1/n It& #39;s looking pretty good for the "I told you so" value crowd (and my DMs have been full of "I told you so"). However, there is a big difference between "Value" and "Anti-Momentum". The "value" factor has not actually done anything when adjusted for the anti-momentum dynamic

2/n When we look at the Value factor alone (Value longs vs Value shorts), it& #39;s interesting that it looks exactly like economic recoveries in 2002-3 and 2009-10. In contrast, in 2000, a VERY different dynamic occurred

3/n And when we look at market neutral momentum, we have unwound virtually ALL of the momentum outperformance YTD and are now below the 5y moving average and almost at the post GFC trendline that has sustained prior "corrections".

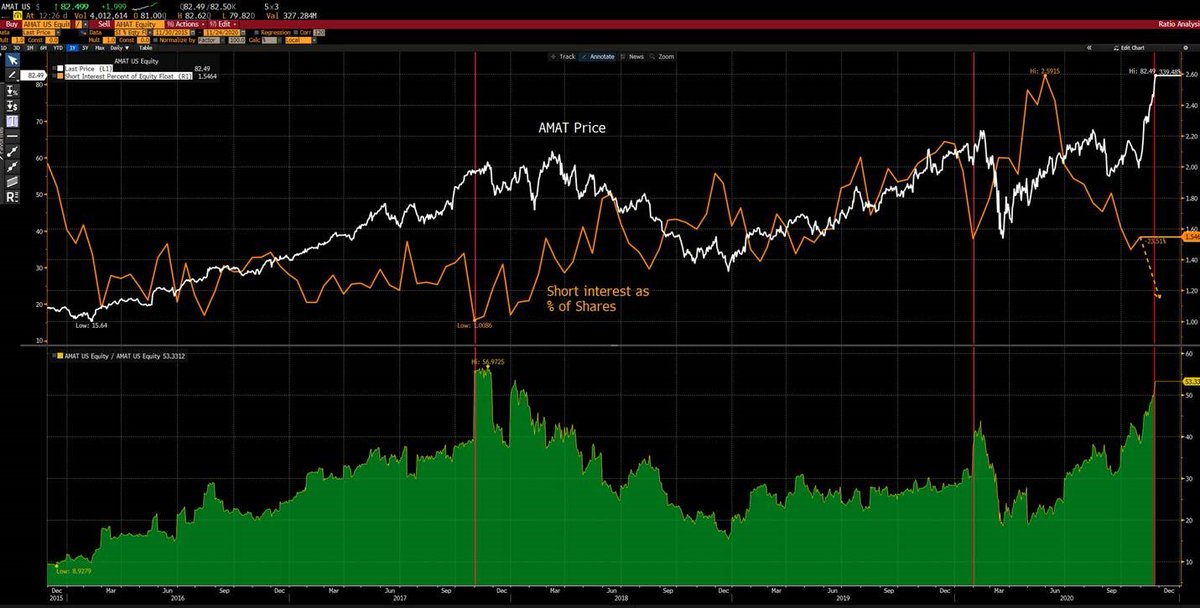

4/n Meanwhile, the gains in technology sectors (which constitute the majority of momentum) are increasingly isolated to short-covering dynamics. I& #39;d argue this is a key driver of anti-momentum as well -- books being unwound/repositioned

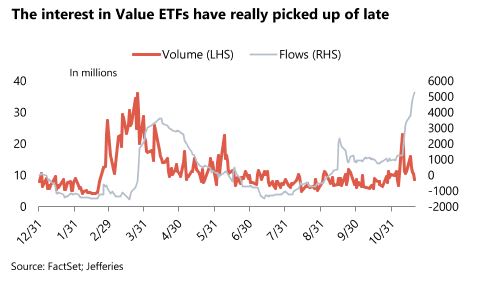

5/n And this is broadly supported by the large inflows into Value ETFs (and funds) while Tech funds have seen outflows. When the flows reverse, performance should be expected to reverse as we have seen (unfortunately these are not "forecastable" in this manner, but clearly like

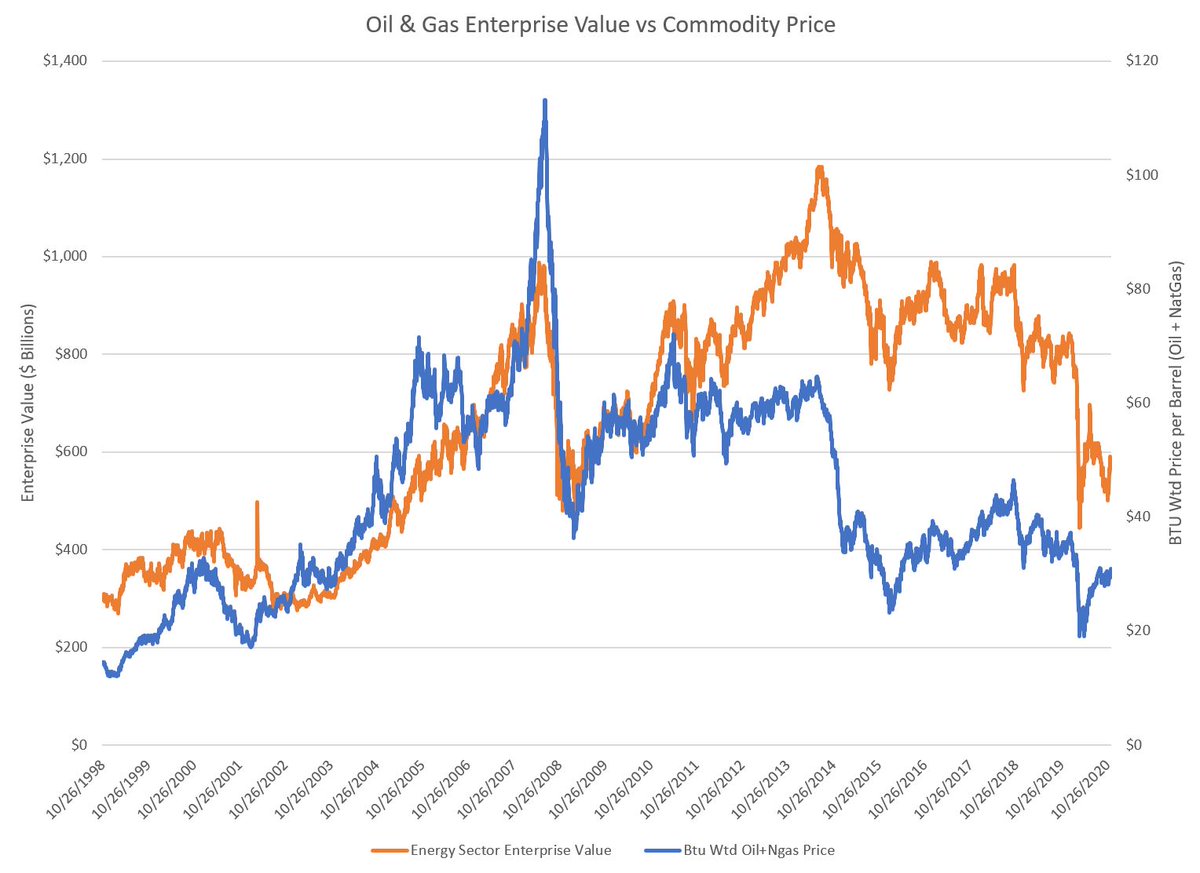

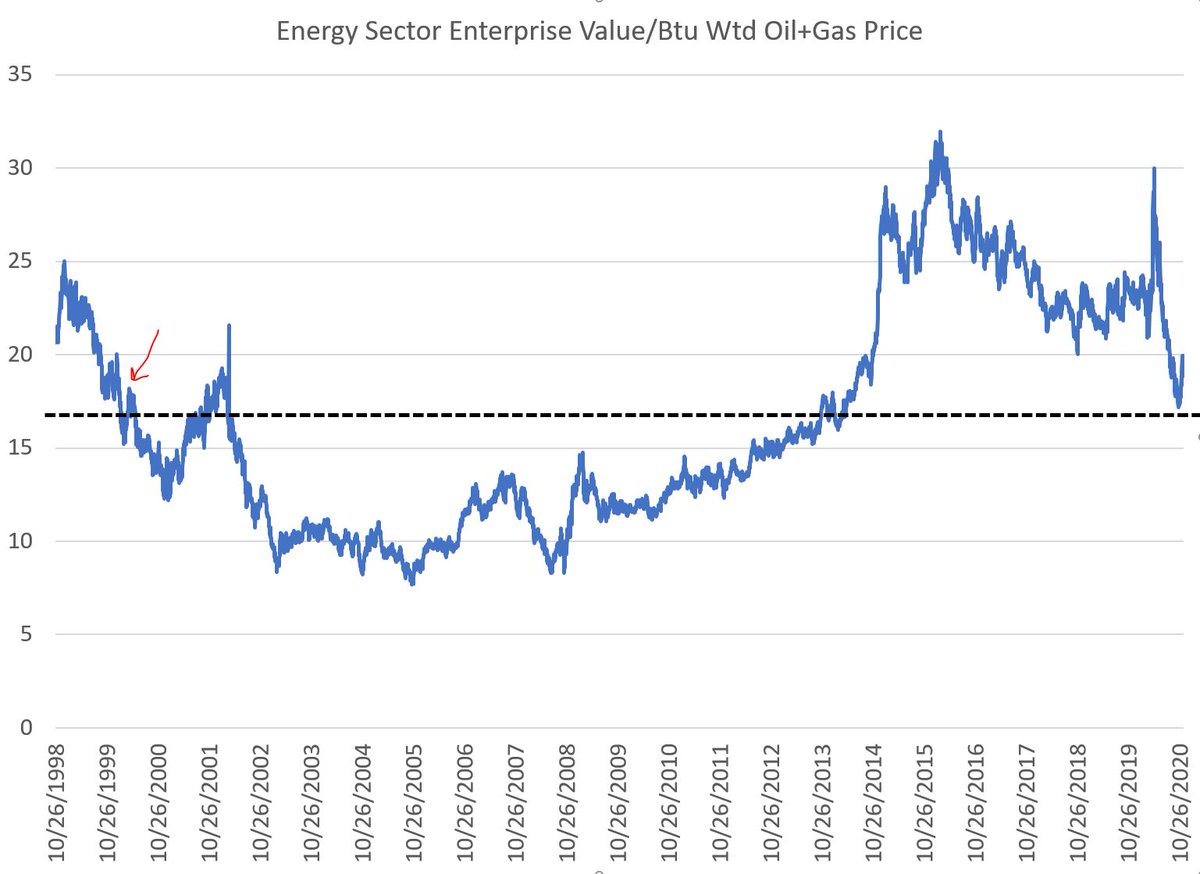

6/n the 2016 election, a narrative of "this time is different" has taken hold). In 2016, that lasted for roughly a month. Will it prove more durable this time? I remain skeptical, but open to "I told you so". In my experience, buying oil stocks to bet on oil rebound is not

Read on Twitter

Read on Twitter