What& #39;s beautiful (and kind of scary) about DeFi is that we can see everything that happens on-chain and connect addresses to identities and firms.

Here& #39;s a breakdown of the known Ethereum addresses of Three Arrows Capital, Polychain Capital, and Jump Trading.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Here& #39;s a breakdown of the known Ethereum addresses of Three Arrows Capital, Polychain Capital, and Jump Trading.

Three Arrows Capital (1/2):

One of the biggest Compound suppliers, with $100m in WBTC, $50m in ETH, and $6m in DAI.

3AC is also supplying 275 YFI and $13m in LINK to Aave and is farming SUSHI with 1.5m *recently-acquired* SUSHI.

3AC acquired 351k LINK during recent dip.

One of the biggest Compound suppliers, with $100m in WBTC, $50m in ETH, and $6m in DAI.

3AC is also supplying 275 YFI and $13m in LINK to Aave and is farming SUSHI with 1.5m *recently-acquired* SUSHI.

3AC acquired 351k LINK during recent dip.

3AC (2/2):

With the collateral, 3AC is withdrawing stables and sending them to FTX. We& #39;ve seen millions upon millions sent to an FTX address.

It is unclear what happens to the funds once they& #39;re there but 3AC is often on the profit + volume leaderboards on FTX.

With the collateral, 3AC is withdrawing stables and sending them to FTX. We& #39;ve seen millions upon millions sent to an FTX address.

It is unclear what happens to the funds once they& #39;re there but 3AC is often on the profit + volume leaderboards on FTX.

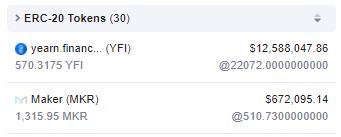

Polychain Capital (1/2):

Polychain Capital has been the biggest YFI buyer over the past few weeks.

They& #39;ve acquired 570 YFI (~2% total supply) over the past five weeks at an estimated cost basis of $12~14k.

They also own 48,000 ETH and 1,315 MKR on this address.

Polychain Capital has been the biggest YFI buyer over the past few weeks.

They& #39;ve acquired 570 YFI (~2% total supply) over the past five weeks at an estimated cost basis of $12~14k.

They also own 48,000 ETH and 1,315 MKR on this address.

Polychain Capital (2/2):

This is one of Polychain& #39;s many addresses.

One of their addresses that received all of the early-stage investments of the previous cycle that held millions in GNT, MKR, ZRX, REP, and other tokens made a bunch of txes in 2018 and it& #39;s really convoluted.

This is one of Polychain& #39;s many addresses.

One of their addresses that received all of the early-stage investments of the previous cycle that held millions in GNT, MKR, ZRX, REP, and other tokens made a bunch of txes in 2018 and it& #39;s really convoluted.

Jump Trading (1/3):

Bit of context first since some in the space may not recog the name. Jump Trading is a massive prop trading firm based in Chicago. They& #39;re big on crypto, even though they don& #39;t advertise that per se.

They& #39;re big investors in Ethereum tokens as well.

Bit of context first since some in the space may not recog the name. Jump Trading is a massive prop trading firm based in Chicago. They& #39;re big on crypto, even though they don& #39;t advertise that per se.

They& #39;re big investors in Ethereum tokens as well.

Jump Trading (2/3):

They hold 39,000 ETH - $18.5m. Much of this was accumulated over the past days with incoming txes from Gemini and Huobi. And they hold a ton of alts.

Biggest positions in Serum, Compound, Keep Network, and HXRO.

None of these postions were acquired in bulk.

They hold 39,000 ETH - $18.5m. Much of this was accumulated over the past days with incoming txes from Gemini and Huobi. And they hold a ton of alts.

Biggest positions in Serum, Compound, Keep Network, and HXRO.

None of these postions were acquired in bulk.

Jump Trading (3/3):

Smaller positions in Numeraire, Orchid, Maker, and Huobi Token.

The ~$5m in stables in the address are being regularly sent to exchanges and seemingly swapped for altcoins.

Jump is an accumulation machine.

$100k+ incoming txes every few hrs.

Smaller positions in Numeraire, Orchid, Maker, and Huobi Token.

The ~$5m in stables in the address are being regularly sent to exchanges and seemingly swapped for altcoins.

Jump is an accumulation machine.

$100k+ incoming txes every few hrs.

There are a bunch of other funds in the space with publicly-known Ethereum addresses.

Will have to cover those at a later date.

While I say I would say it& #39;s unwise to copy trade these addresses, take stock of where the smart money is going every once in a while.

Will have to cover those at a later date.

While I say I would say it& #39;s unwise to copy trade these addresses, take stock of where the smart money is going every once in a while.

And thanks for 2k followers btw - the support has been insane. I& #39;m up like 700 followers in the past two days.

Will continue posting high-signal content when I have the time.

Will continue posting high-signal content when I have the time.

Y& #39;all are nuts. Thanks again for the support.

Read on Twitter

Read on Twitter " title="What& #39;s beautiful (and kind of scary) about DeFi is that we can see everything that happens on-chain and connect addresses to identities and firms.Here& #39;s a breakdown of the known Ethereum addresses of Three Arrows Capital, Polychain Capital, and Jump Trading. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="What& #39;s beautiful (and kind of scary) about DeFi is that we can see everything that happens on-chain and connect addresses to identities and firms.Here& #39;s a breakdown of the known Ethereum addresses of Three Arrows Capital, Polychain Capital, and Jump Trading. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>