IMPORTANT! If you& #39;re a first time South African home buyer earning between R3,501 & R22,000 a month you could be eligible for a government subsidy for over R120,000

It& #39;s called the Finance Linked Individual Subsidy Programme (FLISP) [Thread]

It& #39;s called the Finance Linked Individual Subsidy Programme (FLISP) [Thread]

1. Why was FLISP introduced?

It& #39;s aimed at filling the affordability "gap". Your income might be too high to qualify for government "free housing" but at this salary you may still find it tricky to repay a home loan.

The subsidy makes monthly payments more affordable.

It& #39;s aimed at filling the affordability "gap". Your income might be too high to qualify for government "free housing" but at this salary you may still find it tricky to repay a home loan.

The subsidy makes monthly payments more affordable.

2. Do I qualify for FLISP?

- First time home buyer

- Must be a South African citizen

- Older than 18

- Have an approval (in principle) for a home loan

- Must have financial dependents

- Must never have benefitted from a government housing subsidy scheme before

- First time home buyer

- Must be a South African citizen

- Older than 18

- Have an approval (in principle) for a home loan

- Must have financial dependents

- Must never have benefitted from a government housing subsidy scheme before

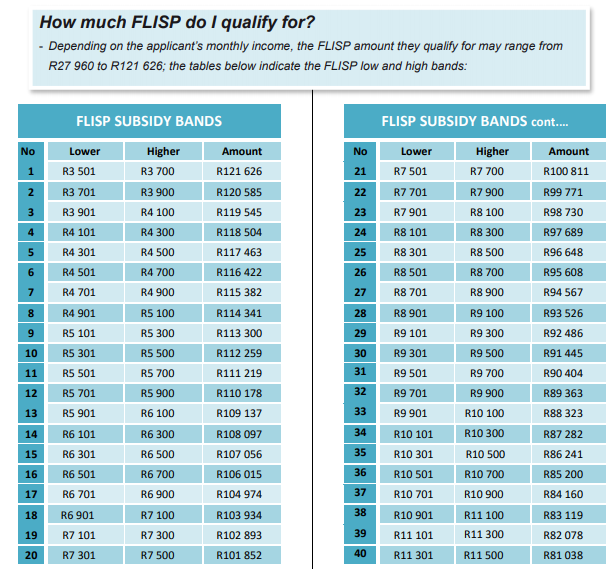

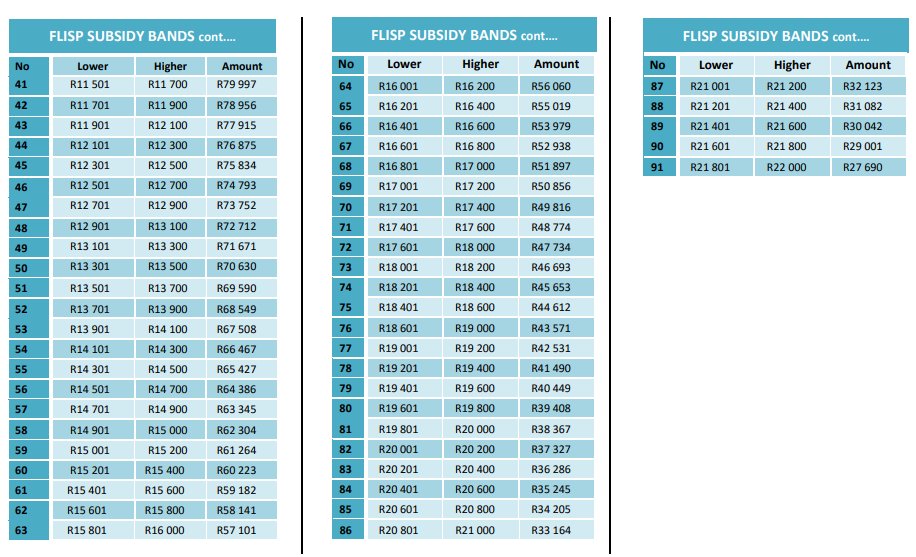

3. How much can I expect to receive?

It works on a sliding scale. The more you earn, the lower the subsidy. Here is the subsidy for each salary band:

If you earn between R3,501 & R3,700 your subsidy is R121,626

If you earn between R21,801 & R22,000 your subsidy is R27,690

It works on a sliding scale. The more you earn, the lower the subsidy. Here is the subsidy for each salary band:

If you earn between R3,501 & R3,700 your subsidy is R121,626

If you earn between R21,801 & R22,000 your subsidy is R27,690

4. What types of property can I use FLISP for?

The subsidy can be used to finance a number of different property types. You can:

- Buy an existing (new or old) residential property

- Buy a vacant serviced residential-stand

- Build a residential property

The subsidy can be used to finance a number of different property types. You can:

- Buy an existing (new or old) residential property

- Buy a vacant serviced residential-stand

- Build a residential property

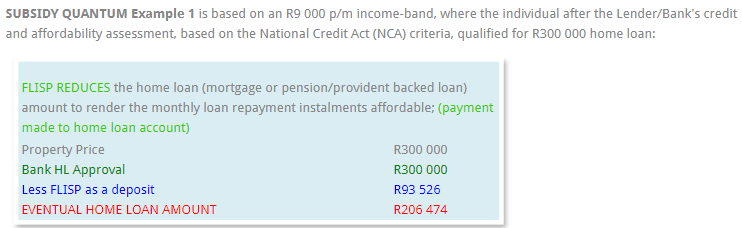

5. What if I already qualify for the full amount of the home loan from the bank?

If you qualify for the full amount of the home loan, FLISP can be used as a deposit to reduce your loan with the bank.

Here& #39;s a worked example from the National Housing Finance Corporation (NHFC).

If you qualify for the full amount of the home loan, FLISP can be used as a deposit to reduce your loan with the bank.

Here& #39;s a worked example from the National Housing Finance Corporation (NHFC).

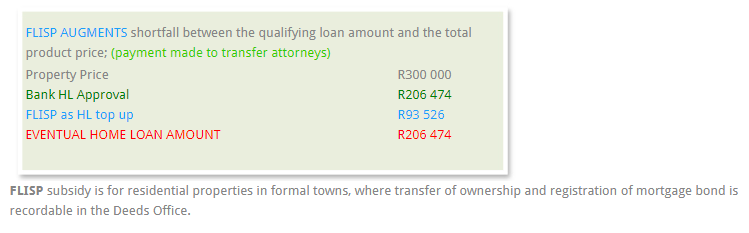

6. What if I need to qualify for a more expensive house?

Here FLISP will pay a top-up payment to get you up to the value of the home loan you are aiming to get.

The subsidy can be used to pay a deposit (if you qualify) or top you up to the loan amount (if you don& #39;t qualify)

Here FLISP will pay a top-up payment to get you up to the value of the home loan you are aiming to get.

The subsidy can be used to pay a deposit (if you qualify) or top you up to the loan amount (if you don& #39;t qualify)

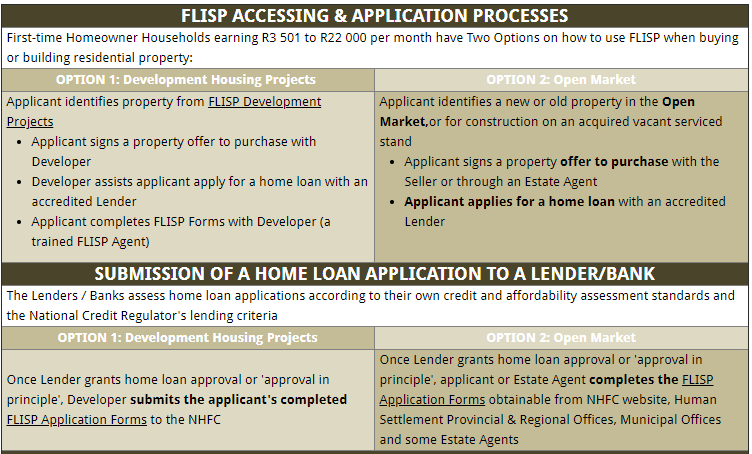

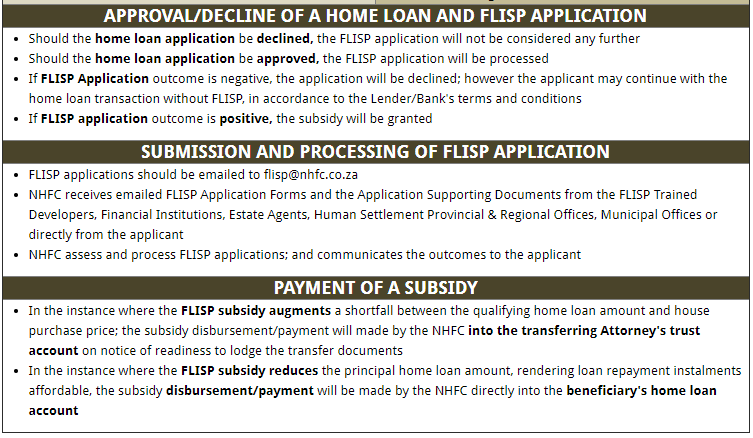

7. How do timelines work? What gets submitted first?

- Put in an offer to purchase & submit FLISP application

- Apply for bank loan

- If loan is approved, FLISP application is processed

- FLISP will say APPROVE/ NOT APPROVED

- The subsidy is paid directly into relevant account

- Put in an offer to purchase & submit FLISP application

- Apply for bank loan

- If loan is approved, FLISP application is processed

- FLISP will say APPROVE/ NOT APPROVED

- The subsidy is paid directly into relevant account

8. Where can I apply?

Here is a direct link to the FLISP application form:

https://www.nhfc.co.za/images/pdf/FLISP-Application-Form.pdf

This">https://www.nhfc.co.za/images/pd... form can be accessed from the NHFC website here:

https://www.nhfc.co.za/index.php/Products-and-Services/application-process-flow.html

All">https://www.nhfc.co.za/index.php... FAQs answered here:

https://www.nhfc.co.za/index.php/FLISP/faq.html

Additional">https://www.nhfc.co.za/index.php... reading:

https://www.nhfc.co.za/images/FLISP-Brochure-UPDATED.PDF">https://www.nhfc.co.za/images/FL...

Here is a direct link to the FLISP application form:

https://www.nhfc.co.za/images/pdf/FLISP-Application-Form.pdf

This">https://www.nhfc.co.za/images/pd... form can be accessed from the NHFC website here:

https://www.nhfc.co.za/index.php/Products-and-Services/application-process-flow.html

All">https://www.nhfc.co.za/index.php... FAQs answered here:

https://www.nhfc.co.za/index.php/FLISP/faq.html

Additional">https://www.nhfc.co.za/index.php... reading:

https://www.nhfc.co.za/images/FLISP-Brochure-UPDATED.PDF">https://www.nhfc.co.za/images/FL...

9. Are banks aware of FLISP?

Most accredited banks know about FLISP.

Make sure you& #39;re aware of how the subsidy amount you qualify for so you can let the bank know you submitted an application & this can help your negotiations in getting your home loan over the line

Most accredited banks know about FLISP.

Make sure you& #39;re aware of how the subsidy amount you qualify for so you can let the bank know you submitted an application & this can help your negotiations in getting your home loan over the line

10. Do I have to repay the FLISP subsidy?

No, you do not repay this at any point.

No, you do not repay this at any point.

Shout-out for making it to the end of the thread.

Have a blessed Sunday https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎉" title="Partyknaller" aria-label="Emoji: Partyknaller">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎉" title="Partyknaller" aria-label="Emoji: Partyknaller"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎉" title="Partyknaller" aria-label="Emoji: Partyknaller">. Here& #39;s to rich success in finding your crib - we& #39;re here to share the cheat codes.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎉" title="Partyknaller" aria-label="Emoji: Partyknaller">. Here& #39;s to rich success in finding your crib - we& #39;re here to share the cheat codes.

Feel free to join the Telegram channel for more BankerX: https://t.me/BankerX ">https://t.me/BankerX&q...

Have a blessed Sunday

Feel free to join the Telegram channel for more BankerX: https://t.me/BankerX ">https://t.me/BankerX&q...

Read on Twitter

Read on Twitter