MEGA-THREAD: @mattyglesias competently summarizes the "Debt no longer matters, so relax & add more" case.

But these arguments - common on econ Twitter - dismiss two key realities:

1) Baseline debt is already set to soar.

2) Interest rates are unlikely to stay < 3% forever. (1/) https://twitter.com/mattyglesias/status/1327243125228785670">https://twitter.com/mattygles...

But these arguments - common on econ Twitter - dismiss two key realities:

1) Baseline debt is already set to soar.

2) Interest rates are unlikely to stay < 3% forever. (1/) https://twitter.com/mattyglesias/status/1327243125228785670">https://twitter.com/mattygles...

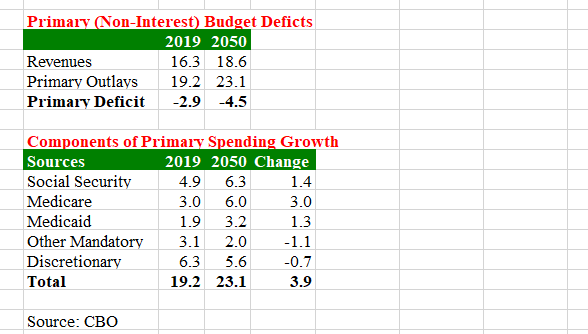

Baseline debt will soar in part because primary deficits (which exclude interest payments) will rise from 2.9% to 4.5% of GDP over 30 years. No one really disputes this CBO data. Its demographics & health inflation - Social Security & health care costs will exceed revenue growth.

But of course there are also interest costs. Take the current $21 trillion debt, add the annual borrowing for these structural deficits, and you get a rapidly growing debt.

Then apply an interest rate to the debt, and you get an annual interest expense.

Then apply an interest rate to the debt, and you get an annual interest expense.

The danger is that - because all revenues will be needed just to fund 80% of current programs - the other 20% of program costs plus 100% of all interest costs must be funded by borrowing. And that makes the debt bigger, which raises interest costs further, in a vicious cycle.

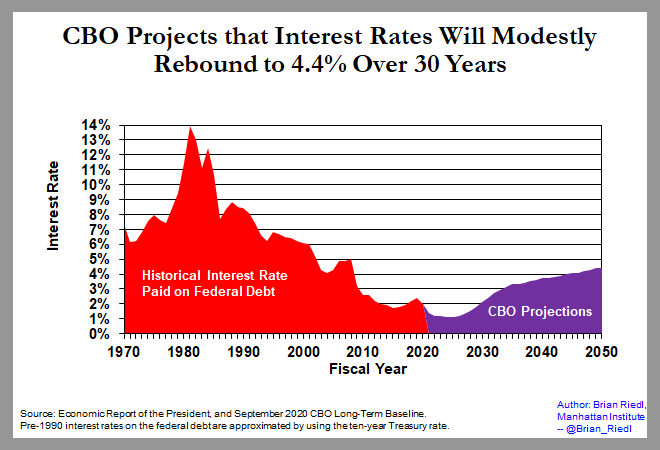

Now, add interest rates. Washington relies on short-term debt (60 months avg maturity). So while today& #39;s rates are low, any future rise in interest rates would soon hit nearly all the debt.

CBO projects Washington& #39;s average rate gradually rises back to 4.4% over 30 years.

CBO projects Washington& #39;s average rate gradually rises back to 4.4% over 30 years.

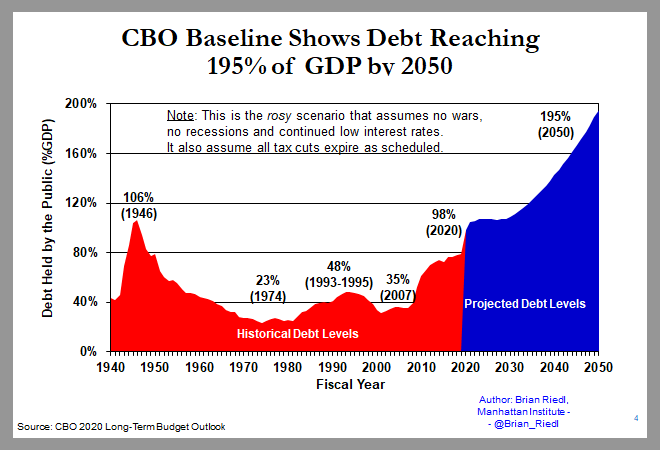

Now, let& #39;s do the math. Combine:

1) A $21 trillion current debt

2) Primary deficits gradually rising to 4.5% of GDP over 30 years.

3) Interest rates rising gradually to 4.4% of GDP over 30 years.

Result: Debt hits 195% of GDP by 2050, per CBO.

1) A $21 trillion current debt

2) Primary deficits gradually rising to 4.5% of GDP over 30 years.

3) Interest rates rising gradually to 4.4% of GDP over 30 years.

Result: Debt hits 195% of GDP by 2050, per CBO.

By the way, CBO projects that in 2050, the 8.1% of GDP spent on interest will be the largest federal expenditure, and consume 44% of all tax revenues.

The budget deficit will be 12.6% of GDP (4.5% primary + 8.1% interest) and growing fast. Does anyone consider that sustainable?

The budget deficit will be 12.6% of GDP (4.5% primary + 8.1% interest) and growing fast. Does anyone consider that sustainable?

Critics who think this 195% of GDP estimate is absurd must answer which of the 3 assumptions above that create this mathematical result is incorrect.

The primary deficit is probably *underestimated* bc it assumes 2017 tax cuts expire on schedule & no new spending expansions.

The primary deficit is probably *underestimated* bc it assumes 2017 tax cuts expire on schedule & no new spending expansions.

That leaves interest rates. Yes, they& #39;ve fallen since 1990 due to factors (low productivity, recessions, boomers saving for retirement, flight to safety) that have counteracted the natural rise in interest rates that result from higher debt.

But no guarantee rises cant rise.

But no guarantee rises cant rise.

Data from terrific Obama Admin economist @ernietedeschi notes that the coming 100% rise in the debt should -- all else equal -- raise interest rates by 4%. (Of course, not all else is equal) https://medium.com/bonothesauro/deficits-are-raising-interest-rates-but-other-factors-are-lowering-them-6d1e68776b7a">https://medium.com/bonothesa...

Tedeschi notes that - in recent years - interest rates have fallen because the effect of higher debt has been counteracted by the factors described above (deep recessions, low productivity, boomers saving for retirement, flight to safety, etc).

But for interest rates to stay this low, you not only need every factor that has held down rates recently to continue forever...you also need those factors to **ACCELERATE** enough to also offset the full 4% interest rate effect that the added debt by itself would create.

But will they all accelerate? Baby boomers retiring will shift from saving to drawing down savings. Global demographics could begin to push up rates. Inflation could occur, productivity could rise, emerging markets could gobble up investment. https://www.bloomberg.com/opinion/articles/2020-10-08/maybe-low-interest-rates-won-t-last-forever">https://www.bloomberg.com/opinion/a...

(Those who expect foreigners to bail us out should note that China/Japan have financed just 1% of the $10.2 trillion in new debt since late 2011, and do not have the capacity or motivation to take much of our $104T in new debt over 30 years. Also, can the Fed monetize $100T?)

So, CBO projecting that Washington& #39;s average interest rate gradually rises from 2.0% today to 4.4% over 30 years is probably conservative. It assumes those other factors accelerate enough to offset about 40% of that 4% interest rate effect of higher debt.

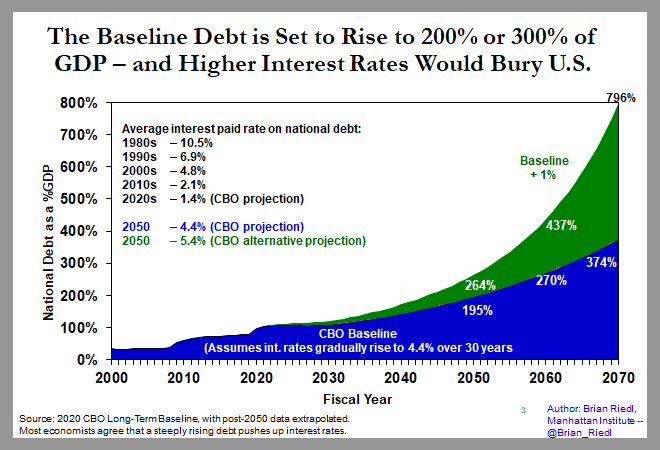

But what if those factors don& #39;t accelerate as much? What if interest rates exceed CBO projections by just 1 percentage point?

Well, we get clobbered. CBO puts the 2050 debt at 264% of GDP. And me pushing that out another decade goes to 437%, then 796%. Impossible numbers.

Well, we get clobbered. CBO puts the 2050 debt at 264% of GDP. And me pushing that out another decade goes to 437%, then 796%. Impossible numbers.

This 2050 CBO scenario:

Revenues: 18.6% of GDP

Spending: 35.3%

Deficit: 16.7% (4.5% primary deficit +12.3% interest).

Debt: 264%

That is the current equivalent of a $3.4 trillion annual budget deficit, and $2.4 trillion interest tab. Yikes.

And that& #39;s just an extra 1%!

Revenues: 18.6% of GDP

Spending: 35.3%

Deficit: 16.7% (4.5% primary deficit +12.3% interest).

Debt: 264%

That is the current equivalent of a $3.4 trillion annual budget deficit, and $2.4 trillion interest tab. Yikes.

And that& #39;s just an extra 1%!

Again, there is no hocus pocus to these CBO calculations

This is just today& #39;s $21 trillion debt, plus an annual primary deficit rising to 4.5% of GDP, plus interest rates gradually rising to 4.4% or 5.4% over 30 years.

You can& #39;t just wish the math away.

This is just today& #39;s $21 trillion debt, plus an annual primary deficit rising to 4.5% of GDP, plus interest rates gradually rising to 4.4% or 5.4% over 30 years.

You can& #39;t just wish the math away.

(And yes, Japan already "survives" a 200% of GDP debt. They also have 30 years of weak economic growth, a much higher savings rate to finance debt, and may face some similar factors pushing up their future interest rates. Not a model to aspire to).

So the question is, do we want to gamble America& #39;s economic future on the hope that interest rates remain at 2% or below forever? Is that a wise course of action? Do we trust the economic experts who failed to predict the mortgage meltdown, and so many other economic events?

Which brings me back to @mattyglesias & many others who - instead of advocating long-term debt stabilization - advocate *piling on even more permanent expensive initiatives* to this baseline.

Btw, I agree we should spend what is necessary to alleviate the recession - absolutely.

Btw, I agree we should spend what is necessary to alleviate the recession - absolutely.

But once back at full strength, we must address these unsustainable trends with some combination of tax increases and spending reforms. And the sooner we begin, the more gradual they can be. You don& #39;t wait until the annual deficit is 15% of GDP and interest rates are soaring.

This isn& #39;t the place to litigate all solutions (Ive written much) - which may include historic tax hikes, entitlement reform, fixing health care (a major driver). Many target defense. The point is SOMETHING must be done to avoid the primary deficit growing to 4.5% of GDP.

But those who would add more initiatives should answer:

1) Do you dispute the math projections? The primary deficits or the interest rate assumptions? How?

2) What debt level is too high for you?

3) Are you willing to gamble it all on rates never reaching 4, 5, or 6% ever again?

1) Do you dispute the math projections? The primary deficits or the interest rate assumptions? How?

2) What debt level is too high for you?

3) Are you willing to gamble it all on rates never reaching 4, 5, or 6% ever again?

4) What if you are wrong and rates reach 4, 5, or 6% in 30 years? How easy will it be to unwind budget deficits of 12-20% of GDP?

5) Are today& #39;s low rates really a good predictor of future rates? Have past interest rates predicted other fiscal and economic crises?

5) Are today& #39;s low rates really a good predictor of future rates? Have past interest rates predicted other fiscal and economic crises?

Its easy to dismiss these projections because the worst is several years off, and interest rates remain low.

But anyone with student loans knows that eventually the debt principal gets so huge that even low interest rates can& #39;t save you. And any rising rates will bury you.

But anyone with student loans knows that eventually the debt principal gets so huge that even low interest rates can& #39;t save you. And any rising rates will bury you.

Read on Twitter

Read on Twitter