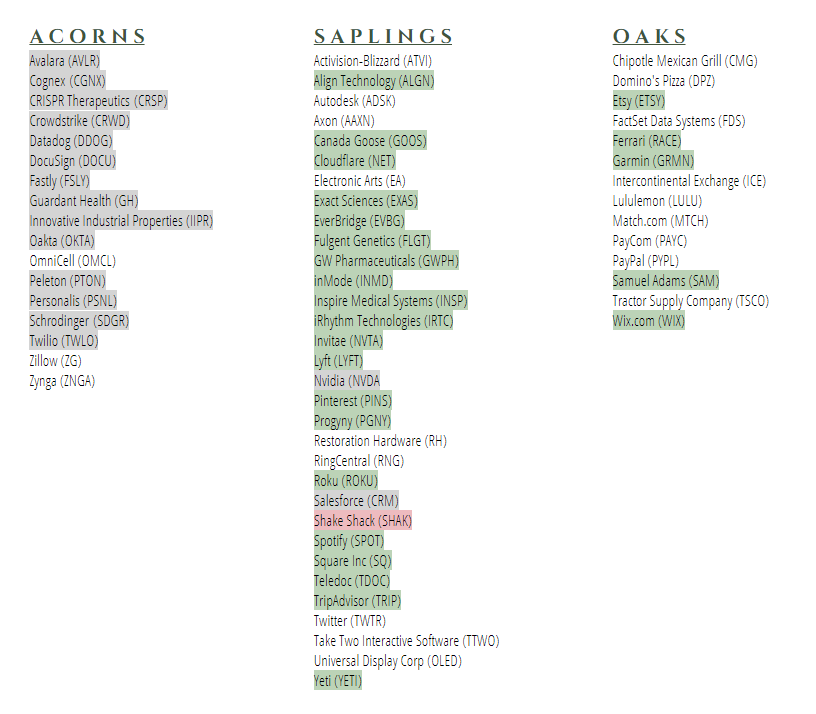

Here is my investment universe. The highlights mean a change occurred in the last year. Grey = new addition, Green = upgrade, Red = downgrade. The portfolio model is weighted 25% Acorns, 65% Saplings, 10% Oaks. Positions within each are equally weighted, reset monthly. 1/n

Here are details for the YTD changes to the investment universe. Past data is available to site members while current/YTD is publicly available here: https://www.oakriverinvests.com/universe ">https://www.oakriverinvests.com/universe&... You can see a pretty clear repositioning throughout 2020, exiting select travel/entertainment/etc... 2/n

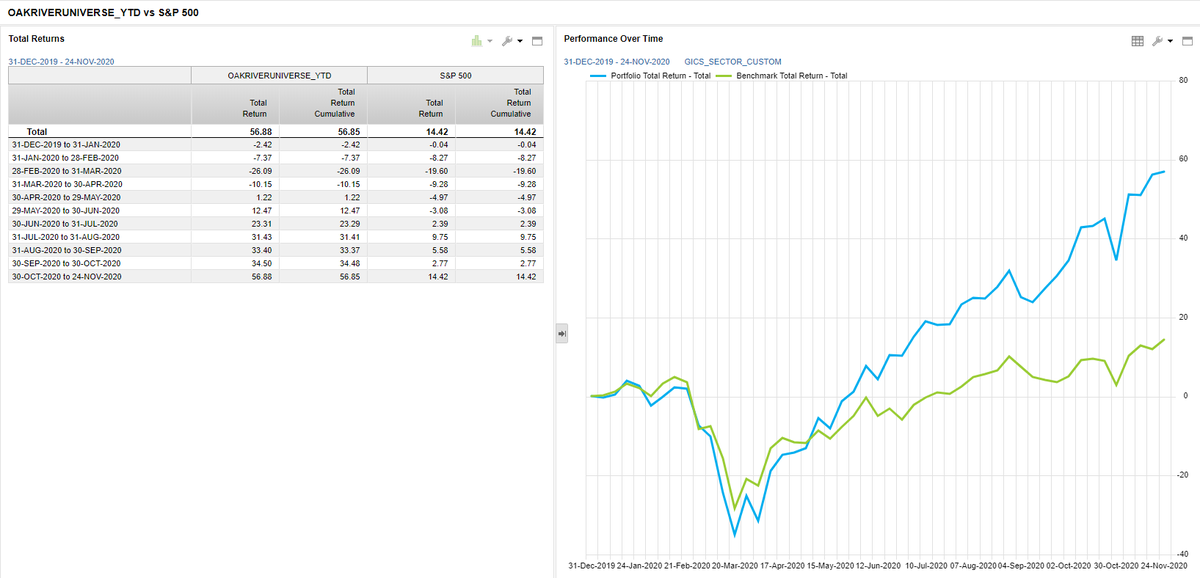

Here is the YTD performance. The S&P 500 is not a great benchmark for my portfolio with my SMID tilt, but the average investor considers $SPY their benchmark so I will use for comparative purposes. Clear underperformance through into May where the portfolio took off... 3/n

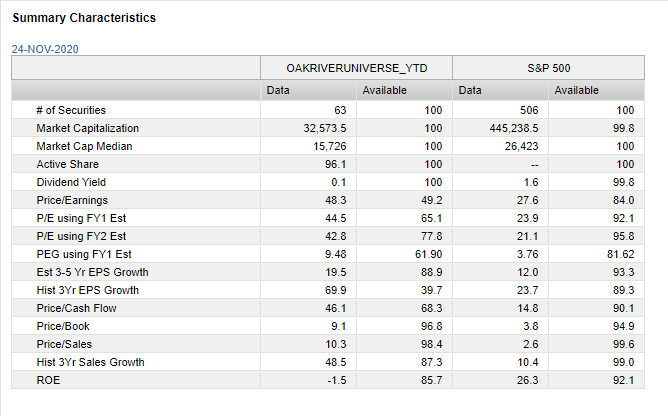

Here is a comparison to $SPY. The model currently holds 63 positions and has held ~60 on average over time. You can see the clear SMID tilt ($32B avg/$16B median market cap) as well as an obvious growth tilt. (Sales/EPS growth multiples of the market, higher valuations).... 4/n

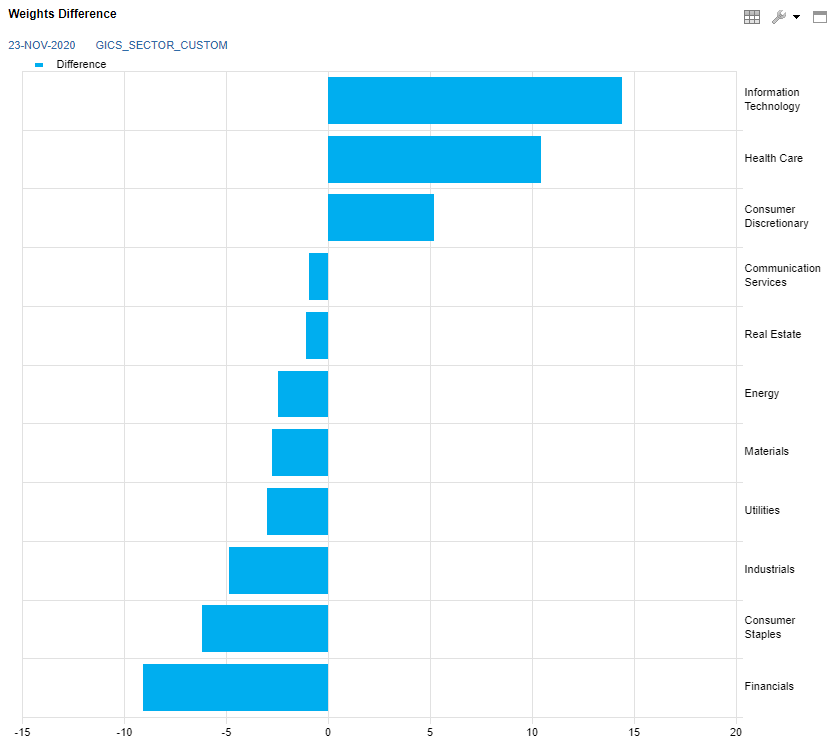

As you might guess, being a growth model, overweight and focused on the "growthy" sectors (Tech, Healthcare, Consumer Disc.) and underweight the more defensive/value sectors (Financials, Stapes, Energy, Utes, etc.)... 5/n

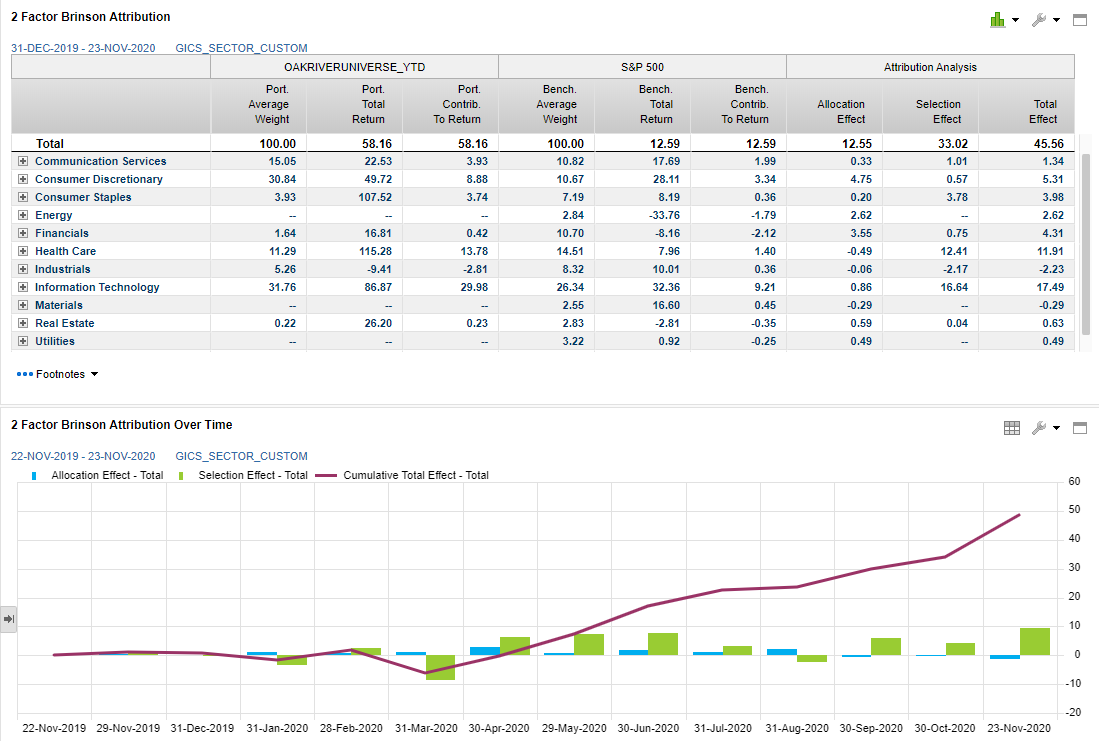

For attribution, the model outperformed $SPY by ~4500 bps YTD with ~1250 bps from allocation and ~3300 bps from selection. Largest detractors were underweight healthcare (50 bps) and poor security selection within industrials (200 bps). Security selection drove performance... 6/n

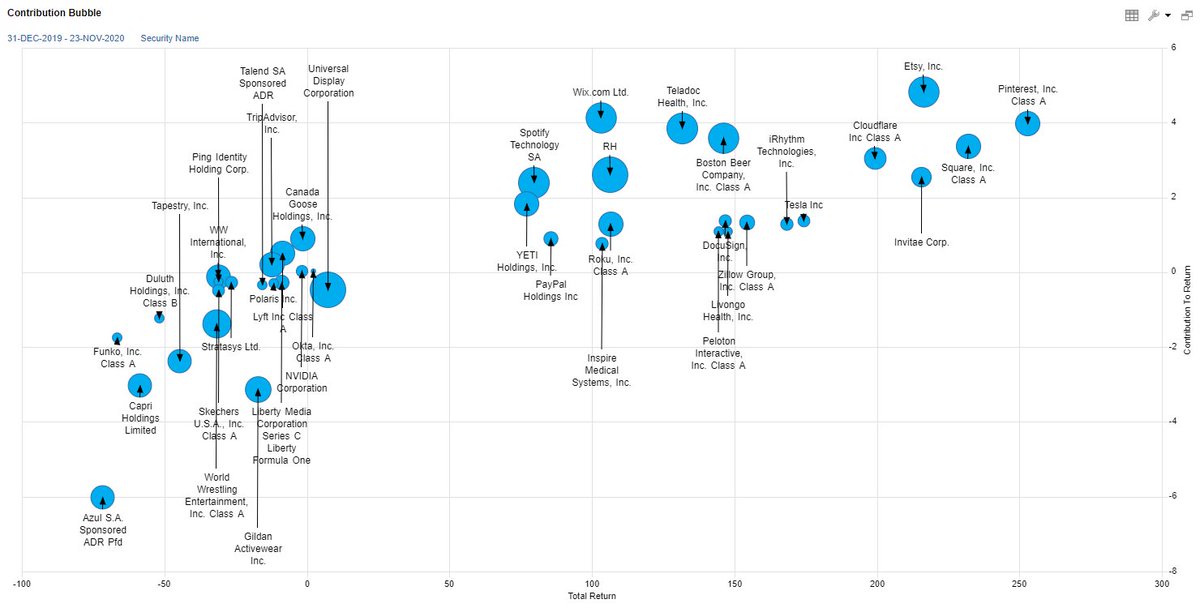

Here are the top/bottom 20 contributors to the YTD performance. Bubble size represents average portfolio weight. The biggest flaw in the model exposed in a position such as AZUL, dragging -600 bps as it was reweighted each month while falling into oblivion during covid... 7/n

The portfolio is built around growth themes that I deem to be "no-brainers". (ie. robotic surgery, non-cash payments, garbage, etc.) A list of themes and trends that I actively research can be found here: https://www.oakriverinvests.com/themes ">https://www.oakriverinvests.com/themes&qu...

and universe here: https://www.oakriverinvests.com/universe ">https://www.oakriverinvests.com/universe&... ... 8/n

and universe here: https://www.oakriverinvests.com/universe ">https://www.oakriverinvests.com/universe&... ... 8/n

If you are interested in following my universe, I recommend checking out my website or StockTwits: https://stocktwits.com/commonking

If">https://stocktwits.com/commonkin... you like (or hate) my portfolio, please feel free to re-share or provide feedback. I am always looking for similar-minded investors or processes!.. 9/n

If">https://stocktwits.com/commonkin... you like (or hate) my portfolio, please feel free to re-share or provide feedback. I am always looking for similar-minded investors or processes!.. 9/n

Lastly, since @BadaBingCapital was so kind as to provide some feedback on our StockTwits "group-think" portfolios, I& #39;d love to see if he or others have thoughts on my Growth Universe. @talbottzink @OphirGottlieb @saxena_puru @cperruna @BrianFeroldi FinTwits meme pages, etc. 10/10

Read on Twitter

Read on Twitter