New U.K. insolvency rules that would prioritise tax debt could make it harder for struggling businesses to access banks loans. https://news.bloombergtax.com/daily-tax-report-international/u-k-companies-face-lending-risks-under-new-bankruptcy-rules">https://news.bloombergtax.com/daily-tax...

https://news.bloombergtatwitter.com/daily-tax-report-international/u-k-companies-face-lending-risks-under-new-bankruptcy-rules

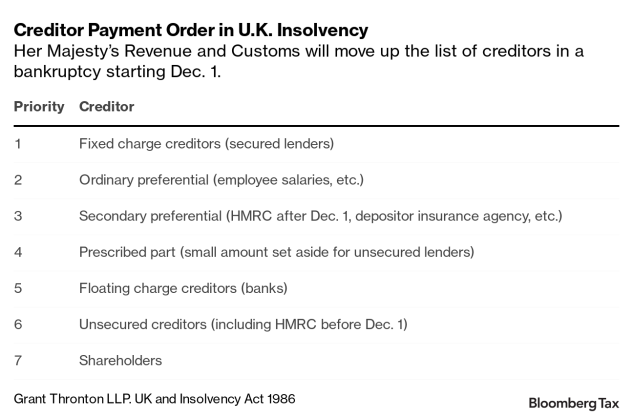

Currently, when there is an insolvency HMRC sits with unsecured lenders at the bottom of the pack, with only shareholders being paid after them.

However, from Dec. 1 HMRC will move up the ranks and become a "preferential secondary creditor" which will mean it sits above certain types of bank lending.

This type of lending known as floating charge lending, will now only be paid after taxes like NIC, VAT and PAYE are paid. Floating charge lending is often used when banks lend large overdrafts for example.

This will likely force banks to review the level of tax debt (including disputed amounts) a company has when considering whether or not to lend.

This problem will be made worse by the fact that many companies have differed large amounts of tax under "time-to-pay" arrangements that will fall due in 2021 after the government will stop guaranteeing stimulus loans.

Beyond Covid-19 banks may now have to take into account, tax disputes, uncertain tax positions and open tax audits when considering the creditworthiness of companies they lend.

One final point worth making here is that time-to-pay arrangements are not allowed to appear on your credit record (a move designed to ensure companies aren& #39;t penalised for taking advantage of the program).

Read on Twitter

Read on Twitter