$DASH. First, what a mission.

It& #39;s clearly personal.

Logistics Infrastructure + Software Tools + Consumer demand = killer combination to build a large, at-scale Internet business.

The delivery of "everything". If $AMZN were started in 2020, wouldn& #39;t they do something similar?

Culture of customer obsession, compounding of skillsets, detail orientation and an ownership mentality.

Focused execution seems to pay off. The market is big enough for the duopoly of $UBER + $DASH, so I am always confused by $UBER& #39;s insistence and focus on market share gains.

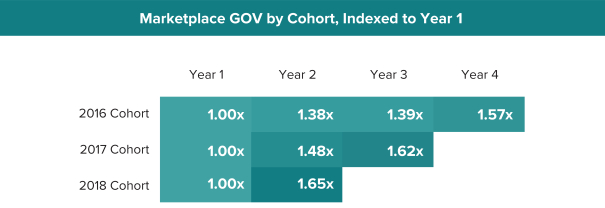

The cohorts are en fuego, w/ each cohort looking better than the previous one. Can& #39;t wait to see the 2019 cohorts, but they obviously look very good.

@hamiltonhelmer clearly influenced their thinking. $DASH highlights 3 out of the 7 powers in Helmer& #39;s framework. Though I think they omitted their real super power - operational process excellence.

Focus on suburbs means that competition is benign for now and the market is deep. Contrary to popular narrative, Eats $UBER and $DASH can both thrive, and the US market could end up looking like Meituan - http://Ele.me"> http://Ele.me in China.

Obviously, COVID-19 was a huge tailwind. But the pull forward in demand shows the scale economies + local network effects embedded in $DASH. The swing from -ve to +ve economics is pretty amazing.

Straightforward unit economics. But - worrisome that customers end up paying a good 40%+ above the cost of their food in tips + fees. Does frequency get impacted long-term?

The COVID-19 bump is clear here as they grew 100% q/q in 2Q& #39;20

That said - the leverage in COGS (to 53% GMs) is impressive - again, scale effects at work. COGS = payment processing + support / onboarding + local ops.

+ve EBITDA margins! Yes...I know it& #39;s EBITDA, but paraphrasing a recent conversation by an on-demand exec, the GAAP to EBITDA reconciliation is not a "page long"

+ve operating cash flow as well. As long the business grows off this base, arguments surrounding profitability are now completely misplaced. More specifically - with the "Elusive $1 in FCF" in the books, the market will likely look past any more short term GAAP losses.

So refreshing - and rare - to see $DASH be transparent about their core drivers. I wish more companies took a leaf from their S-1 (even if the numbers aren& #39;t as good).

On-demand companies are often criticized for excessive discounting. $DASH seems to take a thoughtful approach to first time consumer discounting, followed by stable re-engagement marketing in Year 2 and beyond.

Long term contribution margins seem to asymptote to 8% of net revenue. Given a 15% net take rate, that& #39;s a 53% contribution margin. Ergo, it& #39;s very likely to see $DASH EBITDA margins close to 40% (less 5% G&A and say 10% R&D - ignoring the add back of SBC and D&A)

This likely means that $UBER& #39;s estimate of LT 30% EBITDA margins in their Eats business is sandbagged. cc @modestproposal1.

+ there could be upside risks to these estimates if $DASH adds advertising and promos to the app. The more likely outcome is that $DASH reduces the fees for consumers and makes every day food delivery more affordable for the average consumer.

Price, Selection, Convenience and Experience. This team is clearly learning from $AMZN.

Overall - one of the best S-1s I& #39;ve read in a while. On the one hand, it was specific, data-oriented, with thoughtful data points that pushed back on the main bear cases. Other the other hand, it showcased the long-term, mission-oriented culture at the firm. A+ all round.

Gotta say -- really well done @t_xu and team ( @gokulr @PrabirAdarkar). Known you guys for a long time, and I remember how dark some days were for you. But you are here now, with winds in your sails, and ready for the next innings as a public company. Onwards and upwards!

Read on Twitter

Read on Twitter