The Office is one of the most popular television series& #39; of all time.

Easily my favorite.

It& #39;s hilarious.

Often a little awkward at times.

But did you know there are plenty of money lessons to be learned?

Ill show you below 5 Lessons that I have learned so far.

Easily my favorite.

It& #39;s hilarious.

Often a little awkward at times.

But did you know there are plenty of money lessons to be learned?

Ill show you below 5 Lessons that I have learned so far.

1. Never Rush Into Buying A Home

When Michael bought his condo, he rushed into a deal before reading the fine print.

Dwight also found several issues with the home minutes before signing.

-Do your due diligence

-Do not make yourself house poor

When Michael bought his condo, he rushed into a deal before reading the fine print.

Dwight also found several issues with the home minutes before signing.

-Do your due diligence

-Do not make yourself house poor

2. Communicate With Your Spouse

Michael and Jan were obviously not on the same page with their finances.

She was buying new flooring for the condo and Michael was buying magic supplies all while racking up credit card debt.

-Communicate

-Say no to credit card debt

Michael and Jan were obviously not on the same page with their finances.

She was buying new flooring for the condo and Michael was buying magic supplies all while racking up credit card debt.

-Communicate

-Say no to credit card debt

3. See Opportunites When Others Don& #39;t

Dwight knows how to make a buck.

When there was a shortage of a popular gift at Christmas, Dwight rose to the occasion.

He may have gouged a little, but it& #39;s a great example of the laws of Supply and Demand.

Dwight knows how to make a buck.

When there was a shortage of a popular gift at Christmas, Dwight rose to the occasion.

He may have gouged a little, but it& #39;s a great example of the laws of Supply and Demand.

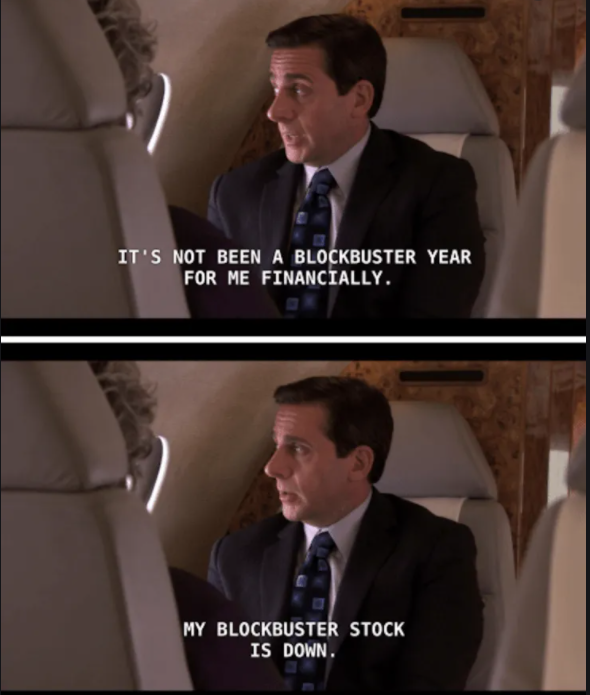

4. Let Go Of That Poor Performing Stock

Michael owned shares of Blockbuster.

Likely not going to make a comeback anytime soon.

No individual stocks for me anymore, still a great lesson.

-Let go of that poor performing stock. Sometimes it& #39;s best to cut the losses and move on.

Michael owned shares of Blockbuster.

Likely not going to make a comeback anytime soon.

No individual stocks for me anymore, still a great lesson.

-Let go of that poor performing stock. Sometimes it& #39;s best to cut the losses and move on.

5. Never Take The First Offer

When negotiating the sale of The Michael Scott Paper Company, Dunder Mifflin low balled hard.

Michael and the crew, who were siphoning their clients, counteroffered and were able to get their jobs back.

You never know unless you try.

When negotiating the sale of The Michael Scott Paper Company, Dunder Mifflin low balled hard.

Michael and the crew, who were siphoning their clients, counteroffered and were able to get their jobs back.

You never know unless you try.

Let me know what other lessons you have learned while watching The Office.

There are several more.

Thanks for reading!

Jrod

There are several more.

Thanks for reading!

Jrod

Read on Twitter

Read on Twitter