1) Portfolio summary - Oct-end

$ADYEY $AYX $BABA $CRWD $DAO $DDOG $DKNG $DOCU $FROG $GDRX $MELI $OKTA $PINS $PLTR $ROKU $SE $SHOP $SNOW $SQ $TWLO $U $VRM $ZM

Return since 1 Sept & #39;16 -

Portfolio +343.54%

$ACWI +32.03%

$SPX +50.63%

Contd...

$ADYEY $AYX $BABA $CRWD $DAO $DDOG $DKNG $DOCU $FROG $GDRX $MELI $OKTA $PINS $PLTR $ROKU $SE $SHOP $SNOW $SQ $TWLO $U $VRM $ZM

Return since 1 Sept & #39;16 -

Portfolio +343.54%

$ACWI +32.03%

$SPX +50.63%

Contd...

2) CAGR since inception (1 Sept 2016) -

Portfolio +42.94%

$ACWI +6.89%

$SPX +10.32%

YTD return -

Portfolio +221.75%

$ACWI (-)2.52%

$SPX +1.21%

Contd...

Portfolio +42.94%

$ACWI +6.89%

$SPX +10.32%

YTD return -

Portfolio +221.75%

$ACWI (-)2.52%

$SPX +1.21%

Contd...

3) Biggest positions -

1) $BABA 2) $MELI 3) $SE 4) $ROKU 5) $PINS

New buys - $GDRX $PINS $PLTR

Sells - $ETSY $FEAC $FSLY

Contd...

1) $BABA 2) $MELI 3) $SE 4) $ROKU 5) $PINS

New buys - $GDRX $PINS $PLTR

Sells - $ETSY $FEAC $FSLY

Contd...

4) Commentary -

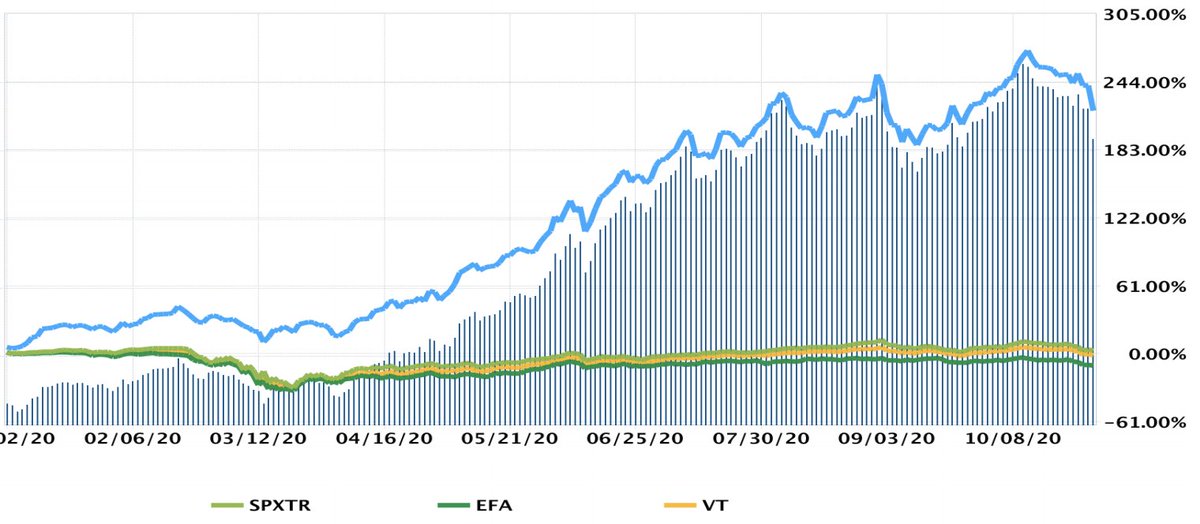

First and foremost, my broker& #39;s new software is glitching so I haven& #39;t been able to post my usual performance charts with the benchmarks. Instead, I& #39;ve posted a screenshot of my portfolio return since inception and the standard YTD performance chart with...

First and foremost, my broker& #39;s new software is glitching so I haven& #39;t been able to post my usual performance charts with the benchmarks. Instead, I& #39;ve posted a screenshot of my portfolio return since inception and the standard YTD performance chart with...

5) ... inbuilt benchmarks which I can& #39;t edit. I& #39;ll contact my broker on Monday and try and sort this out.

Moving onto my portfolio, true to its reputation, October turned out to be a pretty rough month for my stocks and the broad market. During the month, my portfolio hit a...

Moving onto my portfolio, true to its reputation, October turned out to be a pretty rough month for my stocks and the broad market. During the month, my portfolio hit a...

6)...new high but due to the election/stimulus related sell-off, it gave back those gains and then some. Still, my portfolio managed to close the month +221.75% YTD so I& #39;m very satisfied with the growth.

During October, I made a few changes to my portfolio...

During October, I made a few changes to my portfolio...

7) I sold my shares of $ETSY , $FEAC and $FSLY and invested in $GDRX , $PINS , $PLTR

I sold $ETSY due to low growth estimates (and to raise cash for $PLTR), booked my gain in $FEAC to raise cash for $GDRX and closed out $FSLY due to its shocking press release! ...

I sold $ETSY due to low growth estimates (and to raise cash for $PLTR), booked my gain in $FEAC to raise cash for $GDRX and closed out $FSLY due to its shocking press release! ...

8) When I sold out of $FSLY around $91/share and grabbed $PINS, I was criticised by some but right now, it seems my decision was correct.

Yesterday, $FSLY closed at $63.51 (down another 30% from where I sold) and $PINS closed a fair bit higher than my purchase price...

Yesterday, $FSLY closed at $63.51 (down another 30% from where I sold) and $PINS closed a fair bit higher than my purchase price...

9) Elsewhere, in order to raise cash for $PLTR, I booked my gains in $ETSY (its future growth estimates are weak).

In my opinion, $PLTR is a solid business with a durable & #39;moat& #39; and given its growth estimates, it is currently trading at a reasonable valuation...

In my opinion, $PLTR is a solid business with a durable & #39;moat& #39; and given its growth estimates, it is currently trading at a reasonable valuation...

10) So, I& #39;m expecting good things from this new investment.

Finally, in order to raise cash for $GDRX I booked my gain in $FEAC. I really like $GDRX as a business, it is already profitable and if my assessment is correct, this should be a rewarding long-term investment....

Finally, in order to raise cash for $GDRX I booked my gain in $FEAC. I really like $GDRX as a business, it is already profitable and if my assessment is correct, this should be a rewarding long-term investment....

11)...I& #39;m a retired guy now and these days, whenever I need cash for a new position, I have to raise it by selling an existing holding. This is why I reluctantly sold $FEAC - in any event, I already own shares of $DKNG $SEA and $U so have some exposure to the gaming industry...

12) Turning to the broad market, as I posted about a week ago, investors are likely to remain jittery until the US elections so it is my belief that the selling will probably continue until the middle of next week (or longer if the election result is contested).

So, we might...

So, we might...

13)...have to endure some more near-term angst/pain.

My short-term caution notwithstanding, I expect the stock market to rebound so the ongoing weakness is probably a good buying opportunity for long-term investors.

In terms of my portfolio, I am very comfortable with...

My short-term caution notwithstanding, I expect the stock market to rebound so the ongoing weakness is probably a good buying opportunity for long-term investors.

In terms of my portfolio, I am very comfortable with...

14)...my current holdings and believe they will thrive over the long-term. After all, who doesn& #39;t like and use ecommerce, online payments, gaming, software and streaming?

Accordingly, I am just staying invested during this political circus and am certain that Mr. Market will...

Accordingly, I am just staying invested during this political circus and am certain that Mr. Market will...

15)...calm down in due course. It always does.

Drawdowns and volatility are normal; if one is seeking a high return, he/she must also endure the discomfort - if it was easy, everyone would be doing it! No free lunch.

Hope this has been useful.

THE END.

Drawdowns and volatility are normal; if one is seeking a high return, he/she must also endure the discomfort - if it was easy, everyone would be doing it! No free lunch.

Hope this has been useful.

THE END.

16) Afterthought -

I don& #39;t have any special powers (or a team of analysts at my disposal). Anybody who invests in a bunch of rapidly growing, dominant businesses and is able to sit through the volatility can generate market-beating returns over the long-run.

All the best!

I don& #39;t have any special powers (or a team of analysts at my disposal). Anybody who invests in a bunch of rapidly growing, dominant businesses and is able to sit through the volatility can generate market-beating returns over the long-run.

All the best!

Read on Twitter

Read on Twitter