(1/21)

I will break up this FTW credit card (CC) series into the following 6 parts:

#007 - How to use credit cards to pay off debt faster

#008 - How to maximize cash back rewards

#009 - How to travel the world for FREE using credit card points

I will break up this FTW credit card (CC) series into the following 6 parts:

#007 - How to use credit cards to pay off debt faster

#008 - How to maximize cash back rewards

#009 - How to travel the world for FREE using credit card points

(2/21)

#010 - How to build your wealth using credit cards

#011 - My ideal credit card strategy

#012 - A look into my wallet

The purpose of this thread is to show how I travel for FREE by using CC points.

#010 - How to build your wealth using credit cards

#011 - My ideal credit card strategy

#012 - A look into my wallet

The purpose of this thread is to show how I travel for FREE by using CC points.

(3/21)

This is not financial advice, and is for entertainment purposes only. Please do your own research before deciding to open up a new CC.

The two main categories for CCs are:

- travel

- cash back (FTW #008 - https://twitter.com/warrenrubin_/status/1329999116940689410?s=21)">https://twitter.com/warrenrub...

This is not financial advice, and is for entertainment purposes only. Please do your own research before deciding to open up a new CC.

The two main categories for CCs are:

- travel

- cash back (FTW #008 - https://twitter.com/warrenrubin_/status/1329999116940689410?s=21)">https://twitter.com/warrenrub...

(4/21)

I have said in previous FTW posts that I would recommend everyone to start with Chase CCs. So today I will be focusing on how I am utilizing my Chase Ultimate Reward (UR) points to travel for FREE. I do also have points with...

I have said in previous FTW posts that I would recommend everyone to start with Chase CCs. So today I will be focusing on how I am utilizing my Chase Ultimate Reward (UR) points to travel for FREE. I do also have points with...

(5/21)

... American Express, Hawaiian, Delta, United, American Airlines, and Alaska but getting value from UR points are a lot easier than other points systems so I will exclude talking about those other points from today& #39;s post.

... American Express, Hawaiian, Delta, United, American Airlines, and Alaska but getting value from UR points are a lot easier than other points systems so I will exclude talking about those other points from today& #39;s post.

(6/21)

How to travel for free using CC points?

1. Open up a CC that has a great sign up bonus and put your everyday expenses on this new CC to earn the sign up bonus. DO NOT spend more than you normally would just to earn a sign up bonus.

How to travel for free using CC points?

1. Open up a CC that has a great sign up bonus and put your everyday expenses on this new CC to earn the sign up bonus. DO NOT spend more than you normally would just to earn a sign up bonus.

(7/21)

It isn’t considered free at this point if you’re spending more money just to earn a bonus. If you don’t spend enough to earn the bonus, then it may be worth it to wait until you have a big expense coming up to earn these bonuses.

It isn’t considered free at this point if you’re spending more money just to earn a bonus. If you don’t spend enough to earn the bonus, then it may be worth it to wait until you have a big expense coming up to earn these bonuses.

(8/21)

What I do sometimes is I ask my family members if I can charge their big expenses onto my CC to earn the bonus and they just reimburse me.

2. Trade your debit card for a credit card. I always use a credit card for purchases.

What I do sometimes is I ask my family members if I can charge their big expenses onto my CC to earn the bonus and they just reimburse me.

2. Trade your debit card for a credit card. I always use a credit card for purchases.

(9/21)

2 benefits to this: you earn points for FREE travel & a CC provides an extra layer of fraud protection. A lot of CCs offer some sort of fraud liability protection. This basically insures you as the consumer in the event of a fraudulent charge(s).

2 benefits to this: you earn points for FREE travel & a CC provides an extra layer of fraud protection. A lot of CCs offer some sort of fraud liability protection. This basically insures you as the consumer in the event of a fraudulent charge(s).

(10/21)

3. Redeem your points for free flights or hotel nights. This part is important because not many folks know how to maximize their points. You can think of all these different points systems as being their own “currency.”

3. Redeem your points for free flights or hotel nights. This part is important because not many folks know how to maximize their points. You can think of all these different points systems as being their own “currency.”

(11/21)

100,000 Hawaiian points is not equal to 100,000 UR points or 100,000 Hilton points.

I will show some examples to illustrate the different values of some of these point “currencies”

100,000 Hawaiian points is not equal to 100,000 UR points or 100,000 Hilton points.

I will show some examples to illustrate the different values of some of these point “currencies”

(12/21)

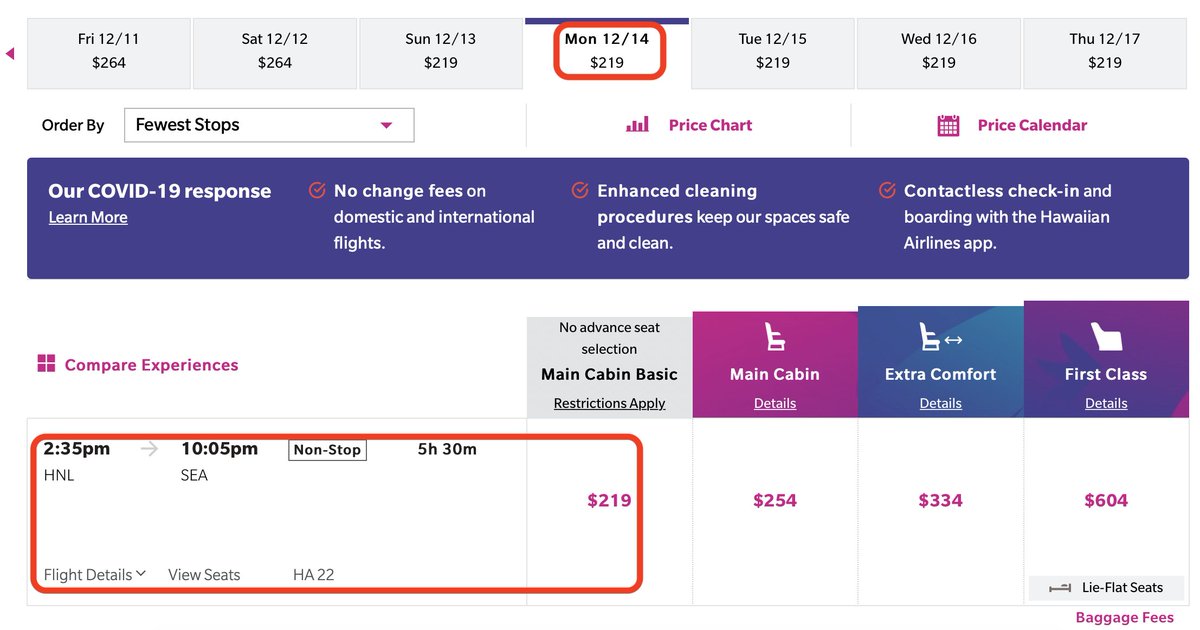

The pictures below show the price (in points and dollars) for a flight on Hawaiian Airlines from Honolulu to Seattle on Dec 14, 2020. Notice that it would cost me 17,500 Hawaiian points to pay for this flight or $219.

The pictures below show the price (in points and dollars) for a flight on Hawaiian Airlines from Honolulu to Seattle on Dec 14, 2020. Notice that it would cost me 17,500 Hawaiian points to pay for this flight or $219.

(13/21)

The picture below shows how many Chase UR points it would cost me to take the same exact flight on Hawaiian Airlines. With Chase, it would cost me only 14,540 UR points! This is because not all points have the same value.

The picture below shows how many Chase UR points it would cost me to take the same exact flight on Hawaiian Airlines. With Chase, it would cost me only 14,540 UR points! This is because not all points have the same value.

(14/21)

A metric we use to determine the value of points is known as cents per point (CPP).

CPP = price of airline ticket in dollars x 100 / price of same ticket in points

A metric we use to determine the value of points is known as cents per point (CPP).

CPP = price of airline ticket in dollars x 100 / price of same ticket in points

(15/21)

In this particular flight, I would be redeeming my Hawaiian miles/points through Hawaiian Airlines at 1.25 CPP ($219 x 100 / 17,500 = 1.25 CPP).

When I redeemed my Chase UR points for the same flight, I’m getting a value of 1.5 CPP. ($218.10 x 100 / 14,540 = 1.5 CPP).

In this particular flight, I would be redeeming my Hawaiian miles/points through Hawaiian Airlines at 1.25 CPP ($219 x 100 / 17,500 = 1.25 CPP).

When I redeemed my Chase UR points for the same flight, I’m getting a value of 1.5 CPP. ($218.10 x 100 / 14,540 = 1.5 CPP).

(16/21)

The higher the CPP, the more valuable the points are. CPP depends on the flight, so for this example, the 1.25 for Hawaiian is not a fixed metric. It will change based on the flight I choose.

The higher the CPP, the more valuable the points are. CPP depends on the flight, so for this example, the 1.25 for Hawaiian is not a fixed metric. It will change based on the flight I choose.

(17/21)

With my current Chase set up, I am guaranteed a 1.5 CPP redemption on ANY flight with any airlines. Which is why I believe Chase is the best set up for most people (see links below if you’re interested in applying fo your first Chase CC).

With my current Chase set up, I am guaranteed a 1.5 CPP redemption on ANY flight with any airlines. Which is why I believe Chase is the best set up for most people (see links below if you’re interested in applying fo your first Chase CC).

(18/21)

Final Remarks:

Credit cards can be very dangerous for those who are irresponsible with them. CCs are a tool, tools may help you but they may also hurt you. DO NOT open a new CC if you think you may be irresponsible with them.

Final Remarks:

Credit cards can be very dangerous for those who are irresponsible with them. CCs are a tool, tools may help you but they may also hurt you. DO NOT open a new CC if you think you may be irresponsible with them.

(19/21)

The purpose of my FTW series is to help people get out of debt and to take control of their finances, the last thing I want is for someone to open up a CC to fall into more debt.

The purpose of my FTW series is to help people get out of debt and to take control of their finances, the last thing I want is for someone to open up a CC to fall into more debt.

(20/21)

If you plan ahead, you should never pay banks interest ever again all while earning points for FREE travel or cash back to invest for your future!

If you plan ahead, you should never pay banks interest ever again all while earning points for FREE travel or cash back to invest for your future!

(21/21)

If you’re not confident in applying or feel like you may not get approved, send me a message! I’ve got some few tips/tricks to possibly help improve your odds of getting approved!

Feel free to also message me if you have any questions!

If you’re not confident in applying or feel like you may not get approved, send me a message! I’ve got some few tips/tricks to possibly help improve your odds of getting approved!

Feel free to also message me if you have any questions!

Chase Freedom Unlimited or Freedom Flex: https://www.referyourchasecard.com/18f/7DLWBD5V0B

Chase">https://www.referyourchasecard.com/18f/7DLWB... Sapphire Preferred: https://www.referyourchasecard.com/m/6a/6L5/G9F9/1557547579

American">https://www.referyourchasecard.com/m/6a/6L5/... Express Platinum: http://refer.amex.us/WARRER8qP0?XL=MIACP

Capital">https://refer.amex.us/WARRER8qP... One Quicksilver: https://capital.one/31ofZfL ">https://capital.one/31ofZfL&q...

Chase">https://www.referyourchasecard.com/18f/7DLWB... Sapphire Preferred: https://www.referyourchasecard.com/m/6a/6L5/G9F9/1557547579

American">https://www.referyourchasecard.com/m/6a/6L5/... Express Platinum: http://refer.amex.us/WARRER8qP0?XL=MIACP

Capital">https://refer.amex.us/WARRER8qP... One Quicksilver: https://capital.one/31ofZfL ">https://capital.one/31ofZfL&q...

Join me tomorrow at 6pm HST for FTW #010.

What is FTW?: https://twitter.com/warrenrubin_/status/1327360078177914880?s=21

FTW">https://twitter.com/warrenrub... #001: https://twitter.com/warrenrubin_/status/1327491766312845312?s=21

FTW">https://twitter.com/warrenrub... #002: https://twitter.com/warrenrubin_/status/1327838753344217088?s=21

FTW">https://twitter.com/warrenrub... #003: https://twitter.com/warrenrubin_/status/1328186040083890176?s=21

FTW">https://twitter.com/warrenrub... #004: https://twitter.com/warrenrubin_/status/1328549059192258561?s=21">https://twitter.com/warrenrub...

What is FTW?: https://twitter.com/warrenrubin_/status/1327360078177914880?s=21

FTW">https://twitter.com/warrenrub... #001: https://twitter.com/warrenrubin_/status/1327491766312845312?s=21

FTW">https://twitter.com/warrenrub... #002: https://twitter.com/warrenrubin_/status/1327838753344217088?s=21

FTW">https://twitter.com/warrenrub... #003: https://twitter.com/warrenrubin_/status/1328186040083890176?s=21

FTW">https://twitter.com/warrenrub... #004: https://twitter.com/warrenrubin_/status/1328549059192258561?s=21">https://twitter.com/warrenrub...

FTW #005: https://twitter.com/warrenrubin_/status/1328911090026115073?s=21

FTW">https://twitter.com/warrenrub... #006: https://twitter.com/warrenrubin_/status/1329277987842187265?s=21

FTW">https://twitter.com/warrenrub... #007: https://twitter.com/warrenrubin_/status/1329638971215790082?s=21

FTW">https://twitter.com/warrenrub... #008: https://twitter.com/warrenrubin_/status/1329999116940689410?s=21">https://twitter.com/warrenrub...

FTW">https://twitter.com/warrenrub... #006: https://twitter.com/warrenrubin_/status/1329277987842187265?s=21

FTW">https://twitter.com/warrenrub... #007: https://twitter.com/warrenrubin_/status/1329638971215790082?s=21

FTW">https://twitter.com/warrenrub... #008: https://twitter.com/warrenrubin_/status/1329999116940689410?s=21">https://twitter.com/warrenrub...

Read on Twitter

Read on Twitter