Hi friends,

Over the last 11 days I& #39;ve opened an insane amount of leverage - my current BTC long exposure is 9x the size of my entire portfolio, all while keeping risk <=3%.

Win or breakeven I figured it& #39;d be nice to provide some insight into how I did this - DYOR ofc, NFA too. https://twitter.com/FangTrades/status/1319026802266902531">https://twitter.com/FangTrade...

Over the last 11 days I& #39;ve opened an insane amount of leverage - my current BTC long exposure is 9x the size of my entire portfolio, all while keeping risk <=3%.

Win or breakeven I figured it& #39;d be nice to provide some insight into how I did this - DYOR ofc, NFA too. https://twitter.com/FangTrades/status/1319026802266902531">https://twitter.com/FangTrade...

Basically, I acquired this massive asymmetry through pyramiding. This Investopedia article covers it pretty well:

investopedia . com/articles/trading/09/pyramid-trading.asp

Pyramiding is compounding with unrealized gains.

investopedia . com/articles/trading/09/pyramid-trading.asp

Pyramiding is compounding with unrealized gains.

The core idea is that in a trending environment, as you trail stops into profit, those profits are repurposed as risk for new positions in anticipation of a bigger move, instead of considering them final.

This allows one to increase leverage while keeping risk constant or 0.

This allows one to increase leverage while keeping risk constant or 0.

The key is to pyramiding safely is to always know your breakeven price B, and to make sure your stops remain at or above that price (for longs, flip for shorts)

There is a way to pyramid optimally. It goes according to the following order of operations or some variation thereof:

There is a way to pyramid optimally. It goes according to the following order of operations or some variation thereof:

1) Wait for new invalidation level S

2) Trail stops to S

3) Considering a new pyramid lot to be opened at price P, find the maximum size Z such that the resulting breakeven price B <= S (flip for shorts)

4) Open the lot at P with size Z. Don& #39;t forget the corresponding stops at S!

2) Trail stops to S

3) Considering a new pyramid lot to be opened at price P, find the maximum size Z such that the resulting breakeven price B <= S (flip for shorts)

4) Open the lot at P with size Z. Don& #39;t forget the corresponding stops at S!

All the leveraged trades I took after I flipped bullish have been pyramided together. This includes both open and closed positions.

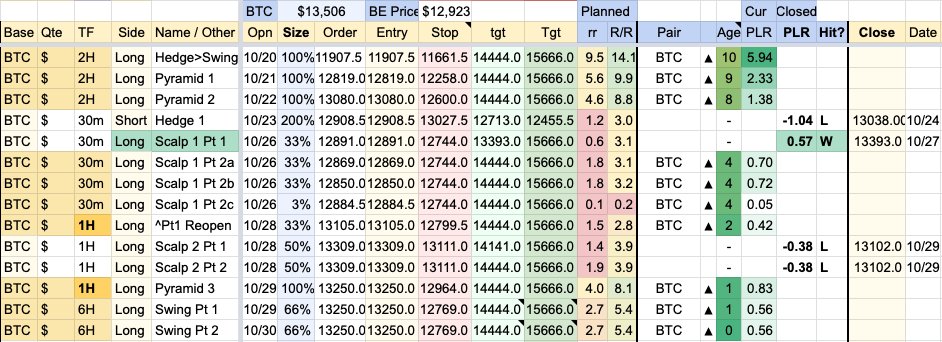

Here are the trades I posted over the last 11 days. Closed positions are overlaid with price, open positions on the right.

$BTC 1H /x/Jv4lDCVk/

Here are the trades I posted over the last 11 days. Closed positions are overlaid with price, open positions on the right.

$BTC 1H /x/Jv4lDCVk/

This table shows the stops, entries, targets, closes, sizes, planned R, current R, closed R and other info for these trades.

To make the PnL accounting easier I normalized sizes and risk (R) to equal that of the original hedge-turned-swing (remember I wanted to short into 9.5k)

To make the PnL accounting easier I normalized sizes and risk (R) to equal that of the original hedge-turned-swing (remember I wanted to short into 9.5k)

100% = size of the original position

1R = 3% of portfolio ~= a difference of 245.5 between entry and stop at 100% size (see first position)

You can verify that every cell matches a trade I& #39;ve posted on Twitter in the two previous threads, starting here: https://twitter.com/FangTrades/status/1318512251410800641?s=20">https://twitter.com/FangTrade...

1R = 3% of portfolio ~= a difference of 245.5 between entry and stop at 100% size (see first position)

You can verify that every cell matches a trade I& #39;ve posted on Twitter in the two previous threads, starting here: https://twitter.com/FangTrades/status/1318512251410800641?s=20">https://twitter.com/FangTrade...

At the current price of 13506, I am:

- Holding 633% the original size, or ~9x the size of my portfolio

- Up 12.25R inclusive of realized wins and losses.

- Chilling with a BE price of 12923 incl. realized wins/losses.

Stops are above BE, so I& #39;m levered up but also 100% safe.

- Holding 633% the original size, or ~9x the size of my portfolio

- Up 12.25R inclusive of realized wins and losses.

- Chilling with a BE price of 12923 incl. realized wins/losses.

Stops are above BE, so I& #39;m levered up but also 100% safe.

So what& #39;s the result?

If my conservative target of 14.4k hits I will make about ~32.9R. If my aggressive target of 15.6k hits I will make ~59.8R. That& #39;s +98.7% and +179.4% on portfolio respectively.

So yeah, I& #39;d appreciate if you could pump BTC for me plz

If my conservative target of 14.4k hits I will make about ~32.9R. If my aggressive target of 15.6k hits I will make ~59.8R. That& #39;s +98.7% and +179.4% on portfolio respectively.

So yeah, I& #39;d appreciate if you could pump BTC for me plz

As an interesting aside, crypto markets are the only ones where it is possible to pyramid 100% safely, since they trade 24/7/265. All other markets are prone to gaps which could open below your stop.

Ofc this assumes you have accounted for slippage in the execution of your stop

Ofc this assumes you have accounted for slippage in the execution of your stop

That& #39;s it! Making my operations fully verifiable can be tedious since I need to tweet every time I enter or exit - I& #39;m not sure if I will do it again. I hope you enjoy the full transparency into my pyramiding operations this time though  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Leicht lächelndes Gesicht" aria-label="Emoji: Leicht lächelndes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Leicht lächelndes Gesicht" aria-label="Emoji: Leicht lächelndes Gesicht">

Trade safe, and have a great weekend!

Trade safe, and have a great weekend!

Read on Twitter

Read on Twitter