Working through @jackbutcher& #39;s Build Once Sell Twice.

I have hundreds of takeaways, but one idea is burnt into my grey matter.

Equity and dividends.

[Thread]

I have hundreds of takeaways, but one idea is burnt into my grey matter.

Equity and dividends.

[Thread]

It& #39;s easy to measure relative success by looking at dollars flowing in.

More dollars in and we think we must be on the right track.

But dollars in is a lagging indicator, not a leading indicator.

More dollars in and we think we must be on the right track.

But dollars in is a lagging indicator, not a leading indicator.

Cash compensation is the last step in a long process of building equity.

It& #39;s an extraction of dividends from the equity we& #39;ve built up in the past.

This equity comes in the form of:

• Experience

• Credibility

• Connections

• Reputation

And this equity compounds quickly.

It& #39;s an extraction of dividends from the equity we& #39;ve built up in the past.

This equity comes in the form of:

• Experience

• Credibility

• Connections

• Reputation

And this equity compounds quickly.

But this equity is hard to see.

There& #39;s no objective "measure" of experience, credibility, etc.

But dollars are objective.

So in gauging a project or opportunity, we underweight the "compensation" of experience, credibility, and connections, and overweight the dollar amount.

There& #39;s no objective "measure" of experience, credibility, etc.

But dollars are objective.

So in gauging a project or opportunity, we underweight the "compensation" of experience, credibility, and connections, and overweight the dollar amount.

But this is short-sited.

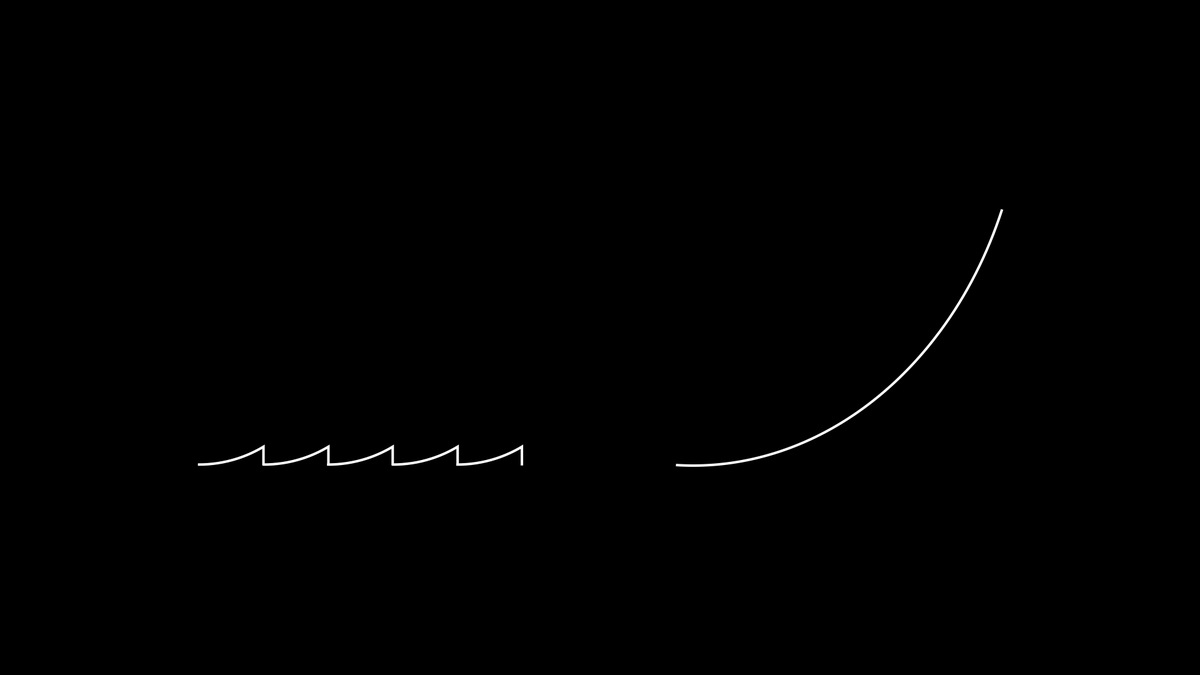

Experience, credibility, connections, and reputation compound much faster than dollars compound.

But by extracting dividends (cash) too early, we interrupt a much more powerful compounding.

Experience, credibility, connections, and reputation compound much faster than dollars compound.

But by extracting dividends (cash) too early, we interrupt a much more powerful compounding.

This is way easier said than done.

Thinking this way - prioritizing experience, credibility, connections, and reputation - is 21st-century arbitrage.

Since others struggle to see this, it& #39;s a market inefficiency.

Exploit that inefficiency.

Thinking this way - prioritizing experience, credibility, connections, and reputation - is 21st-century arbitrage.

Since others struggle to see this, it& #39;s a market inefficiency.

Exploit that inefficiency.

I& #39;m working on a larger thread with more of my takeaways, but I just had to share this one.

Because now that I& #39;ve seen it, I can& #39;t unsee it.

Everything on Jack& #39;s website is 10% off until Friday.

It& #39;s the best investment I& #39;ve made in 2020. https://shop.visualizevalue.com/ ">https://shop.visualizevalue.com/">...

Because now that I& #39;ve seen it, I can& #39;t unsee it.

Everything on Jack& #39;s website is 10% off until Friday.

It& #39;s the best investment I& #39;ve made in 2020. https://shop.visualizevalue.com/ ">https://shop.visualizevalue.com/">...

Read on Twitter

Read on Twitter