I decided to share some light on one of my biggest portfolio holdings: Pinterest ( $PINS )

Pinterest the social commerce company for the future.

THREAD https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Pinterest the social commerce company for the future.

THREAD

1/ The value proposition

Pinterest is a social media company mainly used by users to search for ideas. The ideas can be: what jewelry to buy, what to cook, how to furnish your house...

Ads on the platform are not disturbing but rather wanted by the users as they can be ideas.

Pinterest is a social media company mainly used by users to search for ideas. The ideas can be: what jewelry to buy, what to cook, how to furnish your house...

Ads on the platform are not disturbing but rather wanted by the users as they can be ideas.

2/ The user demographic with power

71 % of $PINS users are women. $PINS captures 83 % of all US women between the ages of 25 – 54. This is a staggering number as this is the audience that makes 80 % of buying decisions in the US household.

71 % of $PINS users are women. $PINS captures 83 % of all US women between the ages of 25 – 54. This is a staggering number as this is the audience that makes 80 % of buying decisions in the US household.

3/ The growth

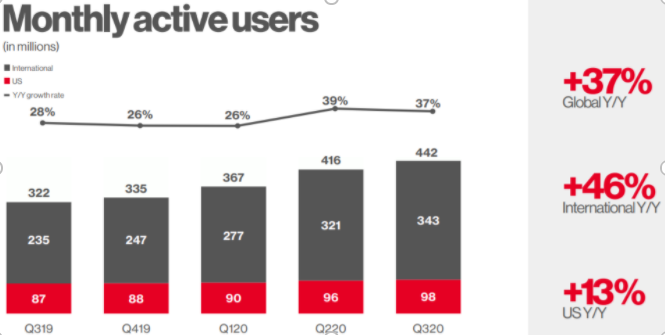

Pinterest has over 442 MAU (Monthly Active Users), and even with that number, it is still growing its user base at almost 40%. In fact, in the last year, the growth has accelerated. Pinterest still has a huge international audience to catch.

Pinterest has over 442 MAU (Monthly Active Users), and even with that number, it is still growing its user base at almost 40%. In fact, in the last year, the growth has accelerated. Pinterest still has a huge international audience to catch.

4/ Monetization

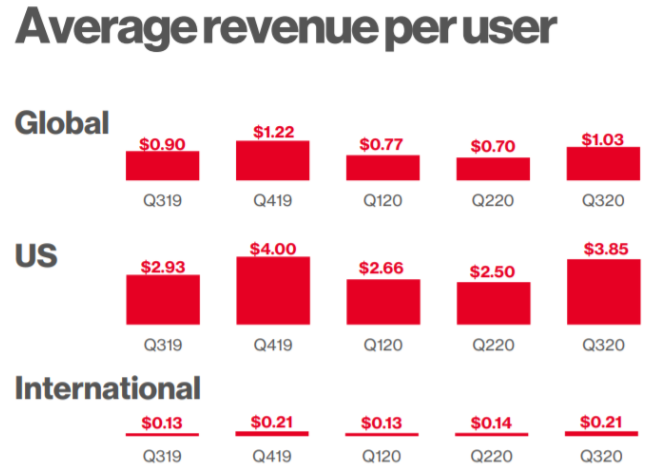

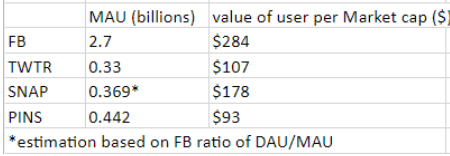

Pinterest, compared to its peers, hasn’t really monetized their ex-US user base. Even though the platform is more “ad-friendly” to users. With more than 75% of the users ex-US, this base& #39;s monetization will bring a significant boost to revenue in the future.

Pinterest, compared to its peers, hasn’t really monetized their ex-US user base. Even though the platform is more “ad-friendly” to users. With more than 75% of the users ex-US, this base& #39;s monetization will bring a significant boost to revenue in the future.

Read on Twitter

Read on Twitter " title="I decided to share some light on one of my biggest portfolio holdings: Pinterest ( $PINS ) Pinterest the social commerce company for the future. THREAD https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="I decided to share some light on one of my biggest portfolio holdings: Pinterest ( $PINS ) Pinterest the social commerce company for the future. THREAD https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>