I disagree, but very respectfully. Thank you Christopher for the inspiration!

I want to show you why the short-term oriented comment he quotes is dangerous for your investing success.

The Nifty 50 included companies like $MCD, $KO, $PEP, $PG, $DIS, $BMY, $PFE, $JNJ, etc (1/7) https://twitter.com/SeifelCapital/status/1325222703754842113">https://twitter.com/SeifelCap...

I want to show you why the short-term oriented comment he quotes is dangerous for your investing success.

The Nifty 50 included companies like $MCD, $KO, $PEP, $PG, $DIS, $BMY, $PFE, $JNJ, etc (1/7) https://twitter.com/SeifelCapital/status/1325222703754842113">https://twitter.com/SeifelCap...

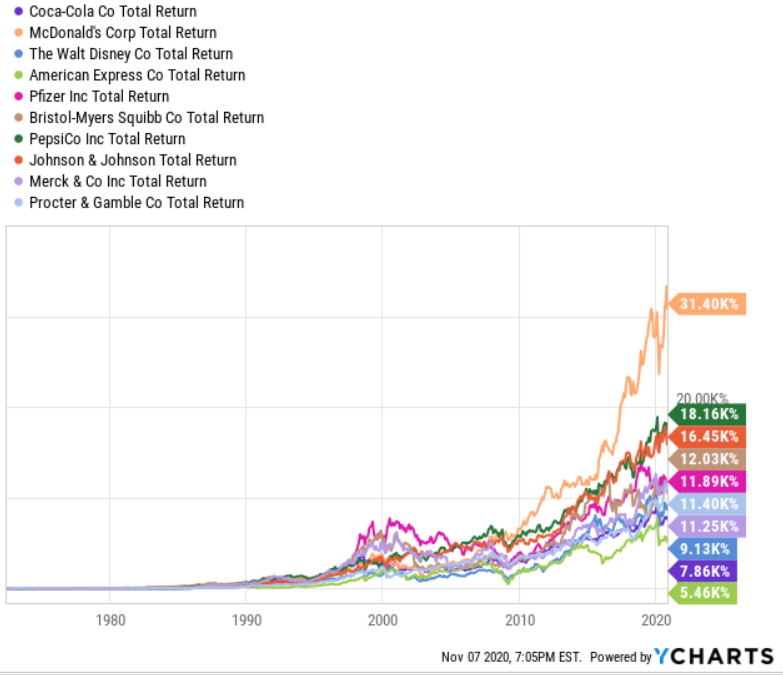

Look at the astonishing results of these 10. As a reference: the $SPY is up 3.5K% since 1972.

So, lesson 1: buy quality, not just anything in a hot group.

Atm, I see several stocks being hyped that are either low-quality or very risky. But I also see outstanding quality! (2/7)

So, lesson 1: buy quality, not just anything in a hot group.

Atm, I see several stocks being hyped that are either low-quality or very risky. But I also see outstanding quality! (2/7)

Even if you included all of the 50 stocks and you held for 25 years, you would have beaten the market. Your CAGR would have been 12.2% vs. 8%. For $10K invested, that& #39;s the difference between $68,485 and $177,755

Here& #39;s the study from 1996: http://csinvesting.org/wp-content/uploads/2015/03/valuing-growth-stocks-revisiting-the-nifty-fifty.pdf">https://csinvesting.org/wp-conten... (3/7)

Here& #39;s the study from 1996: http://csinvesting.org/wp-content/uploads/2015/03/valuing-growth-stocks-revisiting-the-nifty-fifty.pdf">https://csinvesting.org/wp-conten... (3/7)

So, lesson 2: buy and hold great companies for the long term. The longer, the better.

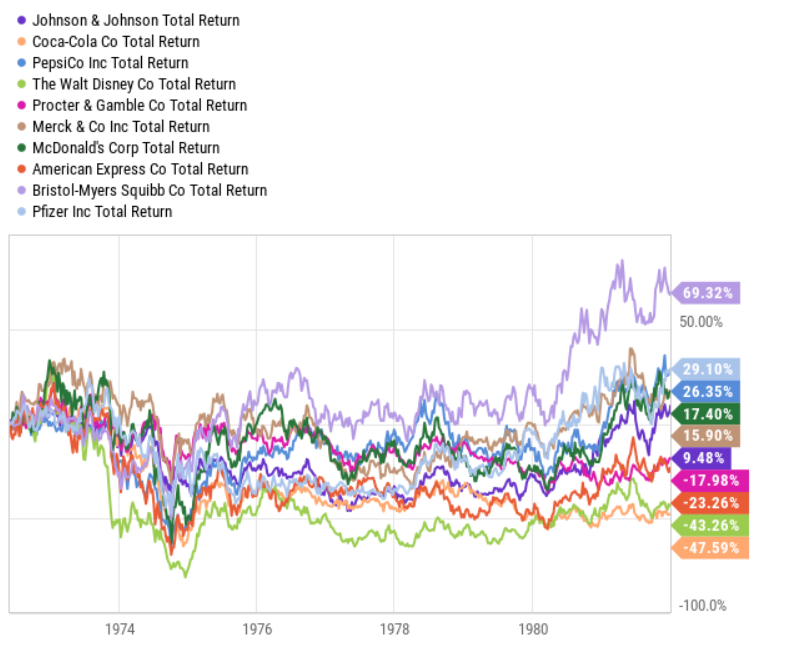

But you could argue here: the returns the next 10 years were awful. And indeed, you only had 3.6% (on average per stock, but not per year, it was a very bad investment period) (4/7)

But you could argue here: the returns the next 10 years were awful. And indeed, you only had 3.6% (on average per stock, but not per year, it was a very bad investment period) (4/7)

Just as a reference: the $SPY was up just 11% over that 10-year period. But 7.4% worse than the market is not what you want. Even the index has poor returns. You don& #39;t want to invest your money to have a measly 11% return over 10 long years. But there is an antidote. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Elektrische Glühbirne" aria-label="Emoji: Elektrische Glühbirne"> (5/7)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Elektrische Glühbirne" aria-label="Emoji: Elektrische Glühbirne"> (5/7)

But suppose you started with a $1,000 investment in the two best and the two worst, so $BMY and $PFE (the best) and $DIS and $KO (the worst). Each month you add $50 to every investment over that same period of 10 years. The returns are all above the $7K total investment (6/7)

Read on Twitter

Read on Twitter