Back in the Spring, I was keeping a plain-language Google-doc on CERB rules. This story is really..... lazy journalism.

Let& #39;s go back to the beginning... shall we? [Thread] https://twitter.com/hollyanndoan/status/1331367466212134921">https://twitter.com/hollyannd...

Let& #39;s go back to the beginning... shall we? [Thread] https://twitter.com/hollyanndoan/status/1331367466212134921">https://twitter.com/hollyannd...

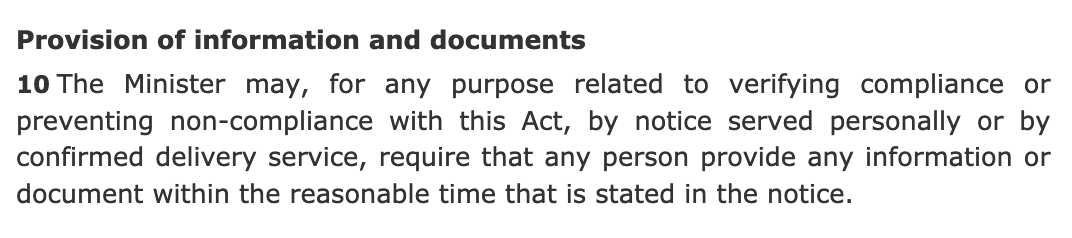

2) Let& #39;s look at the legislation, that all parties voted for. That& #39;s the origin of the rules and marching orders to officials. Here are some of the relevant sections of C-13: The legislation ALWAYS contemplated the power to ask for additional info/docs to verify eligibility

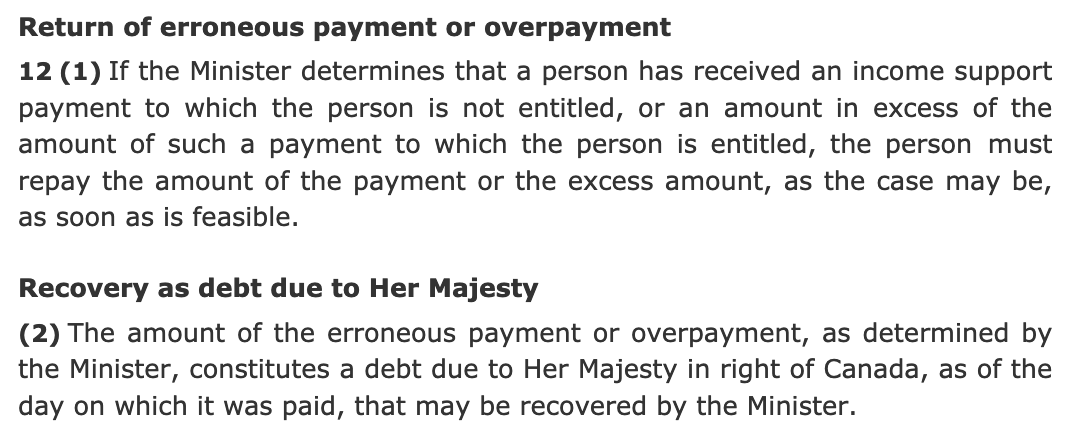

3) And it always contemplated recovering overpayments as a debt to the Crown.

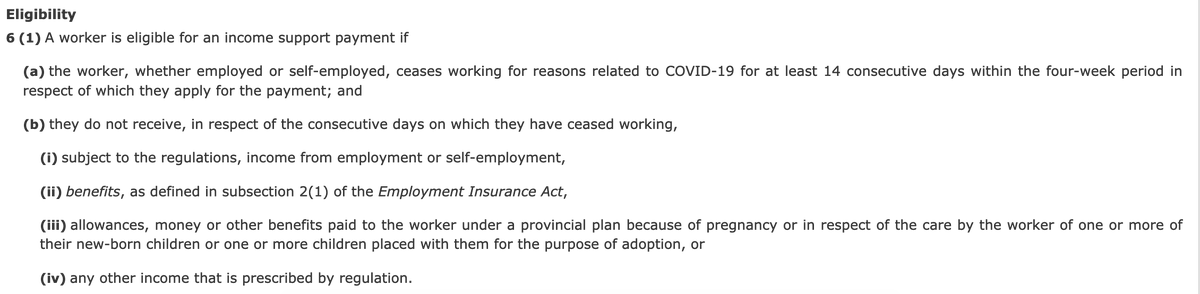

The criteria for CERB never included & #39;have filed a tax return& #39;. It wasn& #39;t a refundable tax credit. Here were the legislated criteria, again that all parties voted for:

The criteria for CERB never included & #39;have filed a tax return& #39;. It wasn& #39;t a refundable tax credit. Here were the legislated criteria, again that all parties voted for:

4) Let& #39;s remember the problem that CERB was created to fix -- a backlog in EI claims that would otherwise have taken months to address. Parties agreed that was untenable in the context of mandatory shut-downs for COVID. The legislation passed on March 25.

5) CERB applications opened April 6, retroactive to March 15. By April 12, there were 2 CERB periods for which someone could claim CERB. By April 16, 6.4 million Canadians had filed over 7.9 million applications for CERB or 1.2 claims per applicant.

6) Soon it became clear that some applicants had applied to BOTH Service Canada and the CRA. Many people were in a panic and had trouble logging on. No Service Canada offices were open for in-person help. Phone lines were jammed solid.

7) I know. I got the emails & DMs from members of the public, journalists++ By my estimate, govt went from processing about 5 EI claims a minute (largely through semi-automation) to about 1,000 CERB claims a minute (again largely via automation & redistributing work to CRA)

8) By mid-May, there were media stories that 200K CERB claims had been "red-flagged". Here& #39;s the National Post: https://nationalpost.com/news/do-not-impose-a-stop-pay-federal-workers-ordered-to-ignore-cheating-in-cerb-and-ei-claims">https://nationalpost.com/news/do-n... On the day the story ran, the govt was reporting 7.83 million Canadians had applied for CERB and 11.3 million applications processed.

9) On May 15, officials running CERB appeared before the House and were asked if they would withhold CERB from a 75 year old without a T4 on file as proof of income. They replied, no - we have to follow the law Parliament passed.

10) Sidebar: T4 won& #39;t show self-employment income. Self-employment income doesn& #39;t always show up via 3rd party reporting to CRA. Parliament expressed voted that CERB should include the self-employed. Later, under pressure from CCPA owners, dividend income was added to $5K rule

10) In mid-April, CRA & Service added info on how to repay CERB if you realized that you& #39;d received 2 payments for the same period. "Don& #39;t call us. We& #39;ll call you" was the message. Remember, the phone lines were still jammed, no counter service available. https://globalnews.ca/news/6815789/cerb-double-payment-what-to-do/">https://globalnews.ca/news/6815...

11) In July, Parliament received documents that 221K double payments had been identified. https://ipolitics.ca/2020/07/21/ottawa-sent-221320-double-payments-of-cerb-totalling-442m-documents/">https://ipolitics.ca/2020/07/2... Hmmm.. sure sounds like a familiar number.

In June, many people reapplying for CERB got notice that they wouldn& #39;t receive a payment bc they were double paid earlier.

In June, many people reapplying for CERB got notice that they wouldn& #39;t receive a payment bc they were double paid earlier.

12) That adjustment shows up in the public CERB data. The count of unique applicants drops from 8.4M to 8.06M in late June. Clean-up was already underway.

By the end of CERB in Oct., it had paid out an average of $9.17K per claimant to 8.9M applicants.

By the end of CERB in Oct., it had paid out an average of $9.17K per claimant to 8.9M applicants.

13) An average CERB applicant applied for 3 payments out of a total 7 possible payments. Again, Parliament voted to extend CERB multiple times. Changes to the attestation were only added partway through the program. The attestation, BTW is especially key on the CRA side.

14) To get CERB on the ESDC side, you had to fill out the regular EI forms and if you had an ROE that was welcome but not essential. The EI form collects a LOT of detailed info on when you say you worked, for whom, what your hours were and what you earned.

15) ESDC can contact the employers you name & check against the info you give.

On the CRA side, the CERB application was streamlined. The attestation on both sides was key - it is your legally-binding statement that your application is true.

On the CRA side, the CERB application was streamlined. The attestation on both sides was key - it is your legally-binding statement that your application is true.

16) That is, BTW, the very same mechanism we use for tax returns. Notice the number of deductions, exemptions and credits you can claim without sending in receipts. You just have to have them in case CRA does a file review or worse, an audit.

17) So CRA can use the same tools for CERB review as it does for tax returns. It can demand additional documentation to prove what you said was true. In many cases, especially for lower income Canadians, file reviews are terrifying and frankly unfair.

18) You have a hard time-limit to answer and it& #39;s onerous. E.G: Prove, in writing, that YOU are the main person who looks after your own kids or your child benefits will be cut off and you may have to repay benefits as a debt to Crown. That& #39;s how it works.

19) The unfairness concern is not just mine BTW, but also comes from reviews from the Taxpayers& #39; Ombudsman.

So, let& #39;s come back to the underlying policy question behind the lazy story. If CERB applicants needed $5K in income in 2019 -OR- the 52 weeks before they applied (see 2)

So, let& #39;s come back to the underlying policy question behind the lazy story. If CERB applicants needed $5K in income in 2019 -OR- the 52 weeks before they applied (see 2)

20) did govt have some way to check - *without* sig admin burden on employers & entrepreneurs who were just trying to keep things afloat, as Mr. Poilievre & colleagues often rightly noted - that someone HAD did have $5K in work income?

21) Here, you need to get your head out of your ass in thinking that all Canadians work as an employee for just 1 employer all year long. By April, CRA might have had 2019 T4 slips for those with 1 standard job. But how long would claims have been delayed to check those?

22) And what of self-employed workers? No T4s there to check and T4A (limited but getting better) won& #39;t show CCPC dividend income & won& #39;t show net from all sources.

There were >4 months in 20202 when someone could have worked, earning income towards $5K rule, before applying

There were >4 months in 20202 when someone could have worked, earning income towards $5K rule, before applying

23) What information did CRA have at hand to check on that?

You can& #39;t have this both ways - include CCPC dividends but require a check on T4 2019 income; pay millions of people fast, but check it all by hand; pass a law saying & #39;last 52 weeks& #39; but only use 2019 info...

You can& #39;t have this both ways - include CCPC dividends but require a check on T4 2019 income; pay millions of people fast, but check it all by hand; pass a law saying & #39;last 52 weeks& #39; but only use 2019 info...

24)... treat everyone equally but use admin processes that leave millions out; dismiss attestations as weak but lean on tax data from voluntary filing.

Read on Twitter

Read on Twitter