Story of Kotak Mahindra Bank

A thread ...

How it all began

How it survived the Asian Financial Crisis

How it built its CASA book

Timing the market cycles

Converting challenges to opportunities

How Uday Kotak built an Integrated Financial Company

A thread ...

How it all began

How it survived the Asian Financial Crisis

How it built its CASA book

Timing the market cycles

Converting challenges to opportunities

How Uday Kotak built an Integrated Financial Company

1/ Uday Kotak started his entrepreneurial journey in 1985 with Rs.30 lakh capital for bill discounting, where he convinced his family and friends to invest at 12% for lending it to a TATA company, Nelco at 17%, earning a 5% spread.

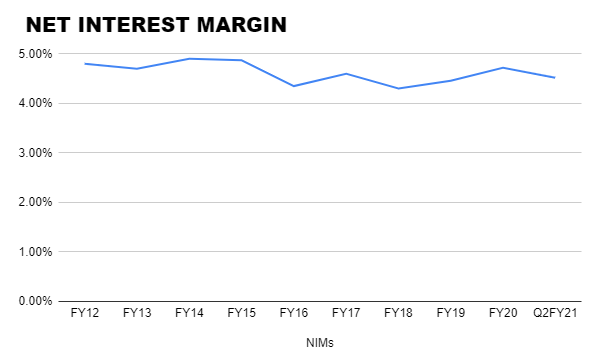

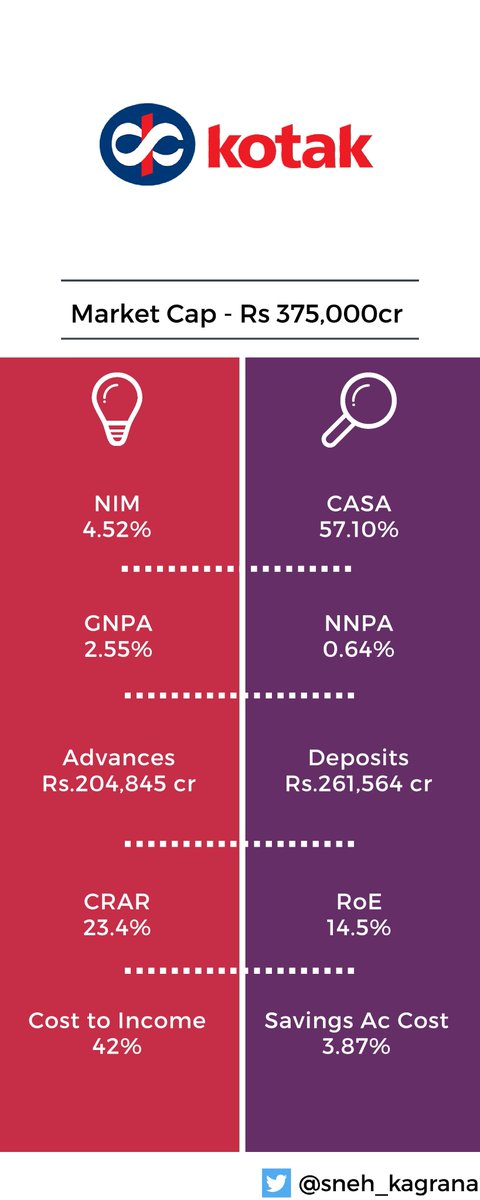

2/ Banks used to give 6% on deposits and used to lend at 17%. So it was a win-win situation for the depositors who earned double interest on their savings. Kotak continues to earn similar spreads even today with a NIM of 4.52%.

3/ Kotak in 1989, an NBFC at that time, had its eye on the car financing business, which was dominated by CITI Bank. It used to finance cars at 31% IRR. There was a long waiting period, so Kotak booked the cars in advance.

4/ Those who wanted the car got it from Kotak at no extra price, but had to take finance from Kotak. They capitalized on the opportunity and earned an even higher spread in car financing. Another story of Kotak’s Adaptability and Agility below-

5/ In 1992, RBI decided to stop bill re-discounting which formed 60% of business for Kotak. Kotak went on to forge partnerships with Goldman and Ford to set-up its capital market business through the 90s, which at peak contributed 60% of profits.

6/ In the late 90s, the Asian Financial Crisis shook emerging markets. Kotak had felt initial stress and cut its book from Rs.1800crs to Rs.1000crs just before the crisis hit. It was one of the very few NBFCs that survived and went on to get a Banking License in 2002.

7/ Trivia: In 1996, Business Standard was running losses at Rs1.5cr/month and was desperately looking for a buyer. Kotak took an equity stake as a financial investment in the newspaper.

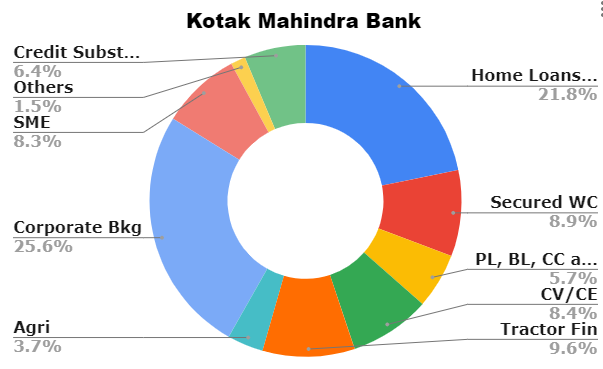

8/ Kotak prior to the Global Financial Crisis had primarily retail loans. It took GFC as an opportunity and grew its corporate book at a good pace. From 10% of the total book, Kotak had a target of 35% mix of corporate book.

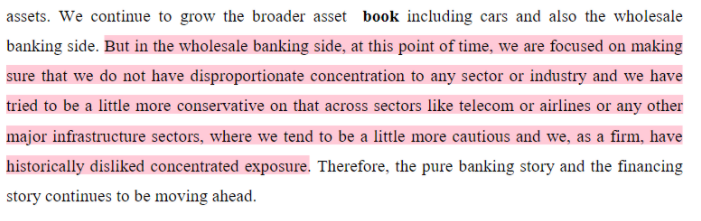

9/ Kotak has also been quite successful in anticipating market cycles. It had a substantial commercial vehicle and construction equipment book. Anticipating stress in the economy and infra space it consciously reduced its weight during 2013-14.

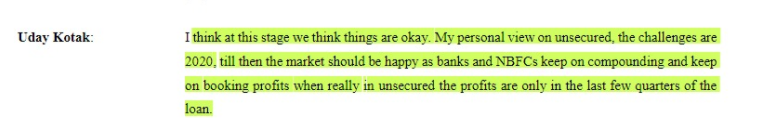

10/ It had taken a similar view during the Asian Financial crisis. On the SME side, it somewhat got lucky, as the ING Vysya book had some stress and it was going slow with it. KMB has been cautious on retail unsecured credit since 2018.

11/ Not only on the asset side, but it also has a good strike rate while timing on the liability side as well. It has done QIP and raised equity only 3 times, in 2007 and 2017, both market top (in hindsight). And recently in 2020.

12/ A good lender apart from anticipating market cycles has another important job; to manage risk. The principle of Risk-adjusted returns as Uday Kotak puts it has been the core of managing and underwriting risk for KMB.

13/ Striking a balance between growth and risk can sometimes get very challenging, especially when your peers are growing and you choose to dial-down the asset growth. But KMB has till now not given to such external pressure.

14/ On disclosures, it recognizes stress proactively, even before it turns NPA. It chooses to recognize stress (as NPA) first over re-structuring the asset. “You get what you see and you see what you get.”

15/ It has been doing the above things so well that it has come out of all crisis stronger, be it the Asian Crisis, GFC, IL&FS issue, or recently Covid-19 (until now). It has ensured that it has a diversified book with no exposure to stress sectors.

16/ On 1st April 2015, ING Vysya got merged with KMB in an all-stock deal. KMB got substantial branches in South India, customers to cross-sell other products, Crop Loan book in the Agri segment, and SME book. It was pro-active in recognizing stress in this book as well.

17/ Issues in this SME book had ensured that KMB goes a little slow in the SME space, which somewhat insulated KMB during DeMo and downturn in the economy, where SME had taken the biggest hit.

18/ ING also held a portfolio in the Infra space and Diamond sector. It had some good international clients. ING’s efficiency was less than that of a KMB branch, and KMB took this as an opportunity to grow. CASA per branch for ING was Rs.18crs and for KMB was Rs.38crs.

Did you Know: Kotak Mahindra Bank owns 15% in Multi Commodity Exchange (MCX)

19/ On the fee income side, KMB realized that it was not generating enough fees relative to its peers. It focussed on transactional fee, business banking, and forex fee income as the base for growing its fee income.

20/ Kotak is not only a banking business. It has many subsidiaries providing different financial services. Uday Kotak’s vision was to provide a complete integrated financial product. He wished to capture both “saver” and “investor”.

21/ Even during bad times, Uday Kotak held the conviction of building the capital market business. Today Kotak AMC has an AUM of Rs.175,000crs and a market share of 6.9%. Its investment banking arm generated a profit of Rs.79crs on revenue of Rs.220crs in FY20.

22/ Total Relationship Value stands at Rs.300,000cr at the end of Q2 2020. Its broker arm is 4th largest among full-service brokers and generated a PAT of Rs 550cr in FY2020. It also has two insurance subsidiaries for Life and General Insurance.

23/ Kotak has also been at the forefront when it comes to digital innovation. Its 811 account is a great mass product and provides a pool for cross-selling. The demographics of this pool too are interesting where most customers are in the age bracket of 18-35. [low avg balances]

24/ KMB sources trading accounts, recurring and fixed deposits account, sells secured and unsecured credit cards, personal loans through 811. It also sells sachet insurance products.

25/ Coming to the most important factor while discussing KMB - the CASA ratio. KMB had its eye set on building a granular CASA deposit book. But a turning point came in October 2011, when RBI De-Regulated the savings deposit rate.

26/ It had two choices, take a hit on NIMs in the short term and focus on long term customer acquisition or protect its near term earnings by not increasing deposit rates. Kotak hiked interest rates to 6% on deposits of over 1 Lakh.

27/ "We are not scared to be putting and investing more money towards what we think is stable retail deposit base, and we will continue to do that" - Uday Kotak

Q3FY11 CASA - Rs.7800crs (28%)

Q2FY20 CASA - Rs.149,000crs (57%)

[+7% with sweep-in deposits]

Q3FY11 CASA - Rs.7800crs (28%)

Q2FY20 CASA - Rs.149,000crs (57%)

[+7% with sweep-in deposits]

28/ As the CASA deposit book grew, Kotak’s extra interest cost too kept on growing from Rs.500crs to Rs.1500crs each year. Marketing and digital infrastructure costs too were damping the bottom line.

29/ Stable low-cost deposits further strengthened Kotak’s asset quality because lower cost meant KMB can move up the quality curve and lend at lower rates without suppressing its NIMs. It can also lend in low RoE assets like Home Loans.

30/ Growing loan book is just one part of a lender& #39;s growth, access to growing cheap and stable funds is the other half, to ensure the cost of funds remains within the range. CASA + TD < 5crs form 91% of total deposits.

31/ “There is absolutely no point getting a disproportionate asset growth and then scrambling for liabilities where we are not able to get fine pricing and raise the level of our overall cost of liability in terms of long term implications for our cost of fund”~Uday Kotak Q1FY11

32/ Kotak has a CRAR of 23.4%. throughout these years had high capital availability. Analysts then used to ask what would Kotak do, will they grow their book fast or take the inorganic route. It found that opportunity in the ING merger

33/ Not growing looking at the risks is fine, but with high capital, it has to pay its own costs. It reduces the RoE. Still, KMB has chosen not to grow for the sake of sweating equity. This once again shows the risk management of the KMB management team.

34/ A well-capitalized bank when decides not to go aggressive on lending, has to pay a price, either in short term by avoiding lending on unfavorable risk-return terms and thus reducing NIMs OR lend & lose money, create provisions after few years when loans turn bad.

35/ Even with regards to the moratorium, KMB decided not to delay the recognizing of stress, rather identify it as NPA upfront. Its moratorium book stood at 9.65%.

36/Interestingly, Kotak has changed gears and will be focussing on growing its asset book now. It also took the opportunity of Sovereign backing and has disbursed Rs.8140crs under ECLGS. It not only gives SMEs a chance to fight but also helps in saving asset quality for banks.

37/ Its SMA-II book stood at Rs.133crs, 0.06% of net advances. Without the SC order on NPA recognition, its GNPA stands at 2.70% and NNPA at 0.74%. Covid related provisions - Rs. 1279crs as of Q2FY21

38/ Market share gain story by pvt banks is known to all. PSUs have a lack of capital. Add to that the unrecognized stress. Not much would be left for lending. Needless to say, well-capitalized banks like Kotak would be able to gain market share here.

39/ In a leveraged business,management quality is of utmost importance because things can go out of hand pretty fast. You need a lender who is alert in spotting market cycles, manages risk very well, and is focused on creating long-term value instead of short term window dressing

40/ Studying the past can help in assessing the management quality.

41/ So to sum it up, KMB is a bank that has built a humongous low-cost deposit book, has good asset quality, is well-capitalized against unforeseen events or to take opportunities, has solid NIMs, and is led by a great management team which is obsessed with risk management. /end

Would love to hear out your thoughts, more points, feedback. @SwarnashishC @AnishA_Moonka @RJGyanchandani @adi2five @FI_InvestIndia @Dinesh_Sairam

Read on Twitter

Read on Twitter

![27/ "We are not scared to be putting and investing more money towards what we think is stable retail deposit base, and we will continue to do that" - Uday KotakQ3FY11 CASA - Rs.7800crs (28%)Q2FY20 CASA - Rs.149,000crs (57%)[+7% with sweep-in deposits] 27/ "We are not scared to be putting and investing more money towards what we think is stable retail deposit base, and we will continue to do that" - Uday KotakQ3FY11 CASA - Rs.7800crs (28%)Q2FY20 CASA - Rs.149,000crs (57%)[+7% with sweep-in deposits]](https://pbs.twimg.com/media/Enf5FY0UcAMLOhD.png)