Today we published the first ECB Financial Stability Review since I joined the team 3 months ago and there’s quite a lot of interesting content to digest. I recommend reading the report but to give you a flavour, here are some of the charts and lessons I find most striking:

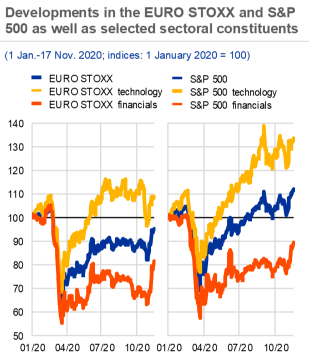

1. The Covid shock was truly unprecedented along many dimensions, including it& #39;s asymmetric impact. The GDP drop in H1 was largely driven by a massive contraction in the most sensitive sectors, whereas tech firms rebounded quickly.

Hence there& #39;s a real risk of permanent scarring in the most affected sectors and of economic divergence which has fundamental implications for fin. stability but also for growth & welfare more generally. See this speech by @Isabel_Schnabel from September: https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp200918~8aaf49cd79.en.html">https://www.ecb.europa.eu/press/key...

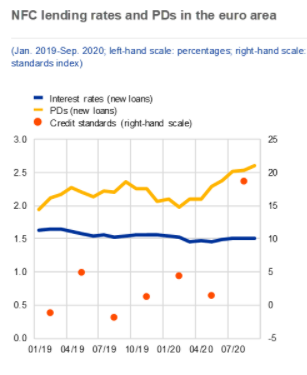

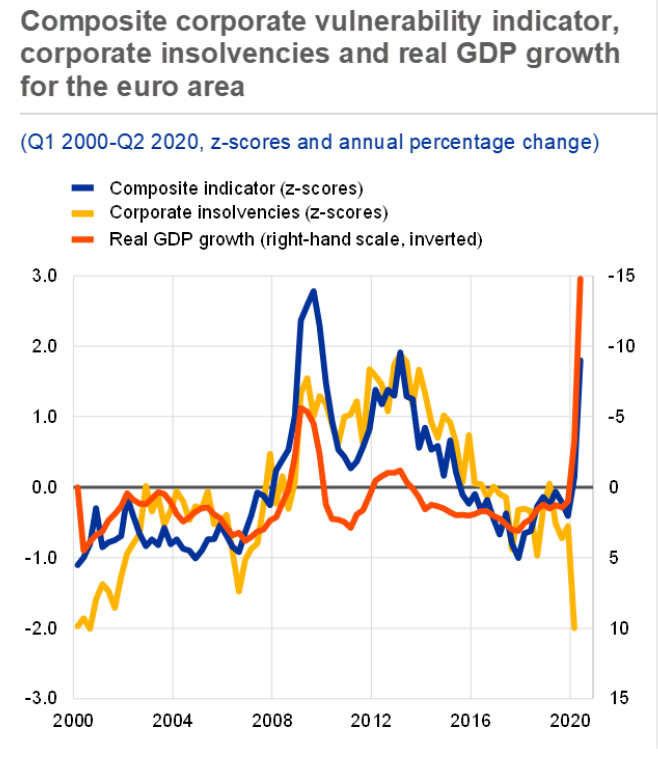

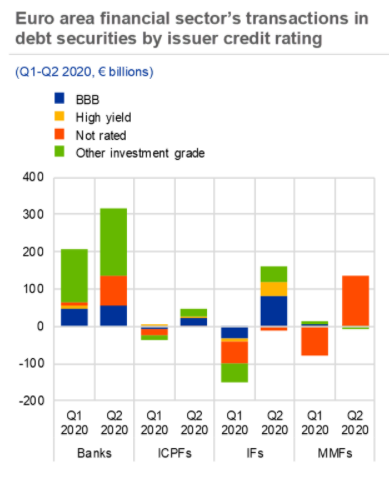

2. Firms would have fared much worse w/o policy support which contained the spike in corp bond spreads in March and supported bank lending at favorable rates despite deteriorating credit quality. But corp risks & insolvencies loom if liqui problems morph into solvency issues.

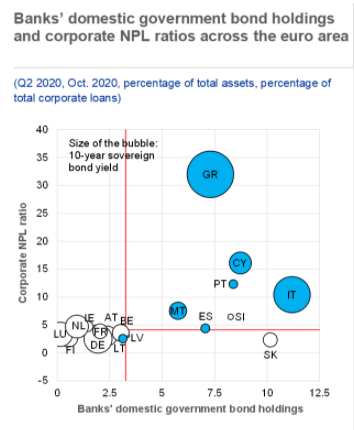

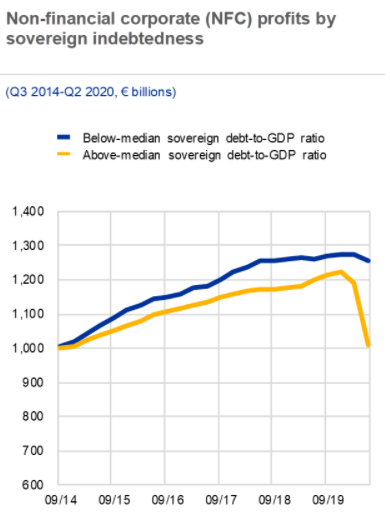

3. Gov. guarantees and equity support expose sovereigns more directly to corp. risk, giving rise to a sovereign-corporate nexus. Unfortunate coincidence: Firms suffered more in countries with high pre-Covid sov. debt levels, reflecting inter alia differing industry structures.

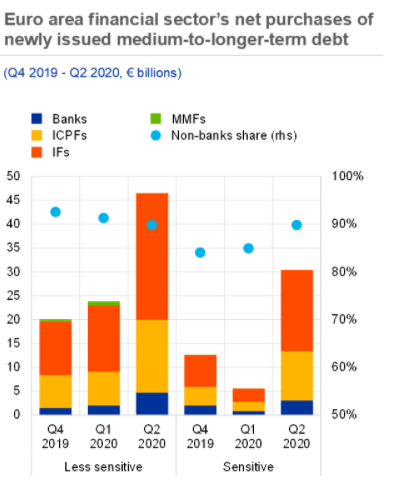

4. Non-banks bought a large share of the newly issued corp debt in H1 overall, but were also a main driver of the procyclical selling of corporate debt in March.

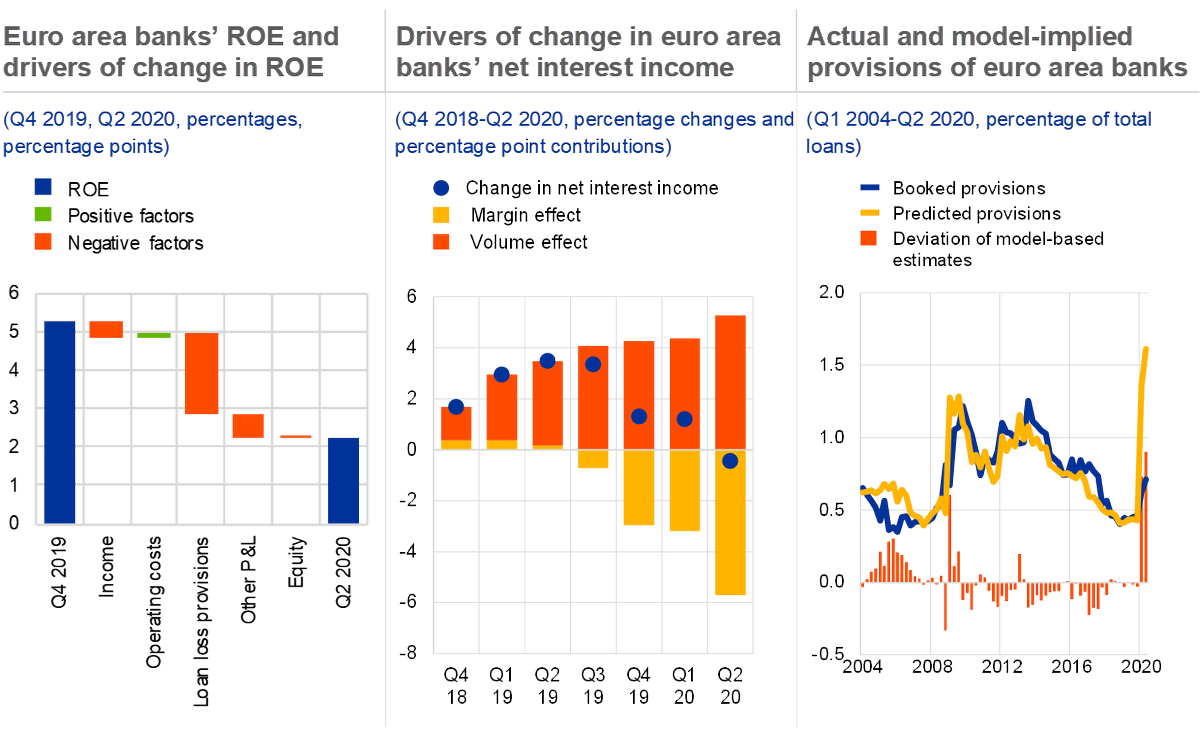

5. Banks were resilient so far (also thanks to post-GFC regulation and policy support) but face challenges as NII declines and loan losses loom. Are banks provisioning adequately? Hard to assess in current environment but I recommend Box 5 for an in-depth analysis.

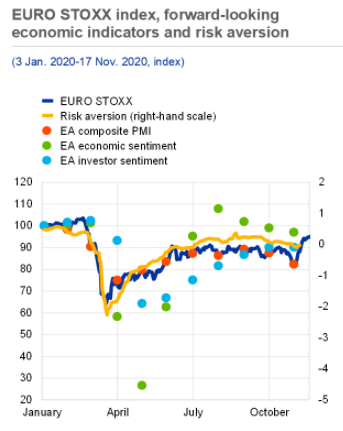

6. Is the booming stock market detached from the still subdued real economy? Not necessarily: Stock prices are forward-looking and their swift rebound might reflect confidence in a quick recovery, in line with forward-looking PMIs and economic sentiment.

(Plus of course the lower rates at which future cash flows are discounted.)

7. Last but not least: What are the longer term changes that will stay post-Covid? This would merit a longer thread, but one chart I find really astonishing is the massive (and persistent!) drop in prices for office and retail commercial real estate, compared to residential RE.

Looking beyond the medium term, this might be a harbinger of how the Covid-19 crisis may change more permanently the way we work, interact and consume.

Disclaimer: These are my opinion/views and do not necessarily reflect the views of the ECB.

Also, you can find the full report here: #toc1">https://www.ecb.europa.eu/pub/financial-stability/fsr/html/ecb.fsr202011~b7be9ae1f1.en.html #toc1">https://www.ecb.europa.eu/pub/finan...

Also, you can find the full report here: #toc1">https://www.ecb.europa.eu/pub/financial-stability/fsr/html/ecb.fsr202011~b7be9ae1f1.en.html #toc1">https://www.ecb.europa.eu/pub/finan...

P.S.: I also recommend the very nice ECB podcast with John Fell and Tamarah Shakir on cycling, financial stability and the FSR: https://www.ecb.europa.eu/press/tvservices/podcast/html/ecb.pod201125_episode12.en.html">https://www.ecb.europa.eu/press/tvs...

Read on Twitter

Read on Twitter