When I see people writing posts “analyzing S-1”, they just copy paste what’s in the S-1 without any real insight.

Changing $ to % and copying graphs is not analyzing.

Here’s an example from Affirm:

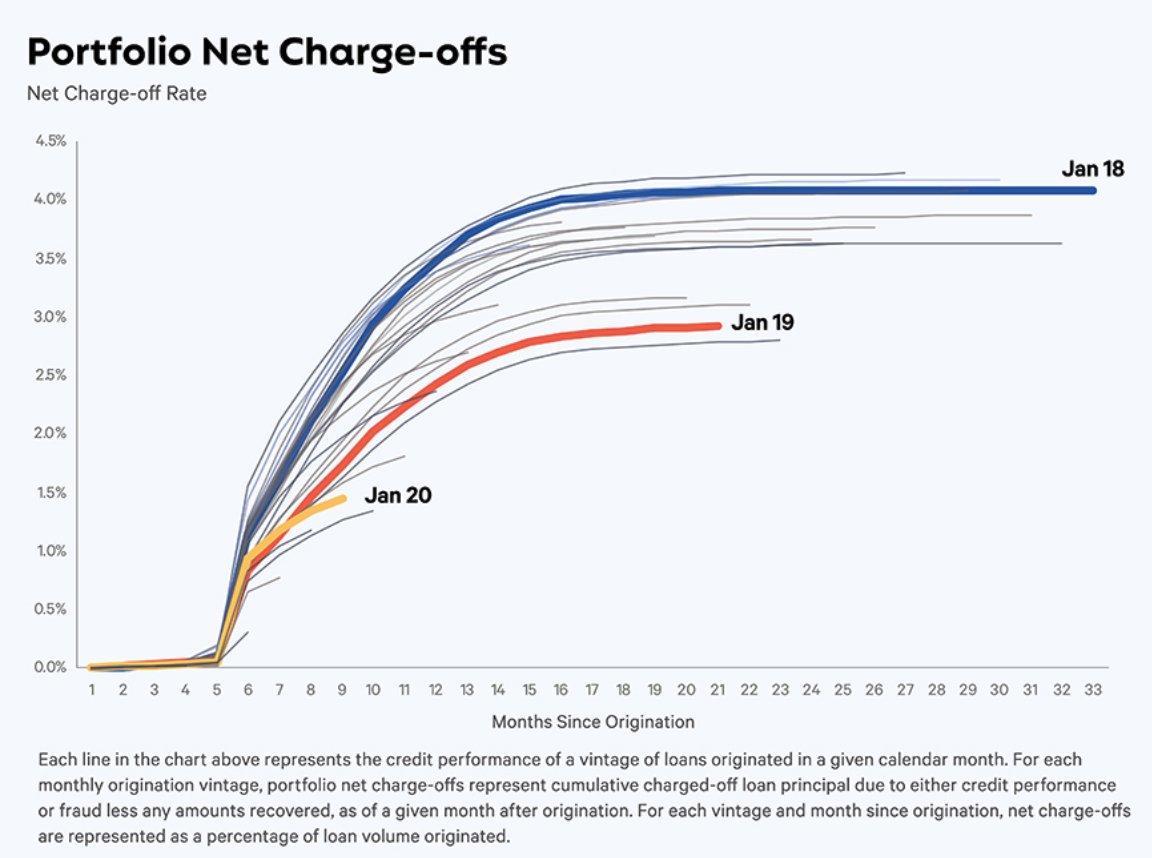

Most people claim that Affirm is reducing losses over time and leave it at that.

Changing $ to % and copying graphs is not analyzing.

Here’s an example from Affirm:

Most people claim that Affirm is reducing losses over time and leave it at that.

In reality, they have to consider all the parameters of the portfolio for each of those months:

- Average interest rate

- Average FICO score

- Average Loan Size

- Quality of merchants

- Average interest rate

- Average FICO score

- Average Loan Size

- Quality of merchants

In this case, Affirm possibly lowered interest rates and gave loans to high FICO Peloton customers - which reduced their default rate. Their performance for each FICO band may have stayed the same.

This shows Affirm needs similar bigger players to grow and keep defaults low.

This shows Affirm needs similar bigger players to grow and keep defaults low.

Read on Twitter

Read on Twitter