Okay are you ready grandchildren for halmoni& #39;s explanation about #SamsanTech "forced" exit. We will talk about numbers here. So fasten your seatbelt and enjoy the ride. #StartUpEp11 title is EXIT, #StartUpEp12 #StartUp #Sandbox

If you still don& #39;t get what happen in #StartUpEp11, read this thread from @doubeten94 that perfectly sum this up. https://twitter.com/doubleten94/status/1330199915386064901">https://twitter.com/doubleten...

Okay first thing first. Before you get to the numbers you must understand the basics first. If you notices the title of every episodes of #StartUp drama are startup term. I suggest you do some googling about the term mention before get into EXIT as #StartupEp11 title.

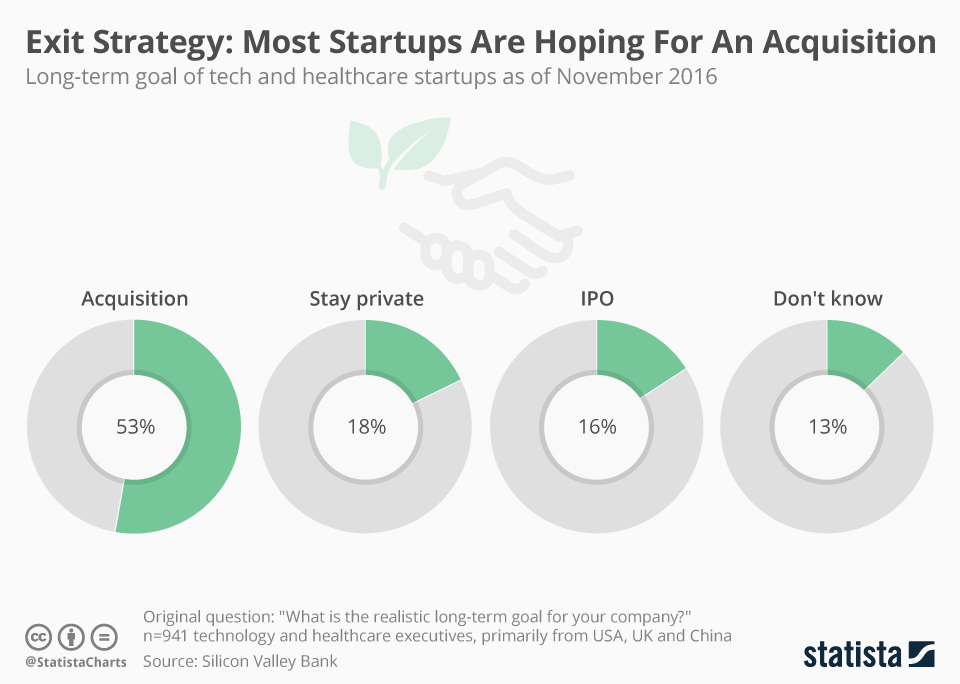

What is Exit? A "startup exit" is when the equity of the company (i.e the company itself) is bought out by another party. In essence, the founders of the company relinquish their ownership (shares) for compensation/monetary gain. #StartupEp11 #StartUp

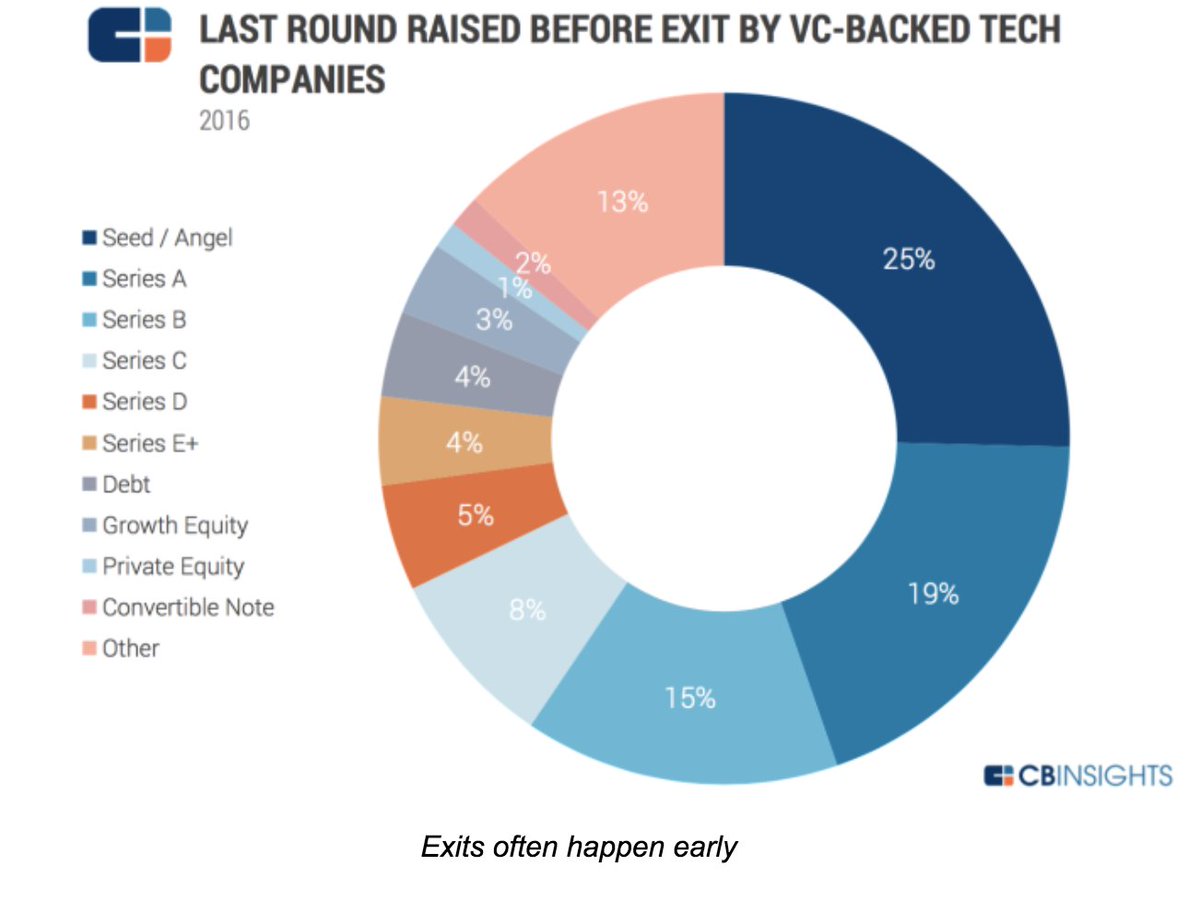

Exit Strategy is an agenda that any #startup CEO must plan from the beginning of the startup itself. What happen to #samsantech (EXIT in the early stage) is somewhat common. This pie chart from CBInsight inform us that in 2016 25% of startup exit in seed stage #StartUpEp11

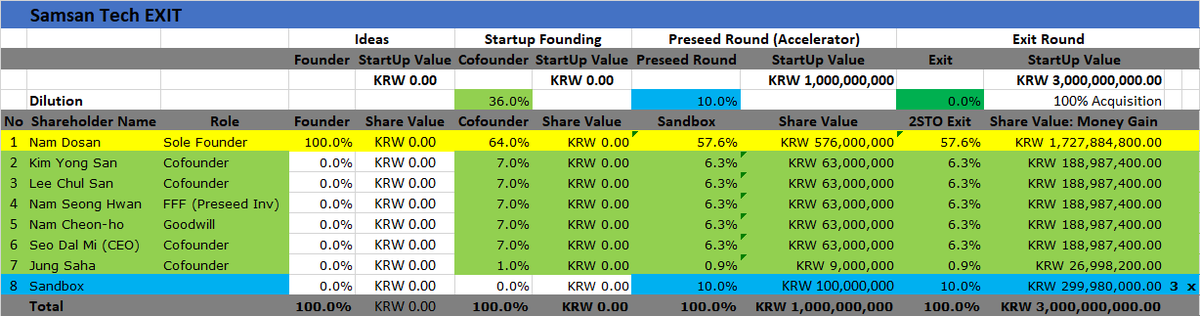

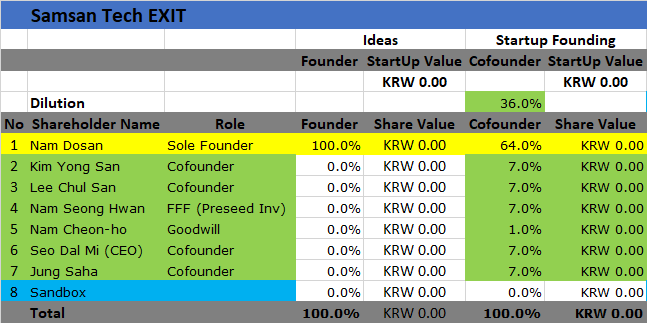

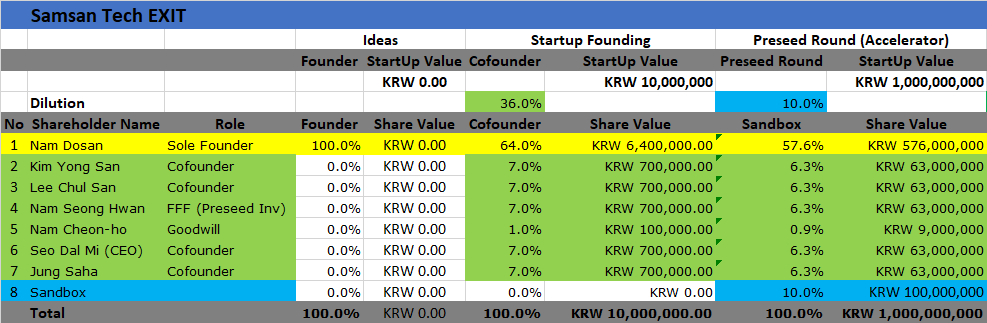

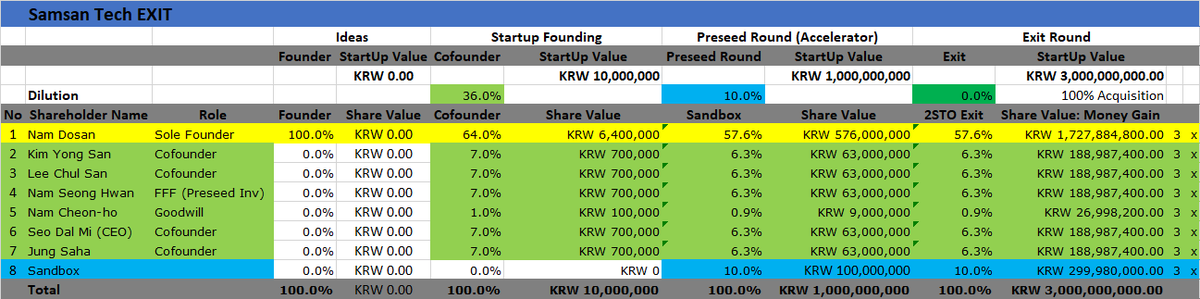

I did a calculation using 50folds cap table #startup template from ( https://www.alexanderjarvis.com"> https://www.alexanderjarvis.com ) that I simplified and modified. The assumption that #Sandbox accept #Samsantech into 12batch with 100 Million KRW in exchange for 10% equity. #StartUpEp11

Okay the timelines first. When #SamsanTech met #SeoDalmi at spring 2016. It was said that NDS dad& #39;s already invest for 1 year. And the boys already bootstrapping for 2 years. So my conclusion is: -cont-

#StartUpEp11 #StartUp

#StartUpEp11 #StartUp

1. Winter 2013-Dosan Tech was founded by #Namdosan

2. Spring 2014-Renamed into #Samsantech (add 2 cofounders)

3. Spring 2015-Dad& #39;s Investment (FFFs)

4. Spring 2016-Dad& #39;s threatened to pull his Investment

5. Summer 2016- Get into #Sandbox Accelerator

#StartUpEp11 #StartUp

2. Spring 2014-Renamed into #Samsantech (add 2 cofounders)

3. Spring 2015-Dad& #39;s Investment (FFFs)

4. Spring 2016-Dad& #39;s threatened to pull his Investment

5. Summer 2016- Get into #Sandbox Accelerator

#StartUpEp11 #StartUp

That& #39;s why I made shareholder list number in accordance to when they were involved/join #samsantech #StartUpEp11 #StartUp. The row color are representing the stage. Yellow Dosan Tech Stage. Green Samsan Tech before #Sandbox Investment. Blue Samsan Tech after Sandbox investment.

Okay there& #39;s a few term that U need to understand first to digest my table.

1. Share/Equity

2. Dilution

3. Startup Valuation

4. Startup Stage (ideas, founding, pre-seed/seed, exit)

#samsantech #StartUpEp11 #StartUp

1. Share/Equity

2. Dilution

3. Startup Valuation

4. Startup Stage (ideas, founding, pre-seed/seed, exit)

#samsantech #StartUpEp11 #StartUp

My suggested reading for U all about Start Up Share and Equity https://www.startups.com/library/expert-advice/startup-equity-101

https://www.startups.com/library/e... href="https://twtext.com//hashtag/samsantech"> #samsantech #StartUpEp11 #StartUp

My suggested reading for U all about Start Up Dilution https://discover.shareworks.com/financial-reporting/dilution-101-a-startup-guide-to-equity-dilution-with-real-world-statistics">https://discover.shareworks.com/financial...

To understand point 3 and 4 you can also read this https://blog.adioma.com/how-funding-works-splitting-equity-infographic/

https://blog.adioma.com/how-fundi... href="https://twtext.com//hashtag/StartUpEp11"> #StartUpEp11 #StartUp

Okay back to the table. When #DosanTech was founded. #namdosan is the sole founder. He own 100% shares and equity of his company. But because his #StartUp still at idea stage (founding stage) that 100% value still 0 KRW. See yellow row. #StartUpEp11

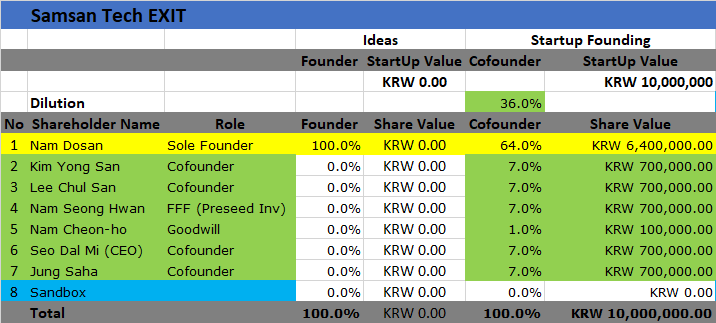

Let& #39;s go back to the table. After adding 4 more cofounders and FFFs investor #NamDosan equity was diluted by 36%. #Startup Value still 0 KRW (simplification coz I have no ide how much NDS investment was). Let& #39;s just assume no real investment with real due diligence= value 0 KRW

Even though #samsantech was found few years before, they only became real startup after due diligence done by #dalmi. 100 issued shares. #StartUpEp11 #startup

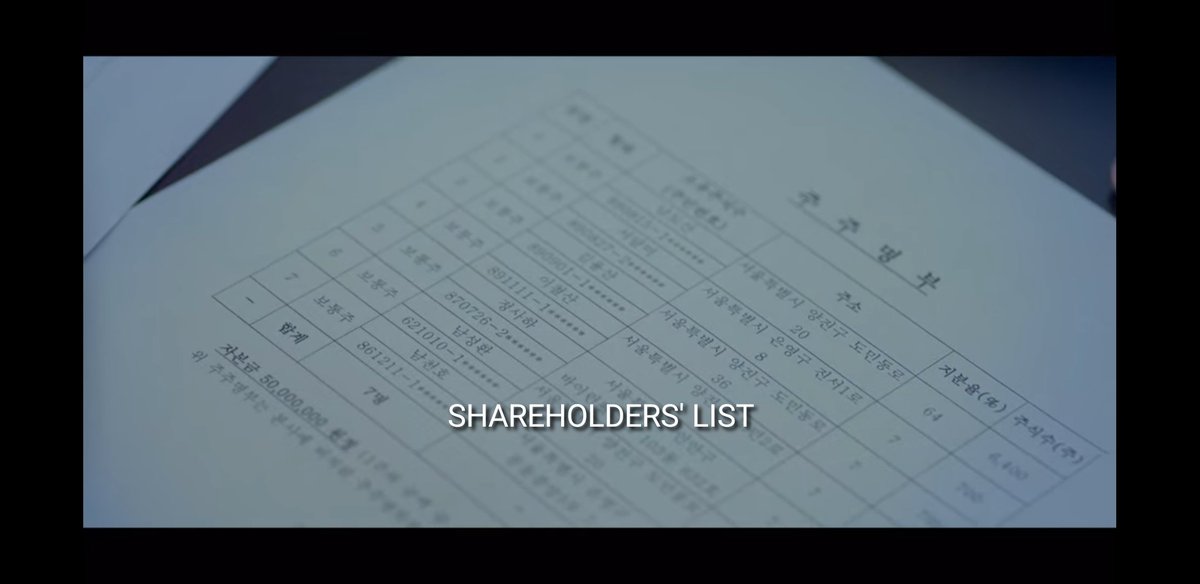

But If I see again #samsantech cap table made by #dalmi it& #39;s seems that they were valuing themselves around 10.000.000 KRW? With 1% shares worth 100.000 krw? Correct me if I am wrong coz I cannot read hangul. If it& #39;s true the value of #StartUp before #sandbox investment is this

I found that #sandbox accelerator was modeled on http://sparklabs.co.kr"> http://sparklabs.co.kr . They usually gives around 50.000$ in exchange of 6% equity. To make it simple I assumed that 100.000.000 KRW was for 10% equity. See blue row. It& #39;ll make post money valuation of #samsantech 1 Billion KRW

So post money valuation of #startup #samsantech is 1 Billion KRW which means it& #39;s pre money valuation is around 900.000.000 KRW. Play with this calculator if you will https://www.omnicalculator.com/finance/pre-and-post-money-valuation">https://www.omnicalculator.com/finance/p... #StartUpEp11

FYI Startup Accelerator usually asked 6-10% equity for 50.000$. So if Sandbox gives 100.000.000 KRW it& #39;s above industry average/generous. Not too mention the facility& #39;s given is too good to be true, lol. #startup #StartUpEp11

Summary: Every time founder get new cofounders or get investment in exchange of equity, his equity is diluted but his share value is growing. In #NamDoSan case equity dilution from 100% to 64% to 57.6%. But his shares value grow from 0 KRW to 6.400.000 KRW to 576.000.000 KRW

Before #samsantech is just a early stage FFFs startup w/o real valuation coz unproven business model. After #sandbox accelerator investment the #startUp shares gain real value by enter the Pre-seed Stage. Seed stage should be their next goal not exit. #StartUpEp11 #startUp

Ok the EXIT. Companies are bought, not sold

Unicorn or not, the most likely exit is an acquisition. Many founders made #StartUp with this kind of exit in mind. In acquisition you give up all of your equity to the buyer. All #Samsantech shareholders must sell their shares to 2STO.

Unicorn or not, the most likely exit is an acquisition. Many founders made #StartUp with this kind of exit in mind. In acquisition you give up all of your equity to the buyer. All #Samsantech shareholders must sell their shares to 2STO.

This is exit so the percentage of equity is the same, but the company value already tripled. So money-wise all #samsantech got monetary gain from shares being sold but lost their #StartUp & their job (except for #NamDoSan. #StartUpEp11 #Sandbox exit with 3X of it& #39;s investment.

Okay to test if U understand my explanation I& #39;ll make a quiz. Which shareholder of #samsantech who get the most profit from this exit? minus the heartbreak. Comment here! #StartUpEp11 #StartUp

Read on Twitter

Read on Twitter