1/ As a long time @RayDalio fan, I& #39;ve been so disappointed with his take on #btc  https://abs.twimg.com/hashflags... draggable="false" alt="">. It seems based on a recent tweet that he is open to learning, so I had to write down some concise and thoughtful notes for each of his "problems with Bitcoin being an effective currency"

https://abs.twimg.com/hashflags... draggable="false" alt="">. It seems based on a recent tweet that he is open to learning, so I had to write down some concise and thoughtful notes for each of his "problems with Bitcoin being an effective currency"

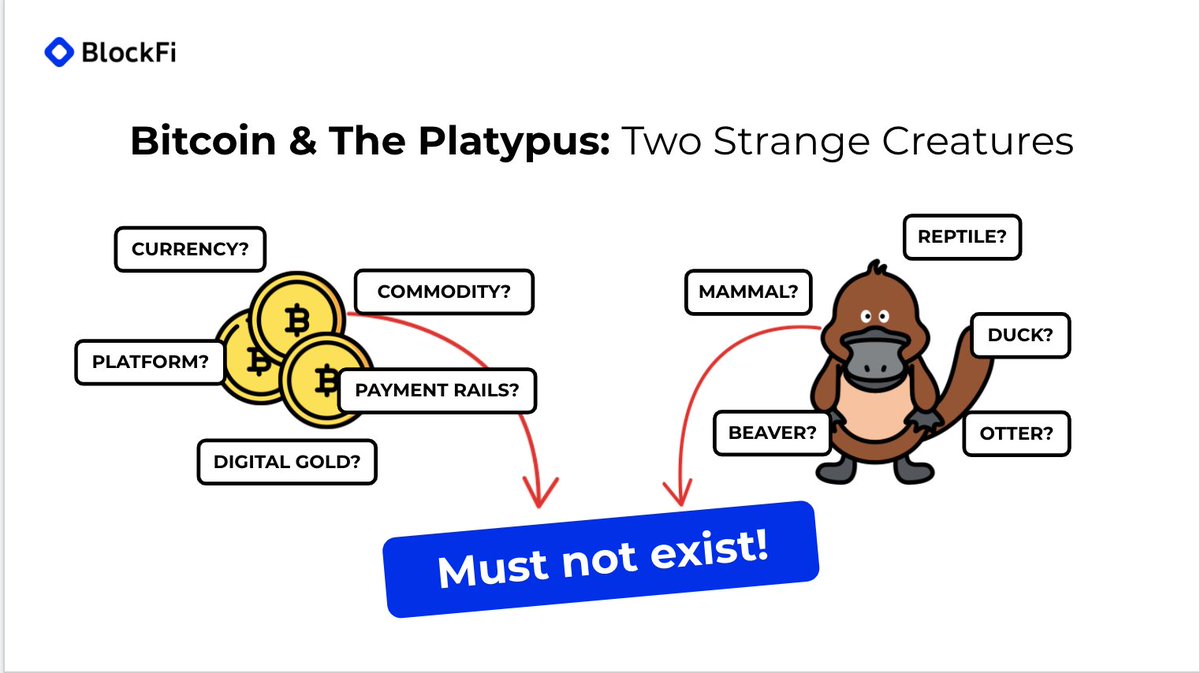

2/ @RayDalio, you are starting from a bad initial position of Bitcoin needing to be a currency to be valuable. Better to think of it as an asset subject to the laws of supply and demand like gold, art etc. There& #39;s a great analogy about this - "Bitcoin has a platypus problem"

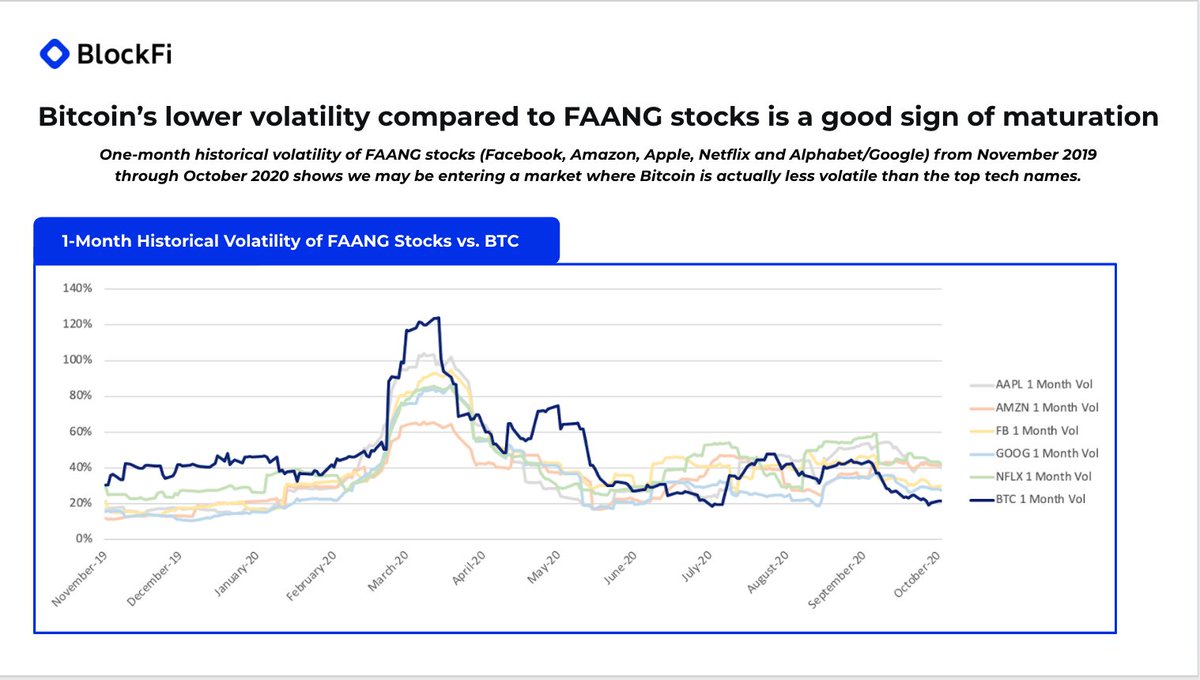

3/ "it& #39;s volatility is too great to be a store of value". Would you say the same about tech stocks? #btc  https://abs.twimg.com/hashflags... draggable="false" alt=""> volatility is below FAANG stocks recently with a clear trend downwards overall

https://abs.twimg.com/hashflags... draggable="false" alt=""> volatility is below FAANG stocks recently with a clear trend downwards overall

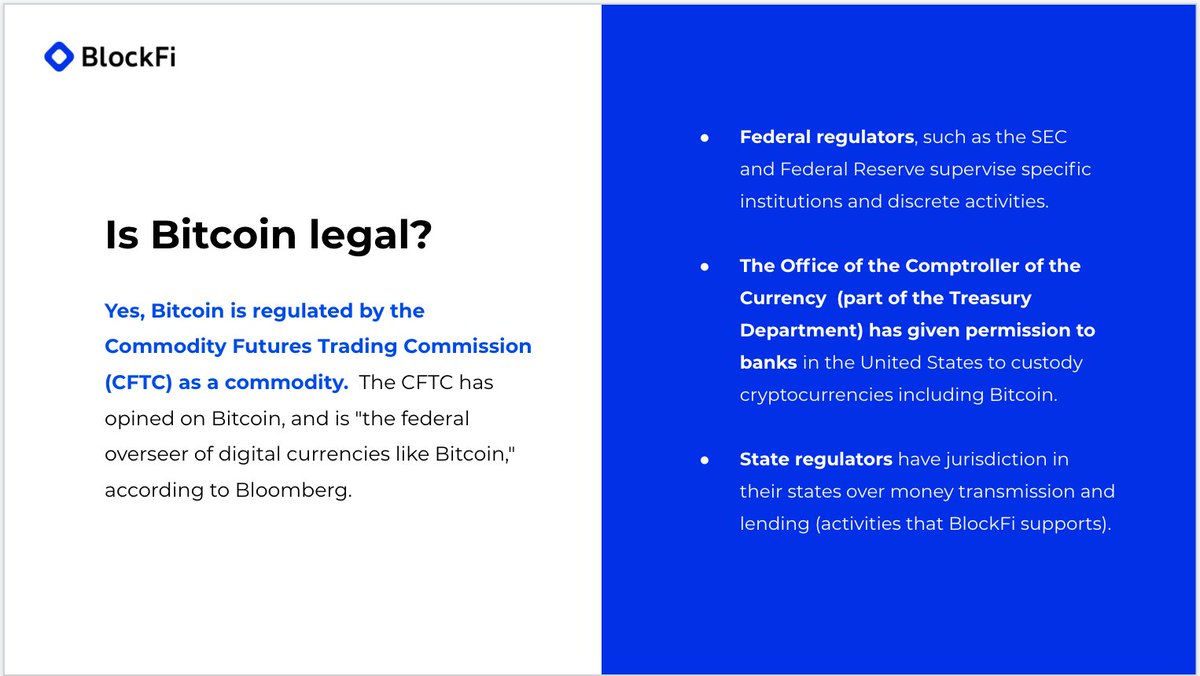

4/ "if it becomes too successful governments will ban it". Some governments sure - probably a strong correlation w/ governments that implement capital controls. In the USA, it& #39;s already well defined and governed by numerous bodies,

and adopted by important corporates.

and adopted by important corporates.

5/ Also, there is an increasingly strong chance the Bitcoin and the broader ecosystem will become a strategic tool for leading economies like the USA. This is as a result of rapid global stablecoin adoption, the increased transparency vs cash and CBDC initiatives

6/ "I can& #39;t imagine central banks, institutional investors etc using it"

Well, respectfully, you just aren& #39;t paying attention! Fidelity, Square, PTJ, Bill Miller, Druckenmiller, MSTR, Fortress, DBS Bank in Singapore, multiple banks in Switzerland and the list goes on...

Well, respectfully, you just aren& #39;t paying attention! Fidelity, Square, PTJ, Bill Miller, Druckenmiller, MSTR, Fortress, DBS Bank in Singapore, multiple banks in Switzerland and the list goes on...

7/ I hope that Ray takes the time to educate himself and think critically about #btc  https://abs.twimg.com/hashflags... draggable="false" alt=""> and what& #39;s happening in the broader crypto ecosystem. It would be a shame to see him miss a paradigm shift happening before our eyes!

https://abs.twimg.com/hashflags... draggable="false" alt=""> and what& #39;s happening in the broader crypto ecosystem. It would be a shame to see him miss a paradigm shift happening before our eyes!

8/ If you& #39;re working at a financial institution and looking for help educating folks internally about these topics - the slides in this thread were taken from a Bitcoin 101 deck we have at BlockFi. Our institutional team would be happy to present to your organization!

Read on Twitter

Read on Twitter

volatility is below FAANG stocks recently with a clear trend downwards overall" title="3/ "it& #39;s volatility is too great to be a store of value". Would you say the same about tech stocks? #btc https://abs.twimg.com/hashflags... draggable="false" alt=""> volatility is below FAANG stocks recently with a clear trend downwards overall" class="img-responsive" style="max-width:100%;"/>

volatility is below FAANG stocks recently with a clear trend downwards overall" title="3/ "it& #39;s volatility is too great to be a store of value". Would you say the same about tech stocks? #btc https://abs.twimg.com/hashflags... draggable="false" alt=""> volatility is below FAANG stocks recently with a clear trend downwards overall" class="img-responsive" style="max-width:100%;"/>