On November 14, Reliance Retail announced an all-cash buyout of 96% stake in @UrbanLadder for ₹182 Cr.

A #Thread

@dmuthuk @SahilBloom @FundamentalGems @FinKrypt @stockskibaat @stocks_in @nifty_baba @FinancialAdda @trdessai @join2manish

Think for a moment, how billion-dollar edtech startup shelled out $300 Mn to acquire a smaller company within 18 months of its launch.( @whitehatjunior)

Urban Ladder, which been since 2012 & built coveted private label, took a 75% cut in paper valuations.

#StockMarket #nifty50

Urban Ladder, which been since 2012 & built coveted private label, took a 75% cut in paper valuations.

#StockMarket #nifty50

The company ( @UrbanLadder) focussed on a private business model, which was not bad idea & it also got them a good brand recall.

But the furniture retail space is tough market & everything depends on strategy” says a VC requesting anonymity.

#Share #sharemarket #banknifty

But the furniture retail space is tough market & everything depends on strategy” says a VC requesting anonymity.

#Share #sharemarket #banknifty

A closer look at its funding history and past valuations are bound to make both entrepreneurs and investors slightly jittery.

#Investment #investing #invest #InvestInYou #finance #NavalCraft

#Investment #investing #invest #InvestInYou #finance #NavalCraft

Founded in Feb 2012 by Ashish Goel & Rajiv Srivatsa, the company raised around $120 Mn from top VCs.

The company closed its Series E round two years ago but struggled to get funding after that.

In Nov 2019, it managed to raise

₹ 15 Cr

#business #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> #Binance

https://abs.twimg.com/hashflags... draggable="false" alt=""> #Binance  https://abs.twimg.com/hashflags... draggable="false" alt=""> #Equity4Life

https://abs.twimg.com/hashflags... draggable="false" alt=""> #Equity4Life

The company closed its Series E round two years ago but struggled to get funding after that.

In Nov 2019, it managed to raise

₹ 15 Cr

#business #Bitcoin

fact that furniture e-retailer went through a sticky patch throughout 2019.

Several cracks started to appear in the firm’s business, including layoffs & the exit of its cofounder Rajiv Srivatsa.

#business #BlackFriday #entrepreneur #entrepreneurlife

Several cracks started to appear in the firm’s business, including layoffs & the exit of its cofounder Rajiv Srivatsa.

#business #BlackFriday #entrepreneur #entrepreneurlife

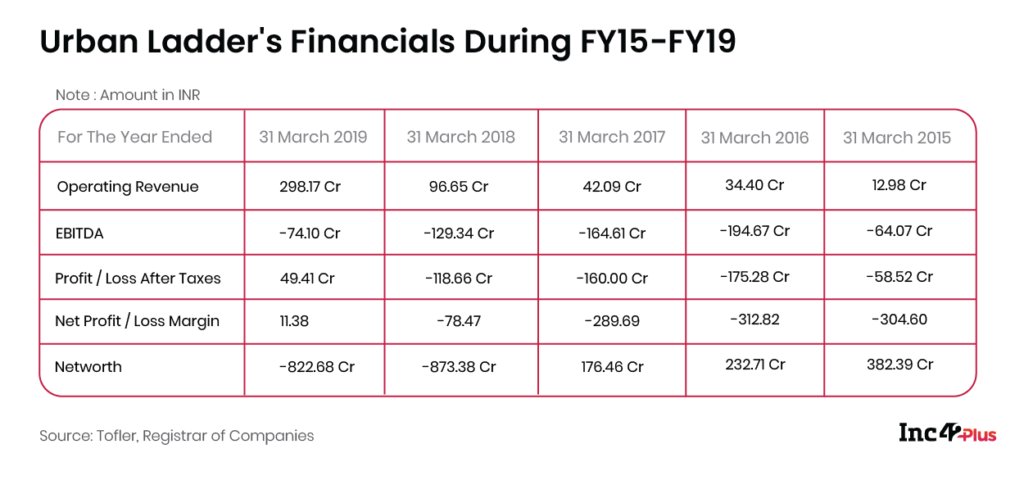

The financials and the change in post-money valuations over the years would further explain the scenario.

On paper, furniture retailer had a valuation of INR 780 Cr at the time of its equity fundraising in September 2018.

#financialadvisor #financialliteracy #company

On paper, furniture retailer had a valuation of INR 780 Cr at the time of its equity fundraising in September 2018.

#financialadvisor #financialliteracy #company

However, much of this valuation started to erode towards FY2019, way before the company entered into talks with RIL.

Two industry executives, directly aware of Urban Ladder’s acquisition talks, have told startup was looking for a buyer for the past one year and a half.

#Nifty

Two industry executives, directly aware of Urban Ladder’s acquisition talks, have told startup was looking for a buyer for the past one year and a half.

#Nifty

“Internally most of the investors knew this, especially as the company was not able to raise more funding than its direct competitor @Pepperfry "

By the end of 2019, Pepperfry secured more than $200 Mn while Urban Ladder only crossed the $100 Mn mark.

#LifeGoesOnWithBTS

By the end of 2019, Pepperfry secured more than $200 Mn while Urban Ladder only crossed the $100 Mn mark.

#LifeGoesOnWithBTS

According to news, when Urban Ladder started looking for a buyer in 2019, it targeted a deal value of INR 300 Cr.

This was already lower than the

₹ 780 Cr valuation it had in the beginning of 2018

#GEW2020 #marketingdigital #DigitalMarketing

This was already lower than the

₹ 780 Cr valuation it had in the beginning of 2018

#GEW2020 #marketingdigital #DigitalMarketing

But by early 2020, the company brought its pricing down to around INR 200 Cr, especially after it started negotiating with RIL.

#Reliance #ICAI_DENIES_SAFTEY #Icai #Stock2020 #icai_be_transparent

#Reliance #ICAI_DENIES_SAFTEY #Icai #Stock2020 #icai_be_transparent

The company’s financials had different story to tell.

According to its RoC filings, Urban Ladder reported a net profit of

₹ 49.41 Cr in FY19, a huge improvement from the ₹ 118 Cr loss FY18

#trading #FinancialFreedom #Trader #tradingpsychology

According to its RoC filings, Urban Ladder reported a net profit of

₹ 49.41 Cr in FY19, a huge improvement from the ₹ 118 Cr loss FY18

#trading #FinancialFreedom #Trader #tradingpsychology

It also recorded total revenue of

₹ 434 Cr in FY19, a whopping 187% year-on-year jump compared to FY18.

improvement was largely due to company shifting from Generally Accepted Accounting Principles to Indian Accounting Standards notified in 2013.

#Technicals

₹ 434 Cr in FY19, a whopping 187% year-on-year jump compared to FY18.

improvement was largely due to company shifting from Generally Accepted Accounting Principles to Indian Accounting Standards notified in 2013.

#Technicals

The startup’s FY19 RoC filings, also show that while its operational revenue stood at ₹ 298 Cr (excluding ₹ 136 Cr in other non-operating income), the actual EBITDA loss was ₹ 74 Cr

#startups #StartUp #NBFCs #BankingAndFinanceNews

#startups #StartUp #NBFCs #BankingAndFinanceNews

By Aug 2018, the segment lost its niche label when Swedish furniture @IKEA entered India with 4Lac sq.ft outlet in Hyderabad,which saw an initial investment of INR 1,000 Cr by the company.

By 2019, it was clear to Goel and Srivatsa that the company would have to find an exit.

A torn Urban Ladder started to explore an acquisition opportunity from rival Pepperfry in 2019.

A torn Urban Ladder started to explore an acquisition opportunity from rival Pepperfry in 2019.

In Apr 2020, the company found a fresh suitor in RIL and began its six-month-long talks, again pushing for an all-cash buyout, both people quoted above confirmed.

#SharkTank #funding

#SharkTank #funding

RIL even offered cash to purchase a majority stake in Milkbasket when it was in advanced talks with Urban Ladder, but the Milkbasket deal fell through.

Nevertheless, it does seem that RIL is buying out the least-valued companies in the consumer Internet space.

Nevertheless, it does seem that RIL is buying out the least-valued companies in the consumer Internet space.

“This deal should not become a reference for the online furniture space"

"Let us not forget this deal came at 75% markdown to the total investment that Urban Ladder raised not a great for the segment as company was considered No. 2 in the space (after Pepperfry),” says Damani.

"Let us not forget this deal came at 75% markdown to the total investment that Urban Ladder raised not a great for the segment as company was considered No. 2 in the space (after Pepperfry),” says Damani.

The fact that a global giant like #IKEA has already entered India, RIL’s acquisition of Urban Ladder might well be the first step to take on bigger brands.

#branding #GloboNews #ecommerce #economy

#branding #GloboNews #ecommerce #economy

Read on Twitter

Read on Twitter RISE AND FALL @UrbanLadder https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">On November 14, Reliance Retail announced an all-cash buyout of 96% stake in @UrbanLadder for ₹182 Cr.A #Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> @dmuthuk @SahilBloom @FundamentalGems @FinKrypt @stockskibaat @stocks_in @nifty_baba @FinancialAdda @trdessai @join2manish" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht"> RISE AND FALL @UrbanLadder https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">On November 14, Reliance Retail announced an all-cash buyout of 96% stake in @UrbanLadder for ₹182 Cr.A #Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> @dmuthuk @SahilBloom @FundamentalGems @FinKrypt @stockskibaat @stocks_in @nifty_baba @FinancialAdda @trdessai @join2manish" class="img-responsive" style="max-width:100%;"/>

RISE AND FALL @UrbanLadder https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">On November 14, Reliance Retail announced an all-cash buyout of 96% stake in @UrbanLadder for ₹182 Cr.A #Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> @dmuthuk @SahilBloom @FundamentalGems @FinKrypt @stockskibaat @stocks_in @nifty_baba @FinancialAdda @trdessai @join2manish" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht"> RISE AND FALL @UrbanLadder https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">On November 14, Reliance Retail announced an all-cash buyout of 96% stake in @UrbanLadder for ₹182 Cr.A #Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> @dmuthuk @SahilBloom @FundamentalGems @FinKrypt @stockskibaat @stocks_in @nifty_baba @FinancialAdda @trdessai @join2manish" class="img-responsive" style="max-width:100%;"/>

#Binance https://abs.twimg.com/hashflags... draggable="false" alt=""> #Equity4Life" title="Founded in Feb 2012 by Ashish Goel & Rajiv Srivatsa, the company raised around $120 Mn from top VCs.The company closed its Series E round two years ago but struggled to get funding after that. In Nov 2019, it managed to raise₹ 15 Cr #business #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> #Binance https://abs.twimg.com/hashflags... draggable="false" alt=""> #Equity4Life" class="img-responsive" style="max-width:100%;"/>

#Binance https://abs.twimg.com/hashflags... draggable="false" alt=""> #Equity4Life" title="Founded in Feb 2012 by Ashish Goel & Rajiv Srivatsa, the company raised around $120 Mn from top VCs.The company closed its Series E round two years ago but struggled to get funding after that. In Nov 2019, it managed to raise₹ 15 Cr #business #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> #Binance https://abs.twimg.com/hashflags... draggable="false" alt=""> #Equity4Life" class="img-responsive" style="max-width:100%;"/>