was funded through fares and other passenger income (£11.6bn), government (£6.5bn) and other sources (£2.0bn).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/1889/rail-industry-finance-uk-statistical-release-2019-20.pdf">https://dataportal.orr.gov.uk/media/188...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/1889/rail-industry-finance-uk-statistical-release-2019-20.pdf">https://dataportal.orr.gov.uk/media/188...

Fares income in 2019-20 dropped by 1.1% to £10.4bn, largely due to the impact of Covid-19 in March.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/1889/rail-industry-finance-uk-statistical-release-2019-20.pdf">https://dataportal.orr.gov.uk/media/188...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/1889/rail-industry-finance-uk-statistical-release-2019-20.pdf">https://dataportal.orr.gov.uk/media/188...

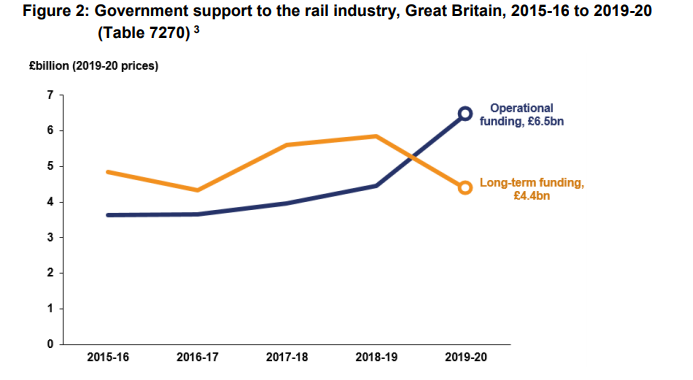

Government funding of the operational railway increased by 45.2% to £6.5bn, largely due to the planned increases in Network Rail’s funding at the start of control period 6, but also due to the impact of Covid-19.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/1889/rail-industry-finance-uk-statistical-release-2019-20.pdf">https://dataportal.orr.gov.uk/media/188...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/1889/rail-industry-finance-uk-statistical-release-2019-20.pdf">https://dataportal.orr.gov.uk/media/188...

Industry costs were £20.2bn in 2019-20.

This represents a £0.8bn (4.0%) annual increase, largely due to increased infrastructure operating and maintenance costs (£0.4bn), and increased rolling stock leasing costs due to the introduction of new trains (£0.4bn).

This represents a £0.8bn (4.0%) annual increase, largely due to increased infrastructure operating and maintenance costs (£0.4bn), and increased rolling stock leasing costs due to the introduction of new trains (£0.4bn).

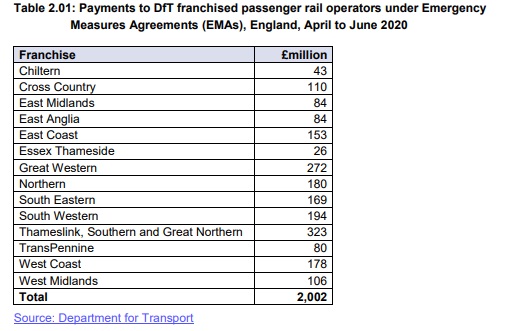

Passenger journeys started to decline from the beginning of March 2020 and by the end of Q1 (1 April to 30 June) had dropped to as low as 5% of normal levels.

Income from fares in 2020-21 Q1 was £184m, £2.5bn (93.1%) lower than 2019-20 Q1.

Income from fares in 2020-21 Q1 was £184m, £2.5bn (93.1%) lower than 2019-20 Q1.

Read on Twitter

Read on Twitter https://dataportal.orr.gov.uk/media/188..." title="As a whole, the industry in 2019-20 cost £20.2bn, which was funded through fares and other passenger income (£11.6bn), government (£6.5bn) and other sources (£2.0bn).https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/188..." class="img-responsive" style="max-width:100%;"/>

https://dataportal.orr.gov.uk/media/188..." title="As a whole, the industry in 2019-20 cost £20.2bn, which was funded through fares and other passenger income (£11.6bn), government (£6.5bn) and other sources (£2.0bn).https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/188..." class="img-responsive" style="max-width:100%;"/>

https://dataportal.orr.gov.uk/media/188..." title="Fares income in 2019-20 dropped by 1.1% to £10.4bn, largely due to the impact of Covid-19 in March.https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/188..." class="img-responsive" style="max-width:100%;"/>

https://dataportal.orr.gov.uk/media/188..." title="Fares income in 2019-20 dropped by 1.1% to £10.4bn, largely due to the impact of Covid-19 in March.https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/188..." class="img-responsive" style="max-width:100%;"/>

https://dataportal.orr.gov.uk/media/188..." title="Government funding of the operational railway increased by 45.2% to £6.5bn, largely due to the planned increases in Network Rail’s funding at the start of control period 6, but also due to the impact of Covid-19.https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/188..." class="img-responsive" style="max-width:100%;"/>

https://dataportal.orr.gov.uk/media/188..." title="Government funding of the operational railway increased by 45.2% to £6.5bn, largely due to the planned increases in Network Rail’s funding at the start of control period 6, but also due to the impact of Covid-19.https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck"> https://dataportal.orr.gov.uk/media/188..." class="img-responsive" style="max-width:100%;"/>