Alpha is not fund return – index return (excess returns over benchmark), that’s called active returns and not Alpha.

Alpha means excess returns over ‘minimum expected returns’ from the fund

(A thread) (1/n)

Alpha means excess returns over ‘minimum expected returns’ from the fund

(A thread) (1/n)

What is the minimum expected return from a fund?

Depends on the risk the fund is taking

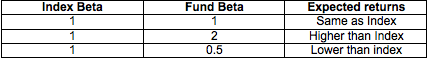

a. If the fund is taking risk same as the index, minimum expected ME return from the fund is same as the Index.

b. Fund is taking risk higher than the index, ME is higher than the index (2/n)

Depends on the risk the fund is taking

a. If the fund is taking risk same as the index, minimum expected ME return from the fund is same as the Index.

b. Fund is taking risk higher than the index, ME is higher than the index (2/n)

(c) Fund is taking risk lower than the Index, ME is lower than the index

You should not look at only beating the index; you should look at beating the minimum expected return based on the risk the fund takes, which is Alpha. (3/n)

You should not look at only beating the index; you should look at beating the minimum expected return based on the risk the fund takes, which is Alpha. (3/n)

What is the risk we are talking about?

Risk here is defined as Beta. It’s a relationship of the funds risk to the risk of the benchmark. Benchmarks risk is generally considered as 1 (4/n)

Risk here is defined as Beta. It’s a relationship of the funds risk to the risk of the benchmark. Benchmarks risk is generally considered as 1 (4/n)

How is the minimum expected return calculated?

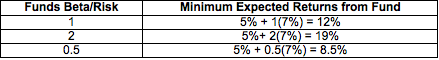

Lets say risk free rate / investing in an FD is 5%, than when anyone is investing anywhere they will have a minimum expectation of 5% right? (5/n)

Lets say risk free rate / investing in an FD is 5%, than when anyone is investing anywhere they will have a minimum expectation of 5% right? (5/n)

But will the expectation be 5% or more if the investment is happening in the stock markets? It will be more because she is going to take risk. So lets say her expectation is 5% + 7%, 5% for risk free and 7% for taking the risk. (6/n)

So if she invests in markets, her expectation is 12% (5 + 7). Now, the more the risk you take the more will be the expectation (7/n)

a. If the funds beta is same as index 1, the return expectation is same as index 12%.

b. If the fund is taking higher risk than the Index, say 2, the return expectation is twice. Here we can’t expect twice of risk free & hence we only expect twice of the risk related return 7%*2

b. If the fund is taking higher risk than the Index, say 2, the return expectation is twice. Here we can’t expect twice of risk free & hence we only expect twice of the risk related return 7%*2

(c) And if the fund is taking lower risk than the Index, say 0.5, the return expectation is half. Hence we can’t expect half of risk free and hence we only expect half of risk related return 7% * 0.5 (9/n)

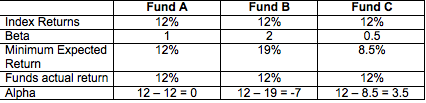

Alpha is the difference between a fund& #39;s minimum expected returns and its actual returns.

Fund B inspite of generating same returns as the benchmark, is not a good fund as it delivered less than expected return of 19%. (10/n)

Fund B inspite of generating same returns as the benchmark, is not a good fund as it delivered less than expected return of 19%. (10/n)

In Fund C, inspite of not beating the index, the funds Alpha is positive because of lower beta/risk the funds expected returns were lower and we still call it a good fund (11/12)

So it is advisable to look at the Alpha of the fund, which will tell you how much more or less returns the fund has generated v/s the minimum expected returns where the minimum expected returns are not the Index return. (END)

Read on Twitter

Read on Twitter