OK, something really momentous is happening here in India.

It is reshaping the digital economy here at home, and will soon make its mark in other countries too.

Join me in this thread as I unpack this revolution

I didn& #39;t really intend for the last tweet to be such a big cliffhanger, so I& #39;m going to get straight to the point - public digital infrastructure (PBI).

This is the revolution taking place in India. We are building infrastructure that will take this country into the future https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

This is the revolution taking place in India. We are building infrastructure that will take this country into the future

India doesn& #39;t have the physical infrastructure, R&D facilities, or sheer capital that some other countries do.

But what we do have is a solid telecom network, rising smartphone penetration, and strong engineering skills

The first piece of PBI to leverage these was Aadhaar.

But what we do have is a solid telecom network, rising smartphone penetration, and strong engineering skills

The first piece of PBI to leverage these was Aadhaar.

Aadhaar is the national ID system. It was launched in 2009.

Today, over 93% of the 1.35bn people in India has an Aadhaar number (!!)

People can authenticate themselves using an Aadhaar number + mobile/email OTP or iris/fingerprint scan

Today, over 93% of the 1.35bn people in India has an Aadhaar number (!!)

People can authenticate themselves using an Aadhaar number + mobile/email OTP or iris/fingerprint scan

The Aadhaar project has had its share of controversies, but multiple products have been built around it including:

- eKYC (cheap, fast, digital KYC)

- eSign (digital signatures)

- payments (DBT via Aadhaar#, withdraw/deposit to bank accs via rural micro-ATMs using biometrics)

- eKYC (cheap, fast, digital KYC)

- eSign (digital signatures)

- payments (DBT via Aadhaar#, withdraw/deposit to bank accs via rural micro-ATMs using biometrics)

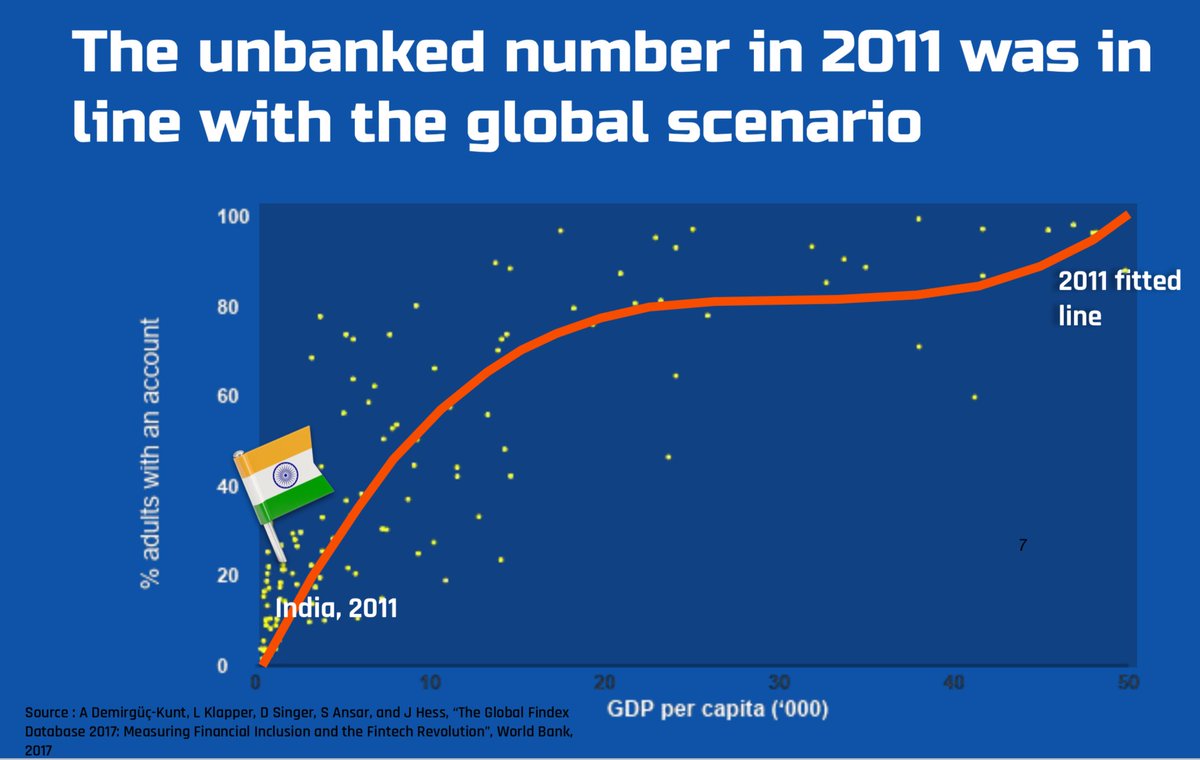

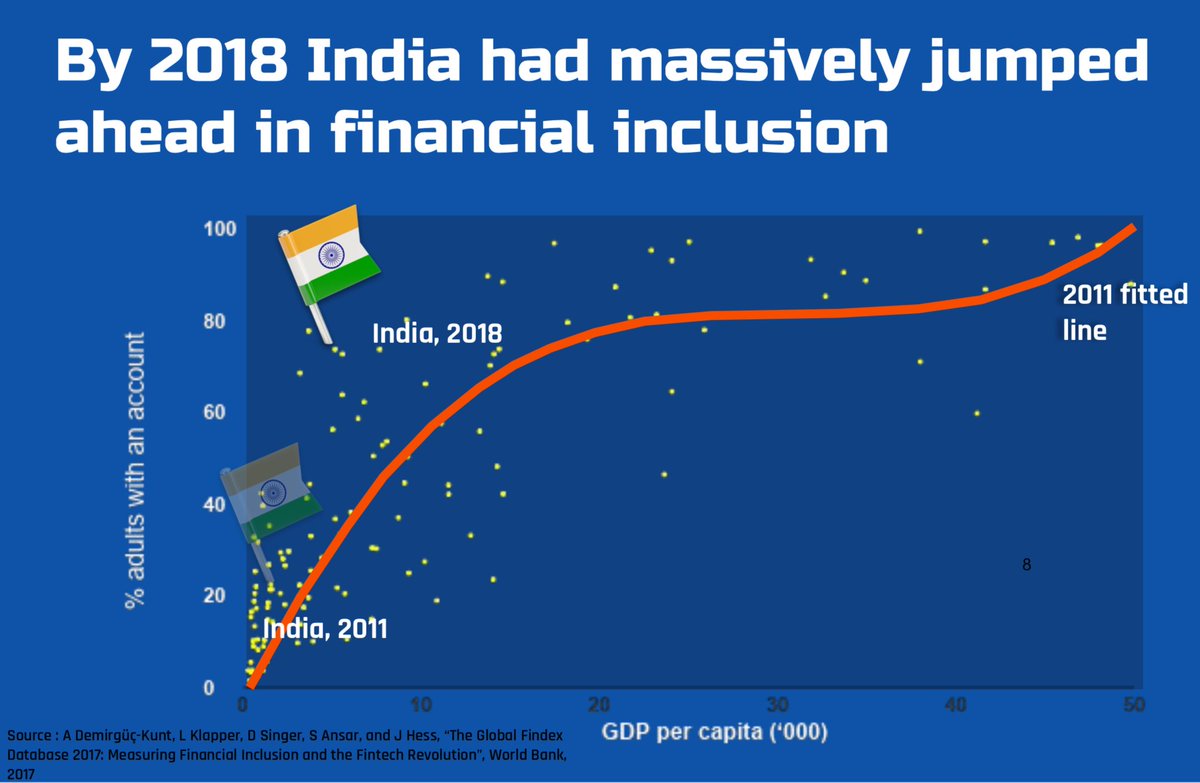

Whatever you think about Aadhaar, its undeniable that eKYC helped banks onboard hundreds of millions of customers in a fast and cheap manner.

Similarly @reliancejio used eKYC to quickly onboard millions of mobile SIM holders (setting the stage for the ongoing digital explosion)

Similarly @reliancejio used eKYC to quickly onboard millions of mobile SIM holders (setting the stage for the ongoing digital explosion)

So... Aadhaar was Part I. Many Indians now own their first ever verifiable ID and bank account.

Now they need a way to leverage this bank account to make and receive payments easily, right from their mobile phones

Enter the Unified Payment Interface - UPI

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">

Now they need a way to leverage this bank account to make and receive payments easily, right from their mobile phones

Enter the Unified Payment Interface - UPI

UPI is designed like a 3 layer cake:

L1 - A central-bank owned payments switch connecting all banks to each other

L2 - The regulated banks holding user funds

L3 - Private innovators and payments apps

As a developer, you just need to partner with one bank in order to use UPI

L1 - A central-bank owned payments switch connecting all banks to each other

L2 - The regulated banks holding user funds

L3 - Private innovators and payments apps

As a developer, you just need to partner with one bank in order to use UPI

This means that with 1 set of APIs, you have access to every bank account in India (!!)

Whats more, you can leave the money movement to the banks and focus on building the best UI/UX and frontend experience

Behind the hood, the central switch handles the routing and settlements

Whats more, you can leave the money movement to the banks and focus on building the best UI/UX and frontend experience

Behind the hood, the central switch handles the routing and settlements

For users, payments are instant. They flow directly out/into your account, no need for intermediary wallets like @venmo

User can generate payment addresses like aaryaman@upi

UPI is interoperable, so you can pay directly into bank accs from any UPI app using a payment address

User can generate payment addresses like aaryaman@upi

UPI is interoperable, so you can pay directly into bank accs from any UPI app using a payment address

Like any grand project, UPI has its challenges. But the UX is  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪄" title="Magic wand" aria-label="Emoji: Magic wand"> and the numbers speak for themselves.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪄" title="Magic wand" aria-label="Emoji: Magic wand"> and the numbers speak for themselves.

Despite launching in Apr & #39;16, UPI now accounts for >2bn txs/month (!), more than all cards in India put together, or indeed larger even than @AmericanExpress global volumes

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💣" title="Bombe" aria-label="Emoji: Bombe">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💣" title="Bombe" aria-label="Emoji: Bombe">

Despite launching in Apr & #39;16, UPI now accounts for >2bn txs/month (!), more than all cards in India put together, or indeed larger even than @AmericanExpress global volumes

Ok, so Part 1 was ID: Aadhaar. People finally have bank accounts

Part 2 was payments: UPI. People are transacting with their accs, creating digital footprints

Part 3 is data! Now that the digital trail exists, folks should be empowered to derive value from their own data!

Part 2 was payments: UPI. People are transacting with their accs, creating digital footprints

Part 3 is data! Now that the digital trail exists, folks should be empowered to derive value from their own data!

The data you generate through transactions should belong to you, not to your bank or service provider.

However, getting your data out of these silos today is painful, costly, or insecure. Eg. if you want to share your bank statement with a lender, you need to go download a PDF

However, getting your data out of these silos today is painful, costly, or insecure. Eg. if you want to share your bank statement with a lender, you need to go download a PDF

This is bad UX for customers. It is also costly for lenders to process PDFs quickly and correctly, since each bank has a different PDF format. Lastly, you can& #39;t pick and choose which txs make it into the PDF you share.

This might sound like a small problem, but its huge.

This might sound like a small problem, but its huge.

If you wish to avail of a service like lending, wealth management, or even applying for a travel visa, you need to share your financial data.

It happens all the time, but PDF statements suck. The latest solution is screen scraping - enter your password, and a bot parses your acc

It happens all the time, but PDF statements suck. The latest solution is screen scraping - enter your password, and a bot parses your acc

This is a huge business. @Visa paid $5bn to acquire @Plaid, the leader in screen scraping and reverse engg of mobile banking APIs. As a practice, this is just messy and insecure!

The alternative is to build bilateral relationships with all banks, which is... you tell me

The alternative is to build bilateral relationships with all banks, which is... you tell me

Globally, a new trend is emerging - open banking. Regulator-led drives to standardize the flow of banking data to make it cheaper, easier, and more secure for users.

This is great, but India is taking it to the next level through something called Account Aggregators (AAs)

This is great, but India is taking it to the next level through something called Account Aggregators (AAs)

Step 1 - Download an AA app

Step 2 - Discover, authenticate, link your financial accs

Step 3 - Give lender your AA handle

Step 4 - Lender requests your data

Step 5 - View/edit request, grant consent

Step 6 - Your data flows from your bank to the lender! In machine readable form!

Step 2 - Discover, authenticate, link your financial accs

Step 3 - Give lender your AA handle

Step 4 - Lender requests your data

Step 5 - View/edit request, grant consent

Step 6 - Your data flows from your bank to the lender! In machine readable form!

As a user, this is secure, easy, and gives you granular control over what you share. You can decide what to include and when to revoke access.

For the lender, this is a godsend! Standardized, machine readable data, straight from the source!

And its not just banking data...

For the lender, this is a godsend! Standardized, machine readable data, straight from the source!

And its not just banking data...

In India, the AA Framework will cover banking, taxes, insurance, securities, and telecom data. Health data and other forms of data will soon follow suit.

The possibilities are quite literally endless. There are so many amazing apps, innovations, and industries that can be built!

The possibilities are quite literally endless. There are so many amazing apps, innovations, and industries that can be built!

Taken together, these three layers (ID, payments, data) form what is known as @India_Stack.

I am proud to be a part of this project as a volunteer with iSPIRT, a non-profit tech think tank that tries to advance India through the building of PBI

But why am I saying this now?

I am proud to be a part of this project as a volunteer with iSPIRT, a non-profit tech think tank that tries to advance India through the building of PBI

But why am I saying this now?

Well, the Account Aggregator framework just went live! @MyIndusIndBank and @AxisBank are the first two banks to roll out this system, giving millions of Indians the chance to connect their bank accounts and begin empowering themselves through easier access to their own data  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Ok hand" aria-label="Emoji: Ok hand">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Ok hand" aria-label="Emoji: Ok hand">

The rest of the banks will soon follow suit. The Indian fintech ecosystem is set for massive growth and innovation  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

UPI has already provided the inspiration for the US Fed& #39;s FedNow payment system, and i& #39;m sure the AA framework will also draw worldwide admiration

UPI has already provided the inspiration for the US Fed& #39;s FedNow payment system, and i& #39;m sure the AA framework will also draw worldwide admiration

But this isn& #39;t an overnight job - this has taken lots of planning. The idea has been nurtured by @RBI, @NITIAayog, and various government agencies.

Private sector leaders have stepped in to show their foresight and conviction.

Dozens of volunteers have poured years into this

Private sector leaders have stepped in to show their foresight and conviction.

Dozens of volunteers have poured years into this

And to be honest, there are so many cool ideas that I haven& #39;t even been able to cover here

If you want to see the planned innovations in the Indian lending ecosystem, check this out: https://tigerfeathers.substack.com/p/ocen-a-conversation">https://tigerfeathers.substack.com/p/ocen-a-...

If you want to see the planned innovations in the Indian lending ecosystem, check this out: https://tigerfeathers.substack.com/p/ocen-a-conversation">https://tigerfeathers.substack.com/p/ocen-a-...

Its been a rough year worldwide. Entire countries and industries have taken a historic beating. Grave human cost.

Hopefully this small milestone marks the beginning of a change of fortunes. I wish you all the best for the rest of the year, and please do reach out to know more!

Hopefully this small milestone marks the beginning of a change of fortunes. I wish you all the best for the rest of the year, and please do reach out to know more!

Cc @RahulSanghi1 @seema_amble @LarsMarkull @NikMilanovic @cemgarih @jay_kotakone @anandmahindra @monikahalan

Read on Twitter

Read on Twitter