Okay, I& #39;ve wanted to do this for a long time

Are you familiar with the Pritzkers?

They& #39;re Chicago royalty, with a saga that& #39;s got it all - rags-to-riches rise, alleged mob ties, huge successes and wild blowups, including a family feud that makes Succession look... tame

Are you familiar with the Pritzkers?

They& #39;re Chicago royalty, with a saga that& #39;s got it all - rags-to-riches rise, alleged mob ties, huge successes and wild blowups, including a family feud that makes Succession look... tame

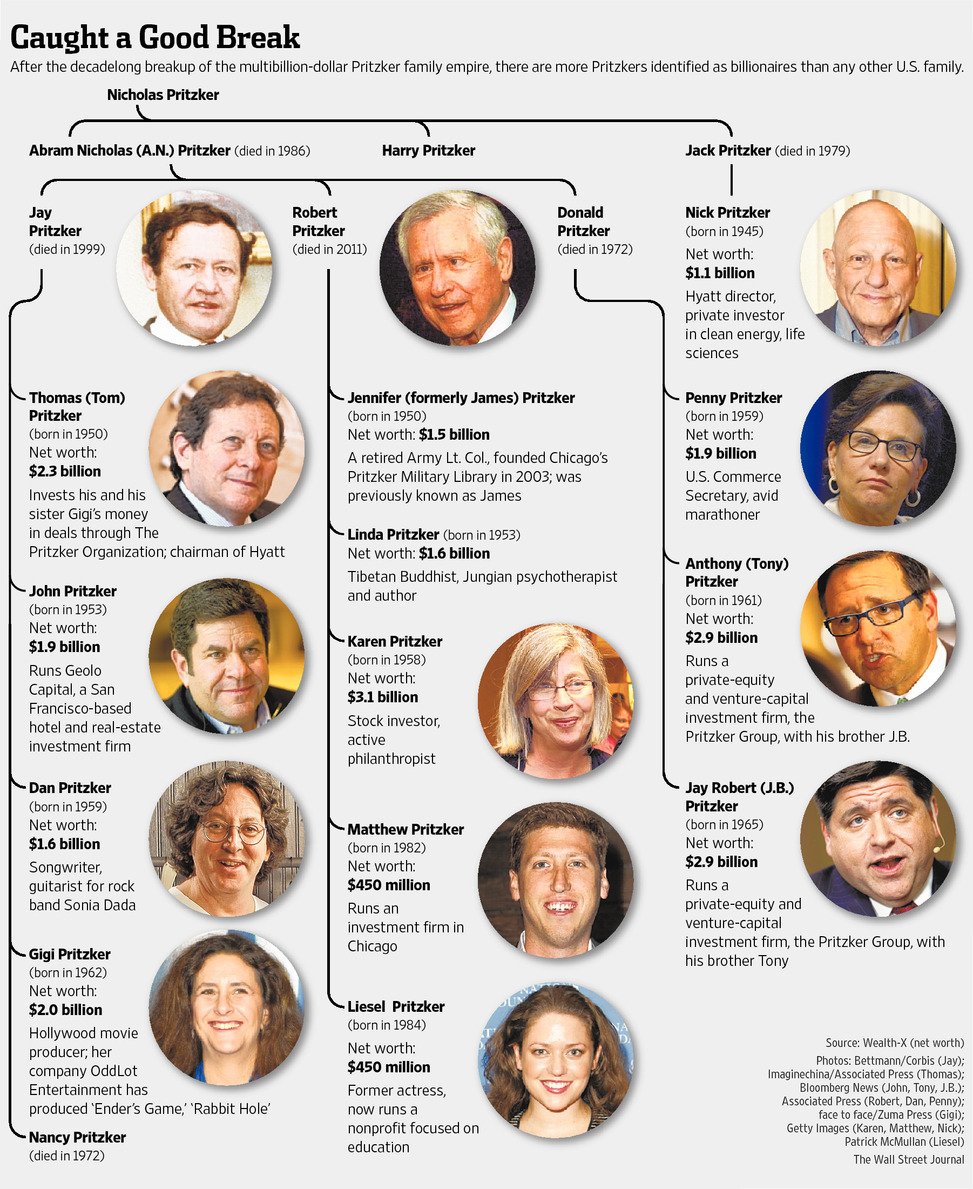

For starters - they& #39;re unbelievably wealthy

Combined net worth of $30B, there are ELEVEN Pritzkers on the Forbes 400, more than any other family

Historical holdings are a wild who& #39;s who of American industry: Hyatt, Marmon Group, Conwood, TransUnion, McCall& #39;s, Royal Caribbean

Combined net worth of $30B, there are ELEVEN Pritzkers on the Forbes 400, more than any other family

Historical holdings are a wild who& #39;s who of American industry: Hyatt, Marmon Group, Conwood, TransUnion, McCall& #39;s, Royal Caribbean

Their base story is an American dream:

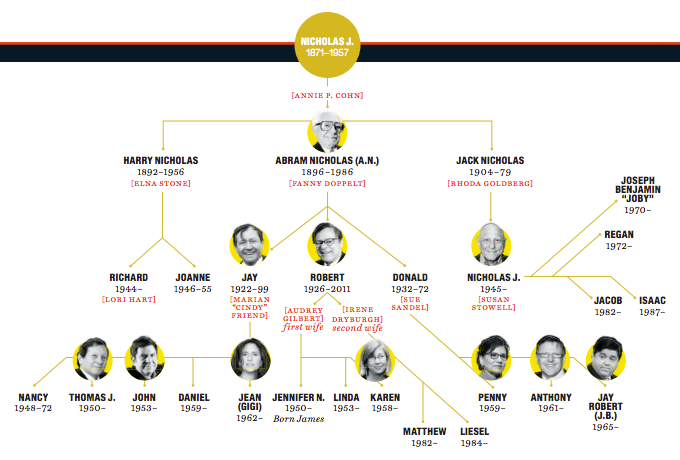

Jewish-Ukrainian immigrant Nicholas J. Pritzker, who came to America in 1881, started the line:

- taught himself English by reading the Chicago Tribune

- became a druggist until founding a law firm after night schooling through law school

Jewish-Ukrainian immigrant Nicholas J. Pritzker, who came to America in 1881, started the line:

- taught himself English by reading the Chicago Tribune

- became a druggist until founding a law firm after night schooling through law school

His sons, led by middle child Abram, started as lawyers, then branched into real estate and business interests

Personal fave of their deals: buying coffee pot maker for $25k and selling for $23M

More dubious: A.N.& #39;s alleged ties to the mob that jumpstarted the Pritzker fortune

Personal fave of their deals: buying coffee pot maker for $25k and selling for $23M

More dubious: A.N.& #39;s alleged ties to the mob that jumpstarted the Pritzker fortune

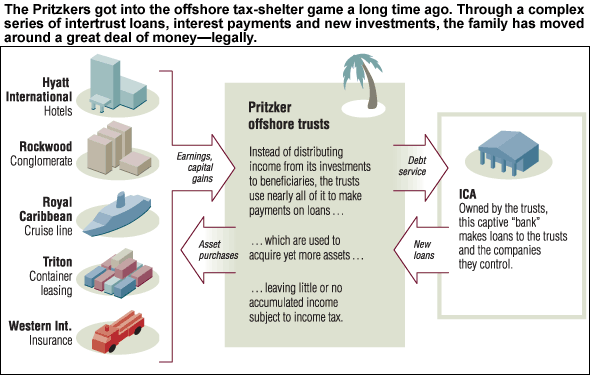

Perhaps A.N& #39;s biggest legacy: a passion for creative tax structuring

In 1935, he began setting up offshore trusts to shelter income and transfer wealth to his heirs

They used now closed loopholes, but trusts were grandfathered in 1994

In 1935, he began setting up offshore trusts to shelter income and transfer wealth to his heirs

They used now closed loopholes, but trusts were grandfathered in 1994

Things accelerated in the next generation with sons Jay, Bob and Donald

All were pretty remarkable, but - Jay was an absolute king, perhaps one of the greatest investors of that timeframe

All were pretty remarkable, but - Jay was an absolute king, perhaps one of the greatest investors of that timeframe

Jay-Bob& #39;s partnership was at the heart of the success, acquiring and turning around businesses

They found companies, Jay made the deal work, and then Bob (family engineer) would improve

Easy to see shades of Malone - Jay viewed structuring and taxes as important as execution

They found companies, Jay made the deal work, and then Bob (family engineer) would improve

Easy to see shades of Malone - Jay viewed structuring and taxes as important as execution

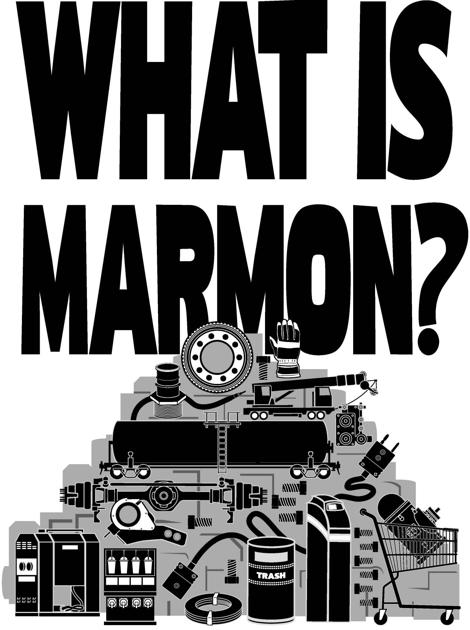

First biggie: Colson Corp., then troubled manufacturer of wheelchairs and bicycles with $3M in sales they bought for $95k

It& #39;d become the basis for the Marmon Group, a manufacturing/service conglomerate with $8B in sales (sold to Buffett in 2007)

It& #39;d become the basis for the Marmon Group, a manufacturing/service conglomerate with $8B in sales (sold to Buffett in 2007)

The other gem: Hyatt Hotels, bought in 1957 as just a single location - the closest hotel near LAX

Sensing demand for quality hotels near airports, Jay bought the hotel with a $2.2M bid scribbled on napkin

Brother Donald and other family members would scale it into a behemoth

Sensing demand for quality hotels near airports, Jay bought the hotel with a $2.2M bid scribbled on napkin

Brother Donald and other family members would scale it into a behemoth

The family maintained a low profile, even when tied up in major events:

- Bidder in the RJR Nabisco buyout battle

- Failed hostile takeover of ITT Corporation

- Major lawsuit with Trump over their interests in Grand Hyatt New York, accusing them of civil racketeering

- Bidder in the RJR Nabisco buyout battle

- Failed hostile takeover of ITT Corporation

- Major lawsuit with Trump over their interests in Grand Hyatt New York, accusing them of civil racketeering

Some they couldn& #39;t dodge, like the 2001 collapse of Superior Bank

Acquired with $625M in tax assistance during the S&L crisis, its subprime portfolio implosion was a telling preview of the pains of the & #39;08 housing crisis

The Pritzkers would end up paying $460M for their role

Acquired with $625M in tax assistance during the S&L crisis, its subprime portfolio implosion was a telling preview of the pains of the & #39;08 housing crisis

The Pritzkers would end up paying $460M for their role

Their tax strategies would also attract attention

When grandfather A.N. died in 1986, the family claimed he was only worth $25,000, the rest having been shifted to various trusts

While the IRS claimed they owed $50M+, they ended up paying over $9.5M

When grandfather A.N. died in 1986, the family claimed he was only worth $25,000, the rest having been shifted to various trusts

While the IRS claimed they owed $50M+, they ended up paying over $9.5M

Quietly, they built a $15 billion empire of 200+ companies and a network of 1,000 family trusts

The families were close friends, sharing an 860-acre family farm and pooling their money with wealth only distributed to meet reasonable needs

It all worked... until it didn& #39;t

The families were close friends, sharing an 860-acre family farm and pooling their money with wealth only distributed to meet reasonable needs

It all worked... until it didn& #39;t

When Jay passed in 1999, he tried to fairly distribute wealth

Yearly stipends for each cousin started at $100k, scaling to $1M by age 40 (totalling $25M each)

Further economics would be based on productivity and contribution, or held by trusts for the collective family

Yearly stipends for each cousin started at $100k, scaling to $1M by age 40 (totalling $25M each)

Further economics would be based on productivity and contribution, or held by trusts for the collective family

Jay& #39;s son Tom assumed control with Jay& #39;s cousin Nick and his niece Penny as lieutenants

Jay’s other sons (Danny and John) and Penny’s brothers (J.B. and Tony) felt excluded - a slight that would be magnified when Tom & Co.& #39;s business deals were more deeply analyzed

Jay’s other sons (Danny and John) and Penny’s brothers (J.B. and Tony) felt excluded - a slight that would be magnified when Tom & Co.& #39;s business deals were more deeply analyzed

Assets valued at $500M+ had been shifted to a trust benefiting just Tom

Also, Tom, Nick and Penny had been awarded equity promotes totalling nearly $480M on family money deals

To what degree were those working on growing the business were entitled to a greater share?

Also, Tom, Nick and Penny had been awarded equity promotes totalling nearly $480M on family money deals

To what degree were those working on growing the business were entitled to a greater share?

Despite Jay’s dying wish, the feud would lead to secret plans to break up his empire - drama that would& #39;ve stayed out of public eye...

Until, enter scene: Liesel Pritkzer, daughter of Jay& #39;s brother Robert

You may recognize her from A Little Princess or Air Force One

Until, enter scene: Liesel Pritkzer, daughter of Jay& #39;s brother Robert

You may recognize her from A Little Princess or Air Force One

Robert had unhappy marriage with 2nd wife Irene, divorcing in 1989

Children Liesel and Matthew bore the brunt of the squabbles

Unknown to them, Robert essentially wiped out their trusts, selling assets at cost values or even donating them

Children Liesel and Matthew bore the brunt of the squabbles

Unknown to them, Robert essentially wiped out their trusts, selling assets at cost values or even donating them

From Robert& #39;s view, he was moving them down a generation in terms of inheritance

Some would claim it was out of anger at Irene

When Liesel heard each cousin was getting over $1B each, a well-publicized lawsuit emerged

They& #39;d eventually settle for $450 million each in 2005

Some would claim it was out of anger at Irene

When Liesel heard each cousin was getting over $1B each, a well-publicized lawsuit emerged

They& #39;d eventually settle for $450 million each in 2005

Now, the family& #39;s influence in business, politics and philanthropy continues to persevere, while their unity has been fractured

Cumulative value of the family& #39;s businesses, slowly offloaded through sales or IPOs, doubled from $15 billion in 2001 to $30 billion a decade later

Cumulative value of the family& #39;s businesses, slowly offloaded through sales or IPOs, doubled from $15 billion in 2001 to $30 billion a decade later

On "Team Tom", Tom continues to serve as CEO of The Pritzker Organization, which still administers shared assets, and as Executive Chairman of Hyatt

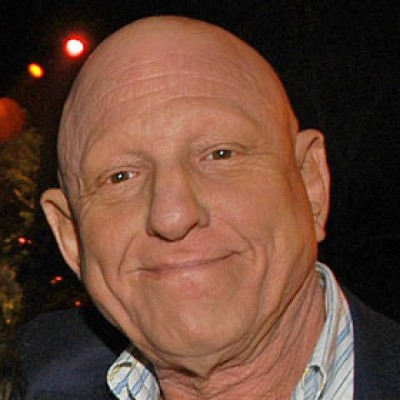

Nick Pritzker runs investment firm Tao Capital, with investments like Tesla, Uber, and SpaceX, and serves on the board of Juul

Nick Pritzker runs investment firm Tao Capital, with investments like Tesla, Uber, and SpaceX, and serves on the board of Juul

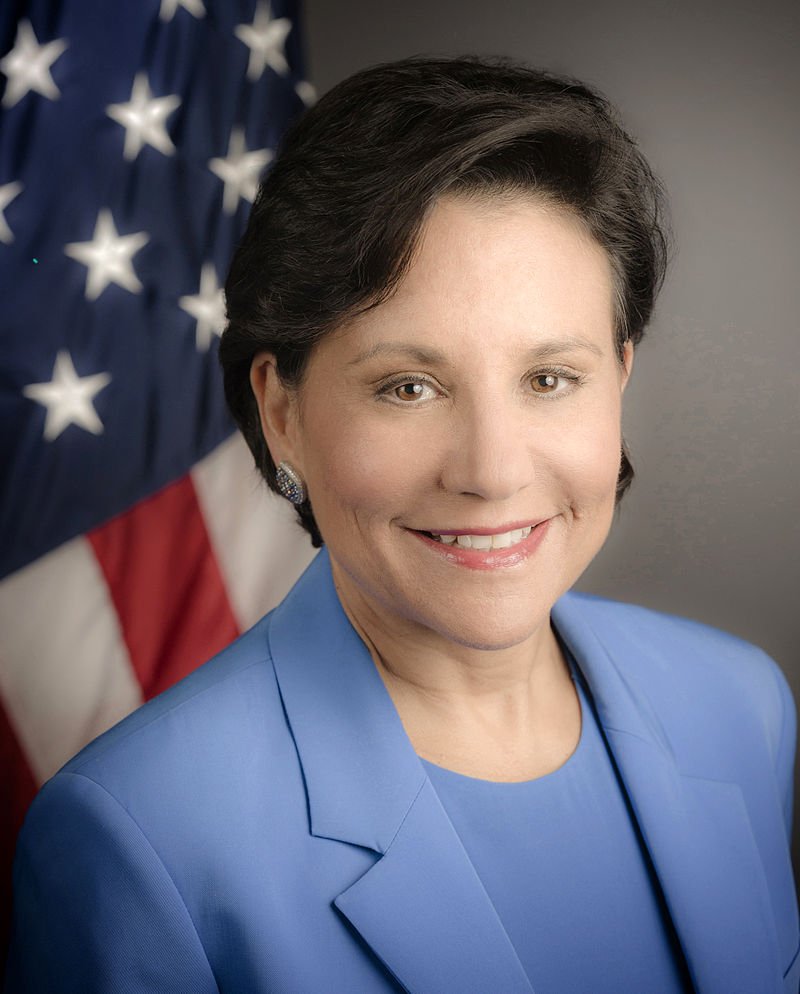

Penny, you may have heard of as Obama& #39;s Secretary of Commerce

She also runs her own fund (PSP Capital) and serves on Microsoft& #39;s board

Of all family members, she took the brunt of the Superior Bank collapse most directly as chairperson, but has largely left that behind

She also runs her own fund (PSP Capital) and serves on Microsoft& #39;s board

Of all family members, she took the brunt of the Superior Bank collapse most directly as chairperson, but has largely left that behind

On "Team Cousins", you& #39;re probably familiar with J.B., the current governor of Illinois

He& #39;s been a huge player in the VC scene in Chicago (founding Pritzker VC, 1871, Techstars Chicago, and a variety of other VC efforts)

He& #39;s been a huge player in the VC scene in Chicago (founding Pritzker VC, 1871, Techstars Chicago, and a variety of other VC efforts)

Excluding J.B. and brother Tony from the original succession seems like it was maybe a mistake

Their hybrid family office/PE group Pritzker Private Capital is essentially a mini-Marmon, focusing on industrial and services investments with a 28.7% IRR from 2007 to 2012

Their hybrid family office/PE group Pritzker Private Capital is essentially a mini-Marmon, focusing on industrial and services investments with a 28.7% IRR from 2007 to 2012

There are Pritzkers outside business too:

- Daniel: musician in a jazz/soul band

- Gigi: Hollywood filmmaker (Drive and The Way Way Back)

- Linda: Jungian therapist who lives in Montana

- Daniel: musician in a jazz/soul band

- Gigi: Hollywood filmmaker (Drive and The Way Way Back)

- Linda: Jungian therapist who lives in Montana

Most surprising when I dug in - richest of all is Karen Pritzker

Unclear how she jumped ahead - net worth estimates are $4-$5B

She runs VC fund LaunchCapital and has apparently made savvy investments through the Pritzker/Vlock family office (with a big win in a bet on Apple)

Unclear how she jumped ahead - net worth estimates are $4-$5B

She runs VC fund LaunchCapital and has apparently made savvy investments through the Pritzker/Vlock family office (with a big win in a bet on Apple)

Cousin Jennifer Pritzker is a military vet and the only transgender billionaire

The only Republican in a family of Democrats (MEGA donor), she flipped on supporting Trump recently following his ban of transgender from military

The only Republican in a family of Democrats (MEGA donor), she flipped on supporting Trump recently following his ban of transgender from military

So... that& #39;s the Pritzkers

If you& #39;re interested in more, happy to share sources - this became a little mini-project accumulating a full picture from 40+ articles, podcasts, Wikipedia and even a few books

If you& #39;re the family and reading this, please don& #39;t come for me https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥸" title="Disguised face" aria-label="Emoji: Disguised face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥸" title="Disguised face" aria-label="Emoji: Disguised face">

If you& #39;re interested in more, happy to share sources - this became a little mini-project accumulating a full picture from 40+ articles, podcasts, Wikipedia and even a few books

If you& #39;re the family and reading this, please don& #39;t come for me

I honestly had to cut myself off because there& #39;s still so many little potential stories

Like J.B. apparently removing the toilets to have his house declared uninhabitable and avoid property taxes

A.N. and Jay& #39;s love for & #39;tax structuring& #39; lives on... https://twitter.com/RMPerry88/status/1330644343141650432?s=20">https://twitter.com/RMPerry88...

Like J.B. apparently removing the toilets to have his house declared uninhabitable and avoid property taxes

A.N. and Jay& #39;s love for & #39;tax structuring& #39; lives on... https://twitter.com/RMPerry88/status/1330644343141650432?s=20">https://twitter.com/RMPerry88...

Read on Twitter

Read on Twitter