In the UK, whenever inflation rates go above the 2% target, the Bank of England Governor has to explain himself to the government.

Nigeria& #39;s inflation rate has increased way beyond our 6-9% target and continues rising. https://www.stearsng.com/premium/article/why-inflation-is-always-higher-in-emerging-economies">https://www.stearsng.com/premium/a...

Nigeria& #39;s inflation rate has increased way beyond our 6-9% target and continues rising. https://www.stearsng.com/premium/article/why-inflation-is-always-higher-in-emerging-economies">https://www.stearsng.com/premium/a...

Why does inflation happen? Two major reasons.

The first is demand: people have more money to buy goods and services than is available in the economy.

The second, and more common reason in Nigeria, is due to supply constraints or when raw materials increase in price.

The first is demand: people have more money to buy goods and services than is available in the economy.

The second, and more common reason in Nigeria, is due to supply constraints or when raw materials increase in price.

Usually, developing or emerging economies have much higher inflation rates—sometimes as high as 20%, compared to developed countries which range between 0-5%.

Why?

Emerging economies grow very quickly or have the potential to do so.

Why?

Emerging economies grow very quickly or have the potential to do so.

So, high growth periods often lead to situations where people& #39;s income rise and there is demand for more goods.

If supply is not able to keep up, then you can be sure that inflation will start to rise. The economy overheats.

Take Ethiopia.

If supply is not able to keep up, then you can be sure that inflation will start to rise. The economy overheats.

Take Ethiopia.

In the 2000s, it was the third poorest country in the world, with almost half of its population living in poverty.

Since 2004, Ethiopia has recorded the highest growth in Africa, with double digits for the first 6 years, and over 5% till date.

So people became richer.

Since 2004, Ethiopia has recorded the highest growth in Africa, with double digits for the first 6 years, and over 5% till date.

So people became richer.

The economy& #39;s growth was driven by an increase in investment.

The amount of money in people& #39;s pockets increased, but the supply could not match the new demand.

Poverty had significantly reduced in the country, so people could afford to buy goods as prices grew.

The amount of money in people& #39;s pockets increased, but the supply could not match the new demand.

Poverty had significantly reduced in the country, so people could afford to buy goods as prices grew.

In 2008, during a famine, high food prices were not only driven by the lack of crops but also because farmers hoarded their food, leading to an inflation as high as 44%.

To them, no matter how much the prices increased, there would still be people that could afford to buy them.

To them, no matter how much the prices increased, there would still be people that could afford to buy them.

Contrast this with developed countries where this cannot happen because poverty rates are low, and possibilities of expansion are limited.

As they continue to invest and increase their capital in the economy, they start to get less returns from it—the law of diminishing returns

As they continue to invest and increase their capital in the economy, they start to get less returns from it—the law of diminishing returns

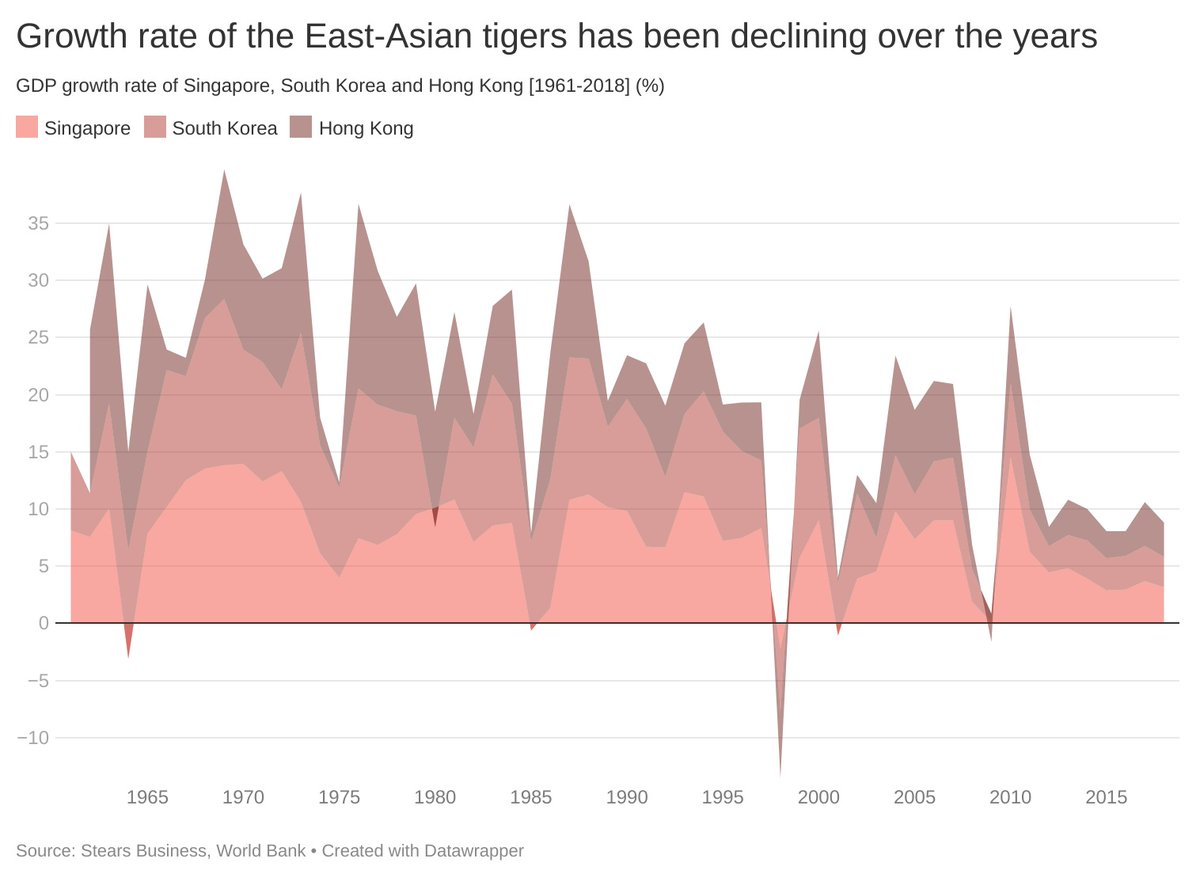

The most common example of this is The Asian Miracle, where Hong Kong, South Korea, Singapore and Taiwan experienced rapid growth by borrowing industrialisation methods from the US and UK, till their economies converged.

China has been recording high growth rates over the last few decades, also driven by industrialisation.

Unlike other emerging countries though, China has maintained exceptionally high GDP numbers—above 5%—for over two decades, with low inflation numbers in the past years

Unlike other emerging countries though, China has maintained exceptionally high GDP numbers—above 5%—for over two decades, with low inflation numbers in the past years

The Chinese government manipulates monetary policies to curb the flow of inflation.

Much like the CBN governor does here in Nigeria. But we get wildly different results. Why?

Nigeria is nothing like China, and our source of inflation is different.

Much like the CBN governor does here in Nigeria. But we get wildly different results. Why?

Nigeria is nothing like China, and our source of inflation is different.

In 2010, China& #39;s inflation hit a 25-month high at 4.4%. It was caused by the influx of a stimulus package worth $586 billion into the economy, two years before.

The package, which was targeted at infrastructural development and welfare, led to an increase in its inflation.

The package, which was targeted at infrastructural development and welfare, led to an increase in its inflation.

In Nigeria, we suffer from structural challenges like bad roads, inadequate storage for goods and disruptive policy changes like border closures—supply constraints.

If the government decided to solve this problem by first attempting to fix the infrastructure problem...

If the government decided to solve this problem by first attempting to fix the infrastructure problem...

Then like China, the government would channel a lot of money into infrastructure and would end up in a high inflation situation—which would be demand induced because people have more money.

But a little hiccup: our supply problem —we STILL will not make as much as we consume.

But a little hiccup: our supply problem —we STILL will not make as much as we consume.

Nigeria is very import-dependent. Of the $115 billion that Nigeria earned in 2019, a little over $100 billion went to imports.

One thing that defines an emerging economy, as we mentioned earlier is the portfolio of its export diversification, and this is Nigeria& #39;s Achilles heel

One thing that defines an emerging economy, as we mentioned earlier is the portfolio of its export diversification, and this is Nigeria& #39;s Achilles heel

China is the largest manufacturer in the world, so there is a need for China& #39;s business and its currency which prompts (and justifies) the central bank, the controller of the currency to control the currency’s demand and supply using interest rates.

But in Nigeria, not so much

But in Nigeria, not so much

Inflation is an indication of where an economy is and where it will likely be in the future.

When prices rise unexpectedly and continuously due to supply shocks, it hurts consumers. Their purchasing power—what they can purchase with their same level of income—reduces.

When prices rise unexpectedly and continuously due to supply shocks, it hurts consumers. Their purchasing power—what they can purchase with their same level of income—reduces.

Read on Twitter

Read on Twitter